Dear Bankless Nation,

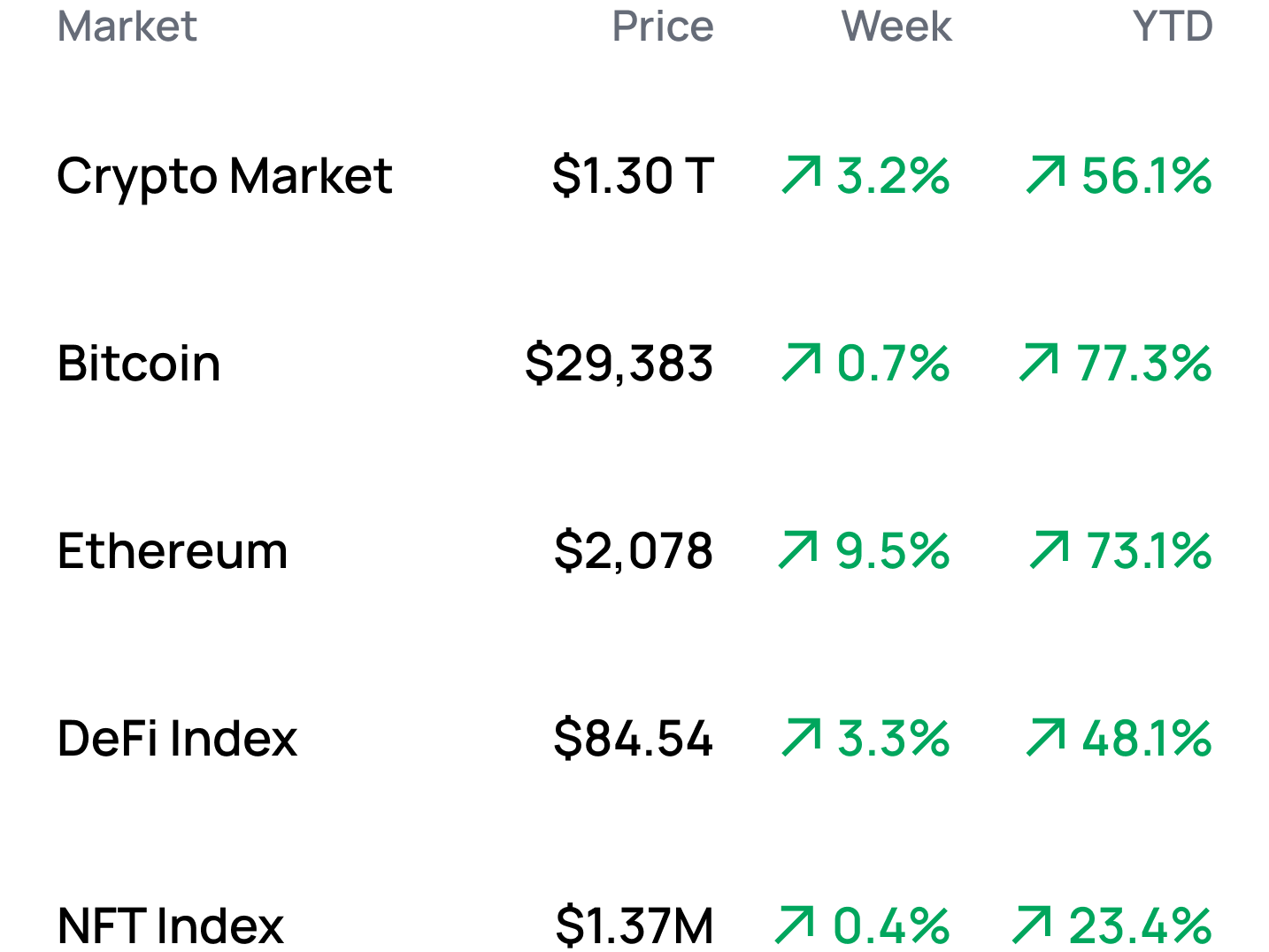

It's been a profitable year to be bullish on ETH. After the network's successful upgrade last week, we've seen a bump in market appetite for the asset, which is up more than 75% on the year.

Today, our analyst desk zooms in on other market signals in crypto worth feeling bullish about.

- Bankless team

P.S. Minting for our episode with Robin Hanson just went live!

Are We Back??

Bankless Writer: Jack Inabinet

Markets are pumping and bears are in shambles. Bitcoin and Ethereum have both broken out of their bear market trading ranges and alts appear primed to rock-and roll!

Despite FUD flying in from every direction, be it doomers foretelling of Ether dumped en masse post-withdrawals or regulators targeting CZ, crypto has been up-only since FTX. Amid banking failures and contagion risk, crypto pumped.

It’s once again time to contemplate crypto’s age-old question: ape now or FOMO later? Today, we’re examining five key crypto indicators that can help you make the decision 🤝

📈 Open Interest Up

Perhaps the most accessible option for traders to gain leveraged exposure to crypto assets is futures.

Open interest represents the number of outstanding futures contracts held by traders that have not been offset or closed. This calculation includes both long and short positions. Generally, higher levels of open interest correlate with risk-on market sentiment and high liquidity, with a larger number of both buyers and sellers in the marketplace.

Aggregate open interest on BTC futures surpassed the pre-FTX high-water mark of $9.9B, breaking over $10B at times during trading on Tuesday and Thursday last week. It's no secret that the implosion of FTX left a gap in the crypto derivatives market; the exchange was once one of crypto’s largest.

Seeing open interest rebuild and liquidity improve is a sign of improving market conditions. Note, however, that a build-up of leverage can cause increased reflexivity when prices move against traders.

⛓️On-Chain Boom

While the macro heads debate the merits of potential recession, the on-chain economy has continued to boom.

Active total daily addresses across major smart contract blockchains has held steady at 2 million – a feat not seen since the end of the bull market in January 2022 – and has increased by 77% since bottoming in late August.

Clear signs of increased user activity are also evident in yield markets, with the aggregate DeFi yield continuing its upward trend from June, up 94.2% from the lows.

Higher DeFi yields are typically associated with higher crypto asset prices, as individuals and institutions increase on-chain trading activities or borrow to access leverage and implement yield-generating strategies. Higher yields also mean borrowers can afford higher costs of capital, indicating better capitalization in aggregate.

As the Fed battled inflation throughout 2022, risk-free interest rates offered on U.S. Treasuries continued to increase, growing competition to relatively risky crypto lending and sucking juice out of risk-on assets. Risk of inflation has somewhat moderated since peaking in June, the same month DeFi yields were their lowest, with year-over-year inflation falling below 5% in March.

Prospects of an easing rate environment have reinvigorated crypto, making the asset class as a whole more investable and DeFi yields more attractive.

🙅 Rejecting Stables

Smart money crypto participants have been increasing their net crypto exposure since the depths of the FTX crisis and have shown no signs of slowing down.

On-chain smart money stable exposure has reached its lowest point since the collapse of Terra-Luna in early May 2022, with these high-profit actors holding an average of 15% of their portfolios in stablecoins.

While the amount of free capital floating around in whale’s wallets has certainly decreased, smart money still has a considerable amount of firepower remaining before reaching bull market lows of sub 5% allocations.

Investing in stablecoins allows crypto holders to mitigate risk and limit potential portfolio drawdowns. Yet, the crisis on confidence in USDC and USDC-backed decentralized stablecoins stemming from the March banking crisis have impacted willingness to hold stables. This is an encouraging sign of positive market sentiment to see a shift from dollar-pegged assets to tokens.

MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. Consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve.

📉 Volatility Crush

Heard of the VIX? It’s a derivative measuring the market's expectation of volatility in the near-future based on S&P 500 index options. During times of elevated volatility, typically to the downside, the price increases.

Crypto has its own native, on-chain market fear indices primitives. One popular VIX-mimicking derivatives platform is CVI Finance, makers of the Crypto Volatility Index, which tracks implied volatility of Ether and Bitcoin, much like its TradFi counterpart. Not only has the index been down-only in the post-SVB/Silvergate/Signature era, it is currently trading at levels previously only reserved for the bull market, breaching the pre-FTX lower boundary of $62.80.

As markets have pumped and open interest has rapidly increased, potentially increasing leverage-induced reflexivity in crypto asset pricing, it is comforting to see diminished expectations of future price volatility from the CVI Index.

🤭 What Withdrawals?

Etherians are united in jubilance at the number of validators exiting the set.

While skeptics peddled FUD in the months leading up to Shapella, suggesting weeks worth of withdrawals were on the horizon while questioning if the market could absorb the millions in Ether they anticipated would be sold, the actual situation has been remarkably bullish.

Currently, 25.7k validators are lined up in the exit queue for a full withdrawal. Kraken, forced by the SEC to deprecate their US staking operations, represents 46.5% of the queue. Given network-imposed constraints, exits should be processed and normalized within two weeks.

A primary concern for many was the potential for over 1M ETH in partial withdrawals being rapidly jettisoned from the Beacon Chain within 5 days of Shapella’s deployment. While these withdrawals are not complete, with 541k ETH remaining (only half of which has upgraded to eligible type 0x01 credentials) -- the market, so far, has seemingly absorbed the first half million of excess supply in stride.

A sizable portion of this supply has not been sold, instead being restaked to the network. Ethereum's largest staking entity, Lido, must restake their accrued rewards, as stETH is a rebasing token, helping to increase the number of validators on the Beacon Chain and counteracting withdrawal flows.

Market Takeaways

While the macro waters are slightly muddy, crypto appears to be trending towards a bullish state of mind. Majors like ETH and BTC have broken out of their depressed bear market trading ranges and altcoins look primed for a decisive upwards move.

After an overbearish, oversold 2023, investors are finding themselves underallocated and aping with size, driving up prices and placing crypto on the precipice of a miniature bull run. Smart money has heavily participated in crypto’s impressive run-up since the beginning of the year and still has plenty of capital to play with.

But this rally is about more than just price, crypto has found sustainable adoption, keeping user activity counts high and driving up DeFi yields in what has been a continued upwards trend since peak inflation in June 2022. Our crypto-native VIX equivalent has breached 2022’s lows, trading at levels unseen since the prior bull market. Ethereum’s Shapella doomerism is nothing more than last week’s news.

It certainly doesn’t seem like a bad time to be a bull…

📊 MARKET MONDAY:

Scan this section and dig into anything interesting

Market Opportunities 💰

- Yield farm for increased APR on Lodestar Finance

- Redeem hacked funds on Euler Finance

- Mint your free Music Pass NFT by Mastercard

- Apply for a Gitcoin grant in the Beta Round

- Create a Telegram notification bot for on-chain events

Yield Opportunities 🌾

- ETH: Earn 32.14% staking USDC-WETH on Uniswap V3

- USD: Earn 10.15% staking USDT-WBTC-WETH on Convex Finance

- USD: Earn 13.93% staking USDC on Conic Finance

- BTC: Earn 13.55% staking BADGER-WBTC on Badger DAO

What’s Hot 🔥

- Enso Finance V2 launches

- Popsicle Finance launches new concentrated liquidity AMM

- Uniswap mobile wallet launches on iOS

- Twitter partners with eToro to integrate crypto trading

- Decentralized storage chain BNB Greenfield goes live

- Terraport Finance is hacked for $2M+

Money reads 📚

- 2023 State of Crypto Report - a16z

- Unraveling the Mysteries of the MEV Market - analyticalali

- Shapella's Show - Arthur Hayes

- Latency Games: the Good, the Bad and the Ugly - Uri Klarman

Governance Alpha 🚨

- Yearn Finance proposal to launch yETH, a basket of ETH LSDs

- Hop DAO failed proposal to increase liquidity mining for HOP

- Lido DAO proposal to accept 773K ARB tokens from Arbitrum Foundation

- Bancor proposal to authorize Carbon as flagship offering

- Redacted Cartel proposal to whitelist USH for Hidden Hand on Aura and Balancer

Trending Project: ether.fi 📈

Analyst: Jack Inabinet

- Ticker: ETHFI (Token not live)

- Sector: Liquid Staking

- Network: Ethereum

- FDV: N/A

- Hotness Rating: 🔥🔥🔥🔥/5

Liquid staking derivative governance tokens across the board are pumping hard post-Shapella, however net of partial withdrawals from accrued staking rewards many protocol’s have seen minor increases in TVL. Today’s trending project is one of the exceptions, seeing deposits pump 34% since Ethereum's latest hard fork went live.

ether.fi is a liquid staking protocol that allows stakers to retain their keys and allows for the creation of a node services marketplace where stakers and node operators can enroll nodes to provide infrastructure services. The Protocol plans to integrate with EigenLayer to provide node services and implement DVT-based key sharing when it's available.

Currently, a gated beta version of the product is live on the Goerli testnet. While ether.fi does not have a token itself, it does have an “Early Adopter Programme” and is a candidate protocol for a potential airdrop.

It is this Early Adopter Programme that has seen massive inflows as of late, likely due to the announcement of an April 27th deployment date and impending April 30th bonus point snapshot, which likely serves as the basis for allocating a large percentage of this airdrop’s user distribution.

Hotness Rating: (🔥🔥🔥🔥/5)

Participating in ether.fi’s Early Adopter Programme is an excellent way to maximize your potential eligibility for an un-and-coming LSD protocol, already a hot crypto sector, that places an emphasis on decentralization. With the snapshot rapidly approaching, now is the time to deposit your Ether.

Meme of the Week 😂

— Bankless (@BanklessHQ) April 14, 2023