Is the Merge Overhyped?

Dear Bankless Nation,

Back in April, we hosted a controversial debate on UST and Terra.

This was right before its collapse. But at the time, the Terra ecosystem had taken mainstage. Everything was going right for it, and anyone who opposed it was shunned by an army of community members.

The person who took the bear case on our debate?

Despite what everyone else thought, he was still skeptical.

Now, with the Merge less than a month away and Terra buried, Jordi believes that Ethereum’s highly anticipated upgrade might be overhyped.

Even though Bankless holds a bullish outlook on the Merge, we need to be prudent investors. We need to see both sides of the argument.

And Jordi makes another good one today.

This is by far the most pragmatic case for why the merge might be overhyped.

Can he go 2/2 on contrarian takes?

- Bankless Team

P.S. Is crypto privacy dead?? Hear what legendary crypto lawyer Jake Chervinsky thinks in today’s podcast.

Guest Writer: Jordi Alexander, CIO of Selini Capital

The sun starts to rise on September the 16th.

Vitalik pours out a measured vial of Malbec into his sencha tea, gives it a quick stir, and takes a gentle sip. “Ahhh... 15.0%, just the right proportion”.

The hard fork went as smooth as a knife through butter. A long-awaited moment that detractors claimed would never come has finally arrived - and it tastes of bliss.

Buzzing, he types out a Mission Accomplished tweet, thanking everyone that helped make the moment a reality. Millions of Likes pour in, as the mainstream news on TV in the background joins the choir of buzz and acclamations.

The future is now, and the path to five-digit ETH is now within sight, certain to arrive with ultra-sonic speed.

A new environmentally-friendly gas burn lights the fire of scarcity deflation, powering flywheels for an Asset the power of which the world has never witnessed until now.

- 💥 Reflexive Up Only Price Cycle

- ➡️ 🔥 Fueled by a Deflationary Supply Squeeze

- ➡️ 💵 And Rewarding Outsized Real Yields

- ➡️ 💪Leading to Ethereum Chain Dominance!

Sounds amazing!

But before we FOMO-panic and start scavenging through the couch cushions for loose change to squeeze out the last few drops of gwei we can afford, let’s take a more nuanced look at these four narratives, and see which ones in fact hold up to closer scrutiny.

Narrative #1. Buy The Rumor, Buy the News: ETH price to spiral up into a SuperCycle

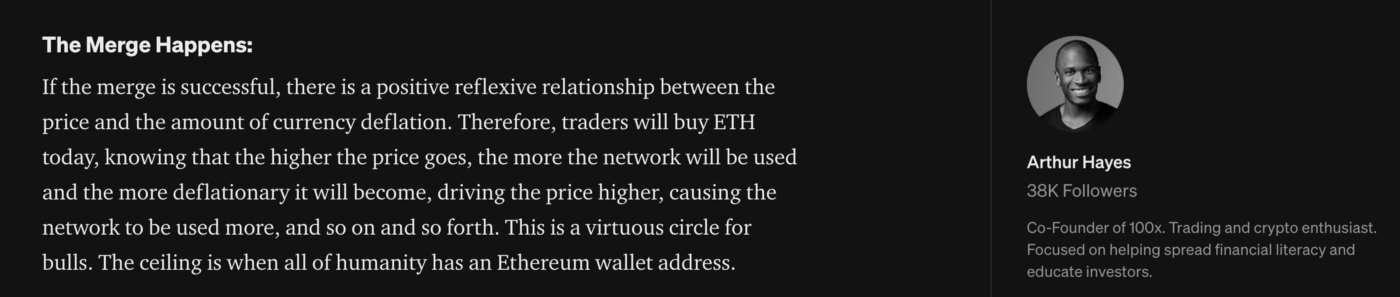

In his popular medium post “ETH-flexive”, Arthur Hayes stirred up the Merge Bulls by evoking Soros’ theory of reflexivity.

Far from taking a breath post-Merge, he predicts that this catalyst will only accelerate what has been already been an intense rally off July lows of ~$1,000.

His central thesis is that the attention from the Merge will lead to higher prices. And as we know, price pumps in crypto lead to more attention. Given that blockchain fundamentals such as users, developers, and on-chain activity, are all correlated with attention, this will spiral into a virtuous cycle only bounded by the size of the Earth’s population!

While this is certainly an appealing mental framework to play with, we can find two major leaks in this Price ➡️ Adoption flywheel — one short-term, and one long-term.

In the short-term, as Arthur himself acknowledges, there can be Sell the News pressure from overly built-up anticipation, that overrides any fundamental improvement.

In the long-term, the relationship between attention from higher prices and more gas being burned can turn out to be much more fleeting than described. A counter-thesis we will examine later in this piece is that the reduction in gas usage we have seen in recent months is structural, and value accrual for Layer-1 blockchains needs to be rethought.

Let’s first consider the likely price action post-Merge:

Time and time again, we have seen the same thing in crypto: When there is a big shiny catalyst on the near horizon, there is a lot of dip-buying support by event-driven participants.

The dip-buying is driven by “I know that you know that I know” the event is coming, emboldening tactical buyers. Short-sellers get scared off by the asymmetric reflexivity of the upside, and retail who is late in the information chain give one last final push when the headlines finally reach them.

Human attention spans are short, especially in crypto. Boredom sets in, shiny new things get the headlines, and it’s off to bet on the next chain’s upgrades or tokenomics tweaks.

It’s hard to forget the BTC all-time high was just as the ETF launched in late 2021.

Or the Coinbase IPO hype that led to a down-only period.

Or... *shudders*, Dogecoin’s one-way slide down after Elon Musk’s SNL appearance.

These moments of maximum saturation and attention seem to leave the market completely one-sided and vulnerable below. Every single time.

While there are plenty Ethereans who wouldn’t dream of being parted from their precious coins, there are funds and crypto whales who have entered into a long position as a tactical event-based trade.

Once the headlines die down, short-term players could find themselves in a game of musical chairs to grab their share of unrealized profits before the music stops!

Is this time going to be different?

Going into a period that many expect to be an extremely challenging macroeconomic backdrop, it seems at least possible that the sell-the-news Reaper remains undefeated.

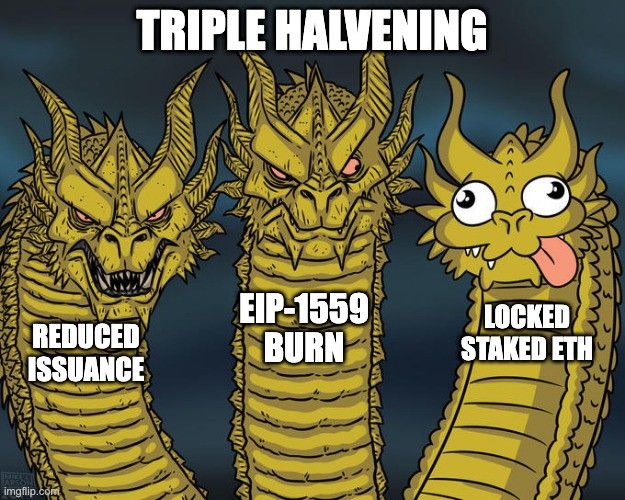

Narrative #2. The “Triple-Halving” drives ETH into a deflationary supply crisis.

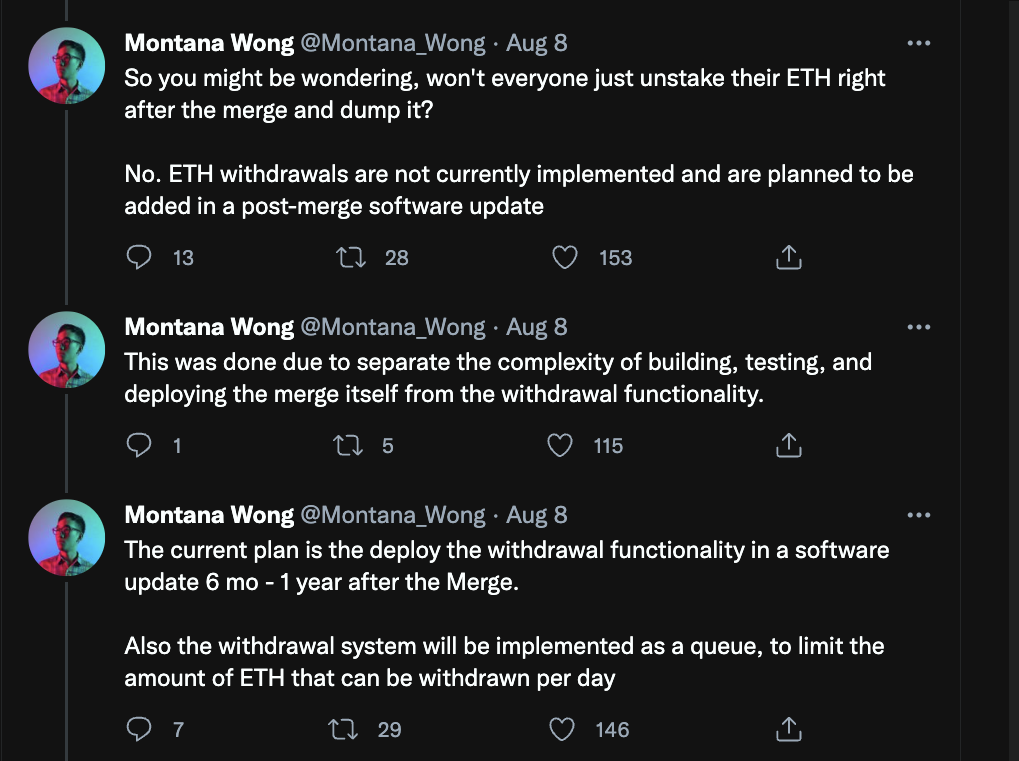

In a recent thread with thousands of retweets, Montana Wong laid out the case for the cataclysmic supply shortage that is anticipated post-Merge.

The so-called ‘Triple-halvening’, which references Bitcoin’s once-in-four-years emissions reduction, is described as an accumulation of three powerful effects blending into a singular phenomena that will make ETH scarcer than a girlfriend on Crypto-Twitter.

Let’s then take a closer look at each part of this monster.

Dragon 1: Reduced Issuance ✅

By no longer needing to pay miners to validate transactions on the network, Ethereum is effectively firing its highest-paid employees.

This will result in saving 13,000 ETH per day of ‘Proof of Work’ expenses. Sorry miners.

Rather, the Ethereum Security Department will be filled with Staking Officers, whose salary is quite a bit lower: Their entire budget will start at just close to 2,000 ETH per day — though over time, as more Staking Officers show up for duty, their budget will increase to ~5,000 per day.

Still, an 8,000–11,000 ETH per day of net savings is indeed a significant catalyst, as $15–20M of daily sell pressure is removed!

An argument can be made that the cheaper Security force may come at the cost of less censorship resistance — but in terms of pure price impact, this first dragon is unambiguously powerful.

The difference between a company with a yearly 4% dilution and one without it - well if we approximate say a sort of 20-year P/E ratio, 1.04²⁰ = ~2.2x more valuable than otherwise. This part seems to check out.

Dragon 2: The Burn 🔵

EIP-1559 was a powerful catalyst for Ether’s price when it was implemented in 2021. A chunk of the gas fees paid by users every block get burned, helping partially offset the new issuance paid towards the Security Department budget.

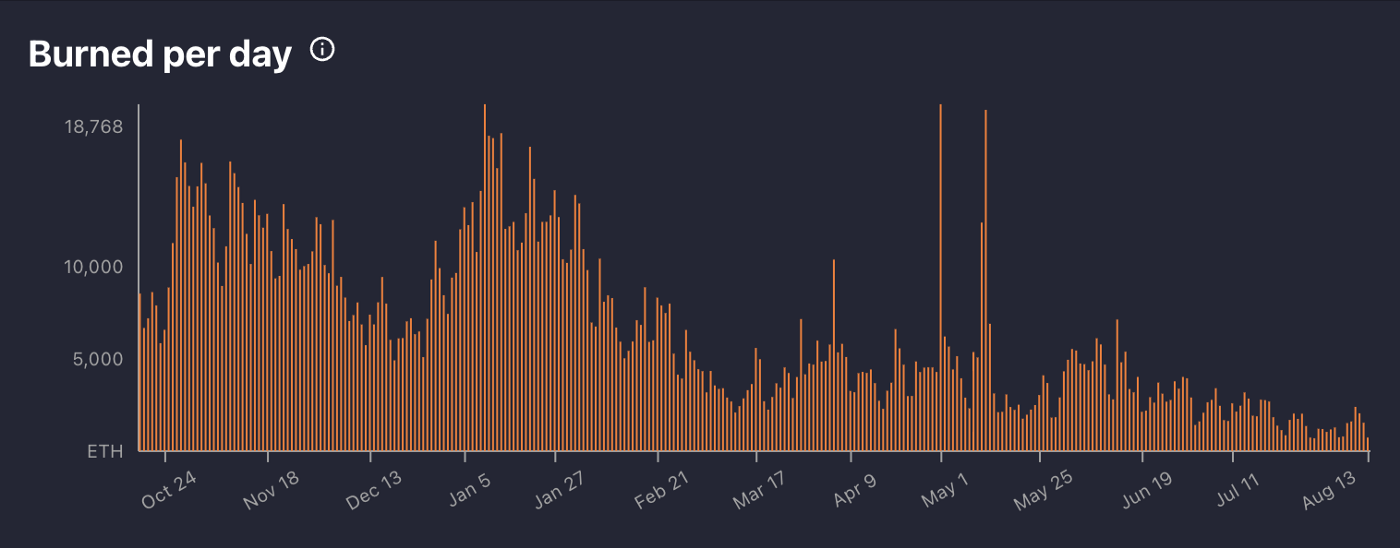

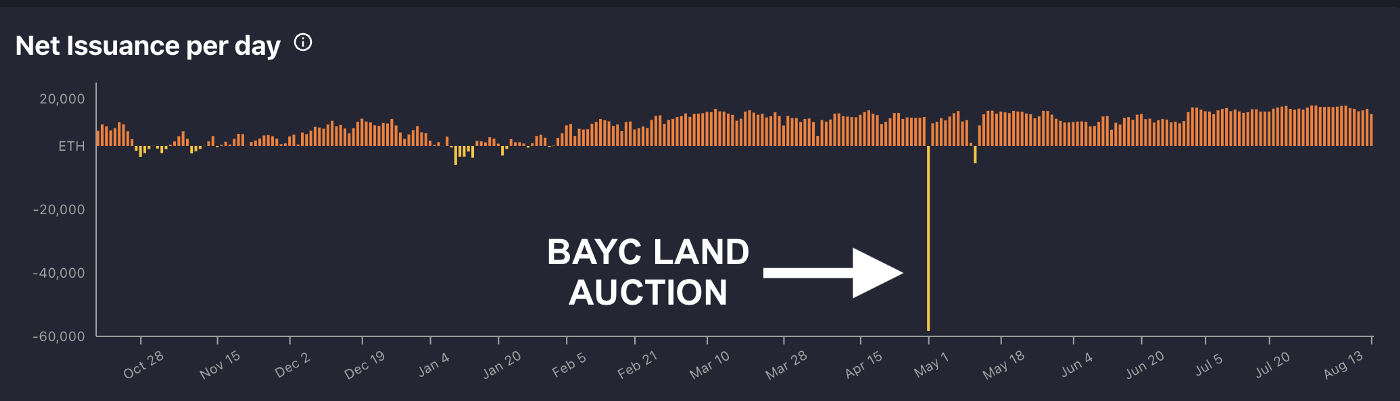

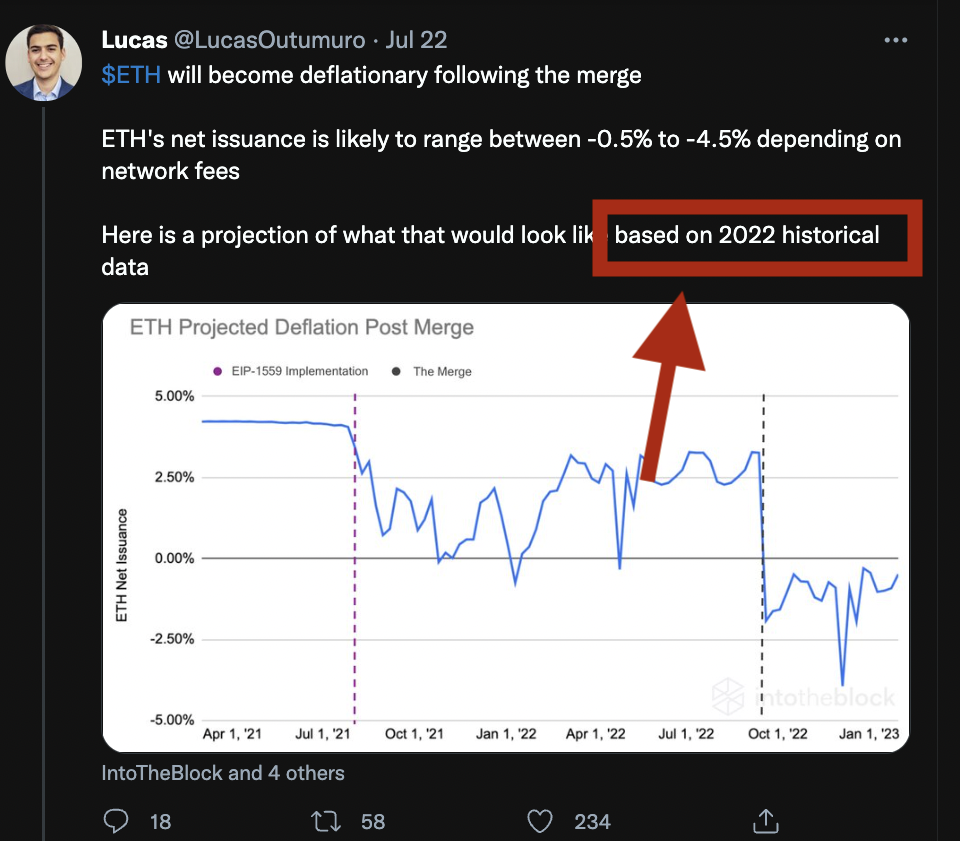

However, it has been a year since EIP-1559 was implemented, so not only is it already priced in, it might be over-priced in: While in the early days the burn was so high that ETH supply could turn deflationary, that is far from the case anymore.

For an ETH price bull (not to be confused with an ETH tech bull), this chart has to be alarming. Not only are the days of 10,000+ ETH burns seemingly long gone, but as a technical analyst would point out — there doesn’t seem to be any support level yet!

We don’t know how low this can go.

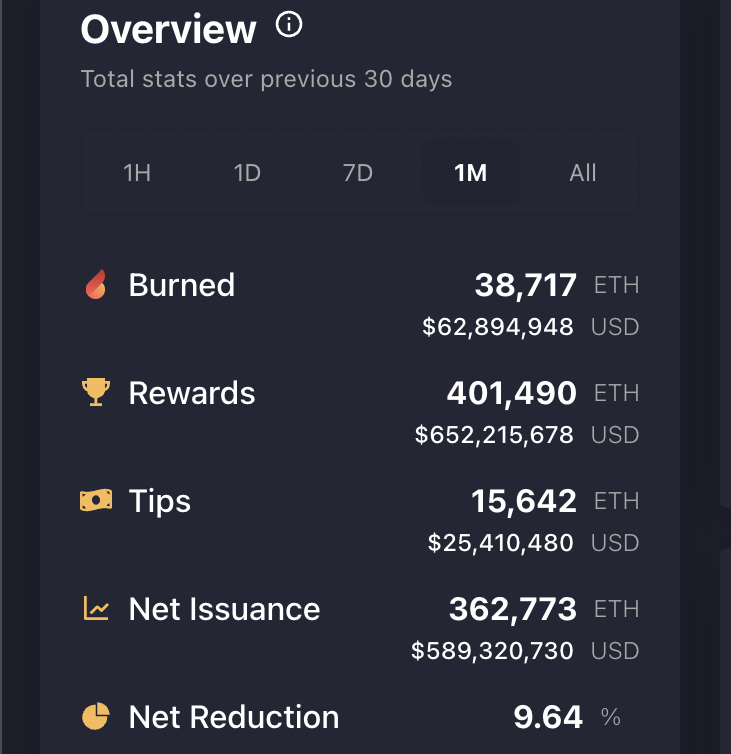

During the last 30 days in the month of August, during which ETH price has been up over +50%, the gas burn has been a mere ~1,300 ETH per day:

While ETH bulls will claim this is simply due to the cyclicality of crypto and fees paid will eventually return to their highs, this ignores the one-way structural changes than are afoot.

Let’s take things from the start:

During bull-market manias, there is so much money flowing into the system that participants are willing to grudgingly pay exorbitant fees as a ‘cost of doing business’.

The first wave of ‘business’ was participation in the early blossoming of DeFi. Pretty soon, the creation of interesting and legitimate financial experiments led to a wave of new ponzis that took the viral marketing components like sky-high APYs% and created a free-for-all grab of seemingly valuable food tokens.

As happens during a new mania, being the main Picks and Shovels shop in town is a great business — and ETH gas was exactly this.

That is, up until the point participants figured out where the free money was coming from.

The food tokens given out to finance liquidity were actually near worthless, and without them being a Passive LP in AMMs turned into a money-losing enterprise.

As DeFi exploits and rug pulls increased in 2021 and Pool2 prices gravitated back to Earth, the willingness to pay for blockspace to participate in these games evaporated.

New mutant versions of the games kept appearing, but even those would go off the Ethereum mainnet so that the PvP pump and dumps could occur in peace, without extra gas fees.

DeFi summer was coming to an end.

But then — just as gas costs started to go down — NFT-mania lit up like a firecracker!

As with DeFi, what kicked off with legitimate digital artists and novel algorithmic art soon turned into an endless stream of copycat PFP collections.

Most of these projects were spun up to meet the insane sudden demand, and duly rug-pulled or dwindled to obscurity. But until the market slowly digested and figured out where the value would accrue, new mints would be hugely oversubscribed and the gas would keep flowing.

And what of the few but huge winners of the NFT and GameFi wave?

As some projects successfully attracted sticky users, they realized that they could be accruing more of the full value themselves, rather than let it go to waste on ETH gas.

This was made evident during the disastrous Bored Ape Yacht Club metaverse land sale which generated $285 million in sales — while a whopping $176 million was wasted in gas!

Great for ETH holders, not so great for the Yuga community.

This event became a lesson learned, not just for Yuga Labs, but also for any other aspiring NFT mega hit.

Whether these projects eventually decide to avoid these recurring costs by moving to an alternative chain, a Layer 2, or to stay on mainnet and optimize the auction to eliminate gas bidding, is unclear.

What we can say, however, is that burn days like what we’re used to are a thing of the past, and should not be extrapolated into the future:

After DeFi and NFTs, won’t there one day be a Third Wave that leads to another intense gas-burn cycle?

Indeed, new innovation that will grab attention is guaranteed at some point. However, it now seems highly unlikely that new mega hit apps will need to burn a ton of ETH gas to succeed. Burn hopefuls will be swimming the tide of technological innovation, which is making blockspace less scarce:

- Code efficiency is improving rapidly, even in existing heavy-usage apps. For example, OpenSea transactions are now 35% more efficient, burning a lot less gas.

- With myriad Layer-2 and AppChain options coming online over the near future to cater to a full range of different use-cases, a lot of apps will find a home off Ethereum mainnet.

- For those who stay on L2s, writing a state update on the Ethereum L1 from the L2 will get cheaper over time with EIP 4844 (proto-danksharding).

The hope for burn-maxis is that Layer-2 chains will create new vibrant on-chain ecosystems of their own, leading to substantial ETH gas burns there.

This remains to be seen — incentives are destiny, and once a Layer-2 chain achieves a large and sticky user base, game theory suggests the Layer-2’s local population will start demanding value accrual be localized instead of being paid as tribute to the empire.

Conclusion for Dragon #2? Unfortunately for those who grabbed some popcorn to sit around and watch the burn, Blippi showed up… and he brought his firehose.

Dragon 3: Staked Supply will be Locked ❌

Finally, the third Dragon is a narrative of staked tokens being locked off-market and thus not being available to dump.

After all the opportunistic participants have farmed their PoW forks and rushed to the exits, staked participants won’t be able to withdraw their tokens until the Shanghai fork in 2023.

Out of all the optimistic price narratives, this is perhaps the most misplaced of all.

Not only is the (over 13M+) ETH on the Beacon chain already off the market, but it has been earning yield while it has been out of sight. All this time, rewards have been generated on both the PoW and PoS chains, but only the PoW emissions have been allowed to be sold.

By the time of the Shanghai fork, there will be ~30M ETH suddenly available for unstaking (+over 1M of accumulated ETH rewards that can get pruned), creating the possibility of an unstake queue and a sizeable supply/demand imbalance.

The fact that there will be an unknown time lag until all these tokens can be finally withdrawn should not be a cause for celebration.

Markets are always forward-looking, and when the next catalyst on the horizon goes from being a highly-anticipated Merge to being a large coin unlock of unclear consequence, this will cause a shaky price floor as Shanghai approaches.

Narrative #3: Staked $ETH will become a ‘yield-seeker’s sensation’

One of the loudest narratives of the Merge has been the creation of a new super Asset in Internet Bonds.

Ethereum proponents, including even the Ethereum Foundation, have been clamoring that this will be a game-changer.

Block rewards — the nectar of the Gods, once only accessible by the miner elites — will now be safely packaged into a risk-free yield for all to enjoy.

Clean, pristine, real yield, straight from the source.

How will institutional treasurers continue to ignore such a divine high yield asset when their balance sheets return a measly 3% APY?

First to quickly brush aside the notion of corporate buyers appearing, ETH yields cannot be ‘risk-free’ if there is ETH price risk being taken!

But even for ETH denominatooors, the staking deal for ETH holders is not as magic as is being represented. Unfortunately, what looks like a checkmate move is perhaps the most misleading of all the Merge narratives, and will quickly turn into disappointment.

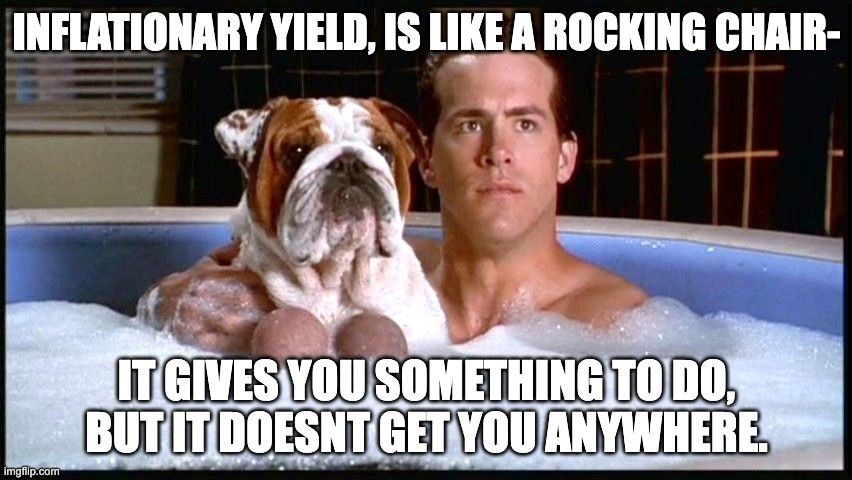

Internet Bondooors will be forced in the end to recall the cardinal rule of returns:

T̵h̵e̵r̵e̵ ̵i̵s̵ ̵n̵o̵ ̵f̵r̵e̵e̵ ̵l̵u̵n̵c̵h̵

Eh, let’s name it something less boring instead: “The Paul Blart Rule”.

You see when the risks are gone, what do Anon Security Guards expect to get compensated for?

They are doing no useful work, and have no skills.

They bought a coin, went to a site, and clicked the big green ‘Stake’ button?

Congrats Mr. Blart! Here is your yield:

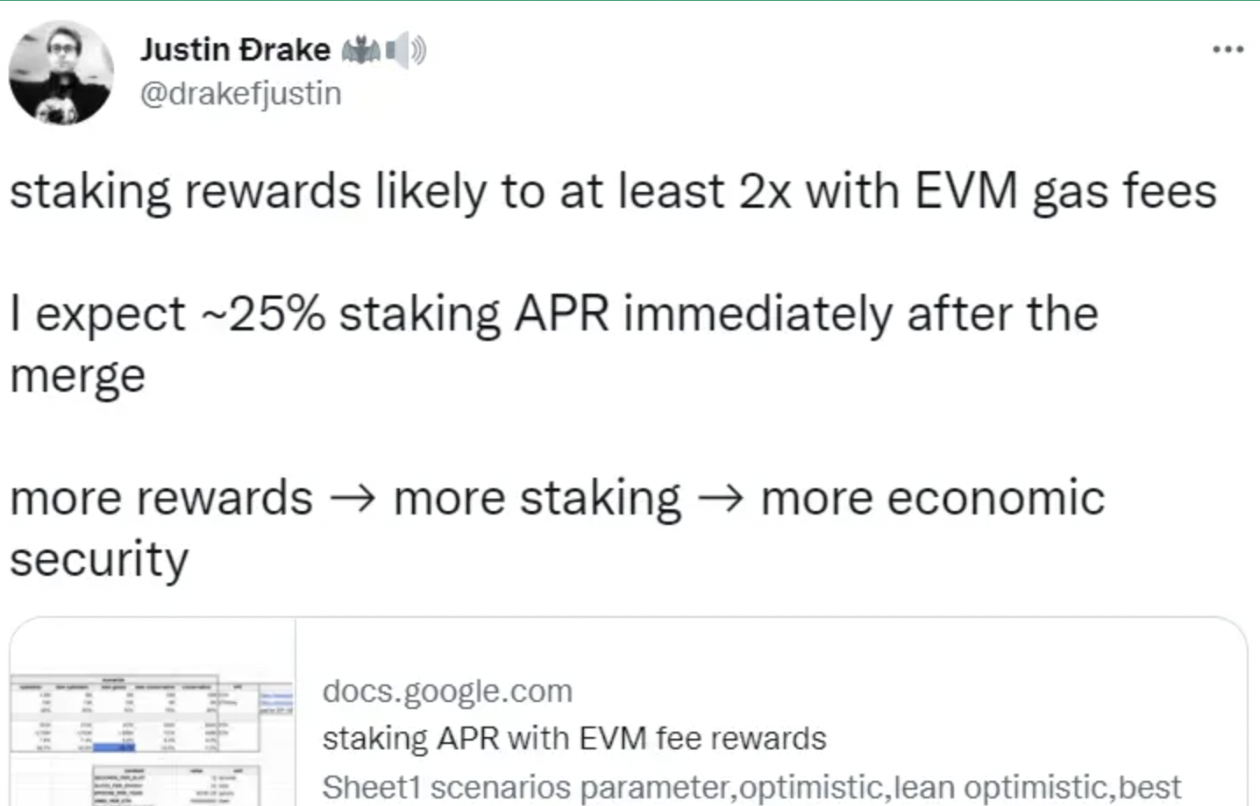

- Yo — Lemme get my 2̶5̶%

- Uhh — How about 1̶0̶ %

- Hmm — Surely 5%?

Well, only for a short period, and only for those who took on the tech risk of the Merge and the illiquidity premium of the Shanghai fork.

In a year when those risks are behind, ETH staking Mall Cops will be lucky to be earning 1–2% APY after token inflation, even lower than US treasury bonds.

But didn’t those researchoors and influencoors promise multiples of that?

How could there be such a disconnect?

Same as always — making projections based on historical data and assuming the parameters of it won’t change. We already saw that they are getting the deflation prediction wrong because of backwards looking gas estimates.

So, how are the experts getting the staking yields wrong too?

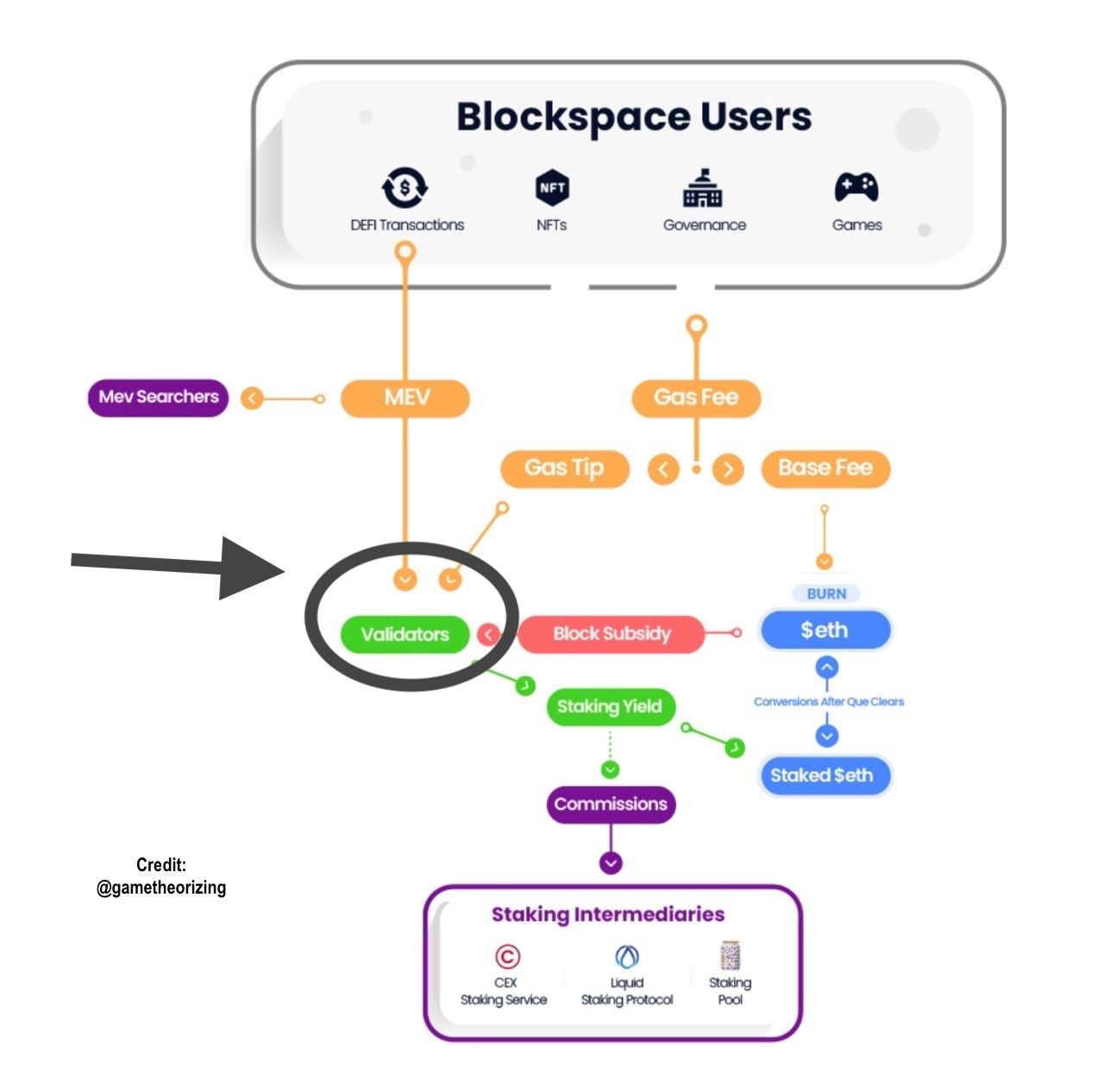

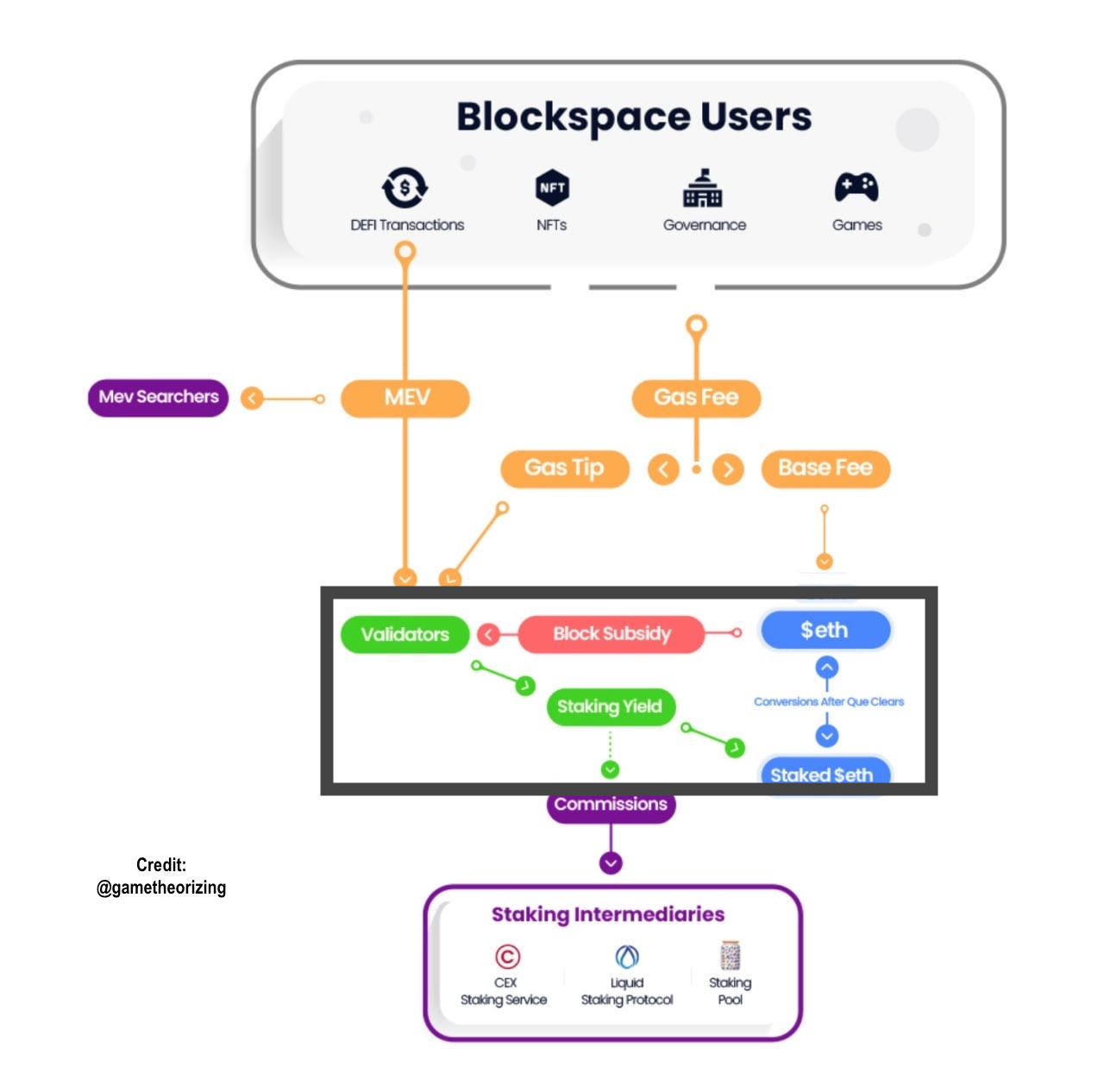

To truly understand, one needs to be able to first visualize the Blockchain economy. As such, I paid a $100 to an Upwork designer to make a clean diagram from my messy sketches.

You do *not* want to see what the ‘before’ looked like! But I digress:

Staked ETH generates yield because it is needed to run a validator.

There are three sources that add up to the headline ‘Yield’:

- 🛡️ Block Subsidies: printed from ETH inflation, as a security cost

- ⛽ Gas Tips: from users who want their transaction prioritized

- 🤖 MEV rewards: bribes to organize transactions a certain way

Let’s see how each works, as they all contribute to the stale predictions by the analyzoors.

🛡️ Block Rewards

Earlier in the year, only 10M/120M possible ETH was staked on the Beacon Chain due to all the risks ahead. Even the Ethereum Foundation didn’t stake their ETH, given that they saw “how the sausage was being made”.

However, this 10% staking participation is much lower than what chains which are already Proof of Stake settle to (~50–80% participation). As Merge risks are sorted, more stakers will quickly show up and stand in the entry queue.

Herein lies the main dilution of the rewards yield. The block subsidy will be shared by more and more Mall Cops once the coast is clear. There are already now ~14M coins staked, reducing rewards to 4.1% per validator.

Needless to say, post a successful Merge, this number will continue to increase by the maximum allowed through the queue: roughly 2M/month.

This is a true up only — even if someone wants to unstake now they will not be able to!

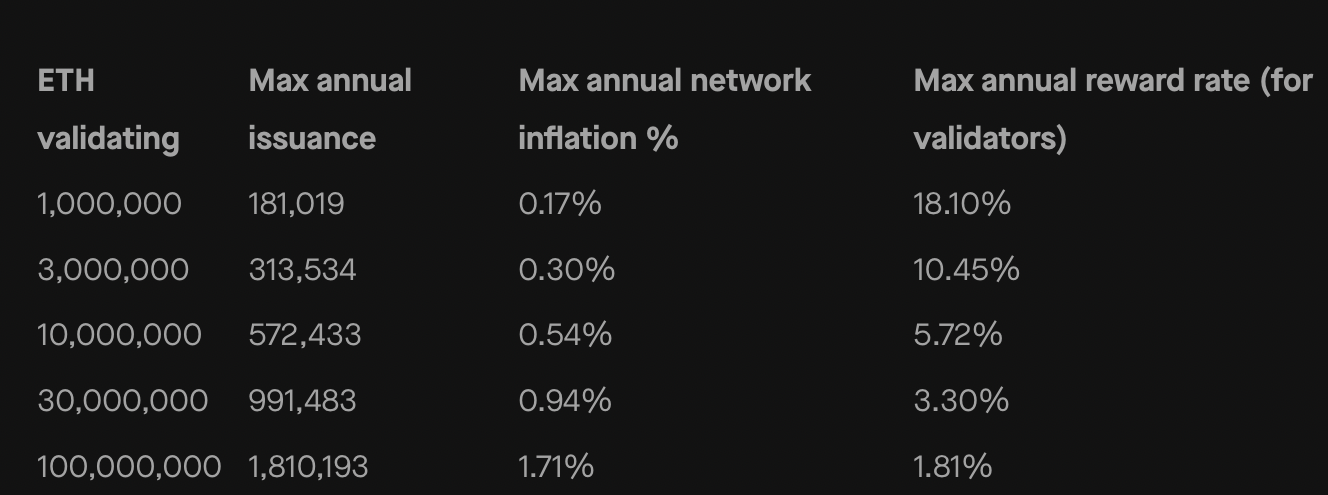

The effects we will have of more ETH validating can be seen below:

As more ETH is validating, not only will the reward rates decrease, but the annual inflation will increase, resulting in even lower real yields. At the extreme, if 100/120M is staked, the resulting Reward Rate minus Inflation would be 1.81%-1.71%= 0.1% APY.

An APY size, that truly, is no size at all.

In some ways, this would be good for Ethereum itself…

More ETH staking is celebrated because it equals more security. TRUE!

- ✅ It will take more resources for someone to successfully attack the network!

But this is also TRUE with more ETH stakers:

- ✅ Higher annual inflation for the entire network

- ✅ Lower yields for those staking.

Real (net of inflation) staking rewards can only be high when a very small % of the supply is staked. Block rewards are a form of inflation given to stakers at the expense of those who haven’t staked yet.

It’s a penalty for them being lazy/ risk-averse/ unsophisticated.

⛽ Gas Tips

Apart from the ever-decreasing block subsidy reward that validators are already earning, a lot of the hype is around the other part of the equation: Gas tips and MEV bribes which will only be enabled post-Merge.

Here too though, we find the hype to be well exceeding the current new reality.

Just as we saw there are structural changes that are causing less gas to be burnt, this is equally if not more true for Tips and MEV:

- 🚫 Less liquidity on AMMs for arbitrageurs to bid on getting to remove first

- 🚫 Less inefficient popular NFT auctions to cause tipping to get a mint

- 🚫 Flashbots silent bid auctions replaced public gas priority auctions

From being over 50,000 ETH a month during the heyday, gas tips are in recent months coming below 20,000 per month — and will likely keep spiraling downwards.

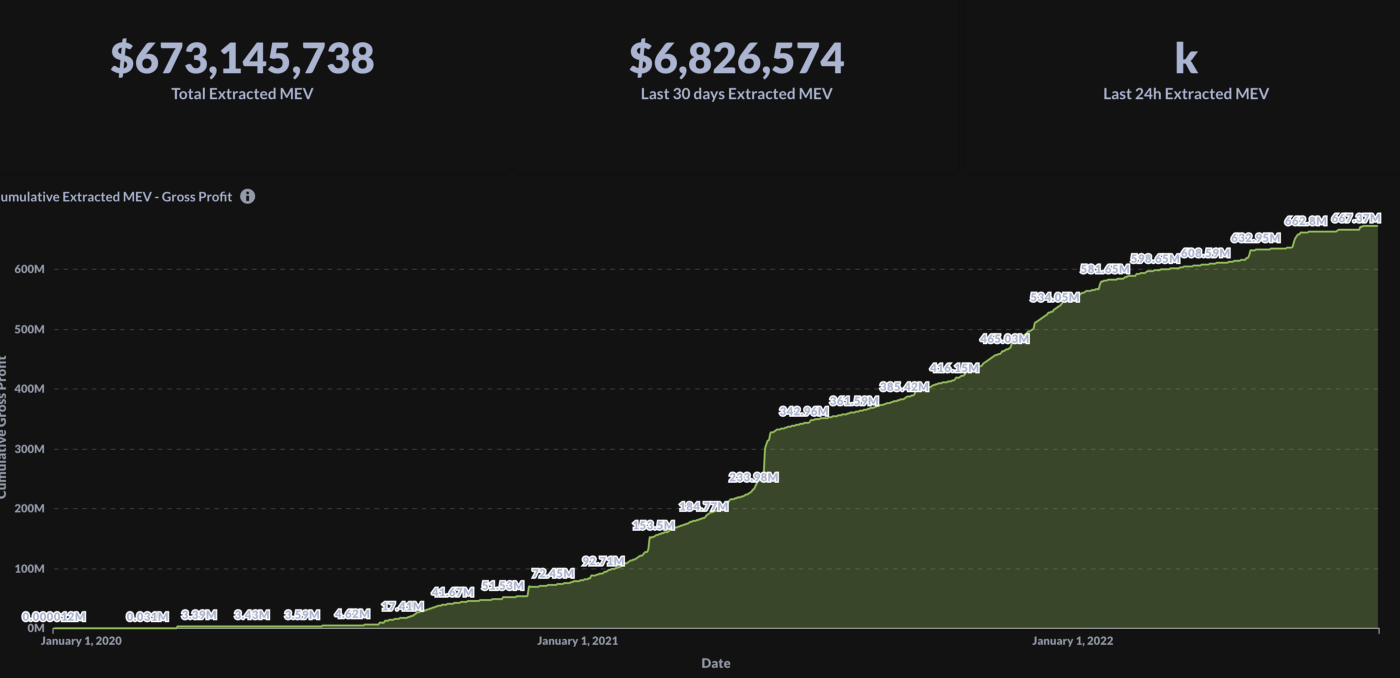

🤖 MEV

Finally, the most discussed — yet least contributing part of the equation — Maximum Extractable Value.

In Proof-of-Stake, the chosen validator that is publishing the block acts as the referee of the transactions vying for position within the block. And if there is a more profitable ordering to be made, the referee can get bribed to rig the game.

While this sounds like a malicious dynamic, it is actually better than the alternatives which create an unstable system. Flashbots is creating a product called MEVBoost to make these bribes transparent and accessible to all referees, and it will mean ETH stakers are more likely to get their ‘fair share’.

Bullish right?

Well, it would have been in the days of wild-west markets and UniV2 dominance. But MEV is being squeezed from all sides, including on the dApp layer (for example by CowSwap which uses batch auctions) .

With a rate of under $100m per year being extractable from MEV these days, in the long run it will turn out to be merely an asterisk in the Yield equation.

A More Realistic Projection:

In 2023, we will see somewhere between 30 and 60M ETH staked:

- ~2.5% APY max validator reward boost

- +~0.5% Gas Tips

- +~0.1–0.2% MEV Boost

This gets us ~3.2% APY.

- 🚫 of which ~1.5% is token inflation,

- 🚫 0.25–1% goes to third-party validator operators (unless having 32ETH and self-expensing a validator)

Hmm, that doesn’t leave much.

It turns out being a security guard isn’t so lucrative when 80% of the town is doing the same job.

A final note on Blockchain Revenue vs Costs:

Tokenomics and the rules of block subsidies and coin burns, these things do matter in creating proper user incentives. But at the end of the day, they are simply PvP games between the stakeholders.

A first-principles way to see through the noise is to break down the Blockchain’s economy into 3 clear parts:

- 🔶 Value in

- ⬛ Coin ecosystem

- 🟣 Value lost

For value to really accrue to a PoS blockchain, the formula is quite simple:

- MEV + Gas Fees > Intermediary Payments

🟣 Searchers, Staking Pools, Liquid Staking DAOs, Centralized Exchanges -

They are all ready to nibble on a piece of the action! Anything that ends up on their balance sheet is entropy loss from the blockchain’s ecosystem.

🔶 Ultimately, the sustainable path forward has to go through providing users with utility that outweighs the cost of the blockspace they are consuming.

Happy, repeat customers are the engine needed to power the entire economy, and efforts to achieve this will have a much greater long-term impact than any PvP yield games will.

Narrative #4: The One True Chain to rule them all

- 🙌 Stronger community and social layer than memecoins

- 💻 Better technology and more decentralized than Alt-L1s

- 💰 Ultra-sound money that will flippen BTC into obscurity

All three ETH narratives can claim a major boost from a successful Merge completion:

- 🚀 Merge attention leading to more user adoption, plus the meme power of ESG friendliness.

- 🚀🚀 Finally shipping a long-awaited tech upgrade of huge complexity, continuing on the roadmap to superior performance.

- 🚀🚀🚀 Drastically reduced supply, challenging BTC’s inflation rate and positioning as a better reserve asset.

Now all three of these narratives can be yummy snacks, individually! But throw them in the same bowl and their separate taste profiles start to clash pretty badly.

You wouldn’t want to chew through a scoop of them mixed together.

Post-Merge and as the roadmap continues, the differing goals start to clash heavily in fundamental ways.

Once things move on from the theoretical ‘roadmap’ stage into one where ossified decisions need to be made, it becomes increasingly harder to be all things to all people.

Tech, Meme, and Store of Value, each has a *different* optimal point on various dimensions. The following are some examples of this to consider:

1. Pushing Tech Innovation vs. Staying static

With constant innovation also happening in other blockchain ecosystems, Ethereum’s tech headstart is not enough to ever be able to rest laurels on. Other chains will not be idly twiddling their thumbs over the next decades!

- ✅ Tech upgrades reset lindyness and leave a larger potential attack surface

- 🚫 Hard money concept can’t be sticky if there is forever ongoing tech risk

- 🚫 Shipping is bearish- anticipation gone! Meme coins thrive as vaporware.

2. Value Accrual vs. Good User Experience

While users and holders are not completely distinct groups, post-Merge coin holders hold ever more sway over decision-making.

There are myriad ways that this can create perverse incentives where short-term value extraction is allowed over long-term ecosystem health.

- ✅ Designing around locking up tokens can increase scarcity value

- 🚫 If the strongest incentivizes are to hoard tokens, usage and innovation move to other chains because no one wants to spend.

- ✅ Tech improvements aim to reduce MEV and lower gas fees through more efficient code and trading dApps like ‘Cowswap’.

- 🚫 Coin value accrual desires more MEV and more gas auctions to milk.

3. Efficiency vs. Censorship Resistance

PoS increases efficiency in some ways, but also creates additional layers of complexity and thus a larger attack surface.

- ✅ Memeing about 99.9% ESG benefit makes for great MSM headlines

- ✅ The roadmap towards the scalability vision moves forward

- 🚫 Decentralized money needs ultimate censorship resistance.

It is important to try and keep a balance between the efficiency benefits of things like winner-takes-most liquid staking protocols, and the centralization risks that they can bring.

4. Solarpunk vs. Lunarpunk

This may be the most important clash of all, and one that is very much pertinent after the recent Tornado Cash code sanctions.

There’s ETH: Vitalik’s Vision, a truly decentralized Ethereum.

If it gets sanctioned, it can go underground to keep censorship resistance alive. Even if it means enabling a user-enabled soft fork and losing access to centralized stablecoins like USDC and rebuilding oracles. Chewing glass as long as it takes.

Or, Ethereum™ which can go fully mainstream. Institutional investment bucks come in, and in exchange, everyone obeys when Uncle Sam gives a tap on the shoulder. Token holders’ incentives swarm over the cypherpunks libertarian dreams.

‘Number Go Up’ rules the day.

The Merge has brought this collision to the fore, and it may not be too long now before a fateful decision is needed to be made.

If so, let us hope the right choice gets made for the sake of the community, our ideals, and all of our familias.

Tl;dr in case you made it here just by scrolling through the memes:

- There may not be enough liquidity slushing around during this period to avoid a “Sell the News” event as many are in profit-taking mode.

- Saving the cost of miner emissions going forward is worth roughly a 2x in ETH valuation compared to previously.

- But fees are falling off a cliff for structural reasons, and locking ETH into staking derivatives will do little to help the situation.

- Checks have been written that won’t be able to be cashed — from predictions of deflation, to internet bonds with attractive yields. The reality of these shows there has indeed been some overhyped.

- Ultimately, the focus should instead go towards better-designed apps, novel use-cases for blockspace, and friendlier user experiences on-chain.

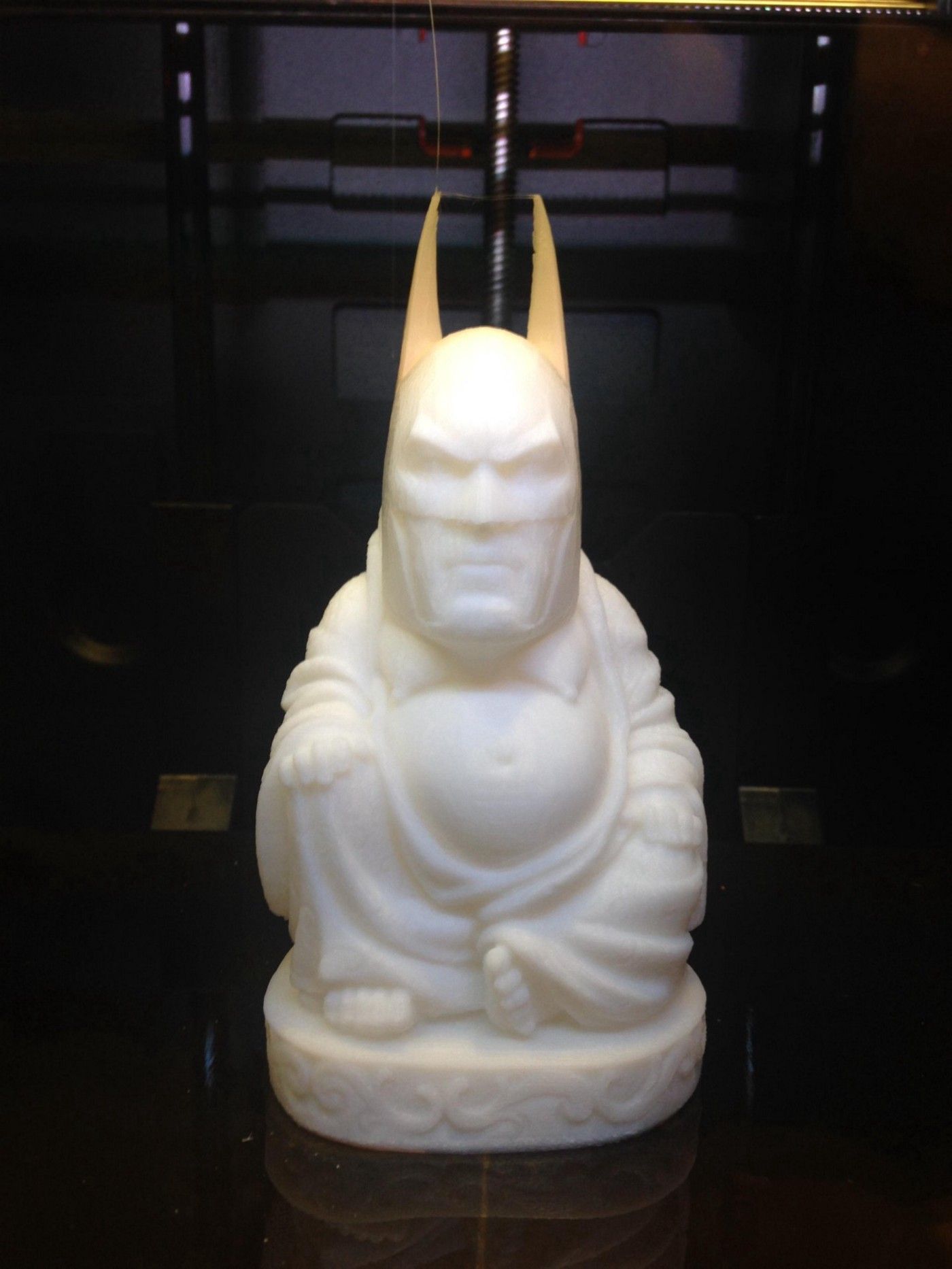

- Confucius says, be a great Batman, or a great Buddha. Maybe don’t try to be both at once.

Thanks to Connor for all the help.

Action steps

- 🐻 Consider the bear case for the Merge

- 📺 Listen to Jordi debate the bear case for UST and Luna

Author Bio

Jordi Alexander is the CIO of Selini Capital, a multi-strategy trading firm and liquidity provider specializing in crypto assets.