How you can participate in DeFi fundraising

Dear Bankless Nation,

There’s been a lot of activity around DeFi fundraising this year.

dYdX recently raised $65M in a Series C led by a16z and Polychain.

Balancer Labs diversified their treasury with a $24.5M raise led by Blockchain Capital (who also just raised $300M).

Set Protocol also closed a $12M investment round at the end of May.

And this is all within the past few weeks. There’s definitely a lot of activity…but there’s a problem. Retail investors can’t participate. These opportunities are only available for accredited investors, well-connected individuals, and top tier investment funds.

Not to blame DeFi protocols either, they’re playing by the rules (which obviously need to change).

But crypto is about open access to financial services for anyone—early investments should be one of them. So what opportunities are there today for the average joe?

That’s what the guys at Dove Mountain Data explore in this article. They’re building a comprehensive database for crypto investment rounds so they have all the context you need on the state of DeFi fundraising.

Here’s how you can participate in early investment rounds as a retail investor and get similar upside on your investments to the likes of a16z, Paradigm, and others.

- Lucas

P.S. Ledger just launched their Paraswap integration—allows you to swap any tokens at the best price directly from your Ledger Live app. No Paraswap token yet so could be worth it…

WRITER WEDNESDAY

Guest Writers: Regan Bozman and Pierre Chuzeville, Founders of Dove Mountain Data

DeFi Fundraising: How it works, why it’s exclusive, and how you can get involved

Crypto has experienced plenty of boom and bust cycles over the years, and the fundraising market has been no different.

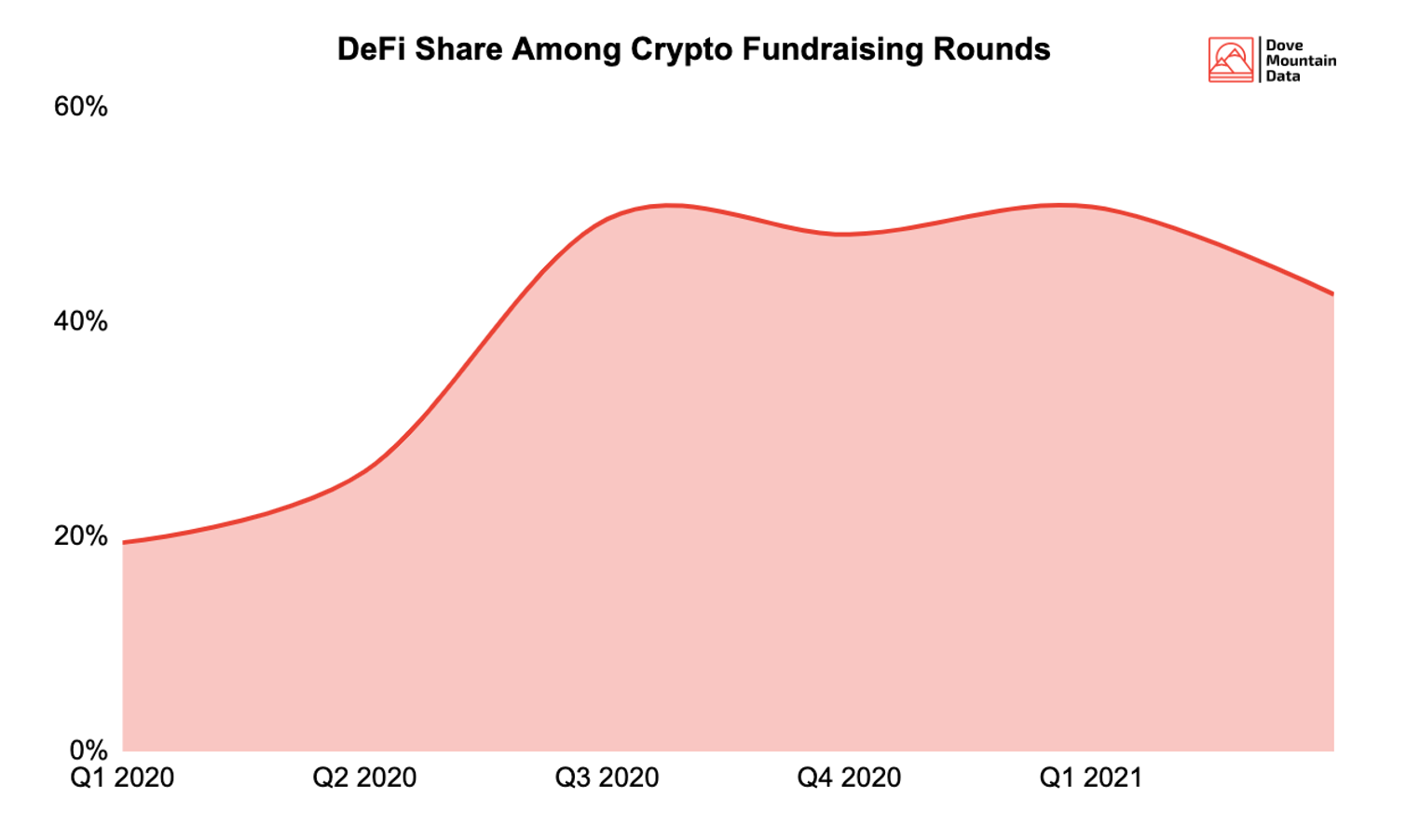

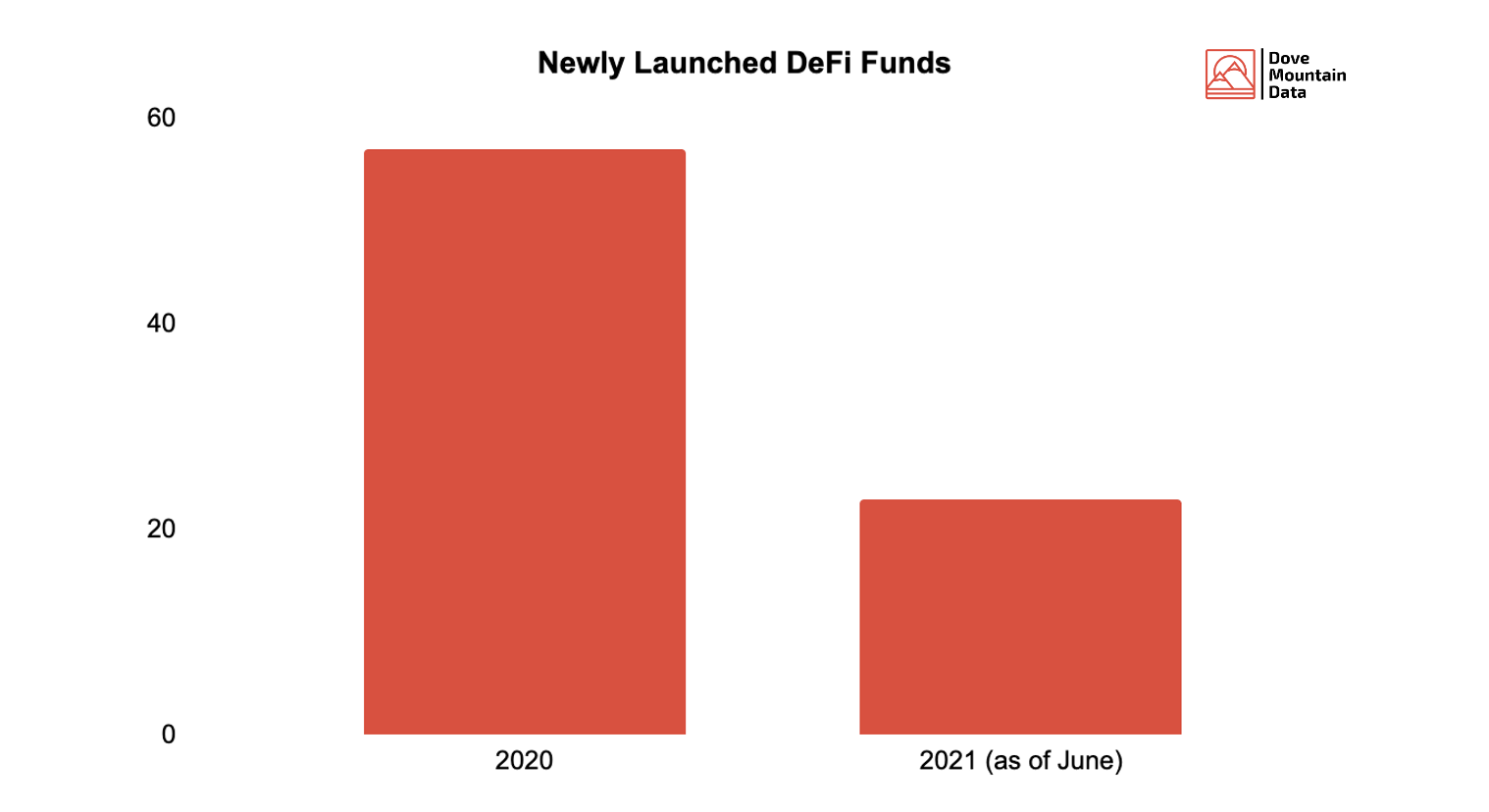

Many funds founded during the 2017-2018 hype cycle did not survive the subsequent bear market, and smaller DeFi focused-funds took their places. As DeFi has grown in prominence over the past two years, brand-name venture funds like a16z and USV have started participating in DeFi fundraising rounds (see Uniswap, MakerDAO, and Compound).

Below we’ll provide some context on how fundraising works in DeFi, why it’s hard for retail investors to participate, and potential solutions for access. We’ll run through:

- How DeFi Fundraising works

- Why retail investors struggle to get involved in early rounds

- Best ways to get access to DeFi investments

Let’s get into it

📊 We started publishing Dove Mountain Weekly to provide updates on recent fundraising activity and share fundraising insights from investors and founders! Crypto markets should be transparent and that’s why we also built Dove Mountain Data, the most comprehensive database of crypto fundraises. Check them out!

DeFi Fundraising: Same Same but Different

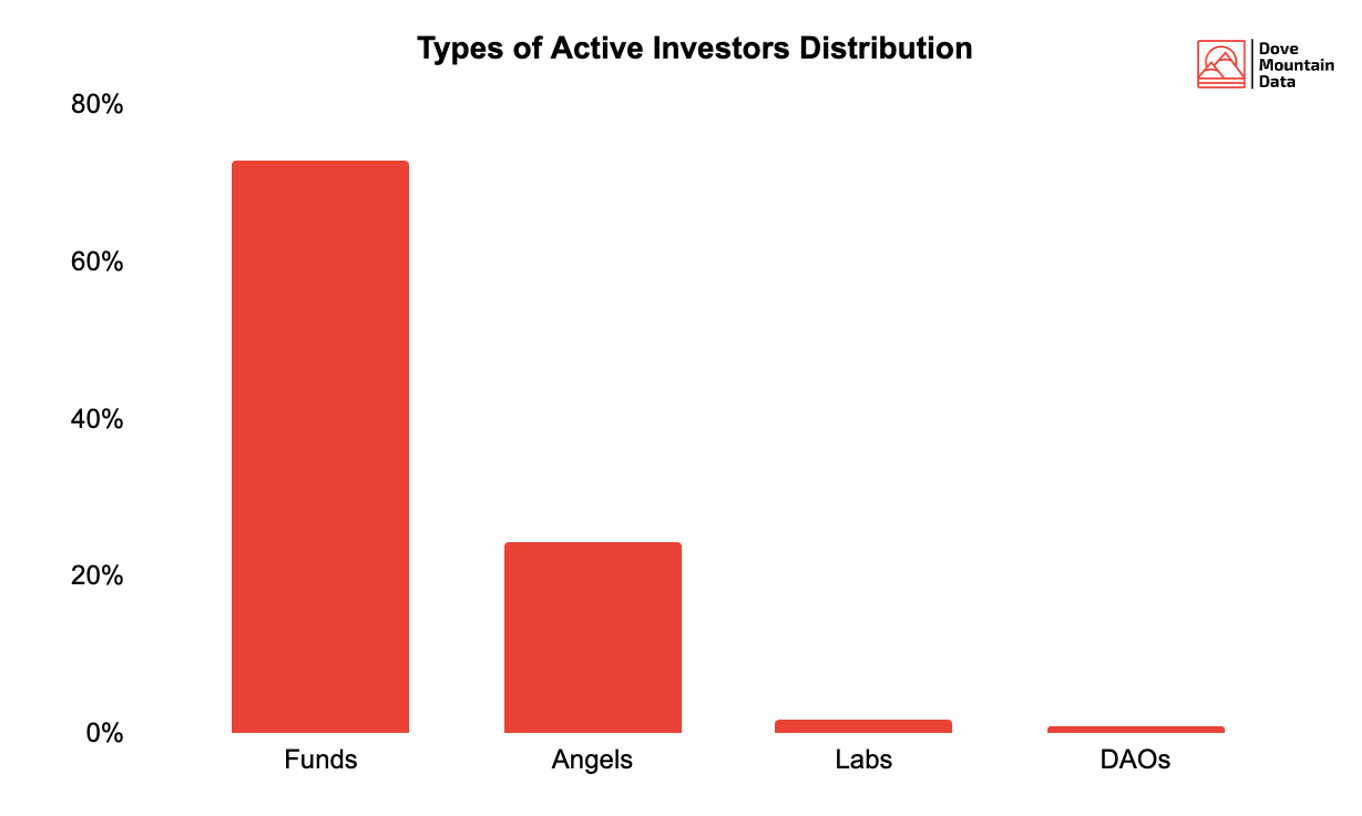

To understand why DeFi fundraising is different, let’s take a look at the major players: funds, investment DAOs, angel investors, and labs. Given the relative nascency of DeFi, many of the investors involved in fundraising rounds are different from what you would expect to see in traditional funding.

The distinction between hedge funds and venture capital funds is blurry. Funds can leverage different strategies with variables like time horizon, risk tolerance, liquidity providing, and yield farming. Some are said to be “DeFi native” (Mechanism Capital, CMS Holdings, Spartan Group, etc.), others can be categorized as “DeFi comfortable” or “DeFi curious”.

Interestingly, a growing number of tier-1 funds with huge amounts of assets under management are progressively looking at DeFi after having backed successful CeFi companies like Coinbase.

Angel investors also play a key role in the space. Successful DeFi builders, principals at DeFi funds, or crypto executives can (and often do) write checks to back promising DeFi protocols. These people get access to deals because they bring clear value to founders.

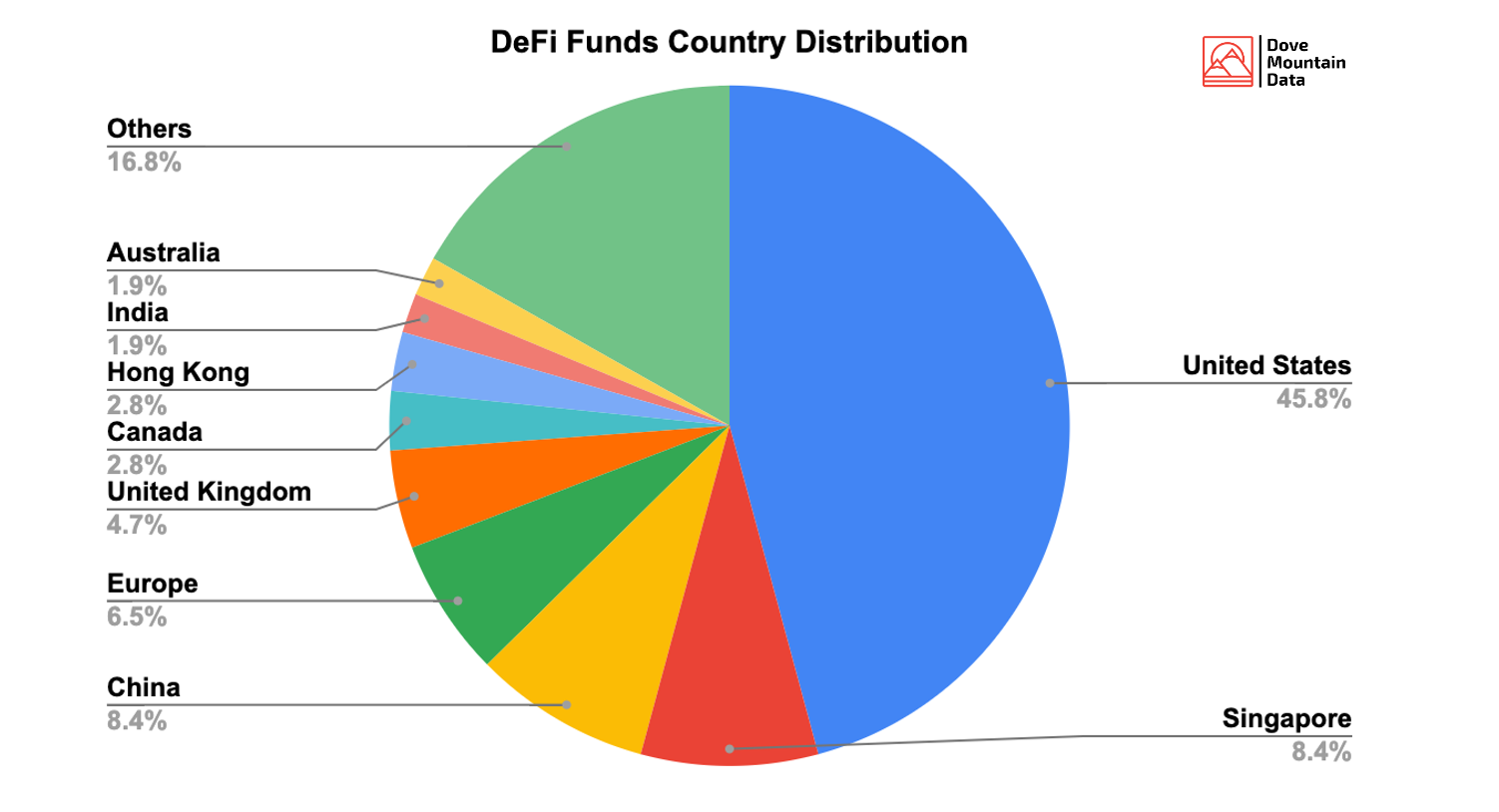

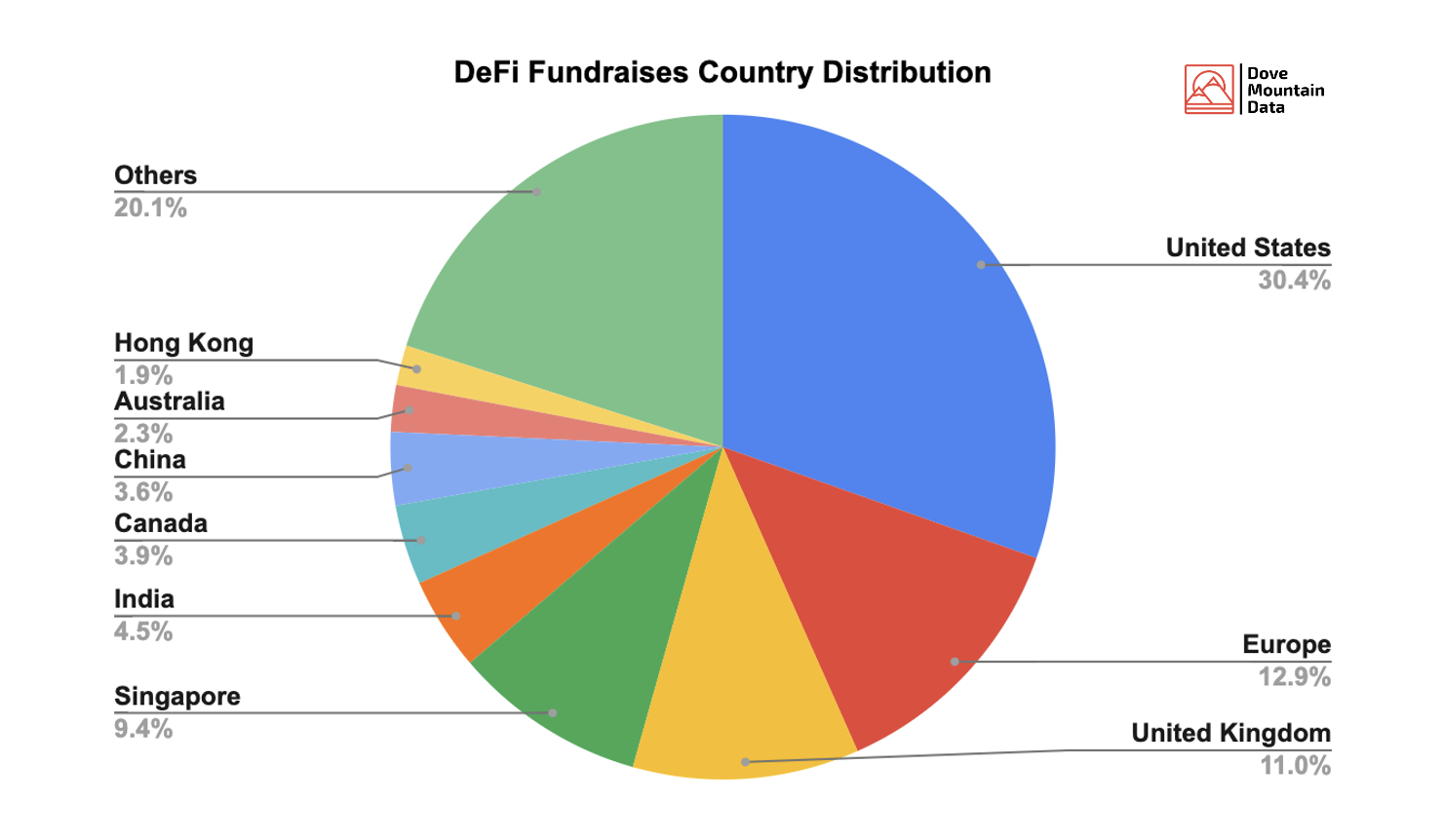

Before diving into the other types of investors, let’s have a look at country distributions. The US is clearly dominant from a capital perspective, holding nearly half of funds actively investing in DeFi. Singapore and China are two fast-emerging DeFi fundraising hubs, with Europe behind.

When it comes to DeFi core teams locations, the US represents a smaller share — around 30%. Interestingly, Europe seems to be a hot place for DeFi builders despite a smaller share of capital.

DAOs represent another class of investors. MetaCartel Ventures is the most famous in the DeFi industry, but others like DuckDAO and The LAO are also very active. Even if they can be seen as on-chain syndicates, being part of an investment DAO can require some connections, and is not as easy as one might think. This makes Syndicate Protocol’s mission to democratize investing by launching investment DAOs imperative.

Lastly, labs and accelerators are a hands-on type of investor which can get upside in protocols they provide operational expertise to. They can also operate as funds by directly investing. Zokyo and Ellipti have invested in some successful DeFi protocols so far.

As is the case with most capital ecosystems, investors’ reputation is their strongest asset. Rounds are competitive and founders have a lot of power in picking their investors. Founders will generally look at investors’ networks and past investments when deciding to let them into a round.

Pre-seed, seed, extended-seed, private…these are all common terms any DeFi professional investors hear every day. 80% of the rounds publicly announced fall in one of the categories mentioned above. Even if the space is maturing with protocols like dYdX raising $65M Series C led by Paradigm, less than 15% of rounds are Series A or Series B.

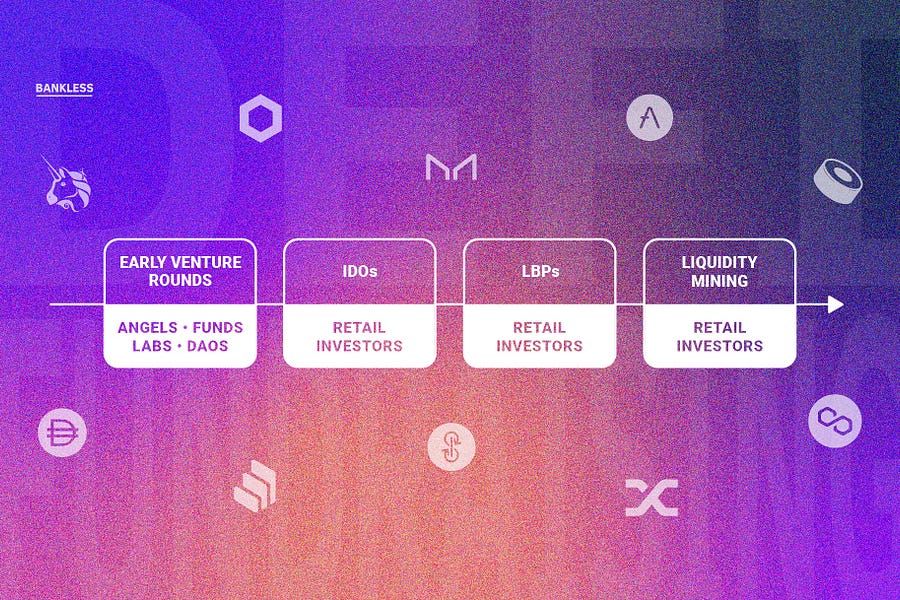

The most common DeFi fundraising path starts with an angel round, followed by a pre-seed, a seed, and a so-called private round, with different deal terms and valuations. Early-stage rounds are generally overcrowded with seed-focused DeFi funds.

There are good reasons as to why community funding might not make sense for the first funding process: as Kerman Kohliput, a founder needs to set up the right legal structure and avoid creating a pressure-filled environment.

What also makes DeFi fundraising different is its strong dependence on market volatility. When the market is hot, valuations can range from $50M to $100M, even for projects that do not have any product. Such high valuations can have an impact on lockups and vesting schedules. DeFi’s recent hype has made project valuations skyrocket, pricing out potential angel investors looking to break into the DeFi investment space by writing small checks.

Why Retail Investors Are Excluded from Early Funding Rounds

There are a slew of reasons as to why it’s often hard to access early-stage investments:

- Ticket Size: founding teams often require large minimum amounts ($10-$25K is common), pricing out potential retail investors.

- Knowledge: As an experienced investor you can take advantage of close relationships and deal-sharing strategies with other investors. If you’re not in these networks, it’s common to first hear about a round as it’s announced (and hence, after it’s closed).

- Access: Building up brand and reputation has become a prerequisite to get into the most promising early projects. Everyone knows Paradigm—naturally, this is not true of the average DeFi market participant.

- Value Add: Founders are more frequently asking for operational support from investors on things like token design, business development, and securing audits. Running a fund and having existing portfolio companies obviously makes this a lot easier.

How to Get Involved

While early-stage fundraising rounds remain exclusive, there is an increasing number of ways for you to get involved.

Initial DEX (Decentralized Exchange) Offering [IDO]

An IDO refers to a project launching its token through a decentralized exchange (DEX). Over the past year, IDOs have become the most common crowdfunding model for DeFi projects. IDO’s represent an improvement in fundraising in that they allow DeFi startups to raise funds more fairly and transparently than previous blockchain-based fundraising iterations.

The first IDO was made by Raven Protocol in June 2019 — a protocol developing a decentralized and distributed network of compute nodes for Artificial Intelligence and Machine Learning. It lasted 24 hours, and a total of 3% of the token supply was assigned.

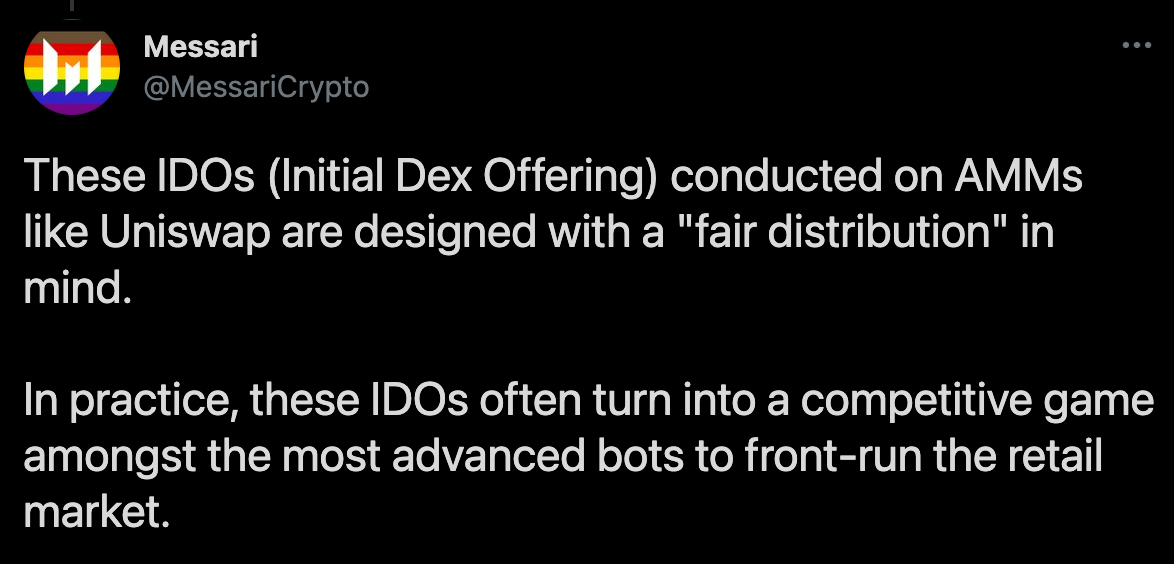

Unfortunately, in many cases, retail investors have been excluded from IDO’s launches because advanced bots front-run them (see UMA’s IDO).

Due to their recent emergence, more sophisticated IDO launchpads have emerged which provide a bit more protection for investors. As launchpads aim to help projects fundraising, there is a curation aspect to make sure scams are filtered out, providing retail investors with more safety.

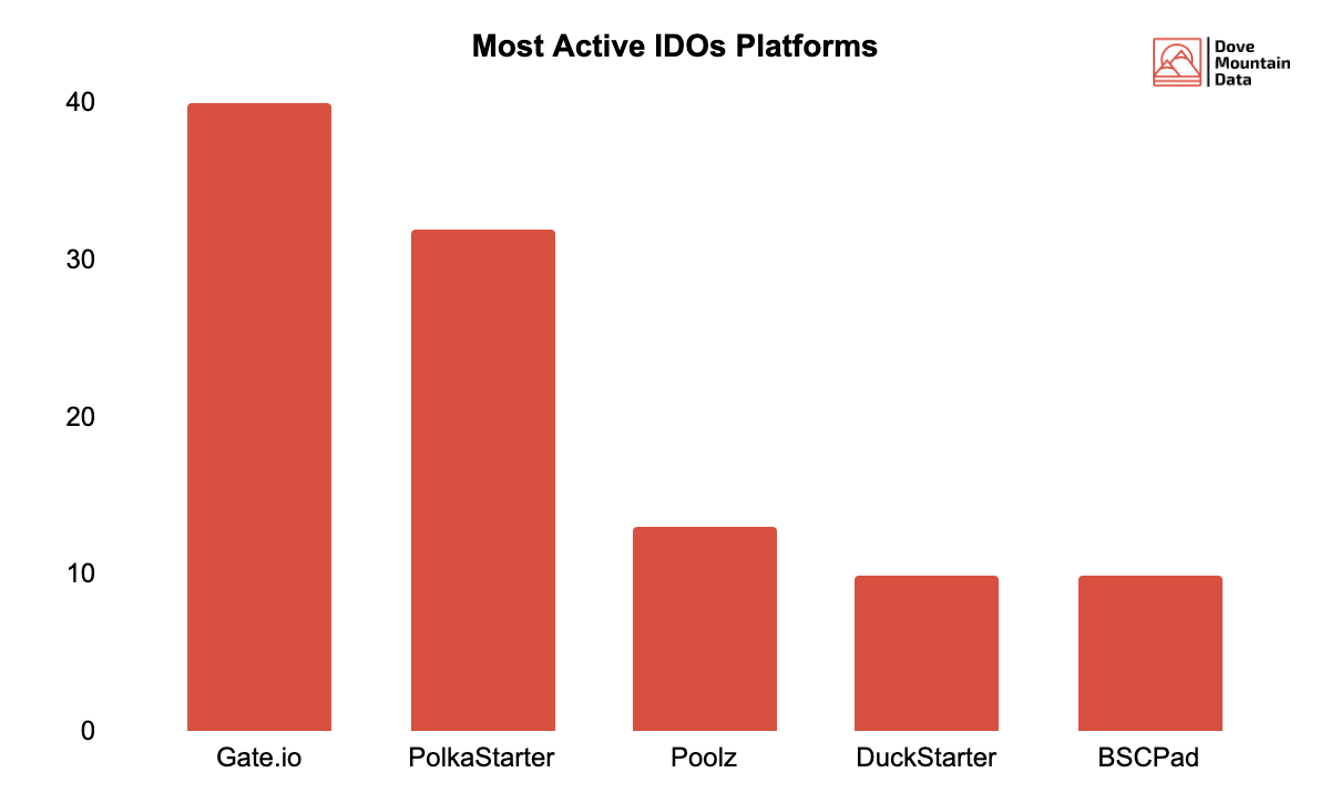

To be eligible for an allocation, a user generally needs to stake the launchpad’s token and participate in its community. For example, PolkaStarter offers two pools: one open for everyone, and one for $POLS holders only, where competition is less intense.

This offers a more inclusive process for smaller players:

- They are no longer priced out by VCs and front-running bots

- They can enjoy further transparency by accessing on-chain information

- They can take advantage of immediate liquidity

Another emerging trend is the creation of several launchpads across different ecosystems: TrustSwap and DuckStarter on Ethereum, Avalaunch on Avalanche, Polkastarter on Polkadot, Solstarter on Solana, BSCPad and KickPad on BSC, MoonEdge on Polygon.

Projects building launchpads have been very attractive to investors lately: Impossible Finance, BSCLaunch, Scaleswap, Launch X, and Launchpool all announced they completed early-stage funding round with participation from tier-1 funds like Hashed, Alameda Research, Lemniscap, Rarestone Capital, and others.

More recently, projects have been deciding to launch their IDOs on multiple launchpads to capture a wider range of investors. On average, over the last 5 months, DeFi projects raising funds via IDOs used 1.4 different platforms, and the trend is growing with LossLess going through 4 different platforms as an example.

While the average allocation per participant tends to be relatively low — generally a few hundred dollars — returns can be staggering. Average returns for Polkastarter IDOs reached 2,700% in March 🚀

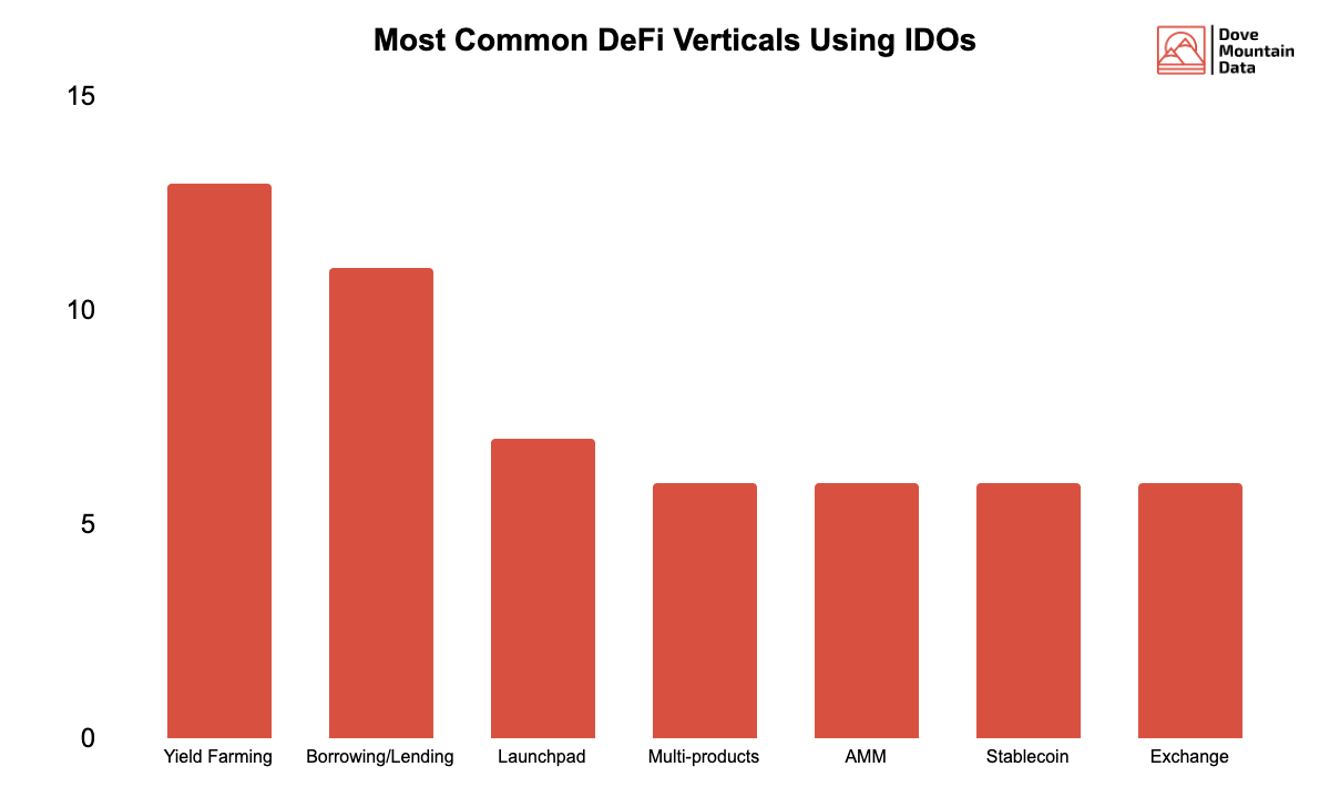

Yield Farming and Borrowing/Lending protocols have been the most common project subcategories raising a public round through an IDO process.

Liquidity Mining

Liquidity Mining is a proven mechanism to distribute tokens, in which participants supply assets into liquidity pools and are rewarded with a protocol’s native token. Liquidity mining is not perfect (see the failure of the YFI distribution as an example), but it represents an additional opportunity to get involved.

Whether you decide to invest by providing liquidity on Uniswap, Balancer, Bancor, or others, make sure to do your own research because:

- Any mistakes from the investor’s side can lead to losses

- Most projects you would invest in are in beta and use is at your own risk

DeFi native composability makes this investment method very interesting because profits earned can be directly reinvested into yield farming.

Balancer Liquidity Bootstrapping Pools (LBP’s)

Balancer LBP’s are token launches on Balancer whereby teams seed a Balancer pool with a high ratio (and hence high price) of their own token and slowly decrease this ratio over time (fairly analogous to a Dutch auction).

Thanks to Balancer’s flexibility, LBP’s ensure a smooth price discovery and disincentivize whales to use any trading strategy that would lead to high price volatility and wrong the retail investor.

📑 Bonus reading: Check out our Ultimate Guide to Balancer Smart Pools!

Balancer Liquidity Bootstrapping Pools are now a top alternative to fundraising by:

- Achieving low slippage

- Requiring low initial capital due to the smaller share of DAI

- Keeping prices stable over time

An increasing number of projects that have raised from top funds have launched through an LBP.

Maple first raised a $1.3M seed round before distributing MPL governance tokens to over 1,000 new holders and raising more than 10M USDC through its LBP.

Similarly, Radicle completed a $12M fundraising round and then collected nearly $25M via a record-breaking LBP sale.

Conclusions

DeFi projects have more options than ever before for fundraising. Slowly, more of these are allowing retail investors to participate. There are options—IDOs, launch pads, liquidity mining programs, and Balancer Liquidity Bootstrapping Pools (LBPs) all serve as viable alternatives to traditional investment rounds.

However, this remains a highly risky asset class (we’re on the frontier) and we recommend you always do your own research before making any decisions.

Action steps

- Explore alternative fundraising models as ways to invest as a retail investor

- Sign up for Dove Mountain Weekly to stay up to date on crypto fundraising!

Author Bio

Regan Bozman and Pierre Chuzeville maintain Dove Mountain Data, the industry’s best fundraising data source. Regan invests in early-stage crypto projects and previously ran the token sales business at CoinList. Pierre previously worked on technology M&A at Ader Finance.