An Investor Guide to Memecoin Mania

Your friend who’s almost clueless about crypto is pre-rich. How? They bought a coin with a dog wearing a hat.

The hat stays on, so the price keeps climbing. And get this – the meme’s about to go mainstream on the Las Vegas Sphere, thanks to the community raising a cool $650,000 to light it up.

Memecoins are all the rage right now.

Historically, memecoins have been among the best-performing assets. Let's take a quick trip down memory lane to see some of the brightest stars in the memecoin galaxy:

- Dogecoin (DOGE) — Elon’s favorite memecoin, which had its moment on SNL, is now part of the memecoin history books and commands a hefty $20 billion market cap.

- Shiba Inu (SHIB) — Shiba Inu is to Dogecoin what the alt-L1 trade is to Ethereum; it’s the beta play that follows DOGE’s tail closely and is currently just one place off of DOGE with a market cap of over $10 billion. It even hit a staggering $40 billion at its peak, marking an 8000x return from early 2021.

- Pepe (PEPE) — More recently, we’ve had examples like PEPE, which showed early signs that we might finally be coming out of the bear market. PEPE hit a $1 billion market cap within a month of its launch and now holding strong with a $3 billion cap.

- Bonk (BONK) — The memecoin that was one of the major catalysts that revived the Solana ecosystem, skyrocketing from a $30 million market cap to $1.5 billion in just over a month (a quick 50x), and it's still sitting pretty after a slight dip from $2.5 billion.

- dogwifhat (WIF) — The memecoin that made it to the iconic bull on Wall Street and is showing no signs of stopping. With a market cap of $2.25 billion, WIF is the top dog among Solana's memecoins.

But let's be real, memecoins are a gamble. There's no foolproof strategy for investing in them – it’s either a moonshot to Valhalla, or you could see your entire net worth vanish.

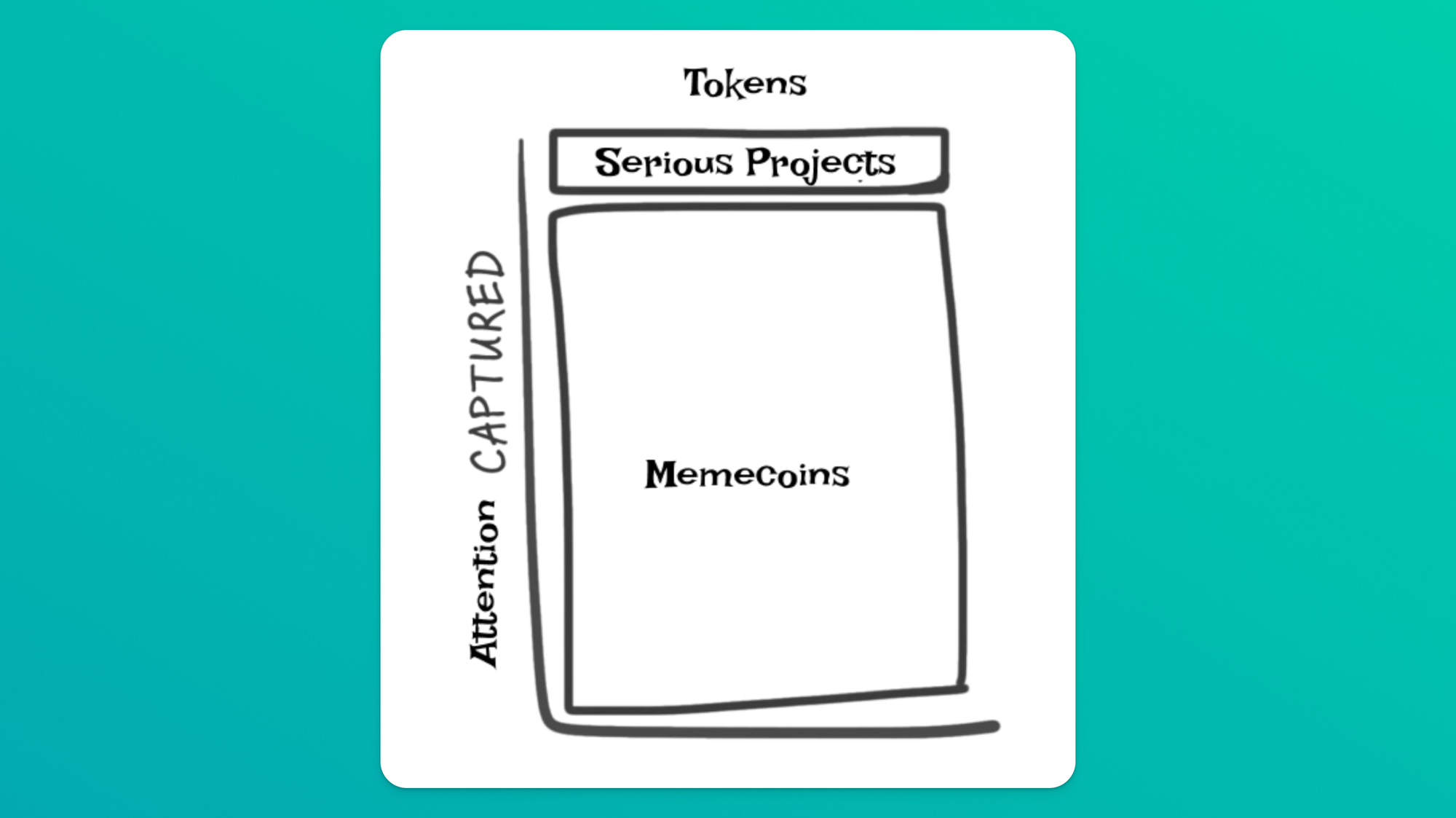

The jury’s still out on whether memecoins are good or bad. But one thing’s for certain: memecoins have become the life of the bull market. They’re drawing people onchain, boosting activity across chains, and offering a golden lottery ticket to making it in crypto.

The below pointers are a guide to assess memecoins without getting caught up in the hype. These tips can help you set your criteria to define what makes a memecoin an attractive investment opportunity. Let’s dive in!

1️⃣ Build a Trusted Network

Don’t get your alpha from your favorite Twitter influencer.

In crypto, timing is everything, especially with memecoins. Being early could mean the difference between a modest 5x and a 100x home run. To be early, you must understand the “alpha chain” and how the information flows.

If you're getting tips from a Twitter influencer with a massive following, chances are you're late to the party. This doesn't always spell disaster, but it could mean the insiders who got in first are ready to "dump their bags,” leaving you with no option but to become a “community member."

Study information pic.twitter.com/pmrBpEMyk5

— Value & Time (@valueandtime) March 16, 2024

However, since it's impossible to constantly watch the crypto market and be the first to act on every opportunity. This is where the friends you’ve made through the bear market come in – these are the people you can trust and have similar interests as you.

With your crew, you can cover more ground, pool insights, and validate each other's hunches. This way, if most of your group thinks a memecoin looks promising, it's likely to have wider appeal, increasing your odds of making a good call.

It's like having a bunch of friends to help you spot the next big thing – if you all vibe with the meme, it’s got potential. But if you're trying to figure it out all by yourself, you might miss the mark sometimes.

2️⃣ Make the Most of Data Tools

To make smart investment choices, you need the latest, most accurate information.

Tools like Dexscreener and blockchain explorers are your best friends for gathering the necessary data points.

For instance, for memecoins, the token distribution is a key metric. It tells you if a memecoin has real community backing or just a few insiders trying to make a quick buck with a pump-and-dump.

Here's how to check out a memecoin's token distribution:

- Spot the whales – Use a blockchain explorer to input the token's contract address. Navigate to the "Holders" section to see the distribution of tokens among the holders. A good sign is when no single whale is hogging all the tokens.

- Healthy spread and growing tokenholders – A token supply that's spread out nicely usually means a more stable and wider community. If you notice a bunch of different holders slowly but surely stacking up more tokens, it could mean they believe in the token’s future.

- Fair launch – Pay attention to the initial distribution after a token launch. A pattern of fair initial distribution, without a disproportionate allocation to the development team or early investors, can be a positive sign.

High growth memes usually exhibit the following early on:

— Ally Zach (@0xallyzach) March 14, 2024

+ consistently increasing holder count

+ more new buyers than recurring ones

+ minimal presence of whales

Let's see if this held true for new coins over the past few weeks

3️⃣ Track Projects Nailing Comms

For any project in crypto, be it a memecoin or a project that caters to the suits, having a solid online presence is key.

If you're liking the meme potential of a project, ensure that they're already showing some traction in communicating their attention niche.

This means a slick website, an engaging X feed, and an active Telegram group are non-negotiable. They're the pillars of communication, community, and branding — the very things that can make or break a project's viral fame.

- The website is the project's official billboard. It's where the memecoin puts its best foot forward.

- The Telegram channel is a direct line to the community, where you can see active community members and the memes.

- And Twitter? That's the megaphone. It broadcasts the memecoin's story to the world.

A memecoin that nails it on these platforms, with a mix of humor and community engagement, stands a better chance of capturing attention and hitting it big.

4️⃣ Know Your Limits in the Onchain Casino

Remember the golden rule: only bet what you're okay with losing.

Memecoins are fun and can be a quick moonshot, but they’re unpredictable and you can very easily lose everything.

The high volatility of memecoins means the risk of loss is significant, so don’t gamble with your savings, but maybe taking shots with your lunch money on some days is fine.

Some investors use a barbell strategy, balancing ultra-safe bets (think BTC, ETH, SOL) with the high stakes of memecoins. This way, you enjoy the thrill of memecoins while maintaining a solid financial base that's not exposed to their volatility.

Also, think of memecoins like an onchain PvP battle – where the greater fool theory often prevails. Always ask yourself: "Will someone else be willing to buy this coin for more than I paid?" If you're not sure, it might be time to take profits and avoid regrets later.

The 4 stages of Meme mania:

— Richard | Tensor (sol/acc) (@0xrwu) March 19, 2024

1. Intrigue - why are dogs and sloths worth billions of FDV?

2. Fomo - fock it what’s the worst that can happen

3. Giga brain genius - I just 10x’ed my money in less than 2 days!

4. Ragrats - my bags are down 99%, my wife left me, and I’m homeless

Are we riding a memecoin supercycle? Who knows, but one thing's for sure: memecoins aren't going anywhere. They’re fun, and the most entertaining outcome is the most likely.

While we’re in a bull market, enjoy the memecoin playground, but don’t risk it all in the hopes of becoming rich overnight. Time in the market is of utmost importance, so make sure you don’t blow yourself up on memecoins or leverage or both.

Invest wisely, be patient, and we’re all gonna make it!