Unpacking Linea’s Ethereum-Boosting L2 Structure

Amid a wide field of Ethereum Layer 2s, new projects need to stand out from the crowd.

I recently wrote about Namechain, built by ENS – one of the most successful Ethereum apps ever – on top of Linea's zkEVM rollup tech. That's a major get for Linea, and significantly validates its L2 stack.

Linea has more under its sleeve than partnerships alone, though. Today, the new network laid out some other advantages of its offering. Let's dig in! 👇

Today, we're setting a new standard for Ethereum Layer 2.

— Linea.eth (@LineaBuild) July 29, 2025

Introducing native ETH yield, protocol-level ETH burn, and an Ethereum-native Consortium to manage the largest ecosystem fund in the space.

This is how we build the Layer 2 where Ethereum wins. pic.twitter.com/lVr5eFV2kr

Linea's New Pillars

Linea is an EVM-equivalent rollup, meaning anything that works on Ethereum will work exactly the same on Linea.

That's deep technical alignment, but the team isn't resting on these laurels. This week, the team announced a series of planned updates that will further align Linea with Ethereum and even route value back to mainnet.

Here's what's coming:

🔥 ETH burn economics

Gas is already paid in ETH on Linea, and soon the L2 will tie this usage to two burns: 20% of all gas income will be burned as ETH, while the remaining 80% will be used to burn the upcoming LINEA token. The intent is straightforward. Make L2 activity accretive to ETH’s monetary story while also shrinking LINEA’s float as demand rises.

💸 Native ETH yield

Another major change coming to Linea is native staking of bridged ETH, with yields earmarked to support liquidity providers and DeFi activity on the network. Details on validators, risk, and distribution are still to come, but the idea is to treat ETH as a productive base asset and not just a gas token.

🏦 A new Ethereum warchest

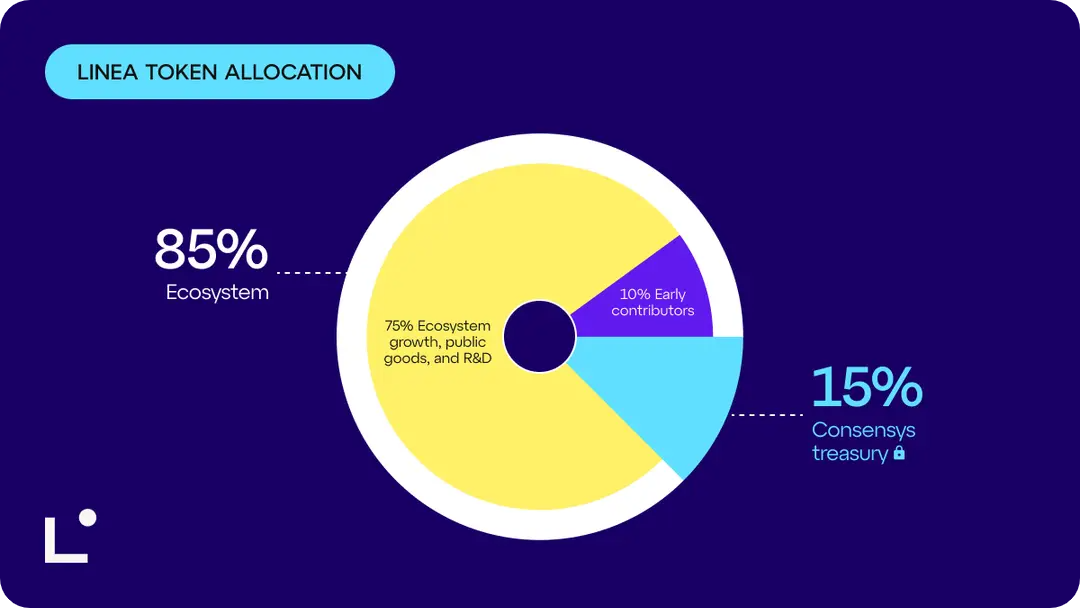

85% of the upcoming LINEA supply is slated for the ecosystem: 10% for early users and contributors, and 75% for "growth, public goods funding, and Ethereum R&D" via what Linea is billing as the largest ecosystem fund of its kind.

A new “Linea Consortium” of Ethereum orgs, starting with Consensys, ENS, Eigen Labs, SharpLink, and Status, will oversee most token distributions, with a governance charter promised as well. If executed well, this body can help shift typical L2 emissions toward broader Ethereum outcomes rather than just local TVL games.

The Big Picture

Linea is about to turn its everyday usage into an ETH supply sink, tightening its ETH-L2 alignment loop and giving its ecosystem apps a clean “we strengthen Ethereum by default” story. That's smart.

Auto‑staking bridged ETH subsidizes DeFi depth without opaque emissions by piping staking returns to LPs, which is also smart. It's transparent market‑making support designed to attract professional liquidity for the long-term.

Plus, allocating the majority of LINEA to public goods and Ethereum R&D can kickstart a trend moving L2 treasuries away from mercenary TVL games and toward shared infra financing. If grants bias toward credibly neutral tooling, everyone on Ethereum will benefit. That's smart, too.

The bottom line? The trifecta of ETH burns, native staking, and an Ethereum superfund offers a new coherent playbook that other L2s can copy. The real moat now lies in execution, governance quality, and real app wins, and Linea looks more than ready for this major challenge.