Is SOL Undervalued? ($)

View in Browser

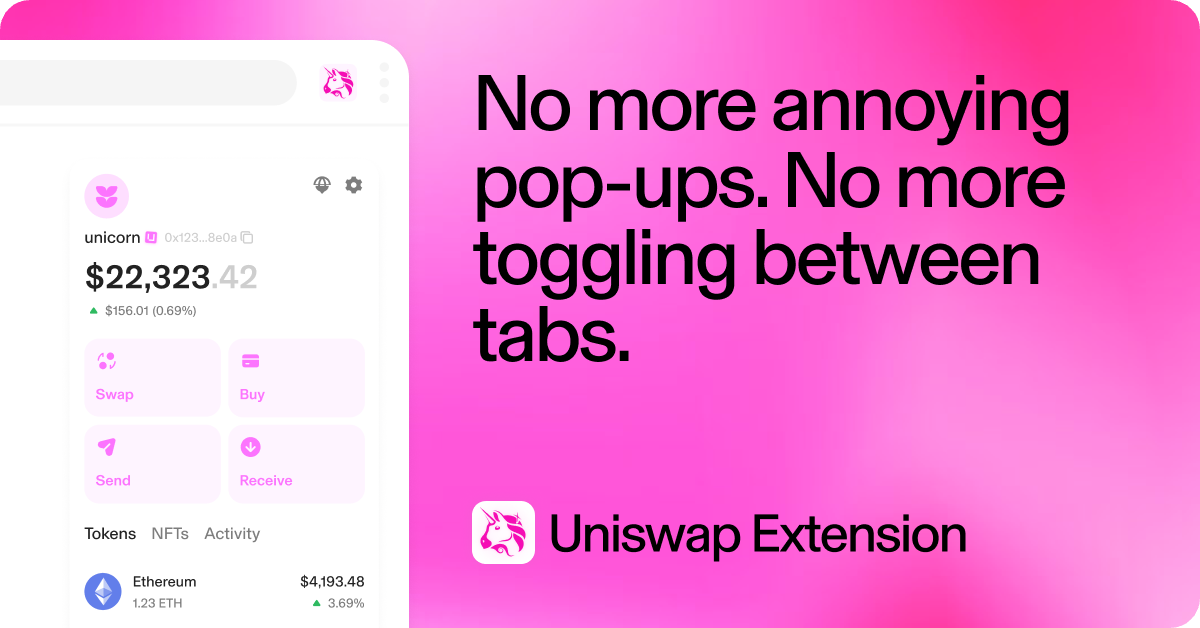

Sponsor: Uniswap Extension — Say goodbye to pop-ups. Download today.

- 🗳️ Vitalik Warns Against Simplistic Pro-Crypto Politics. His latest blog post seeks to showcase that being 'pro-crypto' goes beyond money.

Read more on Bankless.com - 🤖 Grayscale Launches Decentralized AI Fund. The Grayscale Decentralized AI Fund will hold Near (NEAR), Filecoin (FIL), Render (RNDR), Livepeer (LPT), and Bittensor (TAO).

Read more on Bankless.com - 🧑⚖️ German Govt. Shares Report on Its Bitcoin Sales. The government agency reported that 90% of the sales were done over-the-counter.

Read more on Bankless.com

📸 Daily Market Snapshot: Stock market traders are selling large-cap stocks and moving into smaller-cap ones, chasing more upside opportunities. Investors are calling this movement from inflated growth stocks to value stocks the 'Trump Trade' in anticipation of the small-cap outperformance that followed his 2016 surprise election win. This Wall Street trend has yet to chip away at BTC dominance in crypto markets which is flat on the week.

| Prices as of 6pm ET | 24hr | 7d |

|

Crypto $2.36T | ↘0.4% | ↗10.8% |

|

BTC $64,268 | ↘0.1% | ↗11.7% |

|

ETH $3,404 | ↘0.5% | ↗9.8% |

|

LPT $17.21 | ↗12.2% | ↗28.9% |

Solana's staking sector continues to be one of the most lively parts of the network.

Staking, locking up capital for network security in return for yield, is a vital part of DeFi and one of the strongest sectors of the onchain economy. Staking requirements vary by chain – Ethereum requires 32 ETH for native staking on a personal node, or users can opt for liquid staking providers like Lido or Rocket Pool. On Solana, anyone can stake natively through its delegated Proof-of-Stake system by delegating to validators instead of running their own node.

This ease of staking may explain the large gap between Solana and Ethereum in terms of total staked versus liquid staked assets. Solana has $61B in staked capital, surpassing Ethereum, but lags in liquid staking. Ethereum has 65% of its staked ETH in liquid form, whereas only 6.5% of Solana's staked SOL is in liquid staking tokens (LSTs), indicating a significant growth opportunity for Solana.

In this article, we’ll explore the current arena of SOL liquid staking, examining key players as well as the protocols innovating and tackling this opportunity. Let’s begin! 👇

Say hello to the Uniswap Extension, the first wallet to live in your browser’s sidebar. Swap, sign, send, and receive crypto anywhere on the web without dealing with pop-ups. Designed for a multi-chain world, with support for 11+ networks.

SOL is currently trading at an 83% discount to ETH – should it be?

Michael Nadeau is a crypto analyst who can help us answer this question. His approach isn’t technical, he isn’t a decentralization-maximalist, and he doesn’t represent any specific tribe. Instead, he focuses on current on-chain fundamentals like daily active users, fee revenue, and Total Value Locked to provide insights.

In our discussion, we explore why fundamentals matter when analyzing crypto assets like ETH and SOL. We review the data for 2024 to see who’s winning and examine the catalysts for both ETH and SOL. Additionally, Michael shares his price predictions for ETH and SOL this cycle and offers insights on which asset will outperform the other in the second half of the bear market.

Hear all of their analysis👇

- 📱 A Path to a Breakthrough Web3 Social App - Marc Budkowski

- 📥 TEE Coprocessors or Confidential Compute - tumilet

- 🪙 Gold, War, and Perpetual Prediction Markets - kaledora.eth

- 👾 Dynamic Token Economies for Onchain Games - Raf

- ⛽ Ethereum’s Scalability Crisis: The Execution Layer - Fuel Labs

- 🔢 Pointenomics 101 - Kenton

- 🤔 Against Choosing Political Allegiances Based on Who Is Pro-Crypto - Vitalik