View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

1️⃣ L2 Token Reckoning

While altcoins across the board have had an abysmal month, there's been some severe reshuffling of L2 native tokens specifically, with a number of ETH's major ecosystems getting their market caps slashed this week.

Optimism's OP is down 23% week-over-week and 45% on the month. Arbitrum's ARB has fallen 19% this week and 43% over the past 30 days. Meanwhile newer entrants like ZKS and STRK have fallen 43% and 59% respectively in the past month.

What's to blame for the reshuffling? A rush of new L2 token entrants certainly hasn't helped.

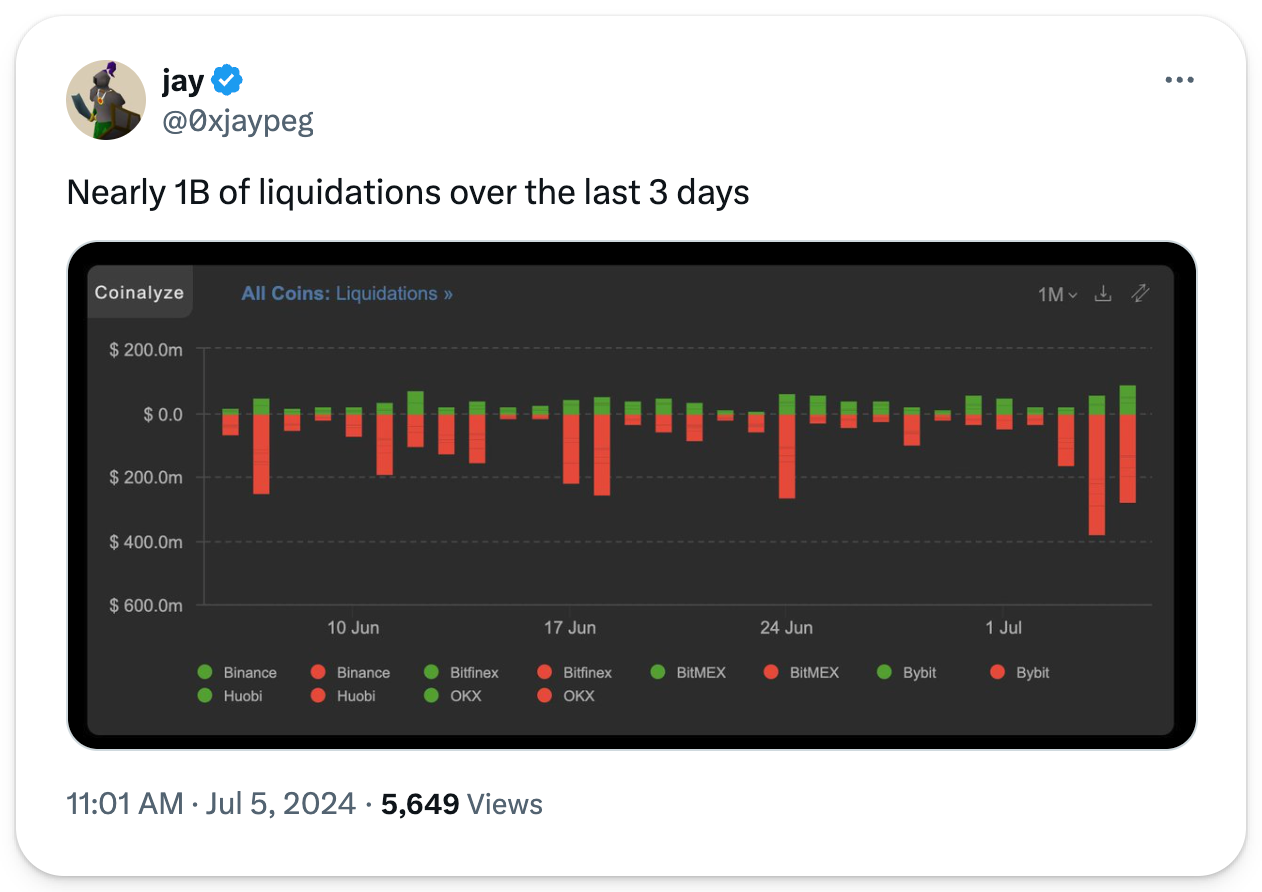

2️⃣ Bitcoin Blows Up

BTC's price fluctuated as much as $10K this week, as Mt Gox redemptions going live and the German government's market sales sent traders rushing to the exits.

The worst of the market action took hold over Independence Day as wallets associated with the defunct Mt Gox exchange moved 47,229 BTC as they geared up to repay depositors. As if a sizable chunk of $9 billion in looming BTC potentially hitting the market soon wasn't daunting enough, German authorities have begun making regular sales of their multi-billion dollar tranche of BTC, which was seized through various criminal cases.

3️⃣ MiCA Goes Live with Circle

The EU's Markets in Crypto Assets (MiCA) regulatory framework went live this week, and Circle became the first stablecoin issuer to earn a license under the new regulation.

Circle will now be able to mint the USDC and EURC stablecoins, and the EU is urging EU-based traders to convert non-compliant stablecoins. This could prove to be a boon to Circle, which still lags behind Tether in circulated stables.

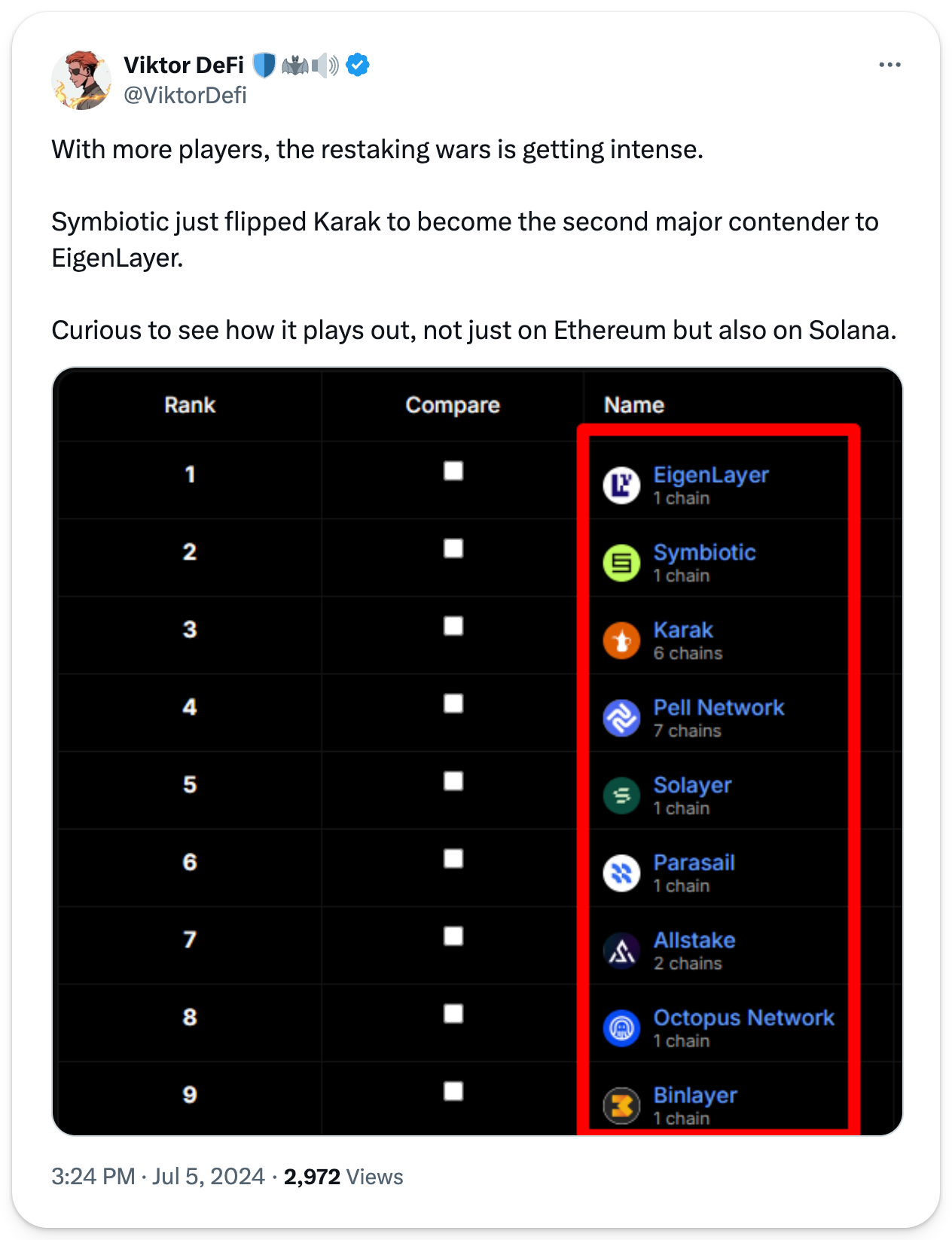

4️⃣ EigenLayer Competitor Shows Traction

The much-hyped EigenLayer competitor Symbiotic just surpassed $1 billion in deposits after less than a month, flipping the Karak restaking protocol and earning the second-place spot among restaking protocols.

Symbiotic's close relationship with staking heavyweight Lido and EigenLayer's perceived vulnerability after a poorly received "stakedrop" token launch has left plenty of market excitement for Symbiotic and its associated Mellow Finance LRT protocol. All that said, there's still a long way to go to catch up with EigenLayer's $19B in deposits.

5️⃣ Silvergate Pays Up

The crypto-friendly Silvergate Bank settled charges with a litany of government agencies and paid $63 million in fines over suits that it had not sufficiently monitored nearly $1 trillion in crypto transactions, including those from FTX. Further, regulators had argued that the bank had misled the public as to the effectiveness of its internal compliance programs for crypto customers.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

Markets are down, but the ETH ETF is right around the corner, so we're still feeling bullish!

In this week's rollup, David and Ryan talk ETF updates, Polymarket's breakout, and what the future of crypto regulation could look like after the Supreme Court's big move.

Listen in! 👇

📰 Articles:

📺 Shows:

Thousands of Bankless Citizens scored an average of $3,500 worth of tokens after Ether.fi's airdrop. Did you miss out again?

Ether.fi was in the Bankless Airdrop Hunter, and you could have gotten into the latest drop by following our quests! There are nearly 100 other crypto protocols in Airdrop Hunter waiting for you.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.