Sounding the Lido Alarm

Dear Bankless Nation,

After last week's regulatory onslaught, it might be tough to focus on even more existential threats facing crypto, but today we're zooming in on a looming issue facing Ethereum – something that last week's CEX lawsuits may only aggravate.

- Bankless team

The Lido Problem

Bankless Writer: Jack Inabinet

For months, stalwart Ethereum decentralization maxis and micro-cap LSD bag holders alike have patiently awaited what crypto analysts assumed would be an inevitability: an exodus of stake from Lido.

Naively, many (including some of us here at Bankless 😅) formed conclusions that enabling withdrawals during the Shapella upgrade would help to decentralize ether stake. Unfortunately, reality has failed to align with this narrative, and now, with a more mature Lido nearing control of 1/3 of staked ether, the alarm bells are beginning to ring out in earnest among the Ethereum community.

Today, we’re exploring why the SEC’s assault on exchange staking will only further benefit Lido, showcasing why Lido’s success story is self-perpetuating, and explaining why it is essential to disrupt Lido's stake centralization now.

👮 A Regulatory Push

Just last week, the SEC came after Binance and Coinbase. The allegations against the two exchanges vary in their scope, but a common theme spans both of the complaints: the SEC is going after the staking services offered by these two CEXs to their American users.

Binance and Coinbase control a combined 15.3% of all ETH staked to the Beacon Chain through staking products that are highly competitive with those offered by Lido.

While the SEC's complaints do not target Ethereum staking solutions today, the agency has already displayed their willingness to go after Ethereum staking. Back in February, Kraken was forced to end its Ethereum staking services for U.S. users as part of the settlement reached with the SEC, which Chair Gensler claimed “should put everyone on notice in this marketplace.”

The deposit landscape resulting from a continued SEC crackdown would be even more centralized and would likely see Lido capture an even larger market share of ETH staking.

🔮 Self-Perpetuating Prophecy

Despite withdrawals being enabled, Lido has maintained dominance over Ethereum staking, growing deposits by almost 900k ETH (14.3%) this month. Since Shapella, Lido’s market share has increased from 31.4% to 31.6% – a testament to the fact that the protocol has transformed its past success into a self-perpetuating prophecy of future dominance.

Lido derives these ongoing advantages from the native superiority of its ETH staking derivative and the deepening ability to undercut competitor’s fee structures.

Token Advantages

HODLers of stETH benefit from the token’s deep liquidity – making it one of the only viable liquid staking options for whales – with widespread collateral integrations across DeFi increasing the use cases of the token.

Because stETH possesses certain qualities that make it more attractive to hold than your average LSD, capital – especially sophisticated capital seeking out the best possible combination of investment attributes – will continue to pour into the token, further solidifying the qualities that make Lido’s staking derivative superior to the rest.

Fee Structure

Currently, Lido offers the lowest fees of any bluechip staking provider, meaning that financial incentives are actively pushing stakers towards Lido!

The gap between Lido and its closest competitors will only grow overtime as Lido continues to decrease its share of staking rewards, undercutting competitors while juicing profits as more stakers flock to Lido to take advantage of what they see as an increasingly lucrative staking opportunity.

Clear parallels to Lido exist in the TradFi world. Vanguard revolutionized the world of investing in the 1980s with low-cost passive indexing giants, continually undercutting competitors' fees in a race to the bottom, and has been able to maintain their edge for nearly half a century. Lido is taking a page directly from this playbook.

The web3 ecosystem is an expansive world, full of endless opportunities for those curious enough to explore them! Head over to MetaMask Portfolio to get started, where you can view your assets in one place and discover other features such as Buy, Swap, Bridge, and Stake.

⚔️ Disrupt Lido

Lido governance has displayed clear indifference towards the existential threat that its climbing stake accumulation poses, overwhelmingly voting against self-limiting deposits in June 2022.

At first glance, it appears doing such would go against the best interests of LDO token holders and harm Lido’s profitability, however, as stake further accumulates it is also clear that consequences of failing to self-limit are very real.

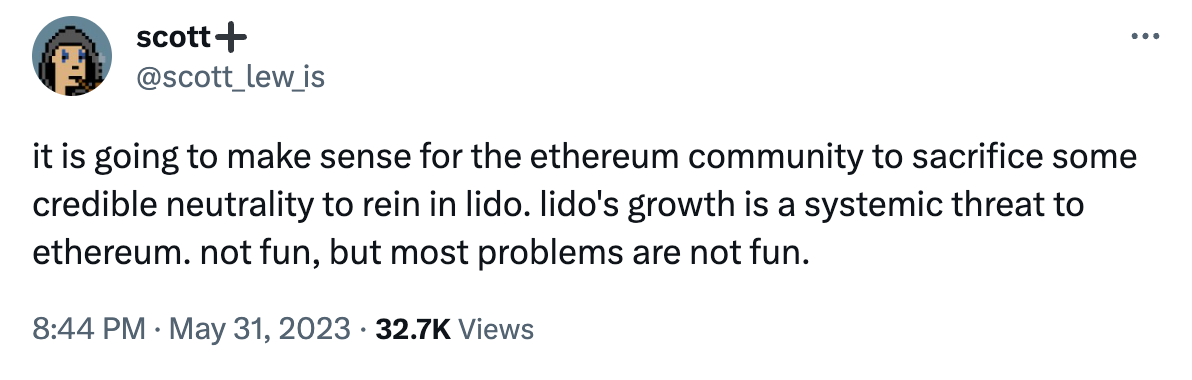

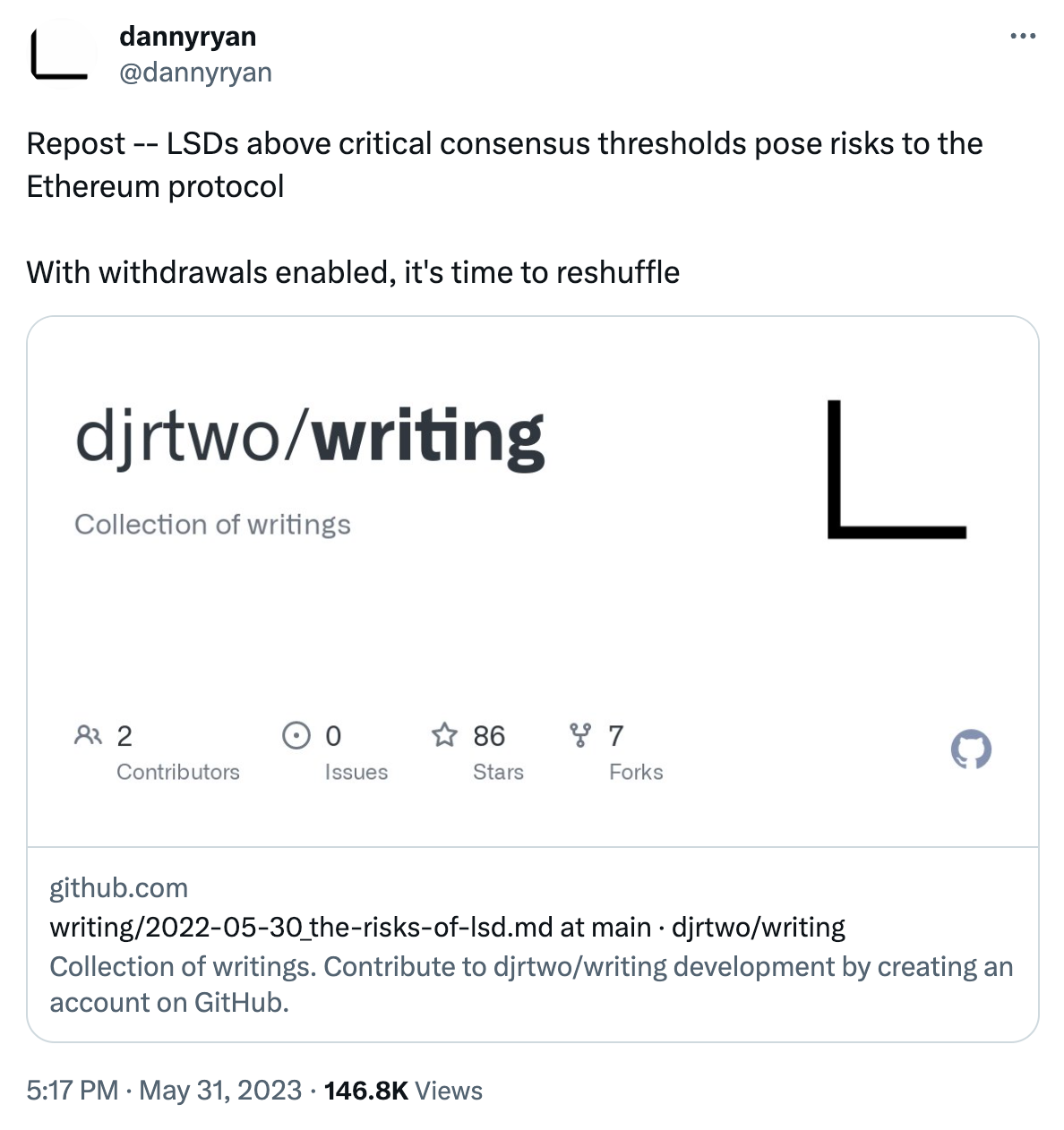

Support is growing among Etherians to reign in Lido, with some arguing that the community should forcibly clean up their act if they refuse to self-limit. While concerning, it is unlikely we see such controls implemented at the base layer, as this would require a hard fork, which risks fracturing the fragile social consensus layer of Ethereum and likely results in a highly undesirable chain split.

The Lido community should be concerned by the prospect that its stake centralization translates to dampened future demand for Ethereum blockspace.

The protocol is nearing the first of three key thresholds at which core properties of Ethereum’s value proposition are degraded, offering would-be attackers increased powers over the chain. Should Lido continue to grow at an unchecked pace, it will inevitably surpass these thresholds and pose a systemic risk to the ecosystem.

In the bull markets of past cycles, narratives of decentralization and censorship resistance take a back seat to the hottest trends in the moment. There’s no better time than a bear market to protect the foundational properties of the Ethereum network. Absent an active campaign to disrupt Lido’s dominance, it is likely the staking provider will continue to grow its market share.

So, how can you get involved? Thankfully, crypto battles are waged at the margins and you don’t need to be a whale to participate in the decentralization of staked ETH. For starters, don't stake with Lido.

Consider staking with Swell and work to qualify for the SWELL airdrop later this year, spin up your own Rocket Pool minipool with as little as 8 ETH to earn boosted yields by charging commissions on the Ether staked to your node, or deposit your Ether LSDs into unshETH to supercharge rewards with token incentives. For the technically sophisticated user, might we suggest running your own validator?

No matter how you do it, moving your stake away from Lido will help in this battle against centralization, but the power of the purse alone won’t deter Lido from its path towards continued dominance; now is the time to take a page out of the activist playbook and get loud! 🗣️

MARKET MONDAY:

Scan this section and dig into anything interesting

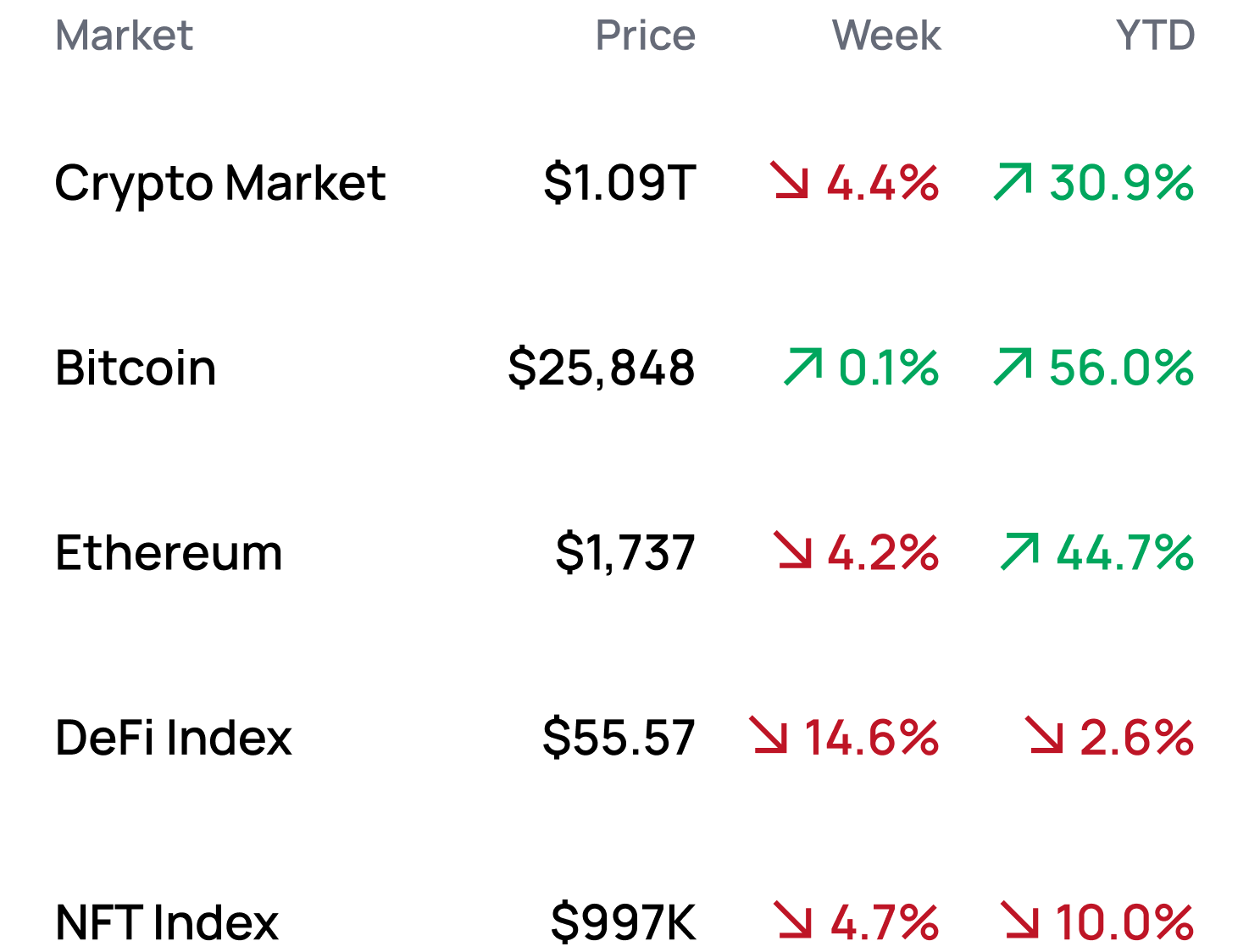

*Data from 6/12 3:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Try out Taiko’s alpha-3 testnet

- Trade NFTs on Kraken’s new marketplace

- Migrate your bridged USDC to native USDC on Arbitrum

- Participate in The Beacon’s Harvester Event with Bridgeworld

Yield Opportunities 🌾

- ETH: Earn 14% LPing the alETH-ETH pool in Velodrome on Optimism

- ETH: Earn 12% staking alETH-frxETH Curve LP tokens in Convex on Ethereum

- USD: Earn 7% LPing the LUSD-DAI pool in Velodrome on Optimism

- USD: Earn 6% staking NOTE-USDC LP tokens in the CLM on Canto

- BTC: Earn 8% depositing wBTC into the GMD Index in GMD on Arbitrum

What’s Hot 🔥

- RobinHood drops support for ADA, MATIC, and SOL

- Lens raises a $15M seed round

- Argus Labs raises $10M to build on-chain gaming infrastructure

- Sushi launches a DEX aggregator

- Optimism ships its Bedrock upgrade

Money reads 📚

- The Three Transitions - Vitalik Buterin

- Autonomous Worlds (Part 1) - Ludens

- Thread on the Immutable Product Roadmap - Immutable X

- Thread on Arbitrum Outage Post-Mortem - Arbitrum Developers

- Patience Is Beautiful - Arthur Hayes

Governance Alpha 🚨

- Aave looks to launch GHO on mainnet

- Balancer moves to allocate its 3 million ARB

- Safe DAO weighs enabling transferability

- StarkNet aims to deploy its V0.12.0 network upgrade

- Silo DAO explores raising protocol fees on Ethereum

Trending Project: SSV 📈

Analyst: Ben Giove

We are initiating coverage of SSV with a rating of Bullish.

Catalyst Overview:

We are Bullish on SSV due to its upcoming mainnet launch.

SSV is a distributed validator technology (DVT) network that acts as “multi-sig for validitors” by enabling a single instance of a validator to be run from multiple locations on multiple machines. The protocol has completed pilot programs with LSD issuers like Lido. The SSV token is used as collateral and a means of payment for node operators within the network.

Price Impact:

SSV’s upcoming mainnet launch should help create demand for its token, as node operators will need to purchase it to participate in the network. This, along with the general adoption of DVT and growth of the Ethereum staking sector, should help lead the token to outperform over the coming months.

See more ratings in the Token Hub.

Meme of the Week 😂