Is Lido Unstoppable?

Dear Bankless Nation,

May was a huge month for Lido. Withdrawals went live and its ETH-denominated TVL hit new all-time-highs.

Staking as a whole has been a tear post-Shapella, but are Lido alternatives catching up or is Lido running away with its market dominance? Let's dig in.

- Bankless team

Lido Is Bigger Than Ever

Bankless Writer: Ben Giove

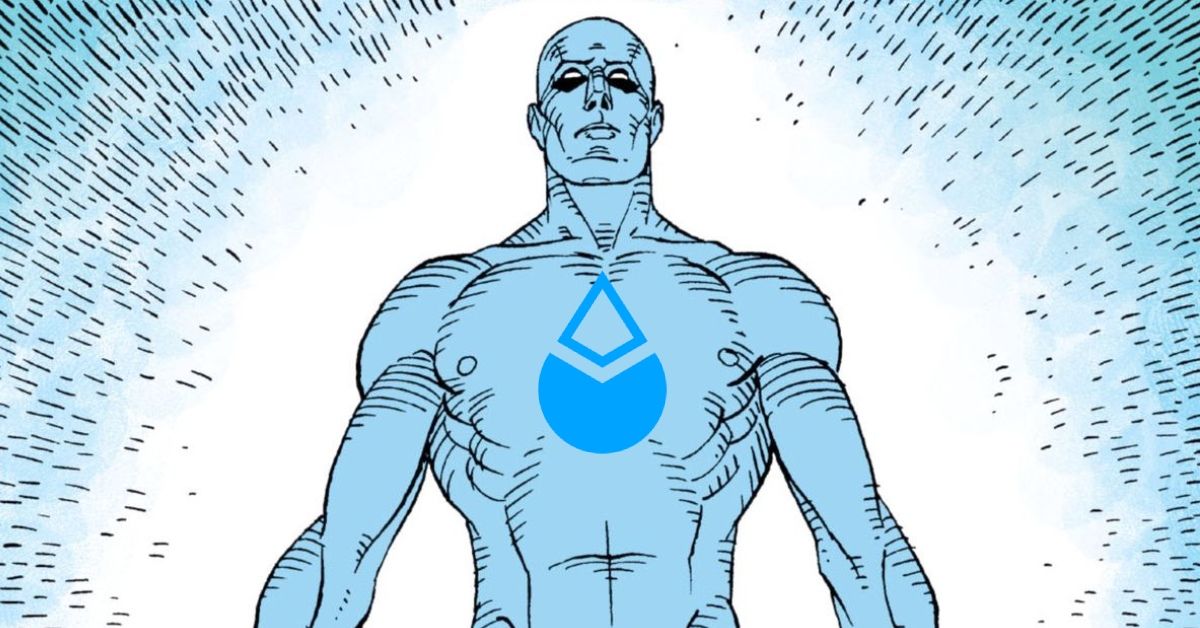

Despite choppy markets, staked ETH deposits are climbing and the biggest players in that space are growing more and more powerful.

The amount of ETH staked has surged despite last month's Shapella hard fork, a network upgrade that enabled withdrawals from staking. Since then, more than 2.9M ETH has been staked or is queued to stake, a 15.9% increase from pre-Shapella.

Today, roughly 18% of the total ETH supply is staking and/or in the activation queue. Even now, this remains well below the average of ~60% for the largest PoS blockchains, suggesting that far more ETH will be making its way to validators in the future.

The staking supercycle is well underway.

Lido Keeps Winning

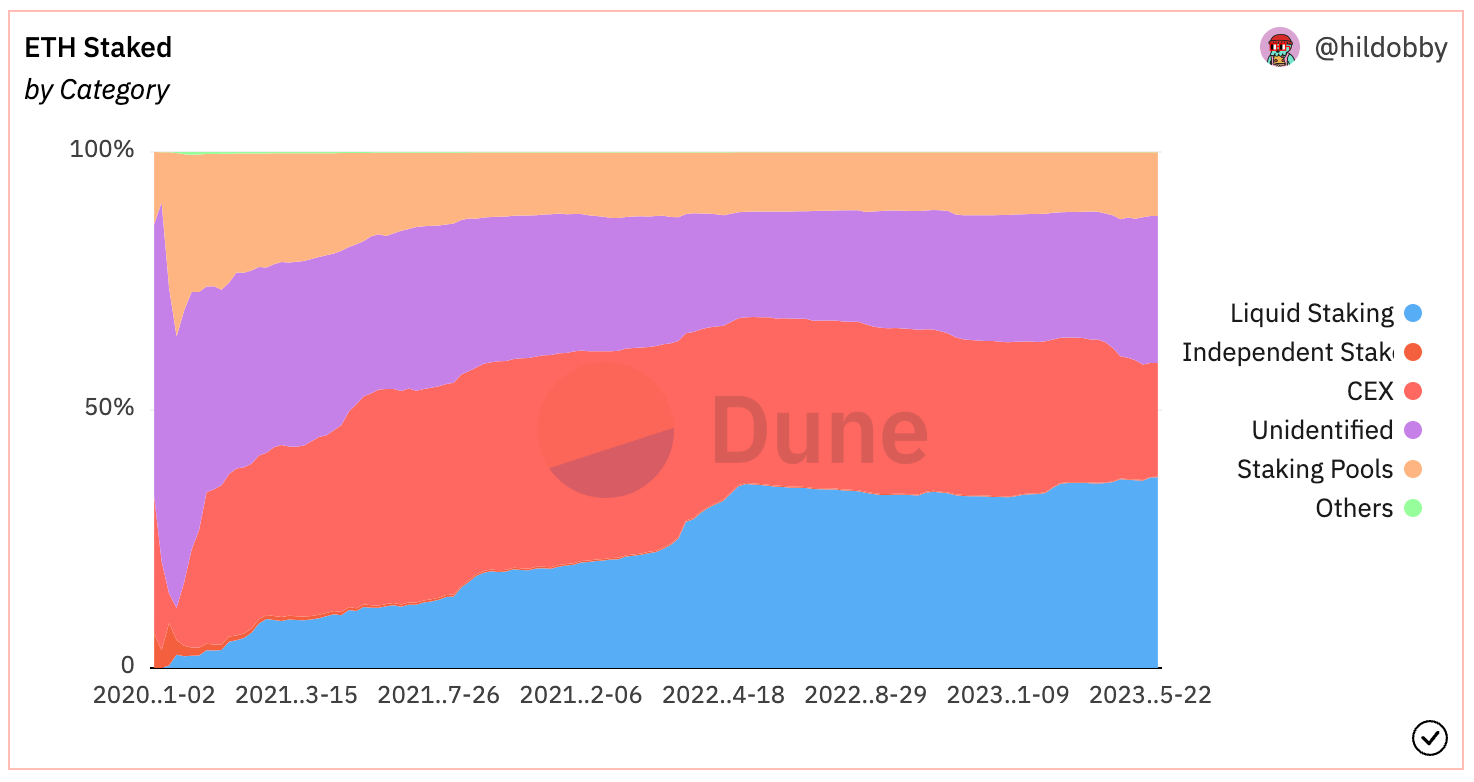

One of the prime beneficiaries of this staking surge has been liquid staking derivatives (LSDs). These tokens, which represent claims on underlying staked ETH, have grown dramatically post-Shapella, with their collective deposits rising.

LSDs in total now have a 36.9% share of all stake, up from 35.8% pre-Shapella.

The largest LSD issuer, and the entity that has attracted the greatest amount of nominal stake since Shapella, is Lido. Lido itself has a 31.8% share of all staked ETH. This is nearly 3x that of the second biggest staking entity, Coinbase.

Lido’s growth has contributed to its governance token LDO being among the best performing in this market, increasing 95% against USD and 22% vs ETH respectively year-to-date. This all comes despite Lido recently enabling withdrawals through the launch of V2 on May 15.

Since withdrawals went live, more than 444K ETH has been withdrawn from the protocol, with the vast majority of this stake (97%) belonging to bankrupt lender Celsius. This accounted for about 7% of Lido’s pre-V2 deposits.

Aside from allowing stETH holders to exit, V2 brought a second major change to the protocol in the form of the staking router. The staking router enables validators to create their own custom, isolated staking pools within Lido known as modules. For instance, a validator, or group of solo stakers could spin up a module that utilizes Obol’s distributed validator technology (DVT) network, or EigenLayer’s re-staking solution.

Modules not only have the potential to grow and diversify Lido’s validator set, but due to their segregated nature, can enable the protocol to experiment with new staking technologies at the margins while reducing overall risk. However, just as with V1, all modules (and therefore new validators) must be approved by Lido DAO governance before going live.

The Lingering Problem

V2 is a step in the right direction when it comes to the decentralization of Lido. However, it still does not address one of the primary risk factors facing the protocol, as LDO holders still ultimately control the validator set.

Considering the immense amount of stake under their control, this could pose significant risks to the health, decentralization, and credible neutrality of Ethereum as a whole.

Now, it’s not as if all of this stake is controlled by one dude in their basement. There are 30 entities validating in the Lido V1 module today. And of course, as a non-custodial, transparent protocol, Lido is a far more palatable option than a black box centralized exchange. However, the ability of tokenholders to cherry-pick who validates for the protocol and how they do so has potentially serious adverse effects.

For instance, LDO holders could mandate that all validators and new modules run a relayer that censors transactions in order to be OFAC compliant. Now, it’s not as if these token holders would want to do something like this. But they may be pressured by governments to do so. And Lido may be acutely vulnerable to that sort of attack due to its highly institutional holder base.

Per Arkham Intel, ~10.1% of the LDO supply is held by seven venture capital funds, hedge funds, and market makers: Paradigm, Dragonfly, DeFiance, Jump, BitScale, Wintermute, and Brevan Digital Howard.

Now, 10.1% may not seem like that much of the supply. But considering that the only Lido DAO governance votes to receive 10% total voter participation were the first two back in December 2020 (there have been 158 votes since), history suggests that it is more than enough to affect meaningful change. That number also doesn't even account for all the other institutional holders who may be out there.

These entities are required to register with governments all across the world. If push comes to shove, they are ultimately at their mercy. Considering that jurisdictions such as the United States are becoming increasingly hostile towards crypto, this could pose a risk to Ethereum’s decentralization and credible neutrality.

To the Lido community's credit, they have acknowledged that LDO holders have too much power over the protocol, and are taking steps to address this such as with stETH governance.

However, in the meantime, it is critical that the community pushes to diversify stake by increasing the ease of solo staking, as well as by creating and growing permissionless, governance minimized liquid staking solutions.

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

MARKET MONDAY:

Scan this section and dig into anything interesting

Market Opportunities 💰

- Swap tokens using Matcha’s new search engine and increased liquidity integrations

- Check out Magic Eden’s new features and learn how to earn fees on trading

- Claim soulbound badge collectibles on Treasure

- Mint the “Path to Base Mainnet” NFT

- Qualify for a potential Gravita airdrop

Yield Opportunities 🌾

- ETH: Earn up to 64.9% APY with Ribbon’s covered ETH call vault

- ETH: Earn up to 14.9% APY with Velodrome’s WETH/rETH pool

- BTC: Earn up to 9.0% APY with O3Swap’s BTC vault on Arbitrum

- USD: Earn up to 17.5% APY with Velodrome’s USDC/BOB pool

- USD: Earn up to 10.9% APY with Yama’s USDT liquidity pool

What’s Hot 🔥

- Introducing Ark: an L2 for private, offchain BTC payments

- These firms claim to have found an SEC-friendly crypto path

- Binance allegedly commingled customer funds and company revenue

- Unciphered claims ability to physically hack Trezor T Wallet

- BRC-20 exchange fuels DeFi boom on Bitcoin

- VC Paradigm shifts crypto-only focus to include AI

- Crypto shuns Multichain as rumors swirl about core team’s arrest

Money reads 📚

- Crypto Airdrops: A Revolutionary Approach - Darcy Allen

- Why DeFi is Broken and How to Fix It: Oracle-Free Protocols - Dan Elitzer

- EigenLayer: Rehypothecation and the Infinite Trust Time Machine - thefett

Governance Alpha 🚨

- Synthetix founder wants to buyback and burn millions of SNX tokens

- Maker looks to increase Dai Savings Rate to 3.33%

- ConsenSys proposes Uniswap deploy to its Linea zkEVM

- Frax eyes deployment of income-generating Automated Market Operations to L2s

- Swell Network proposes onboarding swETH to LSD-Fi protocol unshETH

Token Hub Update: (MAGIC)📈

Analyst: Ben Giove

We are reiterating our bullish rating on MAGIC.

Catalyst Overview:

MAGIC remains Bullish due to the continued growth of the Treasure ecosystem and the upcoming launch of the Beacon Harvester.

Treasure is continuing to expand. The gaming DAO has onboarded two new games into their ecosystem since March in ZeeVerse, a monster-tamer MMORPG, and Spark Defense, a MOBA tower-defense game. In addition, Treasure will soon be launching a new Bridgeworld harvester where MAGIC holders will be able to stake their tokens to earn emissions in collaboration with The Beacon, another game in their ecosystem.

Potential Price Impact:

Treasure’s continued expansion and onboarding of partner games should help attract new users to their ecosystem, helping strengthen their network effects and in turn attracting further studios and players. In addition, the launch of the Beacon Harvester represents a positive catalyst for MAGIC in the short-run, as it should help create demand to buy and stake the token in order to earn emissions.

See more ratings in the Token Hub.

Meme of the Week 😂