Lyn Alden: 3 Models for the Macro Endgame

Dear Bankless Nation,

Our latest podcast features the return of investment analyst and economic thinker Lyn Alden, and it’s all about the game-changing macroeconomic trends playing out right before our eyes.

This is one of those episodes that discusses so many big, fundamental issues happening on such a massive scale that it’s hard to wrap your head around it in one listen. We’re here to help…

Look literally anywhere around the world and you’ll see signs of the hurt: global economic growth stalled, inflation rampant, war and energy shortage in Europe, government collapse in Sri Lanka, bank protests crushed in China…And that’s just in the news this morning.

It’s rough out there.

Somewhere amidst all the chaos is your own plan for financial independence in the world that emerges out of all this. Nobody knows for sure what’s going to happen. But learning from gigaminds like Lyn Alden will only help us understand our place — and the opportunities therein.

Bankless Editor Jem Khawaja distills the discussion into 3 models for understanding the macro endgame, and what they mean for crypto…

🌎💸☠️“Is This the End?” Podcast with Lyn Alden

Lyn Alden is the Founder of Lyn Alden investment strategy and is a leading expert in macro markets. She focuses on long-term debt cycles and how it’s impacting crypto, fiat, bonds, and equities markets.

This is Lyn’s third appearance on Bankless. Each time she’s on, it usually means something is breaking in the macro markets. And something definitely is. Her superpower is to provide clarity during unclear times and this episode is no different.

🎙️ Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed

Long-Term Debt Cycles

Lyn Alden’s thinking is guided by Ray Dalio’s theories on long-term debt cycles and the macro endgame. These rhyming macroeconomic trends resurface every several decades and cause large-scale economic and social upheaval. While each cycle is very different, the climax is always triggered by massive debt, threadbare interest rates, and currency devaluation.

These factors consistently combine to destabilize global systems and result in macro phase changes. That means the end of eras on a global scale: empires falling, wars, currency rebases, major demographic shifts. Alden sees the global economy is a taut balloon in the third act of a long-term economic arc that’s long been in play.

In more recent history, Alden says the 2010s could be seen as a mild global depression even before COVID — many countries did not grow throughout the decade despite continual overleveraging of debt.

This precarious state was thrown further into chaos by the COVID-19 pandemic, for which the US switched to a wartime economy to print money — with no wartime production to gird it — which directly caused the stagflation we’re starting to see now.

Decelerating growth and runaway inflation are flashing leading indicators of a deep downtrend, and by the time it hits the employment market — the final domestic indicator we’re waiting for — it’s already recession season. Consumer sentiment in the US is at its lowest in 70 years, and the pain is beginning to manifest in daily lives of the population everywhere you look.

Ray Dalio adherents see the next major US recession as a catalyst for transition from US-based dominance of the global economy towards a multi-polar world. Russia, China, and India have already begun detaching themselves from the dollar hegemony in the midst of their own emerging financial crises, all of which falls in lock step with Dalio’s ‘Endgame’ and ‘Great Reset’ models.

Opposing Milkshake Theory

Opposing the likes of Dalio, there’s a trendy economic theory doing the rounds right now called the Dollar Milkshake Theory.

Coined by economist Brent Johnson, it’s presumably named in reference to a line delivered by Daniel Day-Lewis’ as the menacing oil tycoon Daniel Plainview in There Will Be Blood: “I drink your milkshake!”

The idea is that the global financial upheaval upon which we seem to be flirting will actually be good news for dollar strength as the American economy will ultimately drinks everyone else’s milkshake and re-assert global dominance.

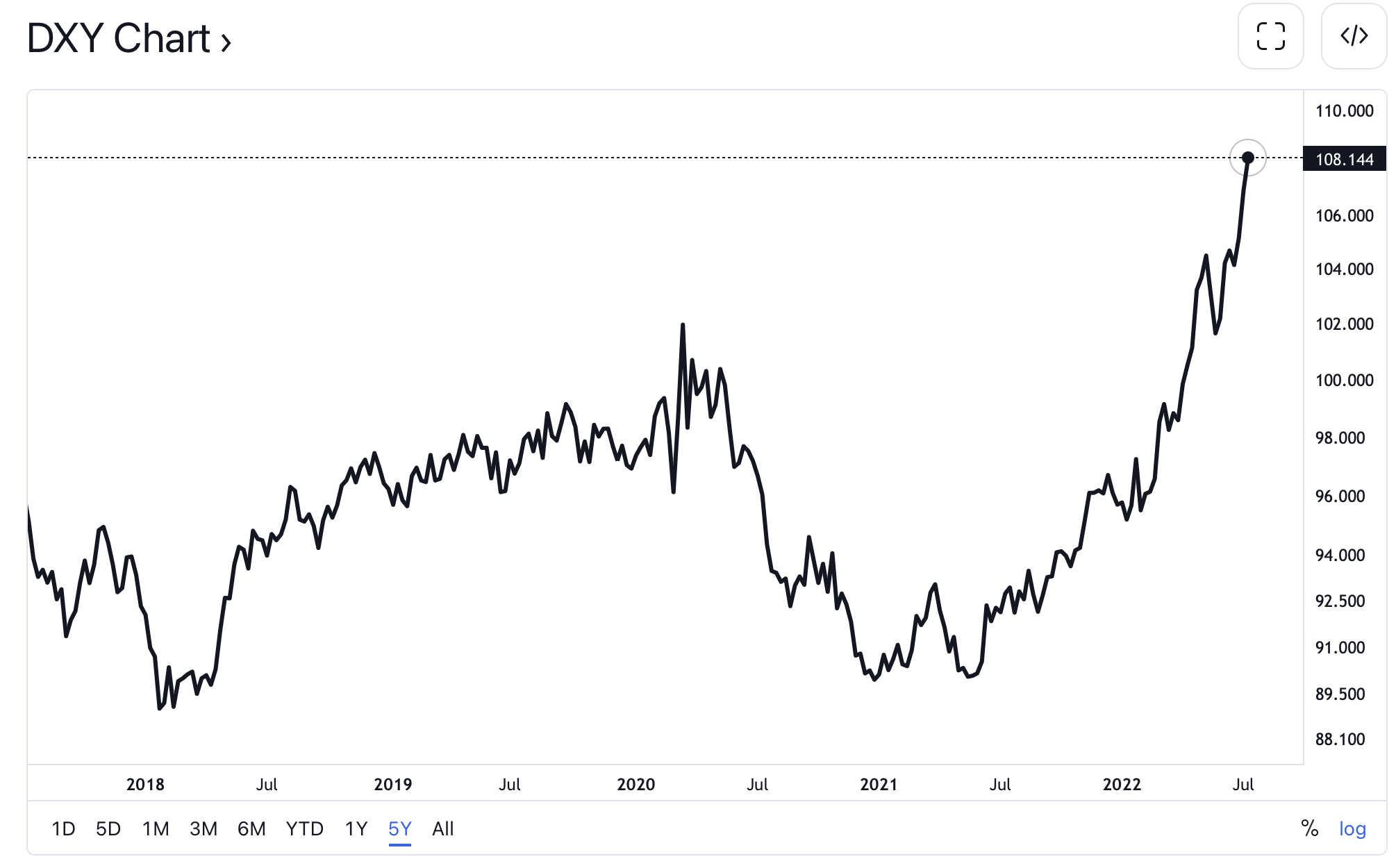

With the DXY popping off towards all-time highs, it’s understandable that the milkshake theory has brought many economists to the yard. Alden thinks the theory is only true until it’s not: short term dollar strength may rather be an indicator of long-term dollar decline.

Here’s why: The US Dollar is the global reserve currency. All central banks hold tons of it. It’s also the currency that most offshore debt is denominated in all over the world. Non-US entities make dollar based loans and transactions in pretty much all markets everywhere because it’s considered more trustworthy than native fiat.

For example: Alden says the BIS notes 13 trillion in US denominated debt over the world, and over 50 trillion in US-based financial assets like treasuries, stocks, and real estate.

When there’s disruption in global cash flows, there’s effectively a short squeeze on the dollar. This makes it spike upwards. That’s not a sign of its strength, but rather the unfolding weakness of other currencies. The stronger the Dollar gets in comparison, the less tenable it becomes as a global reserve.

This accelerates the mega-macro move to multi-polarity, which in turn diminishes the global reliance on the US economy and its dollar. That’s the argument against the Milkshake Theory in a nutshell.

The Fed: Move Slow and Break Stuff

With an interest rate at 1.5% — and last month’s raise of 75 basis points representing half of that — Alden says the Fed has been laboriously slow in responding to inflation, and is now stuck with no choice but to move overly aggressively to catch up. Unfortunately, it’s stuck tightening into decelerating economic activity with Jerome Powell’s legacy on the line.

Alden says that the Fed now has to raise rates until it breaks something fundamental to the core economy like treasuries or credit markets. That’s the point at which it will begin to pull back. Nothing has quite gone kaput yet, but the stress test is getting pretty stressful. With illiquidity in the treasury market already causing volatility and corporate bond markets distressed, there are signs that point may be only months away.

Essentially, what we’re seeing is a big game of chicken. Alden thinks the Fed won’t be able to keep tightening into 2023, which means there’s no time for subtlety in the short-term. The Fed won’t pull the brakes on interest rates until the levee starts to break.

Now, that sounds scary, but it’s not as bad as it seems. The Fed jumps in to steer macro markets with some regularity. As recently as March 2020 — after the COVID market crash and subsequent dollar spike — the Fed immediately bought treasuries to reliquify markets.

What this means for crypto

Although crypto will have a big part to play in the make-up of any new global economic framework that emerges from a phase shift, right now digital assets are getting tumbled in the macro dryer until it all plays out. More significant interest rate hikes will likely be bad for the crypto market in the short-term.

The Merge presents a countertrend secret weapon for Ethereum in particular, but crypto as an asset or a market is not driving the macro machine in the short or medium term. To the Fed, stuff like crypto is considered a barnacle in an ocean of concerns. The Fed does not care about crypto or CeFi contagion. It has much bigger fish to fry.

But maybe they should be paying attention. The CeFi contagion took out scores of notable crypto banks to the tune of hundreds of billions of dollars in a matter of weeks. Alden sees crypto as a ‘canary in the coal mine’ front-running what’s emerging on a more foundational macro level. She says what we’ve seen in crypto is just a precursor to what we’ll see in its legacy equivalent.

The great news is that the infrastructure of crypto, Web3, and DeFi in particular have survived one deleveraging stress test – with flying colors, at that. But the stress might just be getting started in legacy global financial markets.