Dear Bankless Nation,

Last week's mostly favorable SEC v. Ripple Labs summary judgment sent the price of XRP mooning.

In today's newsletter, we ask whether the now third most-valuable non-stablecoin crypto is finally worth your time (and money)?

- Bankless team

Has the investment thesis changed for XRP?

Bankless Writer: Jack Inabinet | disclosures

XRP has had an absolutely massive week, but has the investment thesis changed?

As a quick refresher to last week's events – since December 2020, Ripple Labs and the XRP token have been encumbered in an ongoing legal battle with the SEC, but just last Thursday, Judge Analisa Torres laid down a decisive summary judgment that defeated a major principle underlying the SEC’s argument!

In its initial complaint, the SEC alleged that Ripple violated federal securities law by selling or otherwise offering 14.6 billion XRP, which the agency classified as “a digital asset security,” through a variety of transactional schemes. Judge Torres, however, found that XRP itself, as a digital asset, is not a contract, transaction, or scheme, a prerequisite needed to satisfy the Howey Test, and is therefore not an investment contract!

Ripple’s “institutional sales” were indeed classified as unregistered security offerings under the ruling, but the Court found that other XRP transaction types (i.e.; programmatic sales on exchanges, distribution as compensation, and sales by insiders Brad Garlinghouse and Chris Larsen) failed to satisfy the four prongs of the Howey Test, meaning that these schemes, accordingly, do not constitute investment contracts.

SEC v. Ripple in brief:

— Bill Hughes : wchughes.eth 🦊 (@BillHughesDC) July 13, 2023

Ripple putting XRP on exchanges for trading (and funding their operation with those sales) is NOT an investment contract, and therefore not a security.

Ripple paying people in XRP is NOT an investment contract and therefore not a security.

XRP is NOT a… https://t.co/FzlPbkKH21

While this case must still proceed to trial, where Ripple could be punished for offering unregistered securities – and it's possible for either of the parties involved to appeal the Court’s eventual final ruling – one thing is certain: the XRP ecosystem has come into vogue.

XRP’s market cap doubled to nearly $50B on the Court’s decision and leading centralized exchanges, including Coinbase, Gemini, Kraken, and Bitstamp, are now rushing to relist XRP trading pairs! Even decentralized, Ethereum-based protocols are getting in on the fun, with options provider Lyra announcing a proposal seeking to list XRP markets on the platform.

Hot money seems desperate to ape XRP now that the Courts have said the token is not an investment contract, but should you? Today, we’re venturing down the XRP rabbit hole and exploring the most important developments the ecosystem has made to help you answer this question.

⛓️ Onchain Activities

XRP has long drawn critiques as a "zombie" ecosystem that over-indexes on vaguely outlined partnerships but doesn't boast much development or many interesting applications. What has the XRP ecosystem been building through the last bull cycle and what's on the horizon?

Today, the XRP Ledger (XRPL) has limited functionality, but does offer a token standard and decentralized exchange (DEX) that serves as the XRPL’s exclusive exchange for fungible tokens and NFTs.

This native DEX serves as a piece of public infrastructure and acts as a unified liquidity layer for “gateways,” which provide interfaces to the exchange for average users. While the DEX currently runs on an order book model, an AMM is under construction which would allow users to earn fees by passively providing liquidity to pools.

Unlike Ethereum and Solana, two examples of Turing-complete smart contract blockchains, the XRPL does not support smart contracts, making it impossible for the chain, in its current form, to support crypto activities beyond swaps through the native DEX.

XRPL Labs, a self-styled software developer for the XRPL, is attempting to introduce smart contract-like functionality to XRPL with “hooks.” XRP Labs completed a comprehensive audit of their primitive back in June. While not Turing complete and therefore unable to process arbitrary logic, hooks will allow the XRPL to take a step towards offering devs further programmability by allowing conditions and triggers to be attached to transactions.

The Hooks Amendment has passed its comprehensive security audit by @goFYEO, marking a significant milestone in our journey towards integrating Hooks into #XRPL.

— XRPL Labs 🪝 (@XRPLLabs) June 5, 2023

Read about Hooks passing the audit here: https://t.co/BxfcINMG3l

Potential use cases include “auto-savings hooks” that can sweep a pre-specified amount of XRP into a separate savings account, “carbon-offset” hooks that could charge a transfer fee on each transaction you make and send it to the account of an NGO, and “firewall hooks” that would be able to restrict your wallet’s interactions with a known blacklist of spam account or impose account spending limits.

While the use cases unlocked by hooks are certainly not among crypto's most exciting, the XRPL values complexity minimization above all else, making it difficult to introduce further smart contract-like functionality at the L1 level. In acknowledgement of this dilemma, multiple teams in the XRP ecosystem are developing some side chains in an attempt to enhance the network’s functionality.

One such team doing so is Peersyst, whose EVM sidechain is serving as a proof of concept for bringing smart contracts to the XRPL ecosystem. Their network is in the testnet stage and has seen adoption from a naming registry service and decentralized exchange.

🌐The #EVMSidechain will be a vitally important component for #XRPLedger. Not only will bring the interoperability we are missing with #XLS38d, it will also open the doors to all📄#Web3 protocols to #XRP🪙

— Peersyst Technology (@Peersyst) July 11, 2023

Being #XRPL of the networks with the highest adoption and… pic.twitter.com/ZOAxSaocDy

Additional XRP sidechains include Coreum, The Root Network, and Flare Network.

🏦 TradFi Traction?

Some amount of technical progress is being made on the XRPL, but diehard XRP fanatics truly love to point out how their crypto asset of choice and its associated blockchain are poised to disrupt traditional payments infrastructure.

If you’ve spent enough time in the XRP ecosystem, you’ve likely seen some version of the statement, “Ripple replaces SWIFT,” a messaging network used by financial institutions to exchange information and instructions related to international financial transactions.

Swift will eventually be replaced by Ripple. There’s no doubt in my mind. $XRP

— Robert Dobbs (@iamrobertdobbs) February 12, 2022

The prevalence of this messaging in the community is a direct result of the sheer amount of energy that Ripple Labs devotes to promoting this type of use case. Beyond contributing heavily to aspects of the ongoing technical success of the XRPL at the infrastructure level, Ripple Labs maintains that it provides value back to the XRP ecosystem by promoting its crypto-enabled solutions for XRPL tailored for use by institutions and governments.

Unfortunately for XRP HODLers, this activity is not found on the public XRPL, but is instead being facilitated by Ripple Labs through their RippleNet, a closed network of banks and financial institutions. On this private network, however, Ripple supports “cross-border payments” and provides liquidity on crypto assets with a capability called “On-Demand Liquidity.” This feature uses XRP as a bridge currency for transactions and gives back some amount of utility to the token.

Since early March 2023, Ripple claims to have engaged with over 20 countries in conversations on their CBDC plans.

Despite only having success in partnering with economically tiny nations like the Republic of Palau (GDP of $217M) and Montenegro (GDP of $5.9B), Ripple says that regulators from nations like Singapore (GDP of $397B), Switzerland (GDP of $800B), the United Kingdom (GDP of $3.1T), and Japan (GDP of $4.9T) are welcoming CBDC talks with the firm.

As a result of these conversations, the firm announced enhancements to its CBDC Platform in May. Shortly afterwards, the Central Bank of Columbia announced a renewed partnership effort with Ripple and Peersyst to enhance its high-value payments system using Ripple’s CBDC Platform.

We are excited to announce that @Peersyst and @Ripple will start working with the 🏦 Central Bank of Colombia @BancoRepublica 🇨🇴 through our partnership with @Ministerio_TIC ✅

— Peersyst Technology (@Peersyst) June 15, 2023

👉The objective: Evaluate potential efficiencies of a solution using the Ripple #CBDC Platform based… pic.twitter.com/OmGyLbBdGO

Much like with RippleNet, however, it is important to note that the CBDC platform is based on the XRPL, but does not require XRP to operate. As Ripple discloses with Blockworks, “central banks using the [CBDC] platform do not need to use or interact with XRP.”

Despite having announced a litany of partnerships seeking to convince TradFi entities of the merits of blockchain technology, Ripple's technology has yet to see real world adoption. Perhaps there a chance for real adoption now that a U.S. Court found XRP is not an investment contract?

Such thinking is wishful. An ongoing lawsuit from the SEC and potential for XRP to be classified as a security in the United States are not factors in calculations of a central bank well beyond the jurisdiction of the American legal system seeking to implement a CBDC system.Perhaps this decision opens the door for Ripple Labs' U.S. banking partners to further implement XRP into their systems, but considering that international entities have failed to do so, I'm pessimistic about this possibility.

Takeaway

XRP is one of crypto's oldest assets and Ripple Labs has played an instrumental role in the ecosystem's success since genesis.

After close examination of the XRPL's technical progress, the venerable age of the chain is painfully evident. An absence of programmability has made it difficult for the chain to attract developers and users in the past and there is limited remedy for this shortcoming, beyond sidechains.

While the long-heralded use case of XRP has been to replace the traditional payments systems, much of this development efforts come from the highly centralized Ripple Labs team and real adoption has yet to come to fruition.

Our premium subscribers get exclusive access to today's Token Rating, where we cover XRP! Get insights into how the Bankless Analyst Team believes XRP will perform against ETH over the coming months and view our rationale for the decision 👀

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

MARKET MONDAY:

Scan this section and dig into anything interesting

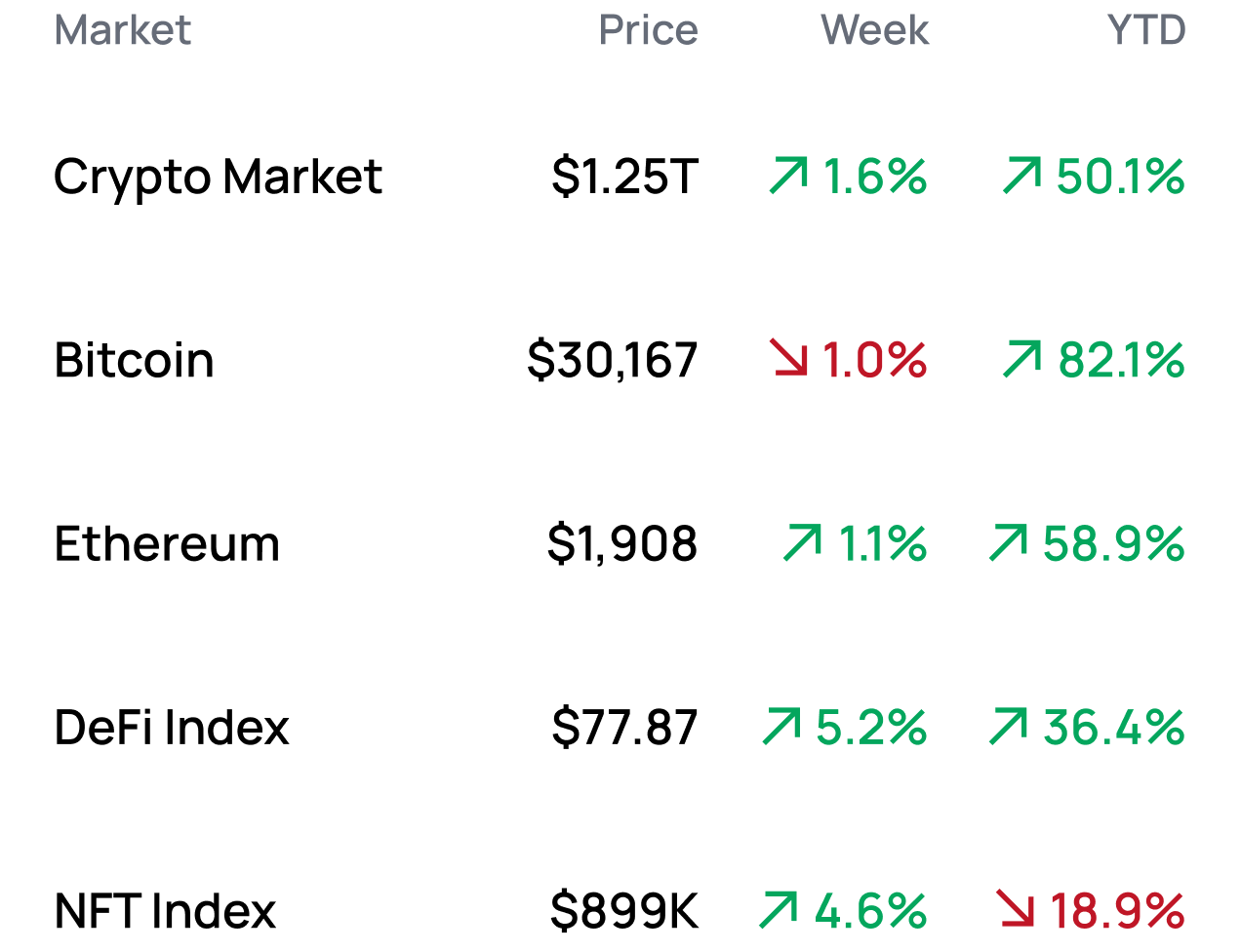

*Data from 7/17 12:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Deposit into Umami’s USDC GLP vault, now open for all

- File your claim against the FTX estate

- Borrow GHO against Aave collateral at a fixed 1.5% interest rate

- Access RWA exposure on Polygon with Ondo’s OUSG

- Encrypt and send messages natively using Coinbase Wallet and XMTP

Yield Opportunities 🌾

- BTC: Earn 6.63% APR by depositing BTC with O3 Swap on Arbitrum

- ETH: Earn 7.4% APY with Beefy Finance’s rETH-ETH vault on Ethereum

- ETH: Earn 17.0% APY with Uniswap’s wstETH-WETH pool on Polygon

- USD: Earn 14.2% APR with Maverick’s GRAI-LUSD boosted pool on Ethereum

- USD: Earn 11.5% APR by depositing crvUSD with Conic Finance on Ethereum

What’s Hot 🔥

- Sens. Lummis, Gillibrand launch second crypto bill

- Starknet mainnet undergoes upgrade boosting TPS

- EigenLayer LSD restaking caps raised (and filled immediately)

- Binance lays off over 1k employees

- Celsius CEO arrested, company agrees to $4.7B settlement

- Arkham announces simultaneous airdrop and dox-to-earn marketplace

- Tokenized US Treasury market surpasses $600M

- Google to permit blockchain games and apps on Android Play Store

- Court rules XRP is not an investment contract in win for crypto

- Major exchanges begin relisting XRP

Money reads 📚

- Ethereum’s New Data Economy - Takens Theorem

- Solana’s DeFi Scene - Squads Protocol

- An In-Depth Exploration of crvUSD - Poopman

- Ripple case is mostly very good for alts - Adam Cochran

Governance Alpha 🚨

- Mycelium, previously Tracer DAO, seeks pathway to dissolve

- Lyra governance proposal seeks XRP options market

- dYdX intends to punish validators that perform MEV

- Polygon Labs seeks to upgrade native token to POL

- Camelot proposal seeking ARB grant for platform incentives goes live

- Ribbon Finance announces proposal to merge with Aevo

- GMX looks to allocate 10% of fees to protocol treasury

- cLabs proposes for Celo transition to an Ethereum L2

Token Hub: XRP 📈

Analyst: Jack Inabinet

We’re initiating coverage on XRP with a rating of bearish.

Catalyst Overview:

In a monumental legal decision, the Court presiding over the SEC v. Ripple Labs case ruled that XRP, as a digital token, is not a contract, transaction, or scheme, a prerequisite needed to satisfy the Howey Test -- and is therefore not an investment contract! Now crypto’s attention rests squarely on XRP.

While the chain boasts an orderbook-based DEX, it is just now moving to construct an AMM that will allow users to passively provide liquidity. Hooks are an upcoming improvement that should provide for some further developer programmability, but offer extremely limited functionality. An EVM sidechain under development by Peersyst is serving as a proof of concept for bringing smart contracts to the XRPL, offering some amount of hope that the network may eventually move to implement them.

Much of the activity to supplant traditional payments rails in the XRP ecosystem is carried out by Ripple Labs. Through RippleNet, a closed network of banks and financial institutions can access liquidity on cross-border transactions and crypto assets with Ripple’s “On-Demand Liquidity.” The firm claims to be in conversations with over 20 countries on their CBDC plans and recently enhanced its CBDC platform and the Central Bank of Columbia recently announced a partnership with Ripple to enhance its high-value payments system.

Price Impact:

While XRP was an easy ticker for hot money to ape, the logic applied by the Court separating the underlying asset from the transaction schemes in which it was offered should extend to the context of other crypto assets. We believe that XRP is overbought relative to other crypto assets and should struggle to continue to outperform ETH.

Despite the victory for the broader crypto industry, Ripple Labs remains in hot water! The issue of Ripple’s institutional sales must proceed to trial, where the SEC will seek to clawback illegally raised funds and prohibit Ripple from selling or offering XRP to any entity or person. Should the SEC get its way, Ripple Labs, the XRP ecosystem’s champion at the infrastructure and TradFi partnership levels, would no longer have economic incentives to continue developing use cases for XRP. We see a substantially higher risk in XRP due to key party dependencies compared to more decentralized L1 tokens that derive their success from the development efforts of independent groups.

The XRPL is unable to compete with the programmability offered by smart contract L1s like Ethereum and Solana. From a technical perspective, there is little exciting development coming down the pipe for XRP at the L1. It will be difficult for the XRPL to attract and retain a user base if the chain continues in failing to provide them with anything to do.

While XRP witnessed a momentary breakout catalyzed by a monumental legal decision, we expect the rally to be short lived and anticipate XRP/ETH resumes its longer-term trend downwards.

See more ratings in the Token Hub.

Meme of the Week 😂

This flag is not a security pic.twitter.com/1jaectJBsF

— Bankless (@BanklessHQ) July 13, 2023