Insider Trading Markets?

View in Browser

Sponsor: The DeFi Report — Industry-leading crypto research trusted by finance pros.

- 💰 Senators Meet to Discuss Crypto Market Structure Bill. The bill is expected to undergo a markup on January 15.

- 🔥 Lighter Expands Trading Hours for U.S. Equity Perpetual Futures. 24/5 trading is here; 24/7 trading is "coming soon."

- 🔐 Brian Quintenz Joins SUI Group After CFTC Nomination Falls Short. The SUI DATCo is the only one with an official Sui Foundation relationship.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.17T | ↘ 0.3% | ↗ 6.7% |

|

BTC $93,650 | ↘ 0.3% | ↗ 6.2% |

|

ETH $3,293 | ↗ 1.8% | ↗ 11.3% |

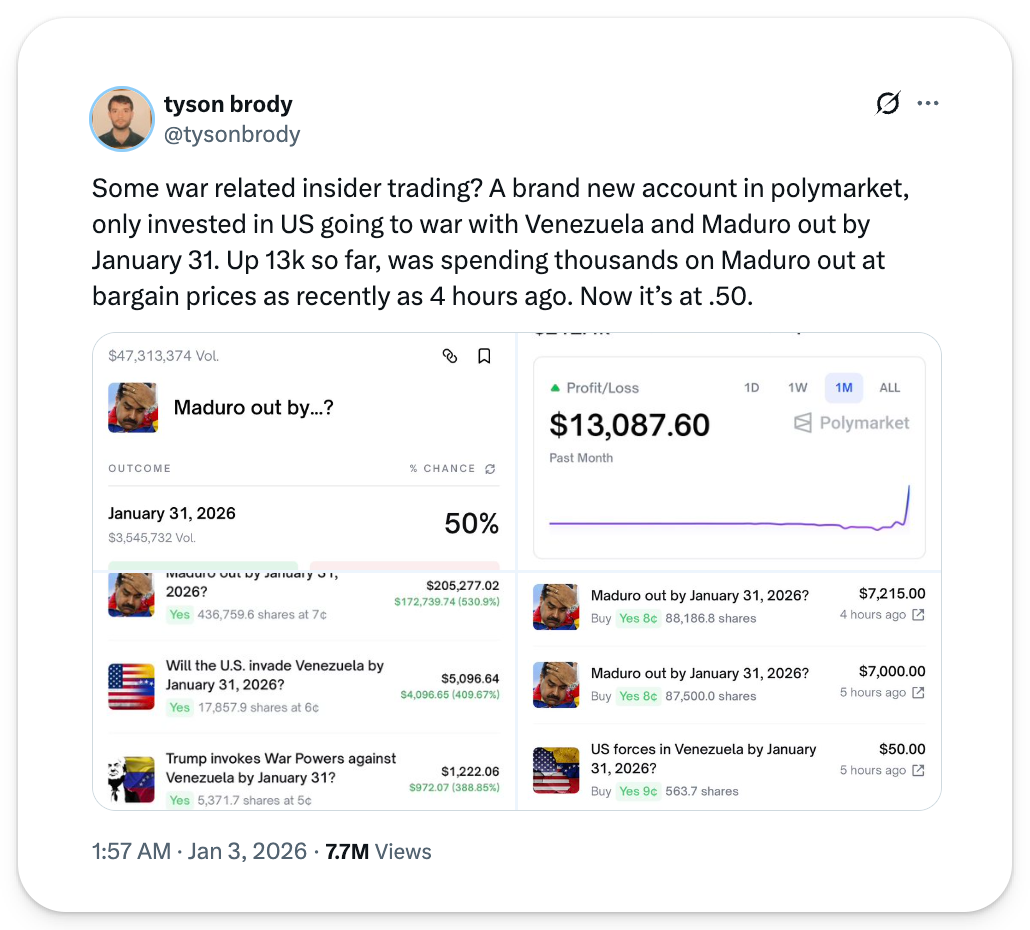

Shortly after U.S. forces captured then-Venezuelan President Nicolás Maduro last week, attention turned to a newly created Polymarket account that had bet roughly $32K on his ouster. The position, purchased when implied probability sat in the low single digits, netted over $400K.

The market for Maduro's removal began climbing hours before President Trump's announcement. Whether the trader possessed insider information remains unclear, but the optics alone, following suspiciously prescient calls such as particular bets on Google's year-end search term positions and Biden’s dropout odds, sparked immediate calls for action.

Rep. Ritchie Torres (D-N.Y.) intends to bring the first of these actions, expediting his “Public Integrity in Financial Prediction Markets Act of 2026” bill, which has been "in the works for a bit," he says. The bill would bar federal elected officials, political appointees, and executive branch employees from trading prediction market contracts tied to government policy or political outcomes when they possess — or could reasonably obtain — material nonpublic information through their official duties.

Given the broader crypto industry's regulatory PTSD from the Biden years, any call for new government restrictions on emerging crypto platforms tends to provoke harsh gut reactions. But prediction markets occupy a unique position right now — one where getting the rules right early could determine whether they mature into trusted infrastructure or devolve into another avenue for insider elites to exploit.

The Political Case

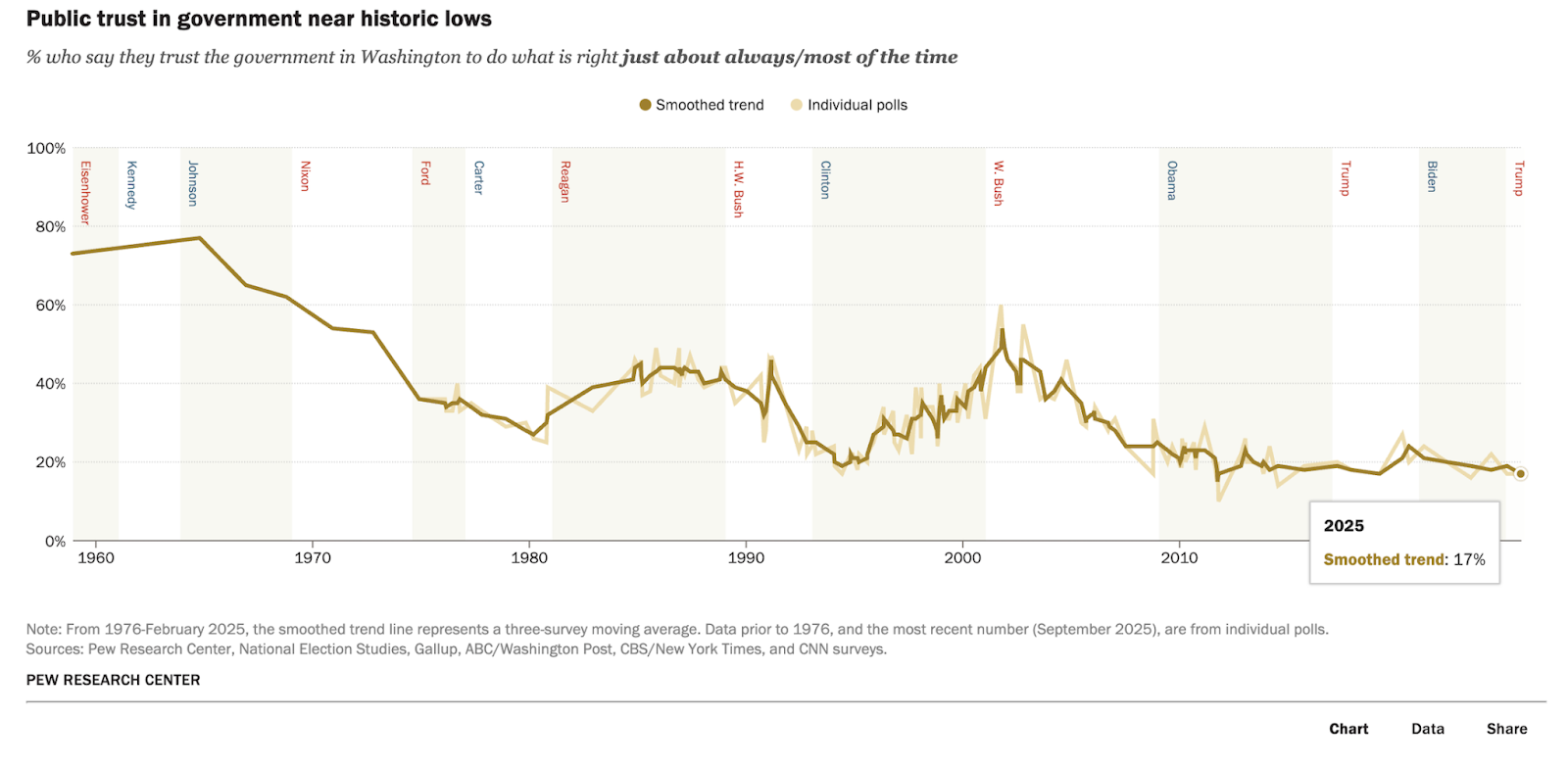

The argument for restricting public officials is straightforward: if politicians can legally profit from bets on outcomes they directly influence or have advance knowledge of, it twists incentives and erodes the already near-record low public trust in the U.S. government.

This dynamic already plays out in traditional securities markets, where the STOCK Act of 2012 was supposed to address congressional insider trading. The results have been underwhelming, to say the least. Despite the law's existence, examples of suspicious trading by members of Congress have continued to surface with regularity:

- Senator Richard Burr sold $1.7M in stock immediately following a classified COVID-19 briefing; the DOJ later dropped the investigation without charges.

- Senator Kelly Loeffler offloaded millions in assets after the same confidential pandemic warning, yet faced no legal consequences when federal probes concluded.

- Senator Tommy Tuberville, a member of the Senate Armed Services Committee, traded millions in defense contractor stocks and violated the STOCK Act’s reporting deadline 132 times, yet faced no significant consequences.

Since the STOCK Act passed in 2012, not a single member of Congress has been prosecuted under its provisions, while the penalty for concealing trades is a trivial $200 fee, which ethics committees routinely waive.

Prediction markets present an even more direct temptation. Unlike stock trading — where connections between policy decisions and price movements can be complex and deniable — prediction markets offer explicit bets on government actions. Will a military intervention occur? Will a bill pass? The path from insider knowledge to profit proves incredibly clear.

While the specifics are still unclear, Torres's bill reportedly extends STOCK Act principles to prediction markets, hopefully with greater, more meaningful enforcement to actually deter such activities. Regardless, though, legal frameworks matter and must be established. Without clear rules explicitly covering prediction markets, prosecuting suspicious trades becomes even harder.

Why It Matters for Prediction Markets

The broader issue extends way beyond politicians.

Prediction markets generated over $44B in combined trading volume in 2025. They've proven their value as information aggregation tools — Polymarket's accuracy during the 2024 election cycle demonstrated what these platforms can do when they function properly.

Functionally, insider participation doesn't necessarily break these markets. The transparency of blockchain-based platforms means suspicious positions are visible. Traders can tail wallets showing unusual activity. Information still gets priced in, which is essential, even if the source is questionable.

But reputation is a different matter. Prediction markets are still fighting for legitimacy — with regulators, institutions, and the broader public. If the prevailing narrative becomes that these platforms are just another vehicle for connected insiders to profit from privileged information, these tools risk becoming a tool for connected elites to dump on the public. The policy progression, mainstream adoption, potential for prediction markets to shine — all of that gets harder when every major market move triggers headlines and rampant speculation about who knew what and when.

There's also a pragmatic concern: if today's broadly crypto-friendly regulators don't work with the platforms to address these issues, hostile administrations of the future could do so with a much heavier hand. The window for self-regulation and productive collaboration is now – wait too long, and the response could be far more restrictive than anyone wants.

The Path Forward

None of this means prediction markets need heavy-handed regulation across the board. Skepticism toward regulatory overreach is beyond warranted given recent history. But there's a meaningful difference between resisting regulatory capture and acknowledging that certain narrow restrictions serve everyone's interests.

Legally barring public officials from betting on outcomes they can influence falls squarely in the latter category. Across the political spectrum, few believe politicians should have new avenues to monetize their positions. The broader crypto community — which arose in part as a check against establishment abuse — has reason to support exactly this kind of accountability.

We don't yet know the full details of Torres's bill. The specifics will matter. But the direction is right. Prediction markets work because they aggregate dispersed information into prices — and that function can survive some insider activity. The bigger risk is reputational: repeated incidents of apparent insider trading invite the kind of regulatory scrutiny that could constrain the industry far more than targeted rules around public officials ever would.

The honest reality is that this behavior will likely continue regardless of what rules get passed. Enforcement is hard. Proving intent is harder. Sophisticated actors will always find ways to obscure their tracks.

But there's much to be said for establishing clear norms — and for the transparency that blockchain-based markets provide. Every trade on Polymarket is visible. Wallet activity can be tracked. The same infrastructure that enables suspicious trades also enables scrutiny of them. Researchers and journalists can monitor for patterns. Communities can call out suspicious activity in real time.

These are formative years for these technologies, which, if stewarded well, will reshape how we aggregate information about uncertain futures and persist long after this administration ends. Getting the foundations right matters. Ensuring that government officials can't exploit these tools for personal profit seems like a reasonable place to start.