Dear Bankless Nation,

There are hundreds of millions of crypto investors out there. The reality is that not all of them have the alpha... Now, as a Bankless subscriber, you're better positioned than most!

But, for anyone who wants exposure to the sector, there are a lot of significant investing pitfalls out there to avoid. In today's newsletter, analyst 563 gives his take to casual bear market investors – stick to the majors: ETH and BTC.

-Bankless team

As a devoted Bankless reader, you're clearly better positioned than most investors out there, but if you consider yourself a casual crypto follower looking to get exposure to the sector, maybe you should just stick to ETH and BTC.

The underlying question here is: what kind of investor do you want to become? (Here's a little inspiration to help you decide!)

As liquidity drains from crypto markets, we've seen the ecosystem devolve into an increasingly Player vs. Player (PvP) environment, with every member's gain coming off the back of another's loss. Being a savvy altcoin investor in this type of environment takes considerable time! And while the majors aren't going to offer you 1000x returns, most investors would be better off sticking to the relative safety of BTC/ETH during these periods instead of buying whatever your sketchy influencer of choice is shilling this week.

Is buy-and-hold too dull for you? Staking your ether could help with the monotony and give you more firepower when bullish times return.

Now, if you, dear reader:

- Have custom market alerts set on your phone,

- Have Dex Screener loaded up at all times,

- And have named your first-born after your favorite altcoin

This advice may not be for you! But for the 90% of crypto investors who don't want to worry about giving their portfolio constant attention, let's explore a quick history lesson.

If you can't outperform the majors, you are losing!

A big % of my portfolio is still in BTC & ETH.

— The DeFi Investor 🔎 (@TheDeFinvestor) September 25, 2023

> Their annual inflation is very low

> The downside is limited (both won't return to their '22 lows imo)

> Today's hot altcoins may be dead in a year

I'd rather wait for retail to come back, and then bet big on altcoins.

Modern portfolio theory and common sense tell us that we shouldn't simply seek returns but risk-adjusted returns. This means that for each additional unit of risk we take (such as buying an altcoin), we should expect an additional return over safer assets.

In other words, if we choose to invest in a riskier project than Bitcoin or Ethereum, it damn well better offer superior returns. Or else, what's the point?

The problem is that most projects simply won't outperform these assets. Still not convinced? Let's look at some data.

2019 vs. today

If you've been paying close attention, no doubt you've seen folks drawing parallels between today's market conditions and those of 2019. It was a bear market, a pre-halvening year, and a pre-election year (for the U.S.). And while a perfect 1:1 comparison doesn't exist, we can use the 2019 market to help understand how the crypto market could progress from here.

I'm going to take you back to the fall of 2019. Brexit was top-of-mind, with crypto taking a subdued back seat. BTC was trading at just over $8K, with ETH under $200. Tether was sitting around $4B in supply, and Bitcoin forks BCH and BSV still occupied the Top 10 spots. If you were around in 2019, did you think of picking up any of these projects?

Survivorship bias can cloud your judgment when you look back at these times - so let's be objective here. If you were to pick some random projects out of the top 200 by market cap, how would they have fared? Would we have been better off sticking with ETH or BTC?

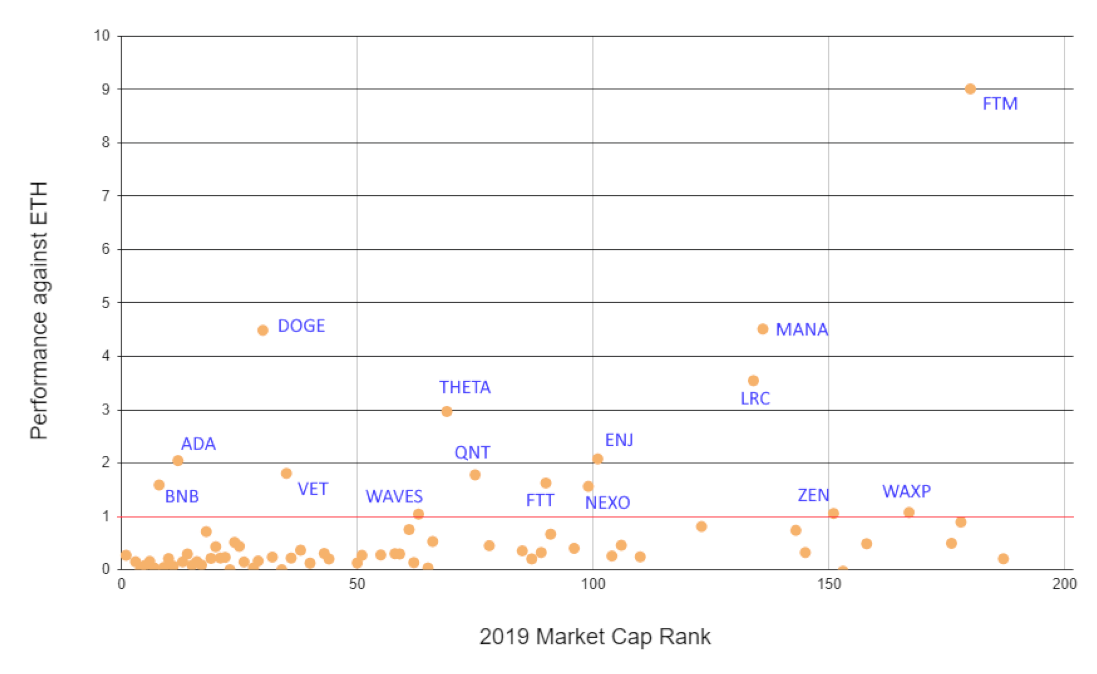

Looking into the performance of the top 200 assets by market cap from September 2019 to the approximate all-time high for BTC (November of 2021), we see some sobering results. In the chart below, projects that outperformed ETH will be visible above the red horizontal line.

In total, just 15 of the top 200 performed better than ETH (40 against BTC), showing how strong survivorship bias has become in our sector. You may notice that the dots become sparser as we walk down the market cap rankings (left to right). Why? It's simple. Projects die.

Of the 200 projects observed in the 2019 snapshot, 63% were no longer in the top 200 in November 2021. Crypto markets are just capitalism dialed up to 11, with no mercy for weak projects.

"But this time is different."

There's no doubt there are more legitimate crypto projects today than in 2019. But look at today's top 50 and ask yourself, how many of these have sufficient product-market fit to last years or decades from now?

Only Bitcoin and Ethereum (so far) have proven their stickiness over multiple cycles, with increasing users, volume, and integrations year after year. The list of "low" risk investments in crypto may grow over the years (and you probably have some candidates earmarked already), but that simply isn't the case today.

Many of the previous bull market winners did not even exist during the doldrums of the 2019 bear. Big-time investors that poured millions into seed rounds wanted to avoid launching tokens during bearish times. And who's to say this time will have a different playbook?

There's a strong chance that the best performing tokens next cycle haven't been released yet.

— Miles Deutscher (@milesdeutscher) September 27, 2023

That's why it's so important to keep unallocated stables reserved.

Don't build your portfolio solely on the assumptions of today, rather prepare for the eventualities of the future.

Found a diamond in the rough?

Say you are part of the 10% who love getting into the weeds and finding gems. Finding undervalued projects requires sufficient due diligence. Do you think the folks who made altcoin picks in 2019 all picked the 15/200 that outperformed ETH? Or would they have been better served by HODLing the majors?

You may think you've found the next big thing, and perhaps you're right. But remember to keep tabs on these smaller projects, as their fundamentals often shift much faster than the majors.

- Is the team delivering on their roadmap?

- Are Key Performance Indicators trending in the right direction?

- Are they on the path to achieving product market fit?

- Are any of your invalidation criteria getting triggered?

Becoming involved in project communities can be exciting, especially in times of bear market building. It's when all the tourists have checked out, and only true enthusiasts remain.

But remember – don't marry your altcoin bags, and when in doubt, stick to the majors.

Action steps

- ⛰️ Read Is this the Last Cycle?

- 🪙 Read yesterday's article Unpacking ETH's Wall Street Debut