Looming ETH ETF Deadline

The moment of truth. Ethereum’s first final spot ETF approval deadline is today, but many crypto assets have dipped into the red ahead of this monumental decision. Was there anything to be gleaned from the early morning price action, and where does ETH go from here?

Despite yesterday’s Nvidia earnings report beat and the announcement of a 10:1 NVDA stock split, which will theoretically bolster share attractiveness by slashing the purchase price from $1k to more retail-accessible levels of around $100, most assets are down on the day.

Although the early morning dump could be interpreted to be a crypto-specific flush of the bulls overzealous on ETH ETF approval, the move lower came in conjunction with a leg down for broader risk markets that started at 5:30 AM PST and sent the S&P 500 falling nearly 1% off its pre-market highs.

In an attempt to predict what the future holds for the future trajectory of Ether price, many analysts have turned to the historical performance of the only other crypto asset to receive a spot ETF: Bitcoin.

While approval odds for these two instruments have taken drastically different pathways, with the high consensus on spot BTC ETF approval for many months after BlackRock filed its application coming in stark contrast to the overwhelming spot ETH ETF denial sentiment exhibited throughout recent months, both assets experienced large pumps to kick off approval week as market participants attempted to frontrun the launch.

Should history hold for a second time, Ether is due for a pump later today, considering that BTC ripped 6% just prior to the cash close of US markets at 1 PM PST (4 PM EST) after the SEC published an “order granting accelerated approval” of spot BTC ETFs, however, with market participants cognizant that spot BTC ETFs were not a near-term bullish catalyst, it is certainly possible that traders could fade approval.

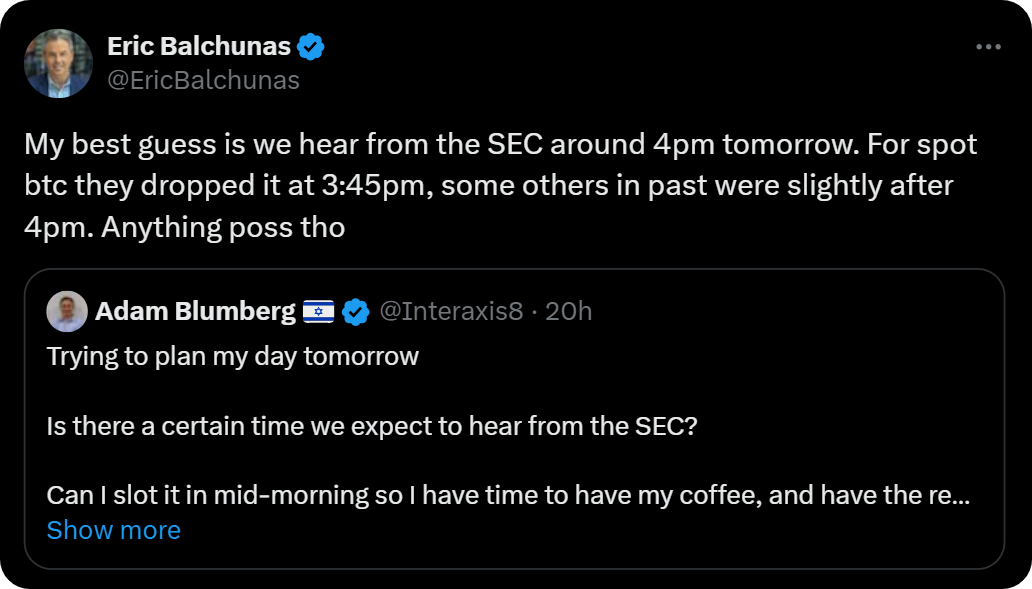

Bloomberg’s ETF analysts currently project that we should receive news on the SEC’s decision to approve or deny VanEck’s spot ETH ETF at a similar time today.

From there, some amount of retracement could be expected before ETH rips to set new highs, until actual trading begins for the new spot products…

As was the case in BTC’s approval process, it appears probable that all pending spot ETH ETF applications likely receive simultaneous approval and begin trading Friday, yet some analysts continue to maintain there could be one-off approvals or a lag in trading given what they perceive to be a sudden restart in the approval process.

Unfortunately, beyond this point, history suggests that Ethereum will need to digest a substantial amount of redemptions from the $10B AUM Grayscale Ethereum Trust (ETHE), which will likely weigh heavily on price in the coming weeks before subsiding and allowing for further upside.

Optimistically, there may be no bleeding in the aftermath of ETF approval if months of depressed sentiment have made market participants too underweight on ETH, as potentially indicated by the multi-year lows at which the ETH/BTC ratio was trading at just last week. However, it will undoubtedly require a significant amount of net new inflows to ETH beyond ETFs to offset ETHE outflows.

Of course, any possibility of near-term bullish pops presupposes that spot ETH ETFs will receive approval today; a denial may spell out the SEC’s rationale behind why Ether is a crypto asset security and wreak havoc on practically every token save BTC.

When asked this morning for insight on the impending spot ETH ETF decision, SEC Chair Gary Gensler ominously advised investors to “stay tuned” and claimed his agency’s approval of spot BTC ETFs was only compelled by the DC Circuit Court’s decision in the Grayscale case.