Drop it like it's hop

Dear Bankless Nation,

It was a turbulent week in crypto.

Let’s recap.

1. Fed crashes market

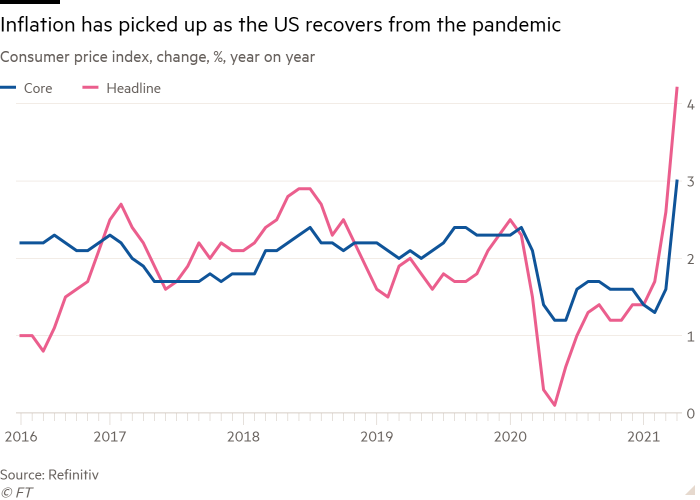

The Fed this raised interest rates by half a percentage point this week.

This is the largest rate hike in 20 years in response to the highest consumer inflation rates seen in the last 40 years.

But it doesn’t stop there.

Fed Chairman Jerome Powell indicated there are more rate rises, at least TWO more 50 basis point raises in the coming months.

While both equities and crypto initially responded well to the news, these reversed gains less than 24 hours later. The S&P 500 is down -14% on the year while BTC and ETH are down -47% and -44% since all-time highs in November.

Not the best time to be in risk-on assets.

The Fed has a difficult job ahead.

Powell must combat the highest-recorded inflation in recent history by raising rates, while staving off a recession.

Raise rates too quickly or too much and the economy can come crashing down.

We’re hoping for “a soft landing”

We’ll see how markets respond in the coming months.

2. Are they coming for DeFi?

PoolTogether, the no-loss lottery, is getting sued by a troll for $230M—2x the amount of value that’s actually locked in the protocol.

The plaintiff?

Senator Elizabeth Warren’s former technology lead. Not surprising given her campaign’s track record against crypto…

After depositing $10 into the protocol, Joseph Kent filed a lawsuit against PoolTogether for operating a lottery in New York, an illegal endeavor in the state.

Ummm…PoolTogether isn’t even a lottery.

PoolTogether is just a gamified crypto savings account. It helps people save money. There’s no mechanism to actually lose with PoolTogether (you can verify that on-chain!).

You deposit money and there’s a chance you win the interest earned from all the deposits. Moreover, your deposit is always redeemable 1:1 for the amount at any time.

This guy couldn’t have picked a nicer protocol to go after.

Instead of suing shady crypto scammers so rampant in crypto, this lawsuit attacks the kindest, most harmless app in DeFi. The thing that helps people save money…unlike the banks with their .01% interest rates.

The article states the plaintiff is “gravely concerned” about cryptocurrency and its “destructive” impact on the environment along with the ability to circumvent financial sanctions.

Is this just a frivolous lawsuit? A political attack? Uncertain.

Maybe the incumbents are scared and this is how they’re lashing out against DeFi.

3. Drop it like it’s hop

We’ve been predicting Layer 2 for a while and now we’re doubling down.

Simple reason why? The tokens are coming.

This week, there were three key developments in Layer 2 ecosystem:

- Hop Protocol token (get the details here)

- Optimism Stimpack—$230M OP project incentivization program

- ZkSync confirms its token after updating its FAQ

We unpack the whole Hop Protocol airdrop here—tune in to get all the details.

In terms of Optimism, this 230M allocation should be substantial. Even though we don’t have a dollar value for this allocation yet, we can do some basic napkin math using comparables.

At $1 OP, this would value the network at $4.2B FDV—less than half of Polygon—meaning the OP StimPak would be worth $230M. This allocation surpasses Avalanche’s similar $180M program, a key driver that propelled it to $8.2B in value locked.

Could the same happen for Optimism?

Bear market aside…one thing’s clear: L2 Summer is heating up.

Here’s what’s lined up for next week:

- Jim O’Shaughnessy gives timeless wisdom for crypto investors (early release)

- William shows us how to maximize ETH yield.

- We’re going deep on meta-governance

Have a stellar weekend. We’ll see you next week.

- Bankless Team