Dear Bankless Nation,

The post-FTX uneasiness seems to be wearing off and regulatory bodies are taking advantage of the calm moment to serve a litany of charges against controversial figures in the crypto world.

The SEC’s Hester Pierce gave a rousing speech on digital assets that gave many crypto supporters a glimmer of regulatory hope.

For our weekly recap, we dig into:

- The SEC Gets Busy

- Crypto Keeps Pumping

- NFT Hacks and Migrations

- DeFi Developments

- A Busy Week for Ethereum

- Bankless Team

📅 Weekly Recap

Here’s a recap of the biggest crypto news from the final week of January.

1. The SEC Gets Busy

The SEC has their hands full this week. First, they’re charging ex-FTX lieutenants Caroline Ellison and Gary Wang for “their roles in a multiyear scheme to defraud equity investors in FTX”.

Ellison allegedly manipulated FTT’s price between 2019 to 2022 (at SBF’s direction) by buying large quantities to pump its price, then used it to mislead investors as overstated collateral for undisclosed loans in its sister hedge fund Alameda.

The SEC also claims that Ellison and Wang “created FTX's software code that allowed Alameda to divert FTX customer funds, and used misappropriated FTX customer funds for Alameda's trading activity”. (Press release here)

Next, the SEC is charging Avraham Eisenberg for market manipulation of the MNGO token on the Solana-based Mango Markets protocol. Eisenberg was arrested in Puerto Rico and currently awaits criminal charges in federal prison. (Press release here).

We charged Avraham Eisenberg with manipulating the MNGO token, a so-called governance token offered and sold as a security on the crypto platform Mango Markets. Eisenberg is in federal prison awaiting transport to NYC on parallel criminal charges.https://t.co/gn0Xf00NkJ

— U.S. Securities and Exchange Commission (@SECGov) January 20, 2023

The SEC also fined Nexo $45M last week for failure to register its lending product, leading Nexo to announce its departure from American markets.

Finally, don’t miss out on SEC Commissioner Hester Pierce’s speech on digital assets. Some excerpts:

Crypto’s value proposition depends primarily on the builders of this technology, not on regulators like me, who lack technical expertise and stand on the periphery looking in.

Regulatory solutions, which tend to be inflexible, should be a last resort, not a first resort.

Privately designed and voluntarily implemented solutions are much better at fixing things than regulators using their inherently coercive power to impose mandatory solutions.

2. Crypto Keeps Pumping

As inflation subsides, numbers are going up in crypto markets. Genesis filed Chapter 11 bankruptcy and crypto prices still didn’t budge.

We’re not the only ones wondering… is the bottom finally in?

BTC and ETH continues to climb to $23,040 and $1,580 in the past week.

Fantom (FTM) is up 52%, ApeCoin (APE) 29% and Optimism (OP) 22.6%. Taking the largest gains is Aptos – up 126% to $17.84. Is Aptos overvalued? More on this in the Bankless newsletter next week 😉

3. NFT Hacks and Migrations

This week in NFT land, PROOF Collective CEO and Moonbirds creator Kevin Rose fell prey to a phishing attack that saw his wallet get drained for ~684 ETH ($1.09M) worth of NFTs. The stolen NFTs include 25 Chromie Squiggles, an Autoglyph, a Cool Cat, a QQL Mint Pass, several OnChain Monkeys and many more. Oof.

How the hack happened: Rose signed a malicious signature on the Seaport tool that lets users trade NFTs in bulk. You can listen to the full Twitter Space here.

0/ Earlier this evening @kevinrose was phished into signing a malicious signature that allowed the hacker to transfer a large number of high-value tokens. Here is a breakdown of what happened, our immediate response, and our ongoing efforts…

— Arran (@divergencearran) January 25, 2023

Moral of the story: unless you’re a tech wizard, you’ll likely not know if what you’re signing is malicious. The answer is wallet segregation – move your overpriced JPEGs to a siloed vault for safekeeping and only move them out to a separate wallet for approvals to trade when you need to.

Elsewhere, a legal clause that Yuga Labs snuck into its new Dookey Dash game is coming to light. Minters of the Sewer Pass NFT needed to play Dookey Dash are implicitly agreeing in the T&C not to sue Yuga or participate in any class action lawsuit (Yuga was sued in December).

The @BoredApeYC set a huge legal precedent yesterday for the whole #NFT space

— flyabstractart W3BSTOCK 🌴🎹💎🎹🌴 (@flyabstractart) January 19, 2023

But most of you are only excited to get that dookey

If you have a pass you agreed to this

🥂 apes #BAYC #SEWERPASS pic.twitter.com/rvqq3mXKrg

Meanwhile, Doodles 2 is announcing its launch on Flow for “frictionless” onboarding of mainstream consumers i.e., scalability. ETH-maxi’s aren’t happy.

So why did we choose Flow for Doodles 2?

— poopie (@poopie) January 25, 2023

We’re able to create a frictionless on-chain app that lets mainstream fans customize their Doodle without limits.

a thread 🧵 pic.twitter.com/lRCtmtpcOE

Pudgy Penguins are experimenting with soulbound tokens and letting holders bridge their Lil Pudgys to Arbitrum, Polygon, and BNB Chain.

Lil Pudgys can now spread our vision to other ecosystems, starting with Arbitrum, Polygon, and BNB Chain.

— Pudgy Penguins (@pudgypenguins) January 25, 2023

To bridge to another chain, visit https://t.co/VtgSjGkZks pic.twitter.com/8XRHbEJnBK

4. DeFi Developments

Uniswap V3 is inching towards deployment on the BNB chain. A preliminary “temperature check” vote organized by Plasma Finance saw 80.28% of UNI holders voting in approval and 19.72% against. Should the final “governance proposal” pass, Uniswap will deploy on BNB chain.

🦄 We’re excited to share that our @0xPlasma proposal to deploy @Uniswap v3 on @BNBCHAIN has passed the "Temperature Check" with 20M votes "YES" and 6,495 $UNI voters (the biggest number for the whole Uniswap Governance History).

— 0xPlasma Labs: DeFi & NFT Metaverse 🦇 🔊 (@0xPlasma) January 22, 2023

Moving forward to the final "Governance Proposal" pic.twitter.com/HoIJgY8mX1

Gemini’s public troubles with Genesis are spilling over into its partnership with Maker DAO. Maker narrowly shot down a vote last Thursday to remove Gemini’s GUSD stablecoin from the protocol. 50.85% of MKR holders voted to maintain GUSD’s debt ceiling at $500M, while 49.15% voted to decrease it to zero. ParaFi Capital flipped the vote in the eleventh hour.

85% of all circulating GUSD is held by Maker DAO for collateralization of DAI. This partnership yields a revenue stream to Maker of 1.25% APY. While Gemini’s stablecoin is concentrated in Maker, DAI is relatively diversified with GUSD making up only 8.3% of its total collateralization.

An early governance post by Lido begins to lay out plans for ETH staking withdrawals, with contingencies for Lido validators getting slashed.

Finally, Aave V3 is coming on Ethereum mainnet.

The highly anticipated V3 launch on the Ethereum mainnet AIP has been created by the community and is now live. V3 is the most significant upgrade to the Aave Protocol, and ETH is Aave’s first and largest market.👻

— Aave (@AaveAave) January 23, 2023

Read📚, vote🗳️, and discuss here 💬: https://t.co/9lVZseiAHM

5. Busy Week for Ethereum

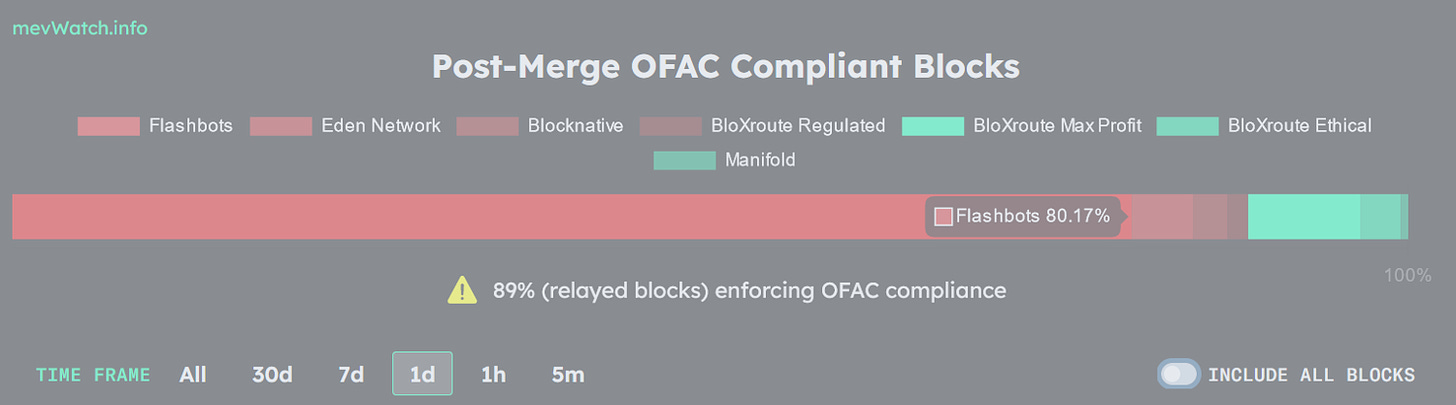

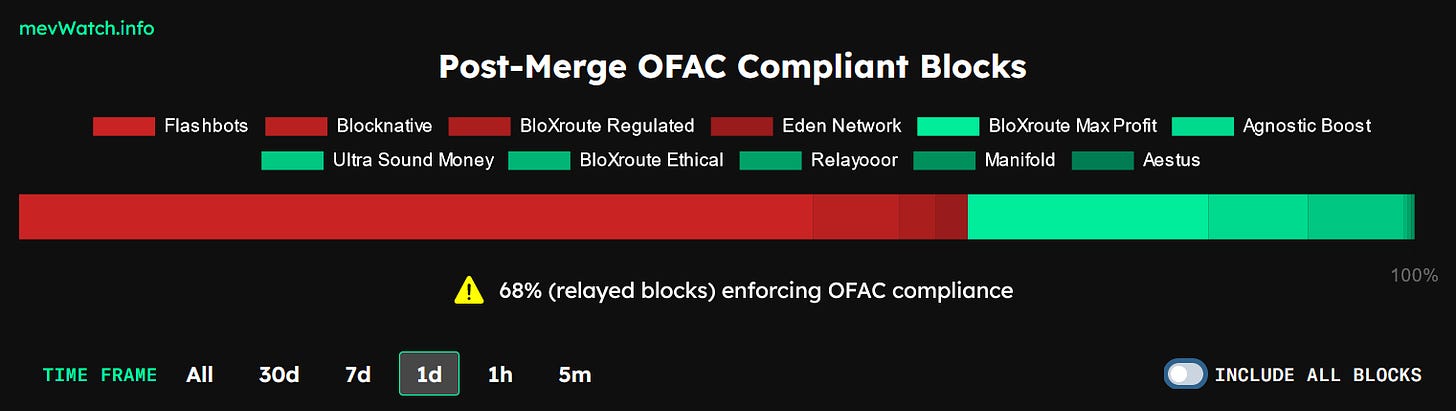

The U.S. Treasury sanctioned Tornado Cash mixer on 8th August, 2022. At that time, a total of seven relayers existed and 89% of Ethereum blocks were plugged into a censoring relayer that omitted Tornado Cash transactions.

Fast forward six months later, there are a total of 12 relayers on the block building market and censored blocks have dropped to 68%. Ethereum continues to win the war on government censorship, slowly but surely.

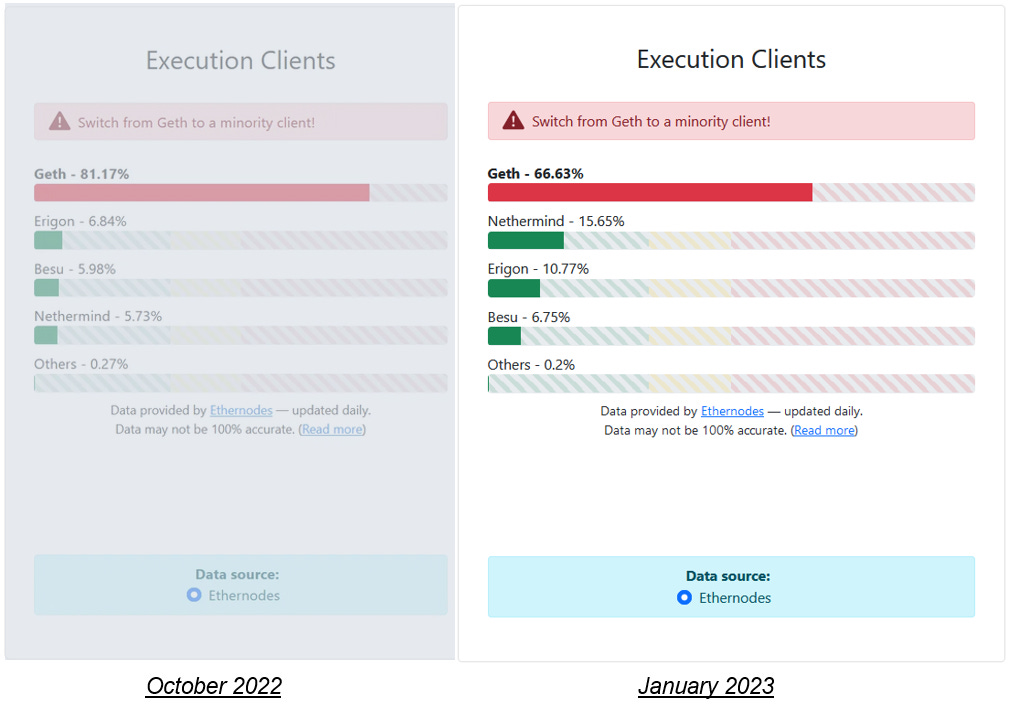

On the client diversity side, execution clients have also grown more decentralized with a reduction in Geth clients and increase in Nethermind, Erigon and Besu clients. Software clients continue to improve in memory usage and attestation performance.

This week also saw the Shanghai Mainnet Shadow Fork go live, bringing ETH Beacon Chain stakers one step closer to ETH withdrawals in March. This will be Ethereum’s biggest network upgrade since the Merge.

About 14% of total ETH supply is staked, and it can be unstaked after the Shanghai fork. This makes some people bearish.

— Jack Niewold 🫡 (@JackNiewold) January 26, 2023

But that ETH doesn't come onto the market immediately: it still has to go through a withdrawal queue.

It takes time to unstake. pic.twitter.com/5iY4S3rMIz

Other news:

- Wormhole hacker is moving funds

- DYDX rallied 18% after derivatives exchange delays token release.

- Porsche drops an NFT and it’s not doing too well

- Proof of Innocence lets users prove legitimacy of Tornado Cash transactions

- Robinhood launches new crypto wallet

- Centrifuge raises $252M in financing

- QuickNode raises $60M to $800M valuation

- Index Coop launches diversified staked ETH index $dsETH

- Leveraged liquid staking is coming