Dear Bankless Nation,

You've probably noticed that ETH gas prices are pretty steep right now – a major contributor to this has been rampant MEV activity surrounding memecoin fever.

Today, we dig into what Ethereum developers are doing to smooth MEV incentives and give value back to everyday users.

-Bankless team

P.S. After you watch today's episode with Justin Drake and Dom, head over to our Collectibles site to mint the episode!

MEV-Burn: The Next Big Ethereum Upgrade

Bankless Writer: Donovan Choy

When EIP-1559 was implemented on Ethereum in August 2021, it marked the first time the network began burning ETH. The upgrade redirected a portion of the fees that users previously paid to block validators (known as the base fee) to be burned.

To date, more than 3.2 million ETH out of the current circulating supply of 120 million has been burned post-EIP-1559. Ethereum bulls love ETH burns because it makes the asset more scarce and therefore more valuable.

But, can we burn even more ETH? Ethereum devs want the network to do so. The next big “ETH burning” upgrade on the Ethereum roadmap is “MEV-burn”, what Ethereum researchers Justin Drake and Dom refer to in the Bankless podcast as a “logical continuation” of EIP-1559.

🧠 A quick MEV primer

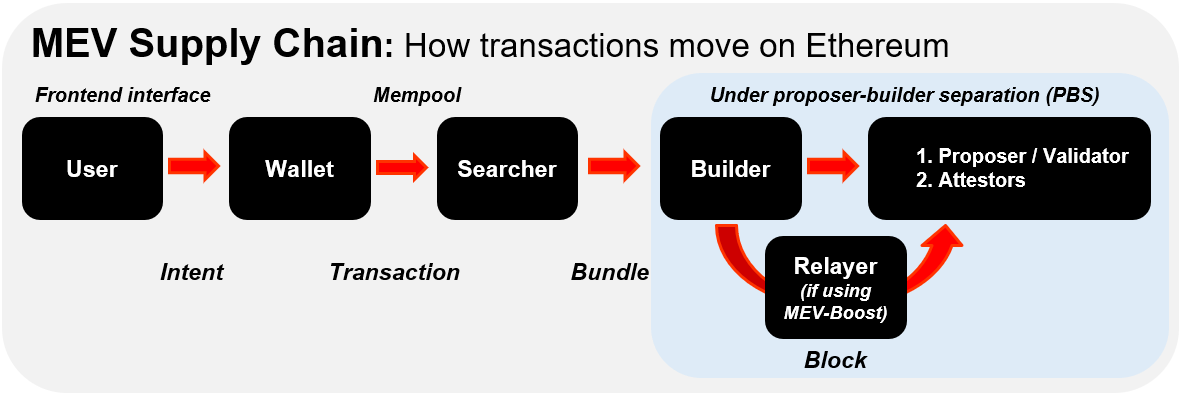

Ethereum’s original protocol design was naive. It assumed that users would simply send transactions to block validators that neutrally would build blocks, but in practice, profitable rent-seeking opportunities in block-building led to an exploitable market. This phenomenon came to be known as MEV i.e., “maximal-extractable value." Fast forward to present and some 566K ETH has been extracted in total from ordinary Ethereum users thanks to MEV.

There are a couple of problems with MEV.

First, MEV is monetary value that is being extracted from everyday users. Second, MEV distorts the incentives for block validators to behave neutrally, which creates blockchain instability. MEV bots engage in competitive attacks like frontrunning, DDOS attacks, eclipse attacks and chain reorgs all in pursuit of a big, fat MEV bounties. Alternatively, ETH stakers on the Beacon chain may choose to have their collateral slashed if the profit from the MEV bounty exceeds it. While this doesn’t happen frequently, when it does, it’s bad for Ethereum.

The motivations behind MEV feel inevitable. Executing trades faster makes for extremely profitable opportunities that arbitrageurs and speculators are willing to pay extraordinary amounts of gas for. This blockspace demand to be first, and the “contention fees” that are produced from it, is what MEV-Burn is targeted at.

📖 For a fuller understanding of MEV, see our

Beginner’s Guide to MEV

🔥 What is MEV-Burn?

MEV-Burn is just one part of the multi-year Ethereum roadmap to address MEV problems head-on. The solution aims to return MEV to ETH holders by burning what is currently being extracted by MEV participants. This amounts to an indirect redistribution of value to ETH holders, bringing more scarcity to the asset and reducing sell pressure by block validators.

The secondary goal of MEV-Burn is to reduce chain instability by equalizing MEV profits for block builders. This is otherwise known as “MEV-smoothing”, which as its name suggests, wants to smooth out the “spike” of MEV rewards. Ethereum devs want the pursuit of MEV profits to be dull, predictable, and stable, rather than the big-game hunting affair that it is today.

Here’s where it gets tricky – in order to know how much MEV can be burned or smoothed out, the Ethereum protocol first has to find a way to quantify MEV based on how much block proposers (AKA builders) are willing to “neutrally” pay for it in a hypothetically efficient market. We don’t know those numbers today because the block building market as it exists currently is an opaque, off-chain market where volatile MEV profits abound.

This is why MEV-Burn requires another major Ethereum network upgrade known as proposer-builder separation (PBS) to first be completed. PBS splits the traditional validator role into two separate roles: proposers and block builders. The goal of PBS is to prevent block builders from being able to simultaneously select and order the transactions to be included in said block. That division of labor strips block builders of the ability to engage in the kinds of transaction discrimination that form the very essence of MEV.

When PBS is said and done, block proposers will no longer be able to tell which transactions are more valuable to include first or second. Proposers will have no choice but to submit “neutral” fee bids for the blocks that block builders have assembled for them. This market process will exist fully on-chain, as opposed to the off-chain market that is supported by Flashbot’s third-party MEV-Boost software today.

Only after all of this happens does the path to MEV-Burn begin. With full visibility into neutral block proposer bids on the Beacon chain, the Ethereum protocol can execute MEV-Burn.

🏴 The benefits of MEV-Burn

At present, Ethereum issues 686K ETH annually as rewards for ETH validators. Note that this issuance is compounded by the result of validators coming in for a piece of MEV profits, which in turn increases issuance. MEV-Burn is expected to further cut this annual money printing by an estimated 400K - 500K ETH.

For a full breakdown of these numbers, watch the podcast episode with Justin Drake and Dom embedded above.

Stabilized MEV profits also means fewer incentives for block validators to redirect capital towards staking, particularly during bull markets when issuance rewards are heightened. This expands the economic bandwidth of ETH and preserves capital for dapp collateral such as decentralized stablecoin collateralization, lending, other forms of staking, etc.

As with many Ethereum proposals, MEV-Burn will not be ready in the short-term and is instead looking at a 3-5 year time frame. But if the reward for waiting is to finally exit the MEV dark forest, it’s probably a worthwhile wait.

Action steps:

- 📺 Watch on the Bankless podcast ETH’s Biggest Upgrade Since EIP-1559

- 📖 Read A Beginner’s Guide to MEV

You can now stake your ETH through MetaMask with liquid staking providers, Lido and Rocket Pool. Head over to MetaMask Portfolio to get started! You can also view your assets in one place and discover other features such as Buy, Swap, and Bridge.

MARKET MONDAY:

Scan this section and dig into anything interesting

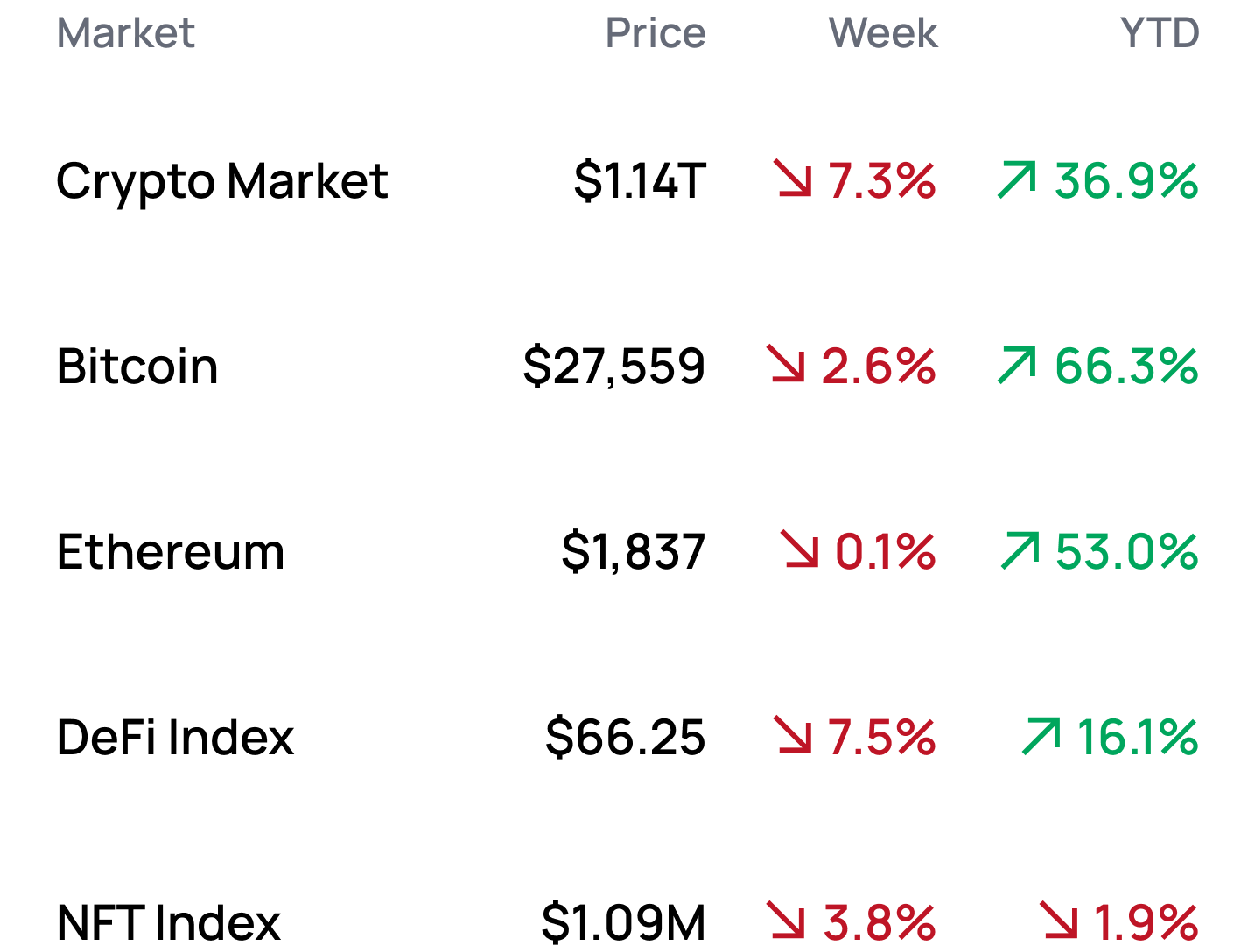

*Data from 5/8 4:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Lend and Borrow on Aave’s testnet Scroll deployment

- Create no-code web3 apps with Steer Protocol

- Mint the next goblintown NFT (for terrible traders only!)

- Watch a16z’s Crypto Startup School video series

- Transfer GALA from Coinbase and LP pools to claim the v2 token

Yield Opportunities 🌾

- BTC: Earn up to 9.2% APY with O3swap’s BTC vault on Arbitrum

- ETH: Earn up to 41.7% APY with Ribbon’s R-STETH-EARN vault

- ETH: Earn up to 17.6% APY with Yearn’s CRV-ETH vault

- USD: Earn up to 7.7% APY with Velodrome’s USDC/LUSD vault

- USD: Earn up to 12.9% APY on USDT with Yama Finance

What’s Hot 🔥

- Illinois lawsuit claims Coinbase violates biometric privacy laws

- JPMorgan wins bid for failed First Republic Bank

- FTX estate sells SUI token warrants for 91% discount from market

- Biden Admin pushes punitive 30% tax on crypto mining

- Court gives SEC 10 days to respond to Coinbase petition for clarity

- Bitcoin transactions hit record high as new token type takes off

- NY AG seeks broader authority to police crypto

- Binance closes BTC withdrawals as gas spikes

- Ripple CEO says firm has spent $200M fighting the SEC

Money reads 📚

- Staking vs Battle Pass - Vader Research

- The Case for Player-Driven Economics - Vader Research

- Is the Federal Government Trying to Kill Crypto? - Jen Wieczner

- Ethereum L1 zkEVM - polynya

- The Case for Fully On-Chain Games - Terry Chung

- What is driving increases in BTC transactions? - Rafael Schultze-Kraft

- Analyzing PnL of meme coin traders - Alex

- Exploring the JPM <> FRC deal - Arthur Hayes

Bankless Jobs 🧑💼

- Bankless Ventures: Investment Analyst Intern

- Coinbase: Staff Blockchain Engineer

- Phantom: Software Engineer - Mobile

- Premia: Web3 Product Management & Architecture Lead

- Dinari: Smart Contract Engineer

- Uniswap Labs: Senior Backend Engineer

- Bankless: Social Growth Lead

Governance Alpha 🚨

- Aragon hits back at activist investors in DAO governance fight

- AaveDAO approves OP token allocation proposal

- BanklessDAO Season 8 funding proposal goes live

- ENS elects new foundation member

- Lido seeks approval of V1 validator exit policy

Token Hub: Aptos (APT)📈

Analyst: Ben Giove

- Type: Ratings Reiteration

- Risk Rating: Medium

- Sector: L1

- Current FDV: $9.0B

We are reiterating our Bearish rating on APT.

Catalyst Overview:

APT remains Bearish due to valuation concerns.

Aptos currently trades at an FDV of $9.0B, the 8th highest valuation among Layer-1 and Layer 2 blockchains. This rich valuation comes despite less usage than many of its peers that trade at similar and/or lower valuations. Aptos has just the 31st highest DeFi TVL at $49.6M and places just 19th in daily active addresses at ~11,000.

Potential Price Impact:

Aptos’s lofty valuation does not seem warranted relative to the traction it's seen to date. While the token should benefit from a lack of unlock-related sell pressure, as insider vesting does not begin until October 2023, APT’s poor fundamentals will still likely weigh on its price, particularly in a low-liquidity environment in which most alt-coins are bleeding against benchmarks like ETH.

Meme of the Week 😂

JPOW be like pic.twitter.com/KMI3kPhhHL

— Bankless (@BanklessHQ) May 7, 2023