Juicebox: the future of NFT treasuries?

Dear Bankless Nation,

2021 saw more than a few NFT projects start becoming cultural institutions. These breakouts have led to these projects amassing considerable ETH treasuries — and treasury management responsibilities — in short order.

For example, I recently wrote about how Nouns DAO staked 1.5k ETH in Lido. These sorts of treasury management matters are going to become more common and more important as NFT projects continue to trend into socio-economic forces to be reckoned with.

All that said, today I want to take a look at the programmable treasury protocol Juicebox. The system is currently unaudited, so tread cautiously for now. Still, even in its early form it offers a glimpse at what the future of NFT treasuries may look like. Let’s explore what I mean.

-WMP

Juicebox: treasury infra for Ethereum communities

“Juicebox was built to allow people and projects to get paid for creating public art and infrastructure, as much as or more than they would working towards corporate ends.” — Juicebox FAQ

ETH is programmable money, NFTs are programmable media, and Juicebox is a programmable treasury protocol.

In other words, community-owned projects in the Ethereum ecosystem can use Juicebox to flexibly and transparently manage their treasuries on-chain. The creators hail the protocol as “light enough for a group of friends, yet powerful enough for a global network of anons sharing thousands of ETH.”

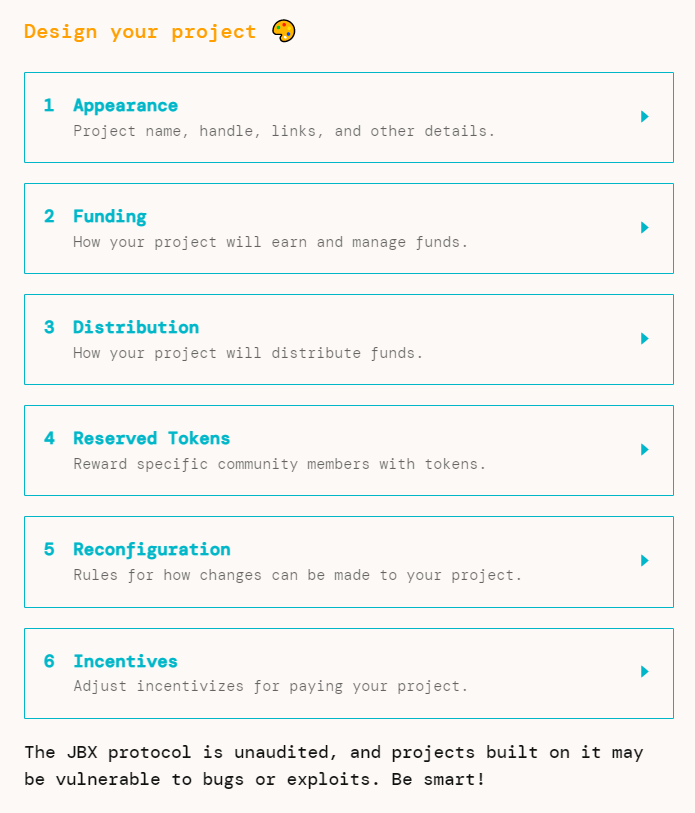

As such, this system isn’t explicitly for NFT projects, as it’s suitable for DAOs and other protocols in general, too. However, Juicebox’s features are particularly ideal for upstart NFT-centric efforts. Among other things, the protocol allows projects to:

- Configure fundraises and accept donations ✅

- Choose how their native tokens are minted ✅

- Set spending conditions + pre-approved addresses ✅

- Create community claims ✅

- Determine how treasury rules can evolve over time, and more ✅

How Juicebox works

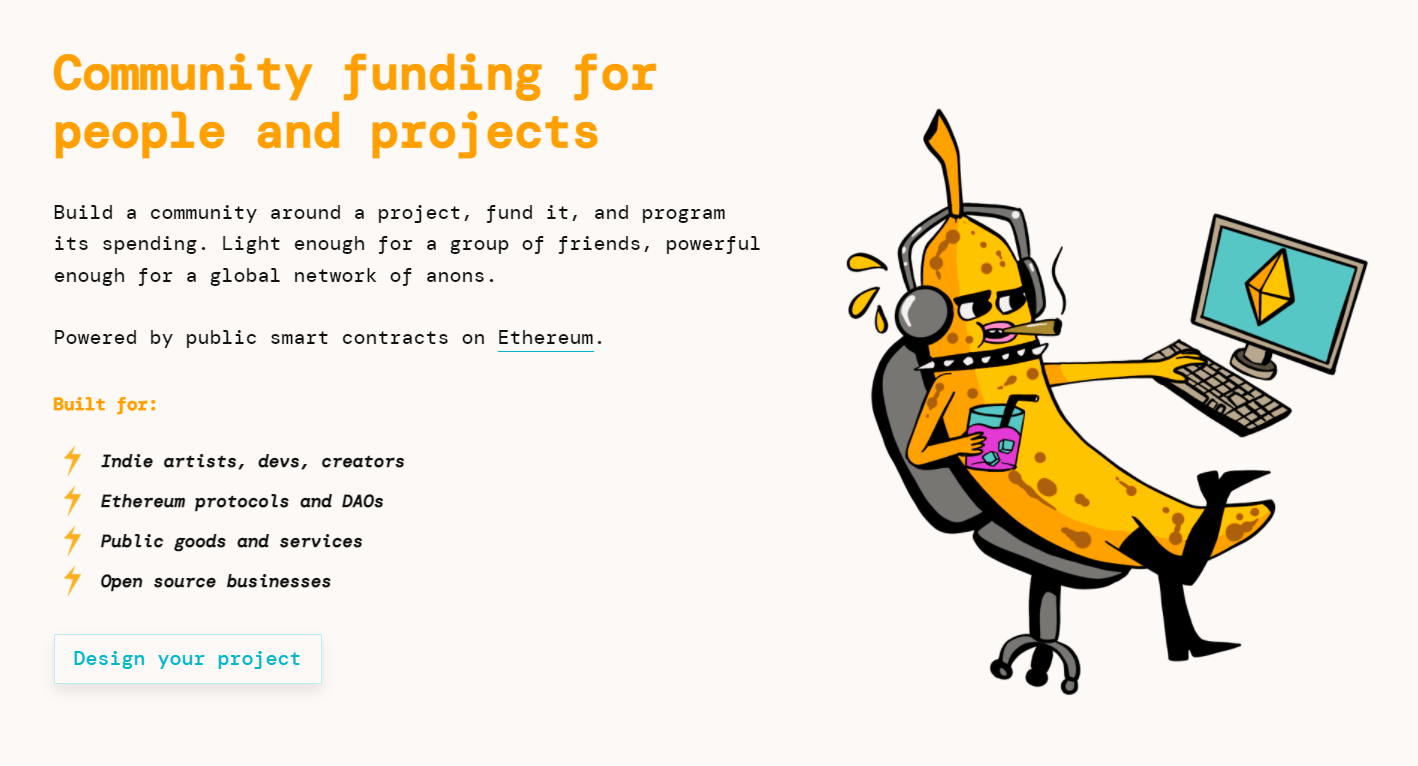

- A group creates a Juicebox project. They mint an NFT that represents ownership of the treasury; the holder of this NFT thus configures the project’s treasury and token parameters.

- Users fund the project. Whether patrons or investors, these users supply ETH to support the project. For this they receive a proportional amount of the project’s governance token, an ERC-20.

- Funding cycles then occur as needed. Projects can customize their later funding cycles, but in the first one they must issue 1M tokens per 1 ETH accrued.

- Projects earn JBX. Projects that use Juicebox pay a 5% fee on their earnings, though in kind they receive rewards in Juicebox’s JBX governance token. Juicebox is in the process of migrating governance over to the community of JBX holders.

Juicebox in action

Two Juicebox projects you might already recognize due to recent mainstream attention are ConstitutionDAO, which attempted to buy a copy of the U.S. Constitution, and Spice DAO, which successfully bought a Dune “director’s bible.”

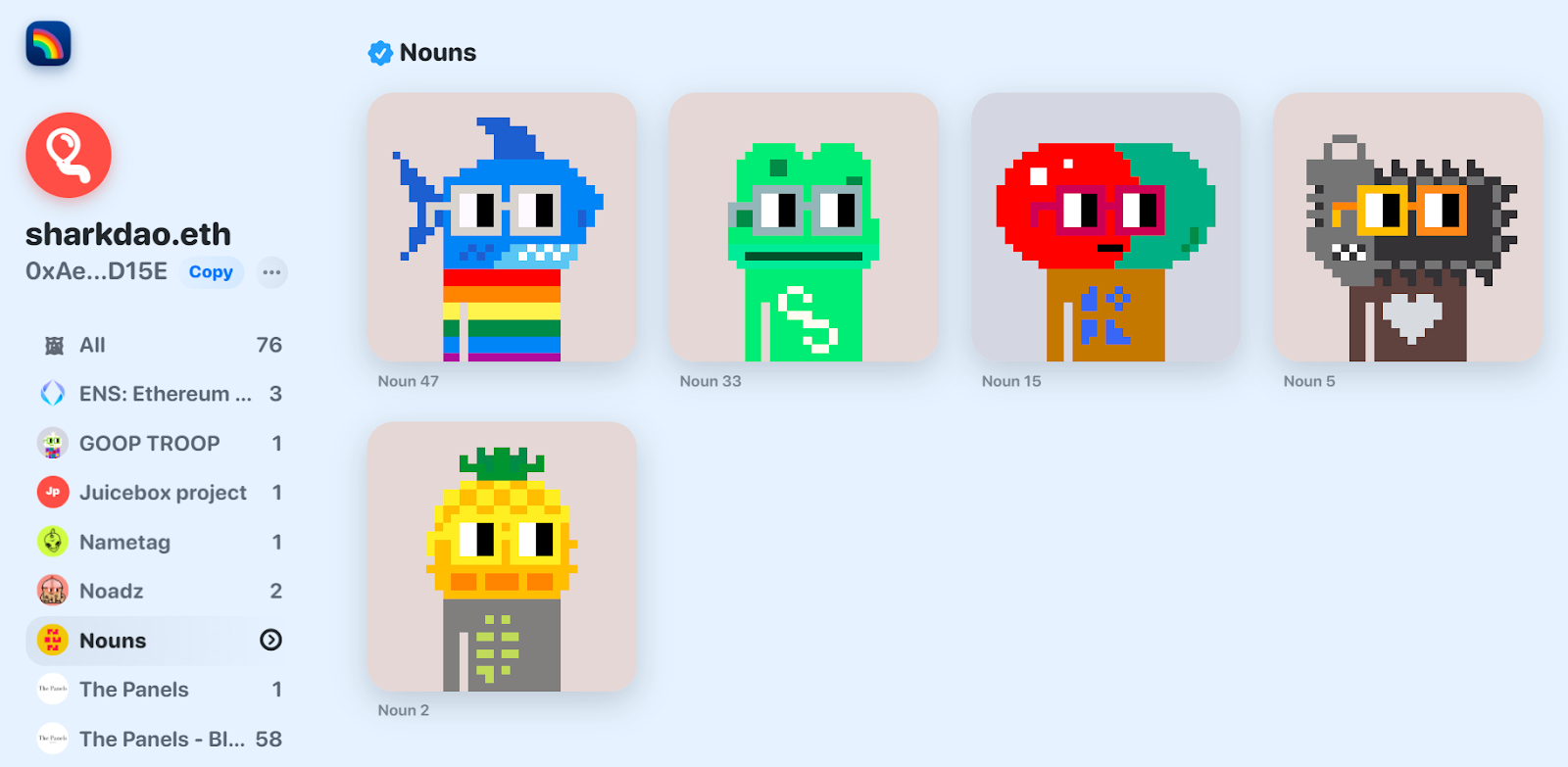

At the time of writing, the largest NFT project on Juicebox was SharkDAO, which has raised an ETH treasury to collect Nouns for its community (of which I’m a casual member). To date, the group’s collected 5 Nouns (#2, #5, #15, #33, and #47) and uses a Gnosis Safe wallet to hold its Juicebox NFT.

Zooming out

Maybe over time some other protocol wins out to become the dominant treasury infra of choice for NFT projects. That’s entirely possible.

However, generally speaking I do think that something or even multiple projects like Juicebox will eventually create new money management standards for creator groups.

Accordingly, the young Juicebox protocol — experimental and unaudited as it may be right now — is already pointing the way ahead here, and it’s doing so at a time when plenty of projects haven’t gotten that serious about treasury management yet.

What’s clear to me, though, is that NFT projects will increasingly need to get serious on this subject. And in the very least, a protocol like Juicebox gives them an on-chain, out-of-the-box treasury solution that makes doing so much easier. Of course, expect more competition to come, too.

Action steps

- Check out Juicebox

- Check out the Juicebox Blog for project updates