Will Ethereum Remain Institutions' Top Choice?

Disruption. Digitization. Financial inclusion. Future-proofing.

What do all of these oft-repeated buzzwords have in common? They’ve all been used by crypto-pilled associates at TradFi firms to pitch their bosses on the exciting upside of blockchain tech. This year, it seems, the executives are listening.

Institutions jumped into crypto more headlong than ever in 2024 with bespoke blockchain integrations, tokenized funds and ETFs, industry partnerships, and research papers. These moves are starting to bridge the gap between TradFi and DeFi. However, this article isn’t focused on why firms are building onchain. Instead, we are focusing on where these funds are choosing to build.

Let's dig in 👇

What’s Happening on Ethereum?

Ethereum is the world’s largest smart-contract blockchain network. It has secured over $90 billion in RWAs, including stablecoins. 2024 has been a big year for the adoption of non-stablecoin RWAs on Ethereum as well, with the network growing its onchain U.S. treasuries, bonds, and cash equivalents from $800 million to over $1.5 billion and overall non-stablecoin RWA value to $2.9 billion.

Some of the major players building on Ethereum this year include Visa, BlackRock and Franklin Templeton.

Earlier this month, Visa announced that they are building the Visa Tokenized Asset Platform (VTAP) on Ethereum. This is the company’s biggest step toward crypto adoption thus far. VTAP enables Visa to issue and manage fiat-backed tokens on Ethereum. It is intended to be a sandbox for participating financial institutional partners to create and experiment with fiat-backed tokens. They expect to begin piloting the platform with Spanish multinational bank BBVA in 2025. While the VTAP program is certainly an experiment, it gives credit to the thesis that TradFi will migrate its operations onto Ethereum over the coming decades.

No one is really competing with Ethereum when it comes to things like Visa launching tokenized assets

— eric.eth (@econoar) October 3, 2024

There's simply no other platform these companies are going to choose

Ethereum will be the World's global financial settlement layer and ETH will be its money. pic.twitter.com/rGqnOuqosm

Earlier this year, BlackRock and Franklin Templeton both incepted nine-figure onchain funds. BlackRock’s fund, dubbed BUIDL (BlackRock USD Institutional Digital Liquidity Fund), is the larger of the two, currently sitting at $522 million.

BlackRock also leads the institutional charge on crypto ETFs with the launches of its IBIT Bitcoin and ETHA Ethereum ETFs. While these funds don’t give investors the chance to custody anything onchain, they do provide a more traditionally attractive method of gaining exposure to the crypto economy. While BlackRock’s head of digital assets, Robbie Mitchnick, made clear on Bankless that following IBIT and ETHA, there were no immediate plans to create ETFs for any other crypto assets, the firm has shown interest in integrating elsewhere across the Web3 ecosystem.

Who Else Is Competing for Institutional Attention?

As the landscape expands, Ethereum’s competitors are vying for institutional attention. Solana and Stellar are both making strides, particularly in the realm of RWAs.

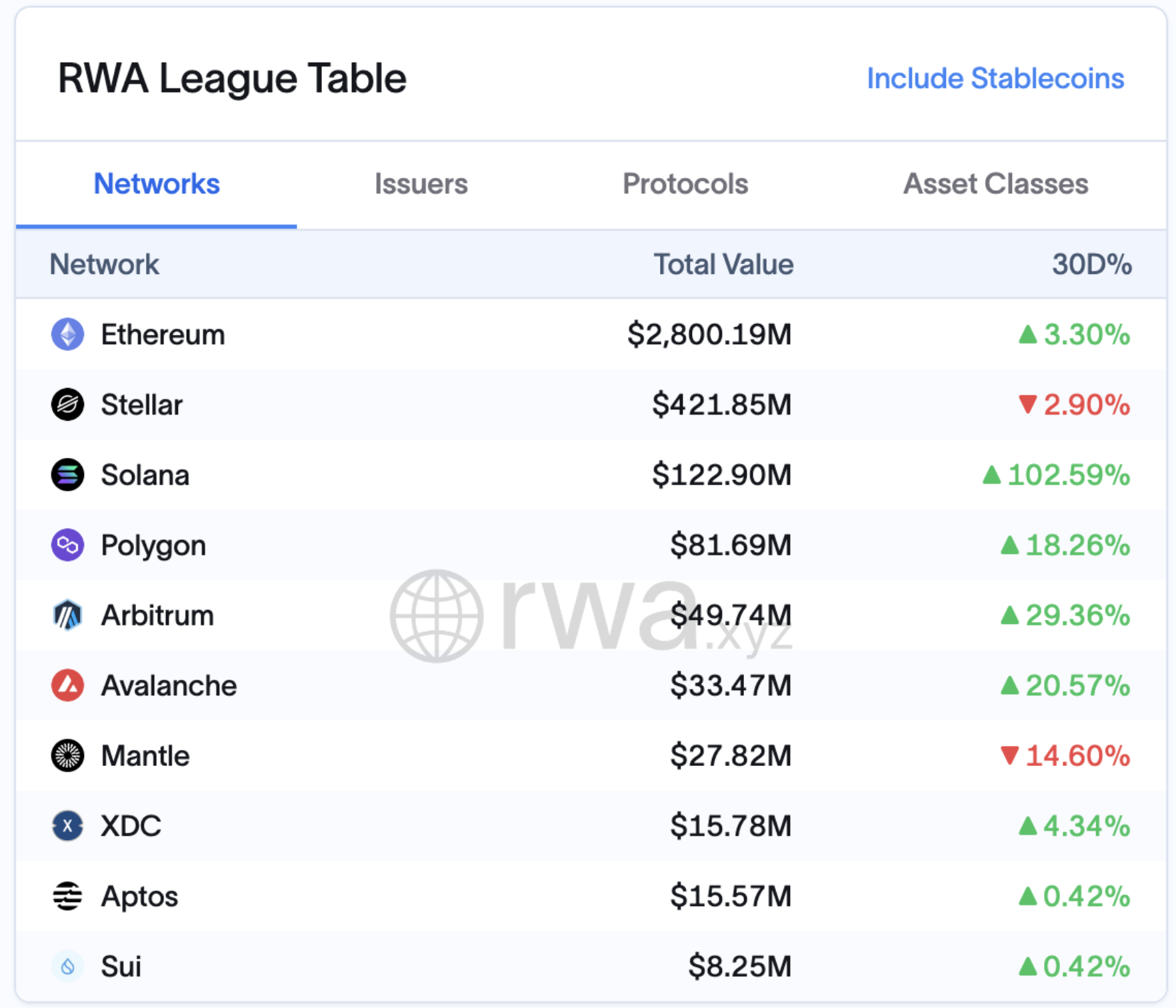

- Stellar’s focus on partnerships with large financial institutions like IBM has resulted in its second-highest RWA value, boasting $421 million in tokenized RWAs.

- Solana, often praised for its speed and throughput, is also emerging as an important player in the race toward institutional adoption. Franklin Templeton announced at Solana’s Breakpoint conference that they are bringing compatibility for FOBXX, their $445 million on-chain fund, to Solana. Still, as things stand, Solana’s RWA value remains relatively low at only $120 million.

EVM-compatible networks such as Arbitrum, Polygon, Avalanche, and Mantle are playing pivotal roles as well. Combining for over $190 million in RWA value, these networks offer institutions familiar smart contract architectures with the added benefit of Layer 2 scalability. Still, Ethereum mainnet’s $2.9 billion in (stablecoin-excluded) RWA value dwarfs these smaller networks, reinforcing its dominance in this space.

Yet, the success of Ethereum’s competitors highlights a critical point: institutions are no longer bound to a single network. While Ethereum is foundational, blockchains like Solana and Stellar provide alternatives that are increasingly hard to ignore. However, they also present novel interoperability concerns.

Interoperability is central to the future of institutional blockchain adoption. As Visa states in their VTAP press release announcement, the largest benefits of building onchain include easy integration, programmability, and interoperability. Institutions that venture onto non-EVM chains like Solana or Stellar may face challenges in asset liquidity and protocol compatibility. This can lead to reliance on third-party services to bridge assets between chains, which introduces complexity and security risks. Ethereum’s widespread use means that staying within the EVM ecosystem—whether through Ethereum or Layer 2 solutions—remains the simplest and most secure option for institutions.

Future Outlook

Institutions like Blackrock are well aware of Ethereum’s value proposition. As BlackRock’s Head of Digital Assets noted on Bankless, institutional investors are “students of the market” and “students of the technology.” They rely on proven technologies, and Ethereum’s strong track record makes it the logical choice for most blockchain projects. BlackRock’s collaborations with Coinbase and Circle further highlight how deeply entrenched Ethereum is becoming in the world of institutional finance.

However, for Ethereum to maintain its lead in the race toward institutional adoption, it must continue to balance world-class security and stability with the performance and scalability that competing chains continue to push. The race to capture the attention of institutional finance will be won by the network that can not only meet today’s demands but also anticipate the needs of tomorrow. Ethereum is well-positioned for now, but staying on top will require constant evolution.