Linea's Next Chapter of Rewards

Bankless first predicted the LINEA airdrop in July 2023, just one month after the Consensys-backed zkEVM Layer 2 network made its mainnet debut.

Yesterday, the long-awaited distribution finally arrived! The drop infused hundreds of millions of dollars into the Linea network and stocked the Ecosystem Fund with more than a billion dollars of tokens to fuel future rewards programs.

Let’s break down the key apps, incentives, and opportunities shaping Linea’s next chapter👇

p.s. Check Bankless Claimables to see if you're eligible for LINEA 🪂

👻 Aave

The largest crypto application on Linea (and in existence) by total value locked, Aave is a permissionless DeFi marketplace that enables users to lend and borrow crypto assets in a peer-to-peer format.

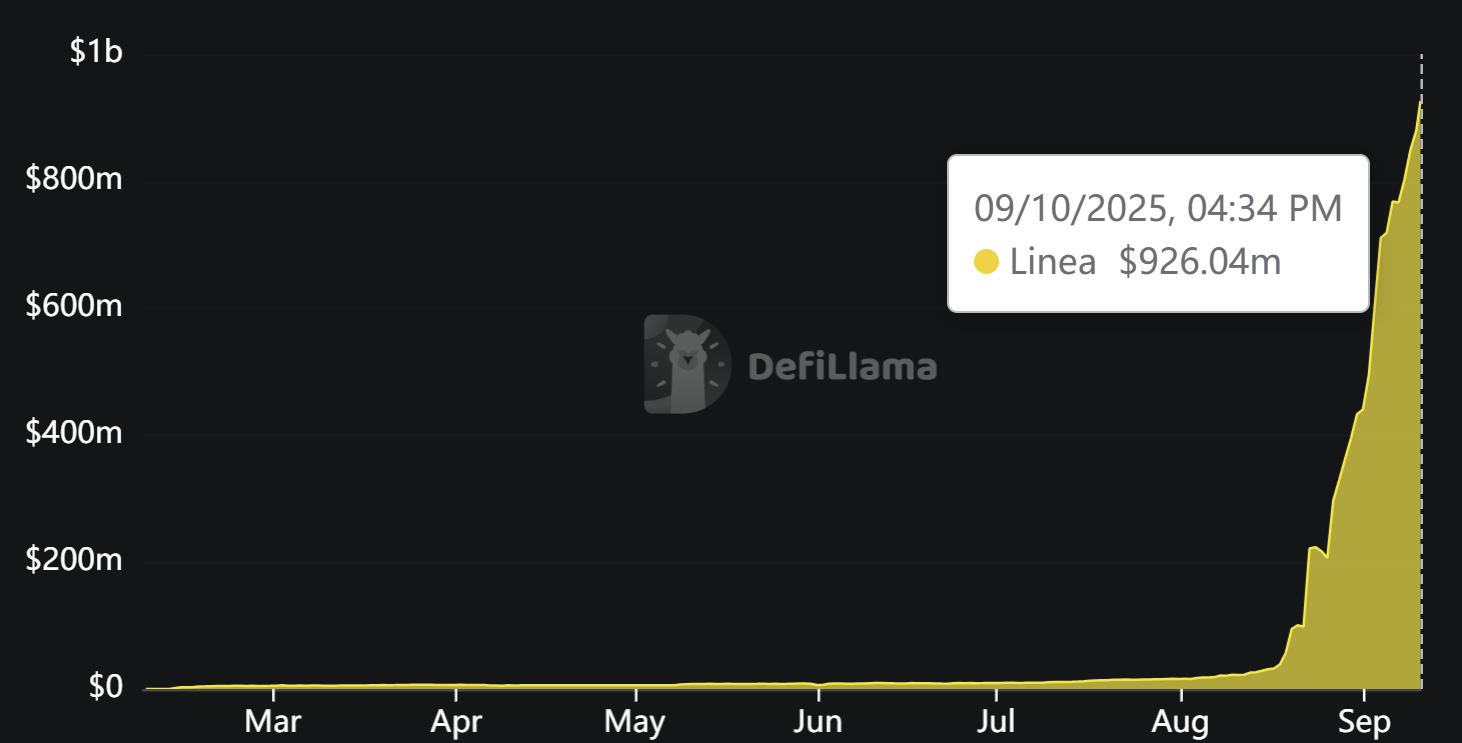

Aave deployed to Linea back in February, but TVL growth was minuscule until August, when the metric embarked upon a parabolic ascension from just $20M to nearly $1B, roughly one month ahead of the LINEA airdrop.

While there are no active Aave LINEA token markets at this time, as part of the Linea Ignition campaign, lenders to Aave Linea’s WETH, USDC, and USDT markets (until October 27) will share in 1B LINEA incentives.

🦊 MetaMask Card

The MetaMask Card is a crypto debit card that allows holders to make everyday purchases with digital assets – exclusively on the Linea network. Users can spend select stablecoins (EURe, GBPe, USDC, USDT), Ethereum (WETH), and Aave deposits (aUSDC) held in their MetaMask wallet.

MetaMask Card is available to residents of Argentina, Brazil, Canada, Colombia, the European Union, Mexico, and the United Kingdom. It can be used at over 150M merchant locations worldwide where Mastercard is accepted.

In addition to cash back rewards for purchases, MetaMask Card holders can receive up to $5k of bonus incentives for supplying and borrowing USDC through Aave on Linea.

We've built something beautiful - and now it’s available.

— Joseph Lubin (@ethereumJoseph) August 1, 2025

This collaboration between @MetaMask and @LineaBuild is a pivotal moment for the emerging crypto class who is living and working onchain.https://t.co/w9yC3G2uYH https://t.co/0oZ5gQLkKe

💱 Etherex

Essentially the Aerodrome of Linea, Etherex is a “MetaDEX” that leverages native REX tokens as rewards for liquidity provider rewards. All platform swap fees are returned to REX stakers, who determine which liquidity pools to allocate REX emissions toward.

Designed on the Ramses v3 engine, Etherex supports concentrated liquidity, efficient swaps, and full governance control. It's integrated with the MetaMask ecosystem, and currently provides the best Linea execution prices for ETH and other top tokens.

Etherex users can share in 1B LINEA incentives as part of the ongoing Linea Ignition campaign by supplying liquidity to USDC-USDT, USDC-ETH, WBTC-ETH, and REX/ETH pairs (in addition to existing REX rewards).

Earn juicy post-airdrop yields that amount to thousands of percentage points on an annualized basis by depositing into Etherex LINEA-paired liquidity pools.

— Etherex (@etherexfi) July 21, 2025

🛢️ Euler

Euler is a flexible DeFi lending platform that allows for permissionless market creation, custom risk parameters, and highly flexible collateralization options.

Vault curators can accept multiple assets as collateral for a single market, or accept rehypothecated deposits from other lending vaults as collateral. This helps to improve borrower capital efficiency and reduces market fragmentation.

EulerSwap is a “smarter DEX” that combines Euler with Uniswap V4 hooks, allowing depositors to natively borrow against and leverage LP stakes as they earn yield from swaps. This creates collateral utility for typically illiquid LP stakes.

Euler lenders to select WETH, USDC, and USDT vaults on Linea can share in 1B LINEA rewards as part of the Linea Ignition campaign. Eligible vaults are denoted by a Linea badge under the “Supply APY” column on the Euler lend page.

1/ Ethereum aligned and built for scale.

— Euler Labs (@eulerfinance) August 18, 2025

Euler expands and is now live on @LineaBuild ↓ pic.twitter.com/0tnrRj6F8T

🦘 Jumper Exchange

Jumper Exchange is a cross-chain bridging protocol that supports any-to-any crypto asset swaps. As a bridge aggregator, Jumper sources multiple potential bridging routes, allowing users to optimize for factors like transaction wait times and costs.

For those seeking crypto airdrops, Jumper’s active XP program rewards users with points for completing “missions” and making bridge transactions. Although unconfirmed at this time, it is possible that Jumper XP converts into liquid tokens at a later date.

The Linea Hub has integrated Jumper Exchange as its official bridge aggregator to facilitate a seamless swapping and bridging experience. Use Jumper Exchange to bridge funds onto the Linea network or offboard freshly minted airdrop rewards in one transaction!

Why not bridge to LINEA via Across on Jumper? 👀 https://t.co/j04vkNRgJX pic.twitter.com/Lo73A1SJIE

— Jumper (@JumperExchange) May 24, 2024