Dear Bankless Nation,

Last week, we saw the successful completion of the Merge.

It was a monumental event for crypto history. Etheruem issuance dropped by an order of magnitude, the network became environmentally friendly, and stakers started earning a real yield.

Given the potential implications of the Merge, a lot of people are wondering if this major catalyst is priced in.

Well… if history is any indicator, it’s not.

In fact, we’ve seen five major supply shocks in crypto history between BTC and ETH:

- 3 Bitcoin halvings (2012, 2016, 2020)

- Ethereum Beacon Chain

- EIP-1559

Not a single one of these events were priced in at the time of the catalyst.

Let’s unpack.

A historical lens

Back in our heyday, my colleague Cooper Turley and I wrote an article titled Bitcoin Halving: Price Effects & Historical Relevance. It was our first big hit in our early crypto careers.

The article examined each Bitcoin halving and analyzed how it affected price before and after the halving.

Here’s the tl;dr:

- Bitcoin historically reached ATHs 12-18 months following the halving

- Each cycle lengthens in duration

- Returns were diminishing

At the time, we only had two halvings as data points. If you can imagine, it was a bold claim given the small sample size.

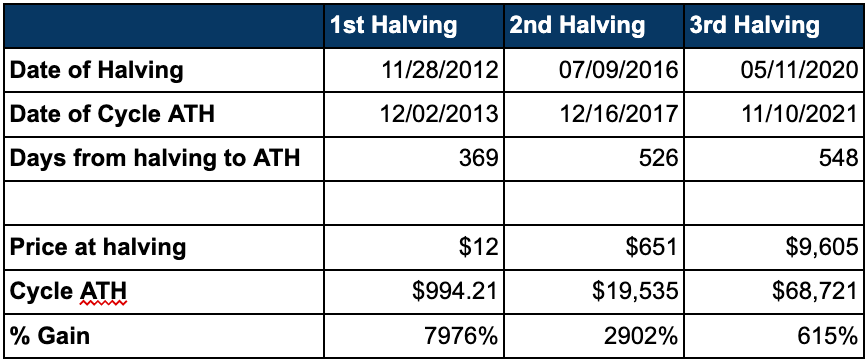

But now, we can fill in data for the third halving.

Here’s the update table that we showcased in the article:

- ✅BTC hit ATHs almost exactly 18 months after the halving

- ✅The cycle was lengthened (barely)

- ✅Returns were diminishing

Our analysis held up. LFG.

This isn’t to gloat that we’re geniuses (we are), but more to highlight the fact that BTC halvings, historically, have never been priced in.

There would be a small run-up in price in advance as the crypto market anticipated the supply shock, and then the asset would go parabolic months later as the reduction in daily miner sell pressure compounded (along with other drivers/tailwinds!).

Here are the receipts to visualize.

First Halving - November 28th, 2021

Second Halving - July 9th, 2016

🆕 Third halving - May 11th, 2020

As we can see, none of the halvings were priced in before, or at the time of, the event.

It was only a taste of what was to come.

But ser, we’re talking about ETH

Bitcoin halvings are one of the most ubiquitous pieces of information within crypto. It’s programmed to happen every ~4 years. Everyone knows it’s coming. Every major player understands it.

Despite this, crypto markets have been notoriously bad at pricing in these simple (yet significant) changes in the asset’s supply and demand dynamics, where daily sell pressure literally just gets cut in half every four years or so.

Straight up — crypto markets fail to price in the simplest, most well-known supply shocks.

With that, Ethereum’s supply and demand catalysts have been bit tougher to predict.

This is mostly because these upgrades have not been programmatically scheduled, but instead are contingent on developer timelines (which usually are a crapshoot).

Regardless, in the past two years, Ethereum has seen two (and now a third) significant fundamental catalysts in its supply & demand dynamics as it progressed towards the fully envisioned network: the Beacon Chain launch, EIP-1559 and most recently, the Merge.

1. Beacon Chain

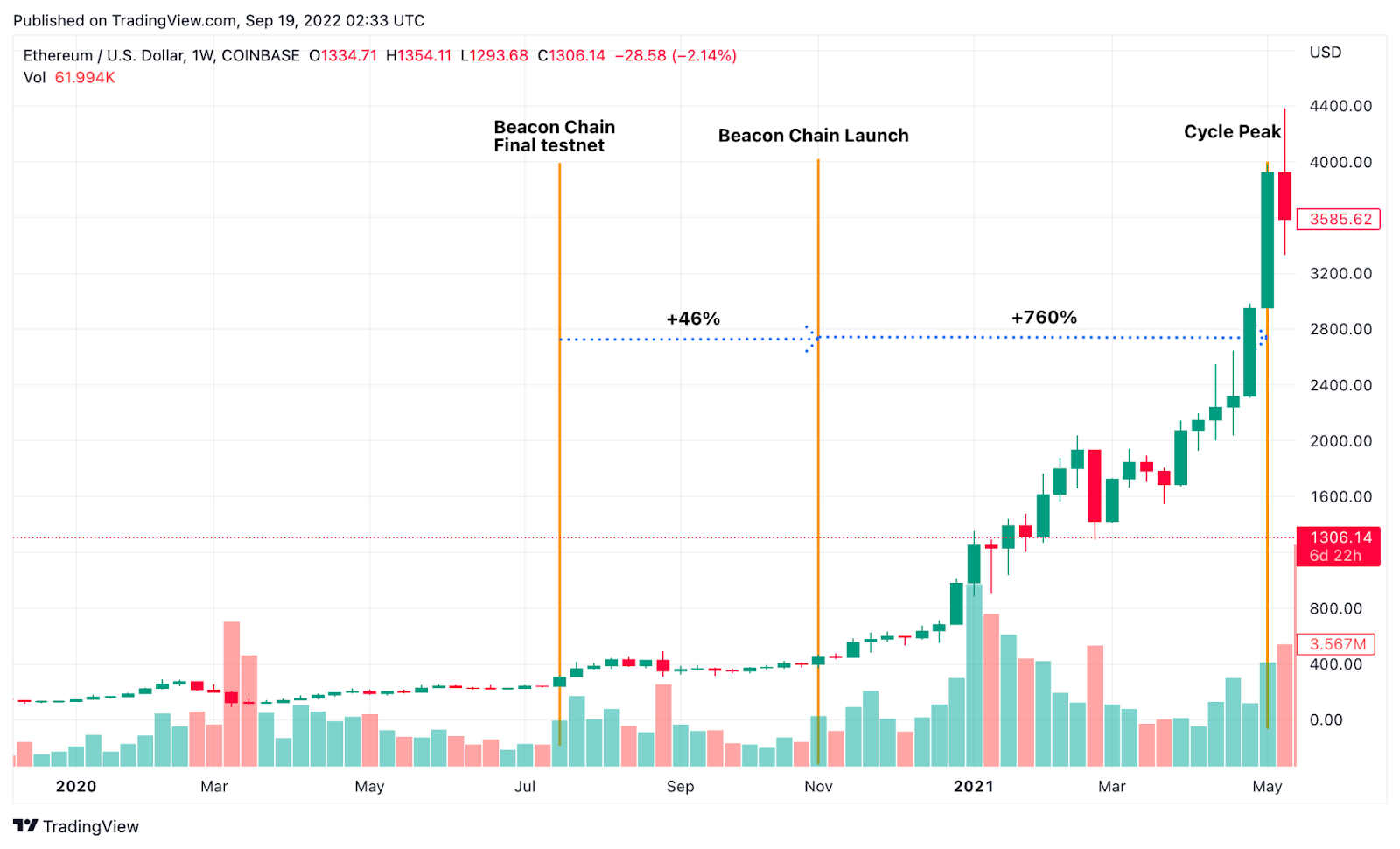

The Beacon Chain launched on November 4th, 2020.

The price of ETH sat at $450 at the time the Beacon Chain deposit contract opened.

From there, it climbed to over $4,000 over the course of seven months as 5M+ ETH was locked away into the new PoS chain.

In total, the gain from the launch of the Beacon Chain to the cycle peak was +760%.

2. EIP-1559

The second major catalyst was EIP-1559, which burns ~70% of the transaction fee paid to miners.

This EIP was implemented in August 2021 amid ETH’s plummet from its previous ATHs back in May.

Oddly enough, the bottom for ETH was right around when the EIP began hitting live testnets in June and began its run-up as the EIP was scheduled for mainnet launch in July.

Once implemented, the price of ETH rebroke ATHs nearly 3.5 months later as 1M ETH was quickly taken out of the hands of miners and off the market for good.

3. The Merge

Just like all of the Bitcoin halvings, the Beacon Chain, and EIP-1559, the Merge serves as another major fundamental catalyst for the supply and demand for a crypto asset.

For context, the Merge began hitting testnets back in early June of this year.

After the second major dress rehearsal on Sepolia, ETH saw a significant rebound from its bottom of $800 back in early June, to where it nearly hit $2K as the mainnet Merge date got penciled in back in August.

This is effectively the pre-hype phase that we’ve seen with every other catalyst.

The proof is in the pudding as ETH is up 50% from the cycle lows whereas BTC is only up 9%.

Now we’re in uncharted water. The Merge is behind us and what lies ahead is a mystery.

If history is any indication, we should be in for a fun ride.

Unfortunately, this thesis is off to a bit of a rough start as ETH tanked over the course of the weekend to sub $1,400.

Looking at the data, this can be partly attributed to miners dumping their ETH (along with another potential rate hike from the Fed this week).

Miners dumping their ETH is an overhang that we’ll have to get through over the coming months in order to resume up only mode, but it will happen.

There’s a bigger issue though

Macro’s a sh*tshow.

Right now, we have:

- 🦅 Fed aggressively raising interest rates (another 75 bps this week?)

- 🔫 An ongoing war with Ukraine & Russia and a resulting energy crisis

- 😰 China & Taiwan tensions rising

This combines for a pretty harsh headwind for crypto and risk-on assets as a whole.

If the world’s on fire, it doesn’t matter what’s happening with the supply or demand dynamics of our magic internet beans. Number won’t go up.

What do we make of this?

This is a tough environment for investors.

On one hand, the market is historically really bad at pricing in fundamental supply and demand catalysts. Every other supply and demand catalyst in crypto history has been followed by an ATH within the next year.

The Merge should be no different. In fact, it would actually be more surprising if ETH doesn’t go on a parabolic run over the next 12-18 months given the track record.

And given the massive implications of this catalyst, it should be a home run.

The only problem is that the world’s on fire right now.

How you decide to play this is where investors make their money.

Place your bets accordingly.

As a Bankless perma bull, I’m taking the side of history (naturally).

It’s not priced in.

Tl;dr - The merge is not priced in unless the world catches on (more) fire.