Is Bittensor's Halving Bullish?

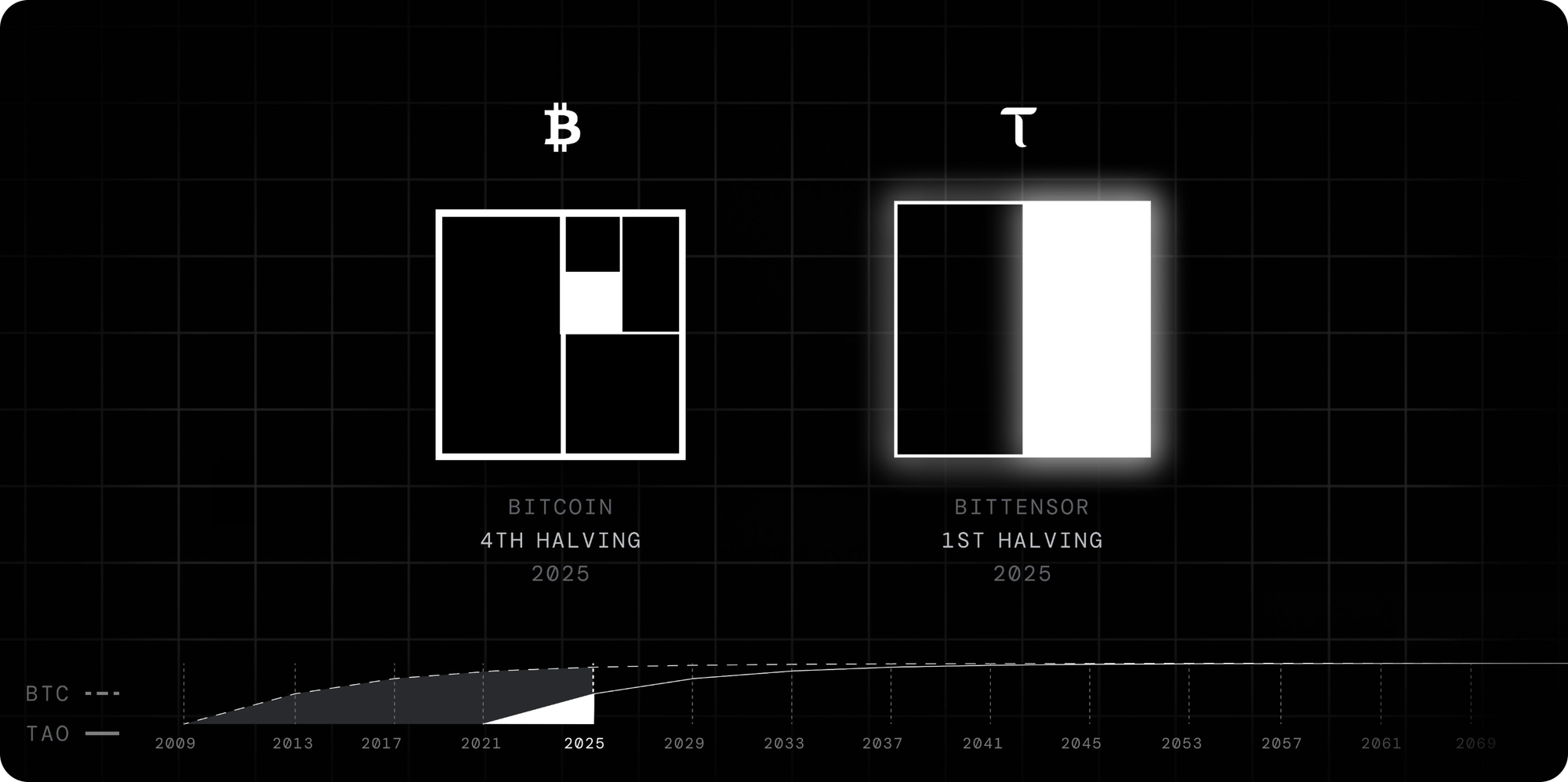

Decentralized AI network, Bittensor, will have its first halving on Sunday.

With tokenomics modeled off Bitcoin’s fixed supply + halving cadence, many are expecting this to be a long-term bullish event given the fundamental effect that reducing supply growth can have on an asset when demand is rising. Concretely, TAO emissions will drop from ~7.2K/day to ~3.6K/day.

But is Bittensor in demand? Let's look. Recently there has been a large institutional push for access to TAO as well as alpha tokens (subnet-specific tokens) as subnets have begun to find product-market fit.

As Grayscale outlined in their recent research report, some subnets are showing early signs of real-world usage:

- Chutes offers serverless inference/compute for developers running AI models, and Grayscale notes it recently ranked as the leading inference provider by usage on OpenRouter (ahead of centralized providers).

- Ridges (agent development) recently produced an agent that Grayscale says outperformed Anthropic’s Claude 4 on benchmark coding tests.

Given the recent growth of TAO-related DATs (digital asset treasury companies) and the emergence of structured TAO and subnet-token exposure for investors, it’s clear — if it wasn't already evident by the fact that I'm citing a Grayscale report — that institutional appetite for TAO and the broader subnet ecosystem is increasing.

So, on a simple level, with demand increasing and supply decreasing, it’s hard not to see this event as bullish for Bittensor. Yet, we can’t over-simplify the comparison since, there are many nuances between the two — most clearly around subnets.

How Subnets and TaoFlow Work

For a quick refresher, Bittensor is a network of specialized subnets, each focused on a specific AI service (inference, agents, etc).

Each subnet also issues its own Alpha token, which exists in a liquidity pool with TAO, and serves as the reward earned by miners, validators, stakers, and the subnet owner who participate in its subnet. Each subnet also receives TAO emissions, which go directly into its Alpha liquidity pool as “TAO in” (TAO injected into the subnet pool’s TAO reserve), rather than being paid out directly to miners/validators.

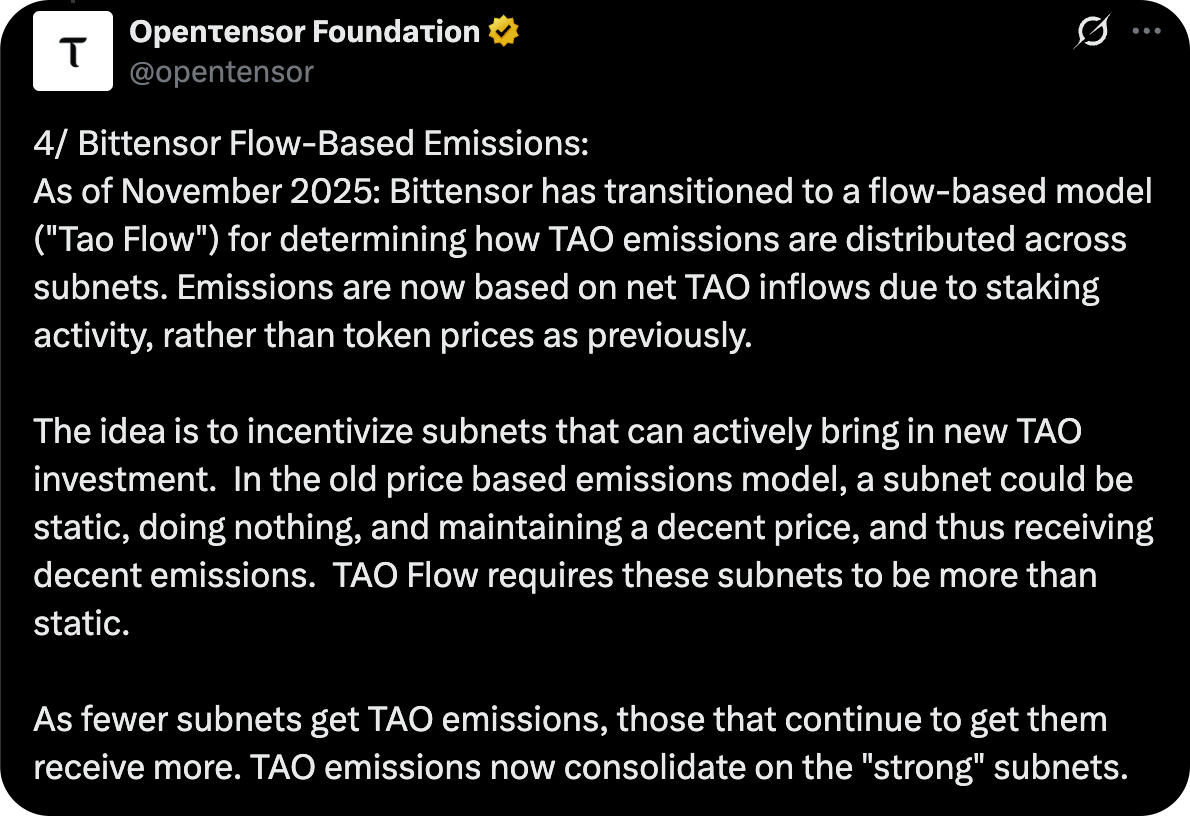

While these emissions were initially determined by the price of a subnet’s Alpha token, with the higher the price corresponding to higher emissions, the recent TaoFlow upgrade changed that. Under the current TaoFlow model, the key signal is net TAO inflow/outflow, not token price.

- Previously, TAO emissions were tied to a subnet token’s price — so “static” valuation could keep a subnet earning emissions even if real activity faded. Thin liquidity also made the signal easier to game, since a small market can hold a high price without much capital behind it.

- Now, emissions depend on net TAO inflows: TAO staked into a subnet minus TAO unstaked. Only subnets with positive net inflow receive emissions; if a subnet has net outflows, emissions go to zero regardless of where its token trades. This forces subnets to compete for real capital, and it concentrates emissions on the networks users are actually choosing.

Now layer in the halving which reduces global TAO emissions, as well as the Alpha injected into subnet liquidity pools.

Important nuance: the halving reduces “TAO in” and also halves “Alpha in” (pool injections), but it does not halve “Alpha out” (Alpha paid to miners/validators/subnet owners). In other words, the halving doesn’t directly cut “miner rewards,” because miners didn’t earn TAO in the first place. They earn the subnet’s Alpha token. Subnet owners also earn their protocol “owner cut” in Alpha (from the Alpha-out stream), not in TAO.

Overall, the dynamics of this dual token system, and the role TAO plays in it, will have several effects on the network’s economics:

- Thinner subnet liquidity — Less TAO reaching pools means less depth for Alpha, which can amplify price swings and make it harder for weaker subnets to sustain value.

- Weaker subnets struggle (and launches get harder) — Under TaoFlow, subnets that can’t sustain positive net inflows receive little or no emissions; with the halving reducing total TAO available, the bar rises further for new and marginal networks.

To counteract these effects, especially the first, subnet owners may have to revamp their subnet’s economics (fees, buybacks, reward policy, incentive design) to reduce sell pressure and damp volatility when liquidity thins. (They can’t “halve” protocol rewards on command, but they can change the subnet’s incentive design and value capture.)

Overall, the halving signals a new, highly competitive era of Bittensor’s networks where only subnets with real usage, consistent inflows, and credible demand can survive.

Why This Halving Is Simple for TAO but Nuanced for Alpha

So, to summarize, while for TAO itself the halving is a straight forward upgrade, that’s not the case for its subnets.

- TAO behaves like Bitcoin here — the supply cuts in half, circulating emissions tighten, and institutional demand is increasing. That's a clean setup.

- Alpha behaves differently — TaoFlow has introduced a competitive layer Bitcoin doesn't have. Subnets must actively attract capital to survive. Emissions aren't guaranteed. Liquidity isn't uniform. And the halving amplifies these pressures.

So, if you’re a TAO holder or someone interested in the network, what should you do? I say, sit back and wait. It’s not the most exciting answer but the network’s putting itself to the fire, so to speak, a good thing in the long term but a test which will certainly cause upheavals in the interim. This trial is most definitely good, and bullish, but it’s something to weather.

In the meantime, I’d keep an eye on subnets you find interesting. There are many so I’ll share a few which I’ve been following more closely in recent weeks:

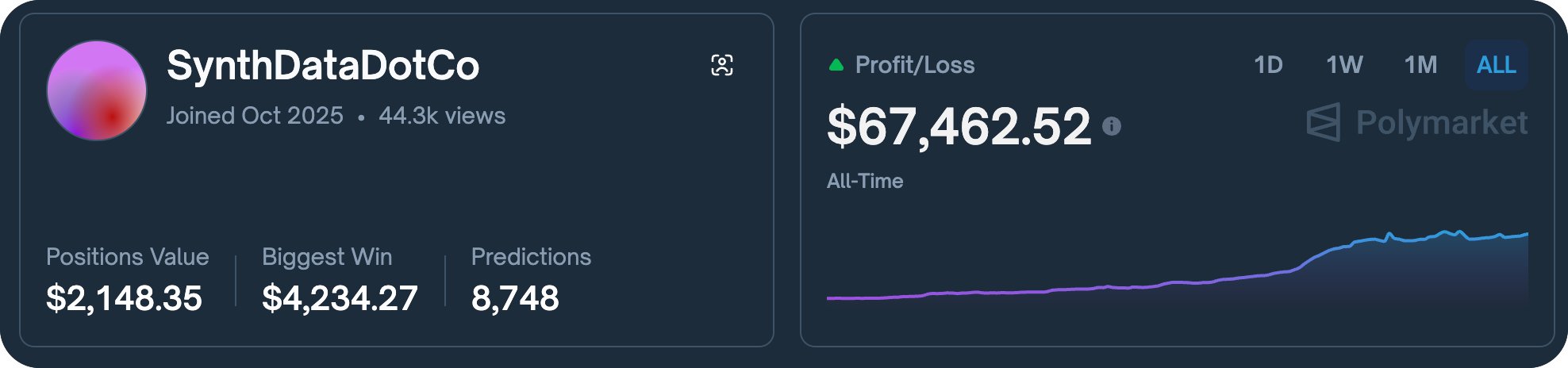

- Synth (SN50) — subnet for predictive insights across all financial markets from Mode. So far, its model has turned $3K into $67K on Polymarket.

- Vanta (SN8) — subnet for surfacing trading signals from its miners, from Bittensor company, Taoshi.

- BitMind (SN34) — subnet for identifying whether content is AI-generated or not, with a browser extension product already live.