Leave Lido Alone

Dear Bankless Nation,

Liquid staking kingpin Lido Finance is finding itself at the center of a fierce debate drawing in plenty of researchers and crypto community members.

Today, we dig into the pro-Lido perspective with resident analyst Jack Inabinet taking the position. Stick around for a counterpoint to this article later this week!

- Bankless team

Lido Did Nothing Wrong

Bankless Author: Jack Inabinet | Disclosures

Ethereum community members have long raised concerns that Lido's dominance is a source of network centralization, and many rightfully view Lido's continued accumulation of market share as posing a systemic risk to Ethereum's consensus.

With just under one-third of all ETH staked through Lido, the Protocol borders upon breaching the first of three critical consensus thresholds, which risks creating a concerning centralization vector, as Lido could prevent Ethereum from finalizing without needing to collude with other validating entities!

Eventually, Lido's market share could exceed 50%; at this point, the Protocol could censor certain transactions and engage in short-range transaction reordering to maximize MEV extraction.

After obtaining 66% market share, Lido would control a supermajority of the validator set, and the Project would become akin to some form of Ethereum governance wrapper, with the ability to fork the chain and finalize on any version it wanted, unlocking the ability to double spend and censor transactions at will 😨

Fight the Power?

In light of these centralization risks, it has come into vogue within many Ethereum circles to propose solutions to constrain Lido's unchecked growth.

Unfortunately, the window of opportunity to dispense such remedies has almost certainly closed…

While it may have been possible to impose base layer conditions limiting the growth of a single actor beyond a given threshold at the genesis of staking, today, the commercial interests of Lido (and other large staking entities like Coinbase and Binance) are too heavily entrenched for these modifications to be made!

The implementation of such controls would require an Ethereum hard fork, but seeing as LDO HODLers overwhelmingly voted against self-limiting last year, such an upgrade risks fracturing Ethereum's fragile social consensus and could lead toward an undesirable chain split, a top concern of Vitalik.

More than Yields

Recognizing that base layer constraints will be impossible to impose, some prominent Ethereans are instead advocating for "vampire attacks," which provide boosted staking yields by utilizing tokens as incentives to encourage LST HODLers to divest from large staking providers, namely Lido.

Returns, however, are just one of the many attributes that stakers must weigh when selecting their optimal staking solution, and enhanced yields alone will likely be insufficient to compel emigration en masse from Lido.

Projects undertaking the vampire attack approach will gain some amount of adoption from mercenary capital in the short term. Still, once their incentives derived from unsustainable inflationary tokenomics dry up, stakers will look to take their business elsewhere.

Once again, they will be forced to reevaluate available staking options on a perceived risk-adjusted basis, and due to the inherent winner-take-all dynamics of staking, it's likely that these depositors will eventually make their way back towards Lido!

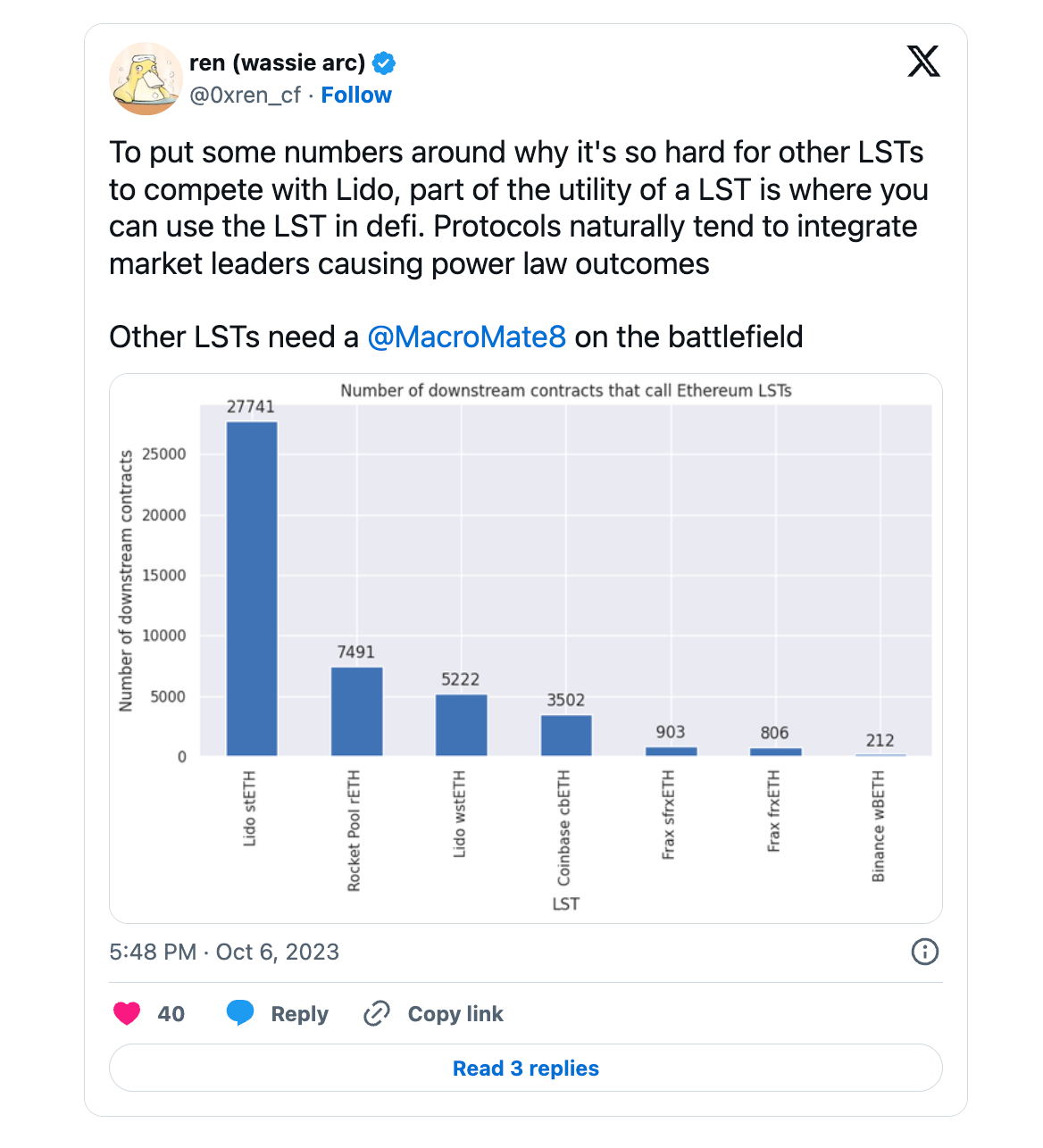

Holders of Lido's stETH benefit from the token's best-in-class liquidity and its widespread integration as collateral across DeFi protocols. These are two significant factors compelling the adoption of stETH over competitive LSTs.

Further, as the leading LST provider by ETH deposited, Lido can easily fend off serious competitors by undercutting their fee structures on a percentage basis while maintaining net profitability. While it is important to note that Lido has yet to move in this direction, this is the same edge Vanguard took advantage of in the 1980s to balloon AUM as it revolutionized the world of passive investing with the birth of the mutual fund.

As fashionable as it may be to wage war against Lido, it's time for the Ethereum community to accept the fact that the underlying economics of staking on Ethereum promotes the concentration of stake with a single provider and to acknowledge that we are thankful to live in the reality where a decentralized player dominates.

In this decentralized reality, Lido is actively looking to expand its validator set with the introduction of a staking router, which will allow anyone from solo-stakes to distributed validator technology (DVT) clusters to operate nodes, and is seeking to empower its LST holders with the ability to veto governance votes through a dual governance model.

MetaMask Portfolio houses our flagship swapping mechanism. The Swap feature allows you to swap tokens directly by aggregating data from various decentralized exchanges (DEXs) and market makers to ensure you get competitive prices and low network fees.

Bad Alternatives

This reality is vastly preferential to the centralized alternative where large CEXs, like Coinbase, control the entire staking stack (i.e., both deposited Ether and node operation).

For Lido to take advantage of the centralization vectors it unlocks by surpassing the three critical consensus thresholds, LDO holders would need to collude with the Protocol's ever-expanding set of node operators, who would risk reputational damage should they comply with non-Ethereum aligned instructions, and stETH holders, whose stake would be at risk of getting slashed.

Without question, Ethereum's staking architecture produces a suboptimal equilibrium. Still, seeing as it's too late to turn back the clock without taking drastic actions that risk disrupting the chain's fragile social consensus layer, we can at least be appreciative of the fact that our staking overlords are of the decentralized variety and that they're working towards mitigating existing centralization concerns to the best of their ability.

Action steps

- 🚨 Read Sounding the Lido Alarm

- 🟦 Check out yesterday's tactic Getting started with Diva