Inside Aztec's Privacy L2

View in Browser

gm Bankless Nation,

Crypto is getting loud about privacy again. Today, we're digging into what Aztec is bringing to the conversation.

Today's Issue ⬇️

- ☀️ Need to Know: Liquid Staking Shift

The SEC finally changes its tune on staking. - 🗣️ Analysis: Get to Know Aztec

Unpacking the privacy-first ETH L2. - 🎧 Latest Pod: ETH's Cycle Shift

How treasury companies shifted the cycle.

p.s. Thanks to Bit Digital. Bit Digital ($BTBT) is a Nasdaq-listed public company that believes Ethereum can re-write the entire financial system. Learn more.

Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3.

- 💦 SEC Says Liquid Staking Falls Outside Securities Law. The new guidance could help pave the way for ETH ETF staking approval.

- 📲 Solana Mobile Starts Shipping Second-Gen Seeker Smartphone. Solana's next smartphone will soon be in consumer hands, bringing new features and the promise of future rewards.

- 🔷 SharpLink Adds $303M More ETH to Treasury. The Ethereum-focused firm picked up 83,561 ETH using proceeds from stock sales.

| Prices as of 7pm ET | 24hr | 7d |

|

Crypto $3.71T | ↘ 1.8% | ↘ 5.1% |

|

BTC $114,063 | ↘ 1.1% | ↘ 3.2% |

|

ETH $3,606 | ↘ 3.3% | ↘ 4.8% |

I've been writing about privacy a lot in this newsletter recently and, to be honest, I don't expect that to change. Between fresh capital, new achievements, and everyone on the edge of their seats waiting for the Roman Storm verdict, our industry seems to be making a renewed push for uncompromising privacy as an onchain standard.

Aztec remains one of the Ethereum community teams leading the fight, building toward a future of private shared state since 2017.

They've already released a series of products, and their upcoming L2 looks to be nearing its mainstage debut after the kickoff of its advanced, "Adversarial Testnet" late last month — a permissionless phase inviting all to stress-test the network’s decentralization and security ahead of mainnet.

To know where we’re going, you must understand where we’ve been.

— Aztec (@aztecnetwork) April 29, 2025

Aztec started in 2017 with CreditMint- an onchain debt platform.

But no one would trust public blockchains without privacy guarantees.

That insight led @Zac_Aztec, @jaosef, @_ArnaudS_, & @tomwalpo to found Aztec. pic.twitter.com/y4hI2RYQqY

While there's no official timeline for mainnet yet, the participation in testnet (over 15K active nodes launched with 160K transactions processed so far) makes it clear Aztec will not be one to miss.

In other words, it's a good time to understand what Aztec has to offer so that when mainnet does roll around, you hit the ground running 👇

What is Aztec?

In one sentence, Aztec is a privacy-first Ethereum Layer 2 that supports both public and private smart contract functions, allowing privacy to be a choice rather than a mandate.

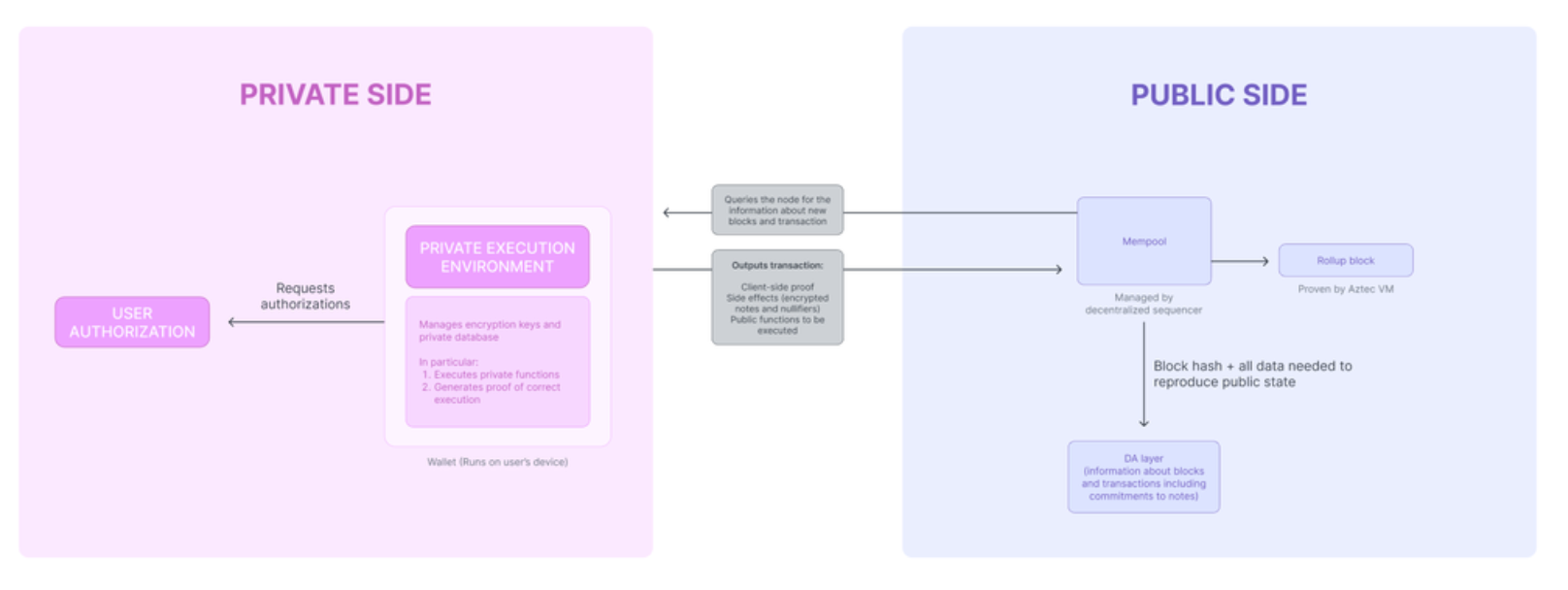

To support both methods, the chain employs a dual execution model: private smart contract operations run client-side, inside your browser or device, while public smart contract operations run node-side on Aztec's decentralized network — just like they would on other chains.

These two sides aren't isolated — they're connected through zero-knowledge proofs (ZKPs), bridging private and public computation.

Unlike most L2s that are EVM-compatible, Aztec chose a different path. The network uses Noir, its own coding language specifically designed for writing zero-knowledge proofs.

Why not just use Solidity? Their answer is that it's because true privacy requires fundamentally different architecture, and they say the EVM's transparent, queryable state makes privacy essentially impossible without compromising security. Noir abstracts away the exhaustive complexity of configuring ZK systems, giving developers a familiar, Rust-like language that makes privacy programming accessible without a PhD in cryptography.

“Start simple. Go deep if you want.”@aztecnetwork's @maximvezenov explains Noir's layered design: easy enough for beginners, flexible enough for experts. @NoirLang offers a smooth on-ramp into true Zero-Knowledge development - providing safe defaults, while still allowing… pic.twitter.com/ncIh5cXGuz

— House of ZK (@HouseofZK) July 28, 2025

But how does this dual execution actually work? That's where the Private Execution Environment comes in...

The Private Execution Environment (PXE)

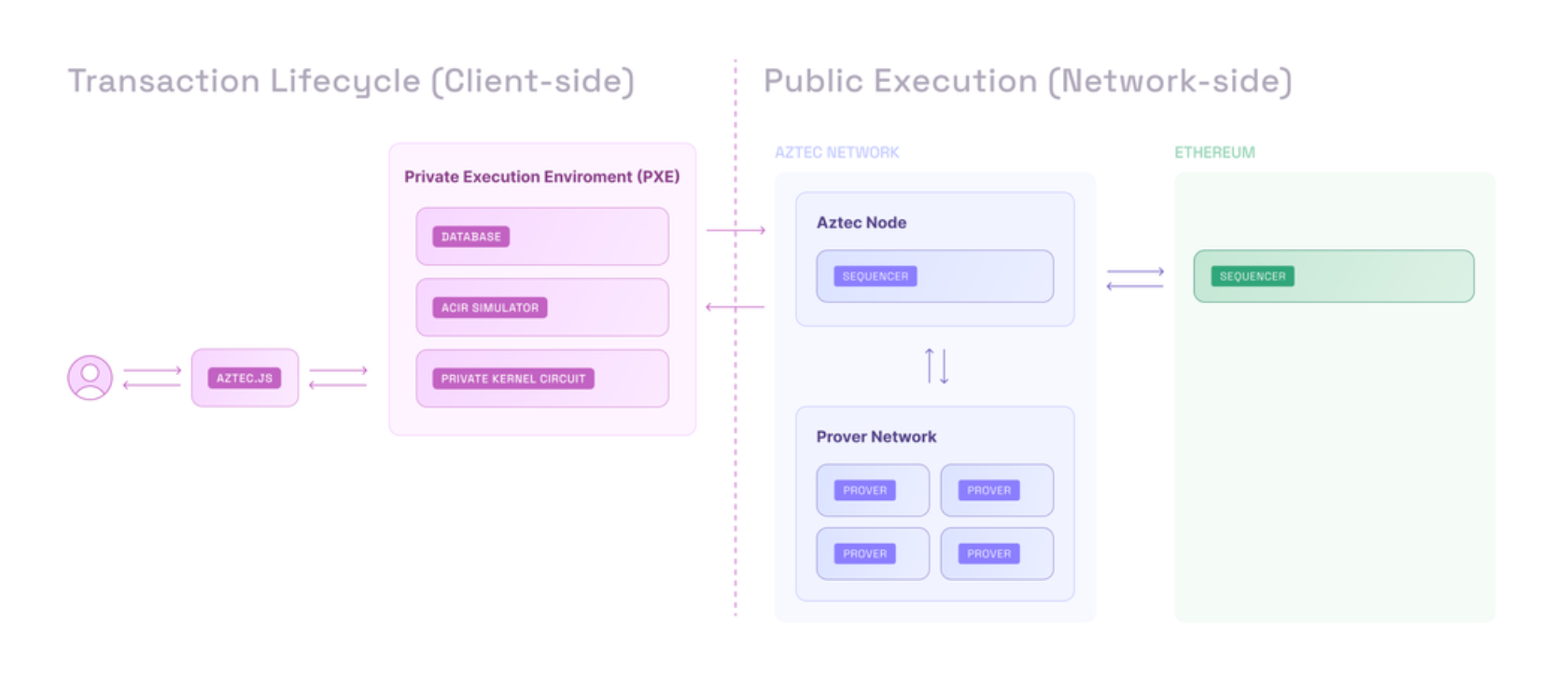

The PXE (pronounced "pixie") is where Aztec's privacy components run. It's a bundled client-side library — software that runs on your device rather than on a server — that handles everything related to private computation. When you use an Aztec dapp, it initiates the PXE which runs entirely in your browser.

Think of the environment as a hybrid of a wallet, a scanner, and a proof generator. It stores your secrets, "discovers" your private assets, and generates the ZKPs that let you use those assets privately.

Here’s what that all means:

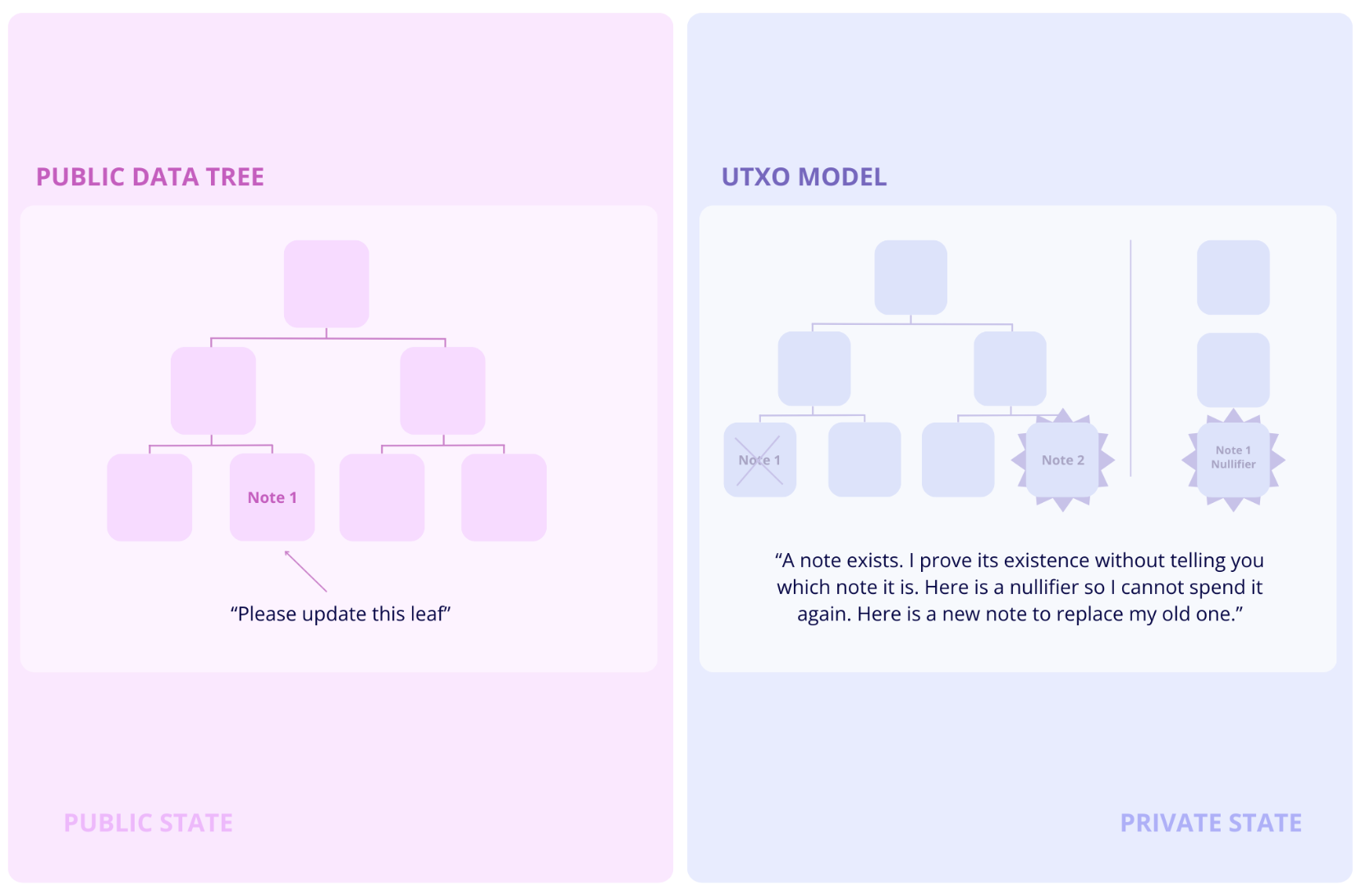

- Stores and manages secrets — Your private keys, decrypted notes (these are your private assets), and metadata live in a local PXE database that never leaves your device. It handles multiple accounts, maintains address books, just like a wallet would.

- Builds and proves transactions — When you initiate a private transaction (a swap, for example), it starts up the PXE. First, it simulates the function locally, doing a test run to make sure the transaction will work and to gather all the data needed for the proof. Then it prepares all the necessary data and generates a ZKP. Finally, it packages everything up with encrypted outputs (the privacy-protected results that only intended recipients can read) and any public function calls, then submits it all to an Aztec node.

- "Discovers" and tracks private assets — While Aztec handles public data with queryable accounts like Ethereum, it uses a separate system, known as a UTXO model, to handle private state. Here, encrypted notes (representations of private transactions) get published on Ethereum as, well, encrypted logs — unreadable to everyone else. Your PXE scans these logs, trying to decrypt them with your keys. When decryption works, it means that note was meant for you. Then PXE assembles all your decrypted notes into a balance, displayed in standard wallet format.

But, remember, Aztec supports both private and public computation. PXE only handles the private side. For what makes public transactions work, we must turn to the Aztec Virtual Machine...

The Aztec Virtual Machine (AVM)

The AVM handles public smart contract execution on the Aztec network, running on its nodes as is the standard for blockchains. But unlike the PXE which only works for private transactions, the AVM can receive messages from private functions and execute follow-on public logic — private actions which trigger public actions and vice versa.

This interoperability is key and imbues Aztec's privacy functions with greater potential. Making a private swap but need public price oracles? Or an NFT auction where you publicly bid, and if you win, send it to a private address? That happens here, fueled by the interplay between PXE and the AVM to create a unique, onchain environment where public and private come woven together, much like regular everyday life.

When everything comes together, Aztec's rollup bundles both types of transactions — private proofs from the PXE and public transactions from the AVM — into compressed batches. These batches, along with their validity proofs, get posted to Ethereum for final settlement. Your encrypted notes remain unreadable blobs to the public while still being verifiable as part of the network's state.

The result? Private and public logic co-exist, interact, and settle together on Ethereum without sacrificing privacy or composability.

What Can You Do Now?

For those who want to test out the network ahead of mainnet, Aztec has released several tools that make it easy to participate.

- Aztec Sandbox — Perfect for devs wanting to test without the network. It's a local environment to build and simulate private dapps.

- Aztec Playground — A no-setup browser tool to interact with the testnet directly and spin up accounts, deploy contracts, and run transactions. Best for those of us who identify as non-technicals but still want to see the technical functions in action.

- Join the Validator Set — Ideal for those looking to truly put the network to the test. Start with ZKPassport registration for private verification, then operate nodes to order transactions or generate proofs, earning roles and rewards along the way. Here’s a great guide for getting started.

Overall, Aztec has architected a compelling vision of onchain privacy where encryption lives naturally, side by side, with public state.

With 16K nodes already stress-testing the network and the infrastructure proving itself in the wild, Aztec looks to be close in its transition from years of research to real-world deployment. For those tired of choosing between privacy and functionality – as a builder or a user – it’s worth keeping up to date with Aztec's happenings so that when mainnet comes, you’re ahead of the curve.

UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier.

Public companies are racing to lock ETH onto their balance sheets, but is this the spark for a late-cycle greed run or a setup for a painful reversal?

Mike Nadeau from The DeFi Report joins Ryan to unpack the ETH treasury boom, explain how staking yield and convertible debt amplify reflexivity, and show why onchain signals place us around 9 p.m. on the market clock. We examine surging DEX volumes, record stablecoin supply, and the alt-season gauges that could send ETH to new highs. Finally, we outline the risks of leverage, premium flips, and the exit strategy smart investors are already planning.

Listen to the full episode👇