Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

It’s Market Monday! Every week I scan the open finance market to surface the best opportunities and insights for us.

Can I tell you something?

I think Bankless subscribers are better informed than the VCs who keep chasing new blockchains and the financial media who are completely ignoring what’s going on.

Know why?

It’s because we have a crypto money framework that helps us avoid stuff that isn’t on the path to becoming money. It’s because we actually use these systems, so we can tell what’s real and what’s hype.

We have an information asymmetry advantage. And for once we’re in a position to do something about it. The playing field is level—we have just as much access to these high-risk / high-return crypto monies as the insiders.

This rarely happens.

Maybe it happened in the 90s when a few internet geeks bought up the .com domains. You know, “in case this internet things takes off”.

They might have been wrong.

And we might be wrong. It’s possible this crypto thing won’t take off—lots of people have said crypto would die over the past 10 years.

Yet here we are…and strangely enough, things seem more alive than ever.

So we’re going keep stocking crypto money like domain names in the 90s. Because maybe this is one of those rare opportunities to front-run the world.

The financial media and VCs can catch up later.

We’re not stopping.

- RSA

Wall Street doesn’t understand open finance—if they did they’d be talking non-stop about the potential of synthetics on Ethereum—I guess they’ll learn

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers

- ETH up to $189 from $184 last Monday

- BTC down to $10,151 from $10,498 last Monday

- Maker stability fees eased down again to 12.5% from 14.5%

Market opportunities

- (Invest) Set released exponential MA ETH Set (best performing ETH Set yet?)

- (Lend) DAI on dYdX at 8.8% (best rate now, but rates everywhere dropping)

- (Lend) Celsius claims good rates on DAI/USDC—9.25% (but i have not tested)

- (Lend) BlockFi ended minimums on interest accounts (was 0.5 BTC / 25 ETH)

- (Borrow) wBTC at 4.18% on Compound still really good

- (Borrow) with gold at SALT on Oct 1 (fyi—SALT did ICO & has a spotty past)

- (Trade) on Kyber w/ new Visa/Debt card fiat on-ramp (click “Buy ETH” 3.5% fee)

- (Trade) DAI on DyDx with their new ETH/DAI market (i plan to try this)

New stuff

- New non-electronic $29 wallet by Ballet (like a super-fancy paper wallet—more)

- Binance US opens on Wednesday and they launched futures (will try US version)

- New Ethereum wallet called Astro on the scene (have not tried)

- ConSensys launches DeFi standard (i’ll find out what they’re up to soon)

- Gnosis Prediction market starting to come to life (get early access to beta)

What’s hot

- #16 largest bank issues $20m bond on Ethereum (wow!)

- DAI locked in money protocols up 2.4x to $24m since June (this is good for ETH)

- USDT migrating from Bitcoin to Ethereum (good analysis here & my take)

- bZx debuts at number #15 on DeFi Pulse with $1.5m collateralized

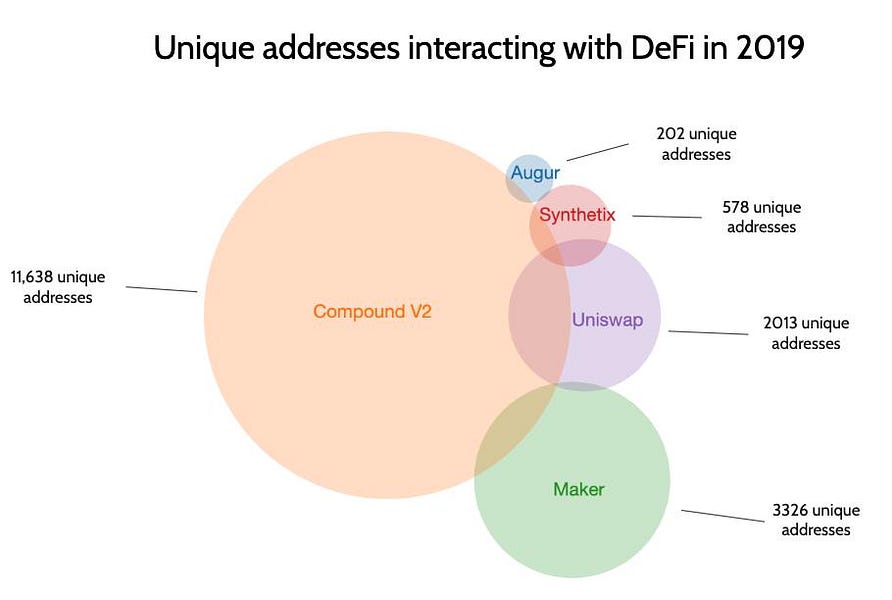

- Each of these bubbles represents a bankless loan (just wanted you to see that)

- Demand for ETH isn’t at an all time high but demand for ETH blockspace is

- The coolest things in open finance this week according to my followers

Money reads

- Only monetary premium is defensible (he’s right) - Kain Warwick

- Why crypto contracts matter - Nemil

- Learn about Maker (the most important money protocol) - Reddit AMA

- Confessions of a Crypto Millionaire (ETH frenzy in 2017) - Dan Conway

- Ethereum is a bamboo tree (skip to the money part) - William Mougayar

Reminder—invites for the Bankless Inner Circle go out at 12pm EST today. Get access by subscribing now. Plus no interruption in program and 20% off forever.

WHAT I’M DOING

Check out a few opportunities I’m capturing right now with my crypto money

Setting aside funds for DSR: the DSR is the Dai Savings Rate and you should drop what you’re doing to read about it here. DSR will be available in the next version of Maker. Once available, you’ll be able to deposit DAI in the DSR smart-contract to receive interest. The experience will be like lending DAI with Compound, only with less risk since there is no counterparty to the loan, no possibility of a bank run, and no added custody risk. Risks of DSR are equivalent to the risks of holding DAI. This means the DSR interest rate will represent the risk-free rate of DAI—just as T-bills represent the risk-free rate on USD. This is a hugely important protocol for the space. I’m reserving DAI now to use in DSR when it launches.

Testing Staked robo advisor (RAY): a staking company released RAY (a Robo Advisor for Yield) last week. The idea—deposit an asset such as ETH or DAI into the RAY smart contract. RAY will automatically allocate to the highest yield lending protocols. (Note: code is closed sourced, they control oracle) I decided to give it a whirl shortly before publishing this. In my case, my .1 ETH was to be balanced between Compound, dYdX, and Fulcrum. While the transaction completed successfully, I’m not exactly sure if I’m accruing interest—there is no indication in the UI. Nor does there seem to be a way to withdraw my funds. Others are reporting issues with inefficient yields. I like the concept I just think it needs more time to bake.

Update on no-loss lottery from last week: I didn’t win, but someone did! This account won the $269, but I still get to keep my $3 in DAI. It was actually fun. So I’m keeping my money in for the next drawing and making it this week’s assignment!

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

Enter the no-loss lottery (10m). This is a simple exercise that exhibits the power of programmable money. I did it last week to test it out for us (see “What I’m doing”). This week I want you to enter the no-loss Lottery at PoolTogether.

First, you’ll need some DAI in your wallet. You can purchase this at Coinbase. A couple dollars of DAI is fine. (You get your money back even if you lose) Next, you’ll need the MetaMask extension for your browser. Send the DAI to MetaMask along with .05 ETH or so to pay for gas. Now, go to PoolTogether, buy tickets with your DAI, and enter the lottery!

On Friday a lucky winner will about $250 in DAI for the winning ticket. Set a calendar reminder to check back on Friday to see if you won.

This lotto is instantly global, open source, and run by a trustless money robot. All you need is an ETH address to enter. Just magic!

Having trouble? Guided tutorial here.

Extra Credit Learning

- (Beginner) Check Gas prices—big increase! Tether & Fair Win ponzi are why

- (Beginner) Learn about Gnosis Safe one of the most trusted ETH wallets

- (Intermediate) Glossary of the flavors of DAI (programmable money is awesome)

- (Advanced) Addressing criticisms of Maker and DAI

- (Advanced) Build a synthetic on testnet with the UMA Token Builder

- (Advanced) Watch Chris Blec get a transaction unstuck on his Monolith wallet

MAIN TAKES:

Read my takes but draw your own conclusions

- Connecting the dots on synthetics and what it means for the value of ETH. Seriously—read the tweetstorm above before Thursday. It’ll tie into this week’s though-piece.

- WallStreet does not understand open finance. If you need further proof take a look at the S&P for DeFi that just got a NASDAQ listing. They put MakerDao, Augur, Gnosis, Numerai, 0x and Amoveo in an index somehow thinking these tokens measure growth in decentralized finance. WHAT? If you don’t recognize some of these tokens don’t bother looking them up—not worth your time. Do you want my Bankless DeFi index? Really simple. It’s just: ETH, MKR, BTC.

- Synthetix is considering adding ETH as collateral which would be an improvement. Some background. Synthetics are tokens that track the price of a financial position such as the price of an asset. You can have a gold exposure, w/o owning gold. To create a synthetic you need a price oracle and something of value to back it. Synthetix has created a bunch of synthetics using their own token SNX as the store-of-value. Using ETH rather than SNX is more scalable and less fragile, since ETH has higher liquidity & moneyness. It also reinforces the monetary premium of ETH. (Note—Synthetix currently maintains high degrees of control of funds inside their system—much more work to be done to become trustless)

- France isn’t taxing crypto-to-crypto gains. Why does France get to have all the nice things? In the U.S. if you buy BTC, and then buy ETH with the BTC later, its a tax event—you owe taxes on the BTC gain or loss—and worse, you have to record it. (We’ll cover all this later in the program) This makes using crypto a bit cumbersome. Buy DAI with ETH? Tax event. Spend the DAI on a coffee? Tax event, maybe. None of this in France, it’s only taxable when crypto is exchanged for fiat. My hope—countries that adopt good tax policy will accrue a competitive advantage forcing other countries to do the same. Will take time to play out.

MINI TAKES:

- Coinbase lending $2m to money protocols helps Coinbase because it propagates their USDC stablecoin and it helps money protocol liquidity—I like this type of cooperation—the next step is for crypto banks to start building services on top of the money protocols

- Uniswap is crushing Bancor which is embarrassing since Uniswap did it with a $100k grant vs Bancor’s $157m ICO raise—useless tokens playing out as I expected but at least they’re giving a tiny bit of the money back?

- Missing the fixed rate loans money lego—protocols like Compound and Maker only provide variable interest rates but I’m glad we’re beginning to see experiments in fixed loans—Dharma seems to be cooking up something too

- I like the idea of meta lending protocols that auto-balance to high yield opportunities but I worry they’ll breed more rate chasing behavior—in reality risks differ wildly across lending protocols—good lending decisions must consider risk not just yield

- Germany, France and other countries are taking a stance to block Libra—all will likely launch their own digital currencies someday to replace cash and strengthen their ability to control monetary policy—none of the above is bankless

TWEET-A-QUESTION

Tweet me your question—I reply to one per week

Anonymous:

I wanted to try a CDP but given the stability fee is 14.5% and you make 9% supplying DAI to Compound, am I missing something here in the math? Am I not paying more money in interest back to the CDP than I'll earn in DAI on Compound?

RSA:

Yes! You’d be losing money if you opened a CDP just to lend DAI on Compound at a lower interest rate. Don’t do it!

(For the readers unfamiliar, a CDP is a collateralized debt position on the Maker protocol. To create a CDP, you put ETH in a smart-contract, then using the value of your ETH as collateral, you borrow DAI. This works like a home equity loan: the amount of money you can borrow depends on the value of your equity and the risk tolerance of the bank. If you have a $150k house, a bank might let you borrow $100k. In the case of a CDP, ETH is the equity and the Maker protocol is the bank. Just like a bank, they charge you an interest rate and will call the loan if the collateral ratio falls too low)

So why in the world are people opening CDPs?

First some history. In 2018 CDPs interest rates stayed as low as 2.5% for many months. At that time there was talk of CDPs being used to pay down mortgages and car loans—CDP owners could pay down any higher interest loans with lower interest CDPs all without selling their ETH positions. Seemed too good to be true!

And it was. These CDP owners didn’t account for two things: first, falling ETH prices would liquidate their CDPs unless they continued to add more ETH and second, CDP interest rates are not fixed—they can vary on a weekly basis if DAI remains unstable. This was a brutal combination for CDP owners over the past 18 months as the price of ETH dropped by as much as 95% and CDP interest rates rose as high as 19.5%.

The lesson: CDPs are poor tool for paying down your consumer loans.

So who’s still opening CDPs? Speculators and investors mostly. A CDP is still a reasonably cost effective way for an investor to leverage ETH to buy more ETH—just collateralize ETH, borrow DAI, and use that DAI to purchase more ETH. This even provides tax advantages—since the ETH you collateralized was never sold, it’s unlikely to be considered a taxable event is most jurisdictions. (Note—I do not recommend leveraged investing in the Bankless program)

But if all you’re trying to do is lend DAI you don’t need to bother with a CDP. Instead, just buy DAI on an exchange, then lend it on Compound. I like to use Coinbase where you can purchase DAI with ETH, BTC, or USDC.

Some recent tweets…

Actions

- Execute any good market opportunities you saw

- Complete weekly assignment: enter the no-loss lottery at PoolTogether

Continue leveling up. $12 per month. But 20% off if you subscribe before November 1.

Let’s onboard 1 billion people to open finance…

If you believe in what we’re doing don’t keep it to yourself—share Bankless with as many people as possible.

Post. Tweet. Tell. That’s how we take back our money system.

DCInvestor shows us how it’s done…

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.