I still write checks | Market Monday

Dear Bankless Nation,

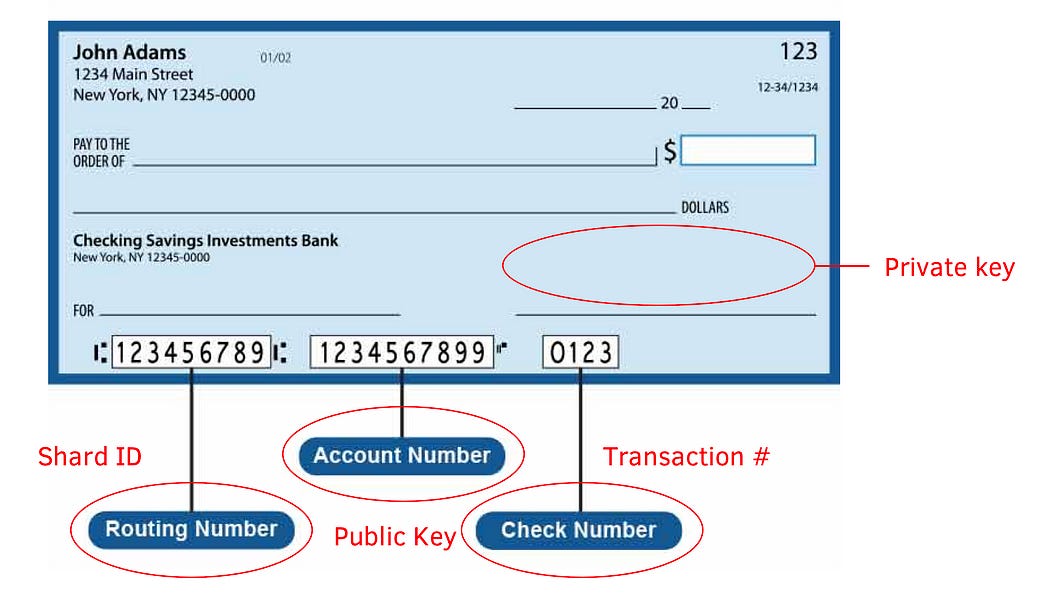

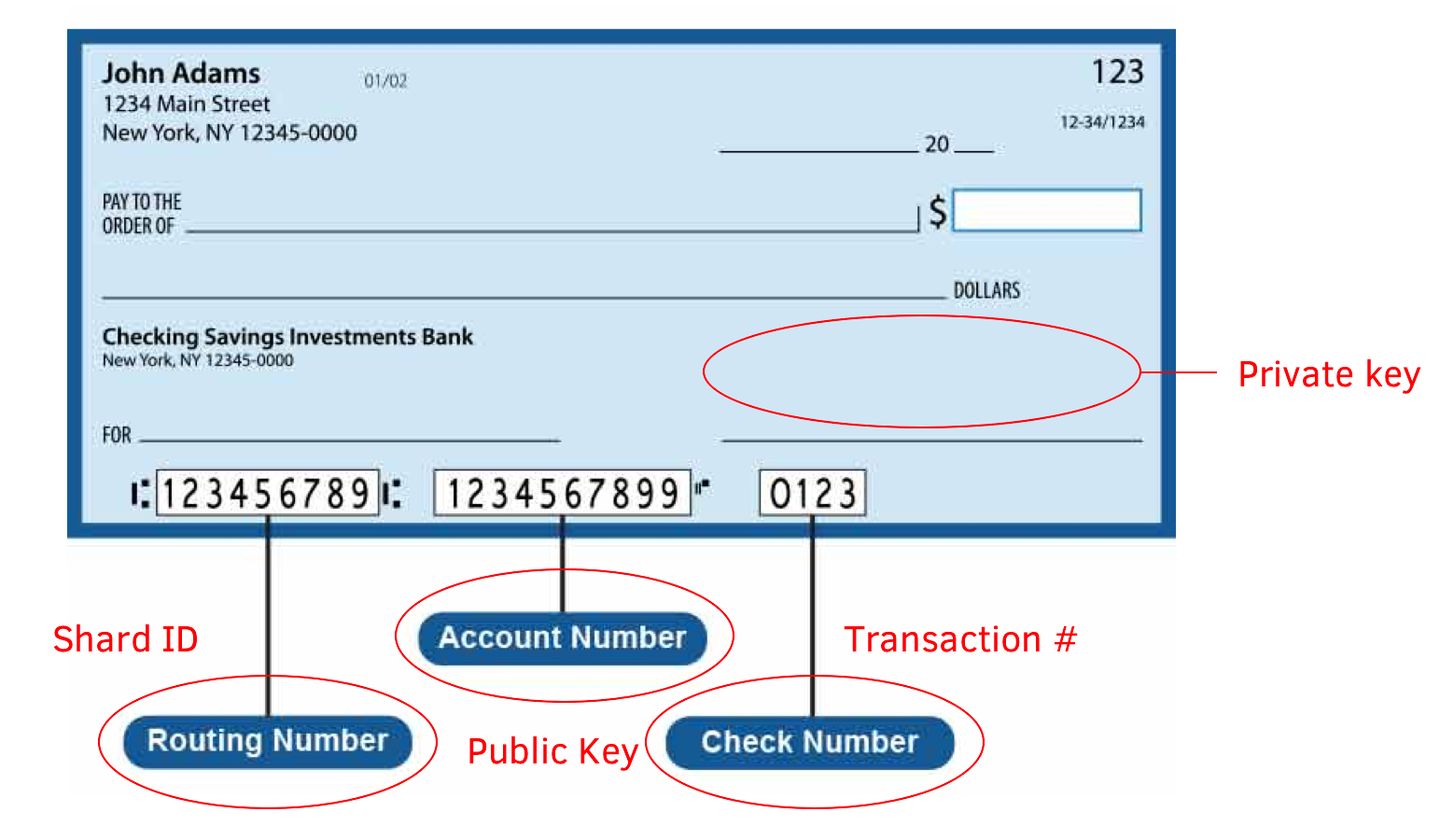

It’s 2021 in the United States and I still write checks.

Not because I want to but because the banking system in my country is stagnant.

Each month I write a check from the business checking account in my local credit union to my personal Wells Fargo bank in order to pay myself. No ACH transfer, no automatic payroll—my credit union doesn’t support these.

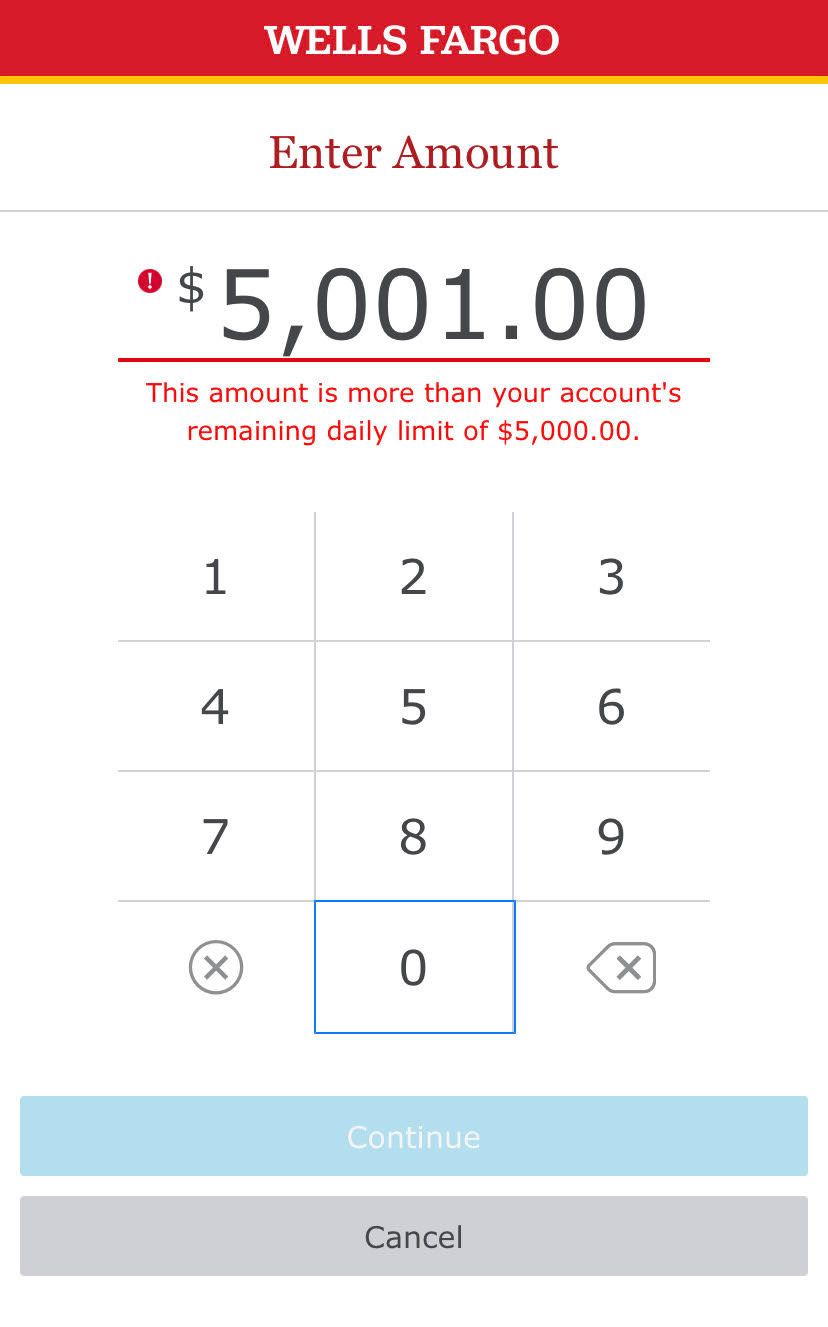

The check can’t be too large either. If it’s over $5k, the Wells Fargo mobile app can’t deposit it. Over $5k and I have to show up in person and present my an ID.

Why not switch to a bigger bank that supports better payment features?

I tried that.

I did hold my business account with the second largest bank in the U.S. then one day they sent me a Dear John breakup letter. I had 30 days to close my account because “my risk profile no longer aligns with the banks risk tolerance”

They booted me because I was in the crypto industry.

So I still write checks.

I still wire funds by showing up to a bank branch in-person, presenting my ID, paying $30, then waiting 3-5 days for it to clear.

I still accept credit card payments as a vendor on networks like Visa and Mastercard and pay 2.5% of all revenue for the luxury of doing so.

So when I hear Jerome Powell say cryptocurrencies “completely failed” as a payments system, I’d like to ask him if he’s ever used the U.S. banking system.

Then I’d ask him if he’s used crypto.

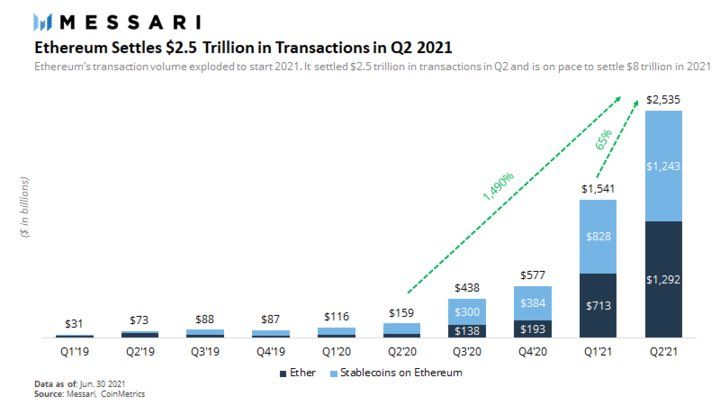

Because I can send $100k to anyone in the world in with an internet connection for a couple dollars using Ethereum. Settlement in 13 seconds.

Where can I do that in the U.S. banking system?

Ethereum is on track to settle $8 trillion in value this year while U.S. politicians castigate crypto and wax poetic on the “wildcat risks” of stablecoins.

You gotta be kidding me.

They propped up a rent-seeking legacy banking system that’s falling further and further behind, they’ve blocked the FinTech innovators who could modernize it, and now they’re telling Americans that crypto has failed…but oh yeah America still has the best financial system in the world.

You believe them?

China didn’t stay stagnant

I’m halfway through Cashless a book about China’s digital banking system. (Stay tuned—we’re recording a podcast with the author next week)!

Here’s what China did differently. They let big tech eat their banks.

They were so hungry to digitize their financial system they gave it all to AliPay and WeChat. These are China’s equivalent of Amazon, Google, and Facebook.

So over the last 10 year while the U.S. banking system stayed stagnant, China’s Silicon Valley completely digitized China’s banking system. They turned banking into a giant app platform. As a result, digital banking functionality in China has leapfrogged the the West in ways Westerners are just beginning to fathom.

Here’s a stat…

- WeChat and AliPay do $52 trillion in annual mobile payments. 🤯

- Apple and GooglePay recently broke $540 million. 😬

And now China’s starting to export…I hope you like RMB.

Paths for the U.S.

I understand why the U.S. doesn’t trust its big tech companies with the powers of a banking system. Neither do I.

I trust China’s big tech even less.

So what’s the path forward? I see three paths for the U.S…

- Keep status quo (small gains while falling further behind)

- Give it to big tech (create a SciFi dystopian)

- Upgrade to crypto (build on a decentralized base layer)

The status quo path is the one we’re on. It keeps us writing checks and paying Visa fees and falling further behind.

The second path is China’s path, but it’s fraught with privacy challenges and remains politically infeasible in the U.S. The Libra talks w/ Zuck and Congress didn’t go well.

The third path seems beyond the comprehension for most in office right now. Rather than embrace USD stablecoins as an export of the U.S. monetary system, they’ve taken to bashing them. Rather than digging into the incredible innovation and financial access DeFi provides, they’ve relegated to speaking of crypto as a tool for criminals and fraudsters.

The third path is the right one. But when will U.S. realize this?

We’re in no-man’s land. There’s no path forward, just arguing. At the moment the anti-crypto contingent seems strangely fond of CBDCs but I find it hard to believe the government has the juice to pull it off. Lots of talk so far.

Yet I’m still optimistic they’ll come back to the third path. We can have digital money without sacrificing decentralization. We can build have the best financial system in the world and it can be based on open, censorship resistant, and permissionless technology.

There’s glimpses already. It’s not here yet, but it’s happening.

And I can’t wait until the day I no longer have to write a check.

- RSA

P.S. Sign up for the Smart Contract Summit! It’s a FREE virtual summit featuring top speakers from the industry. David and I will be hosting a panel on EIP 1559. Register here.

Actions

- Execute any good market opportunities you saw

- Listen to The History of Electronic Markets | Tarun Chitra