Liquidity Mining Around NFTs 🌊

Dear Bankless Nation,

As DeFi and NFT projects continue to interact and take inspiration from one another, one thing we’ve recently started seeing is the rise of liquidity mining, which originated in DeFi, in the NFT ecosystem.

These liquidity mining programs mark an easy way for projects to bootstrap themselves and a new way for users to earn crypto, so expect to see it much more as NFT projects keep reaching for the stars.

One such NFT-based project that just launched its own liquidity mining program is Unicly, a new NFT fractionalization protocol.

To give you a better idea for how this trend works and how it’s now taking place around NFTs, let’s explore Unicly’s UNIC distribution in today’s Metaversal 👇

-WMP

The Unicly LM Case Study 🌊

Liquidity mining, a trend that’s taken off in DeFi since last year, involves new projects “mining” liquidity, i.e. amassing crypto deposits, which these projects need in order to bloom in their nascent days.

These DeFi protocols accomplish this mining by rewarding liquidity providers (LPs) with crypto rewards, namely the governance tokens of these respective projects.

These “gov tokens” can be traded for other tokens like stablecoins, i.e. the ol’ farm and dump maneuver, or they can be used as governance instruments for steering these decentralized projects via voting.

Since last year we’ve also seen a boom of teams exploring DeFi x NFT melds, so we’re starting to see more NFT-centric projects explore liquidity mining programs.

These melds have already been particularly fruitful in the fractionalization sector, i.e. platforms where you can trade fractions of NFTs. Unicly is one such budding NFT fractionalization protocol, and the project just kicked off a textbook liquidity mining program. This phenomenon is here to stay in the NFT ecosystem, so let’s get a refresher on how it works by exploring Unicly’s ongoing campaign.

Unicly: making NFTs easily tradable

Again, Unicly is an NFT fractionalization protocol. The project allows collectors to tokenize collections of NFTs, whether they be ERC-721s, ERC-1155s, or combinations thereof, into fractions called uTokens.

Every fractionalized collection gets its own unique uToken, so for example the uToken for the first Mystic Axie collection on the protocol has been dubbed uAxie.

Accordingly, the idea is that Unicly’s uTokens can easily help users permissionlessly acquire fractions of highly-sought NFTs. But these tokens aren’t useful if their markets are too illiquid. That’s why winning over and maintaining uToken liquidity is key for the up-and-coming Unicly project, hence the new UNIC liquidity mining program.

Earn UNIC for being an LP

UNIC is the native token of Unicly and is used to participate in the protocol’s governance, e.g. voting on new project parameters. The distribution of UNIC started last week with the launch of the project’s new uToken liquidity pools.

To earn UNIC in this liquidity mining program, then, there are a series of boxes you’d first have to check. They include:

☑️ Acquiring ETH & uTokens

Your aim would be to become an LP for one of these uToken pools, so you’d need to prep an equivalent amount of ETH and your desired uToken, e.g. uBEEPLE. To get uTokens, go to Unicly’s Discover page, find the project you want, and then click on the “Trade” button on the right side of the interface. You’ll be taken to a trading interface, e.g. Unicly’s ETH-uMASK trading pair.

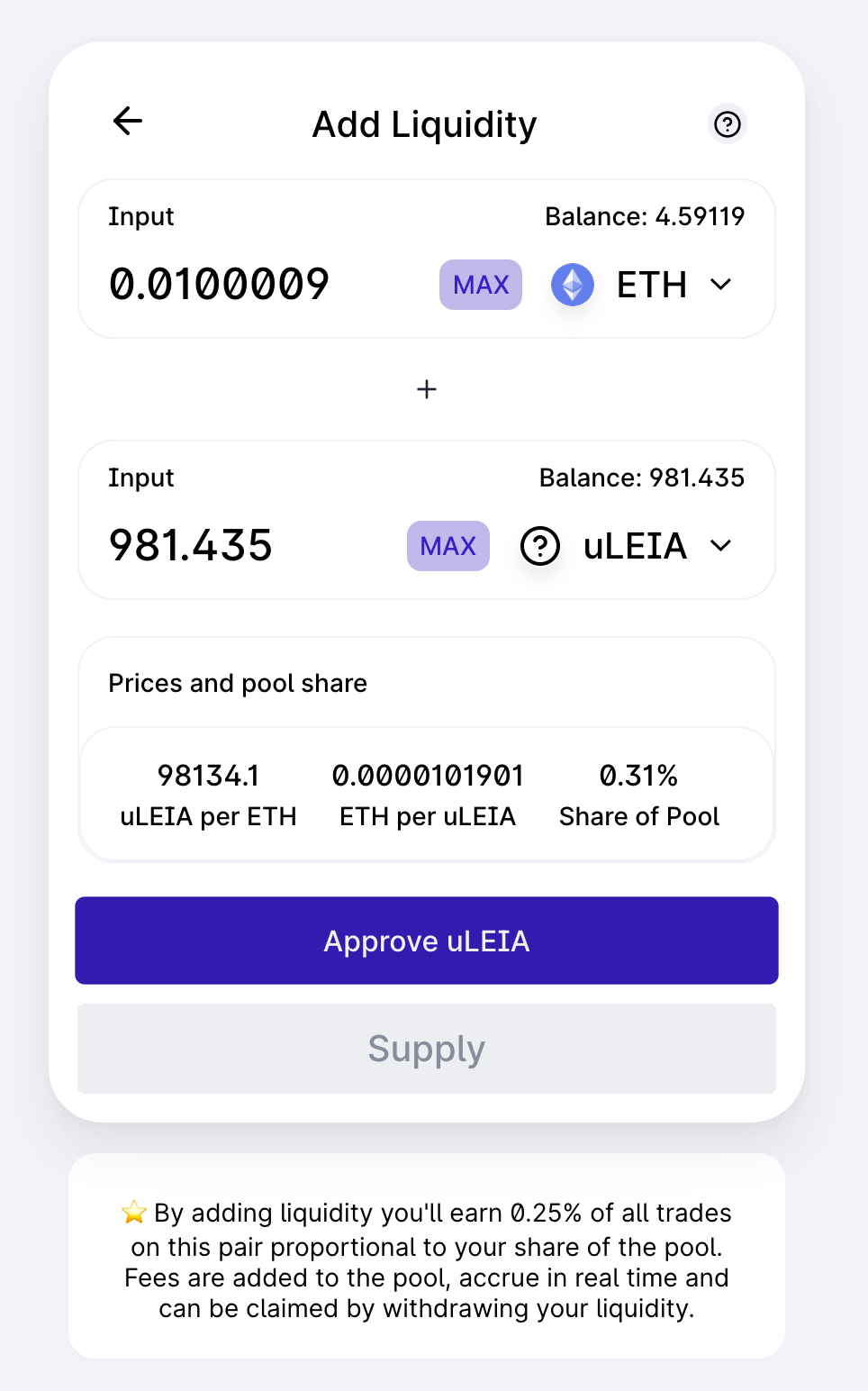

☑️ Adding liquidity

Then you’d go to Unicly’s Pool page, find your new uTokens, press “Add Liquidity,” input the amount of tokens you want to deposit, and complete the transaction to receive Unicly LP tokens.

☑️ Stake your LP tokens

Lastly, you’d go to Unicly’s Farm v2 page, find your LP token staking pool, “Approve” the transaction, and then press “Stake” and confirm the staking transaction to start earning UNIC rewards. The staking awards for the largest uToken pool by market cap right now, the CryptoPunks-focused uPUNK, is presently ~1,000% APR.

Risks!

I wrote this post to offer a general sense of how a basic NFT-centric liquidity mining program works, because we’re undoubtedly going to be seeing more of them going forward so you may want to familiarize yourself with them now.

As interesting as they may be I didn’t write this post as some blank stamp of approval for Unicly or its liquidity mining campaign, as liquidity mining does entail non-trivial risks for LPs and thus any money you deposit in can be exposed to multiple threats. Main ones are:

- Impermanent loss (IL) risk — You have to serve as an LP to earn UNIC rewards, and LPs face IL, which entails losing value via LPing as a result of trading volatility in a token pair. Would you have been better off simply holding ETH rather than serving as an LP across a specific time frame? That’s the threat of IL.

- Smart contract risk — Unicly’s core smart contracts have been audited by blockchain security firm Sentnl, but there’s always the non-trivial chance that something was missed that could later lead to an economic exploit against Unicly’s smart contracts.

- Project risk — Unicly's team certainly has given no causes for concern to date, but previously we have seen malicious projects make off with users’ money or undertake actions like mass sell-offs that have adversely affected users.

- Regulatory risk — This area is much grayer and more focused on the future. For example, though, there’s always the chance that some jurisdictions will class fractionalized NFT tokens like uTokens as unregistered securities. How this plays out remains to be seen, but it’s a risk to factor in nonetheless.

I’ve personally been testing out the uPUNKs farm since this weekend, but I’m also an expert and I’m only doing so with a small amount of money that I’m willing, and can afford, to see go to $0.

I suggest this approach to you, too, so you never overextend yourself when it comes to the possibility of things going bust. Learn about liquidity mining, maybe test it out some since it’s here to stay, but treat it more like an experiment especially if you’re just starting out!

Action steps

- 👀 Check out some of the NFT collections that underpin Unicly’s uTokens. Which ones are most interesting to you, and why? Comment below 👇