🏴 How to Win the Multi-Chain Future

We recently updated our Token Ratings. When you read through, you’ll get the Bankless team’s thoughts on which tokens to buy, sell, and hold (for entertainment purposes only 😊).

The first token is available to everyone, but you’ll need to upgrade to Bankless Premium to get access to the rest.

Dear Bankless Nation,

There’s a market demand for cross-chain bridges in DeFi and that means a big opportunity to score some trading fees if you sign up as a liquidity provider.

Today’s newsletter spotlights opportunities across four cross-chain protocols: Hop, Synapse, Across and StarGate. Check them out!

- Bankless team

🙏 Thanks to our sponsor KRAKEN

👉 Kraken has been on the forefront of the blockchain revolution since 2011 ✨

How to Win the Multi-Chain Future

Writer: Lucas Campbell, Web3 Lead at Bankless

The future is multi-chain.

Whether you believe it will happen with multiple L1s like Ethereum, Cosmos and Solana, or a roll-up centric future, there’s an opportunity to earn money by fueling these cross-chain swaps.

The main way to do this is by providing liquidity to any of the top bridge aggregators – like Hop, Synapse, and Across. In return for doing so, you’ll earn a trading fee for your service.

Better yet - our prediction was right — most cross-chain bridges today have launched a token with a yield farming program, providing a nice yield boost for all LPs.

Interested in capitalizing on this opportunity?

This article highlights some of the best yields from cross-chain bridges on the market right now.

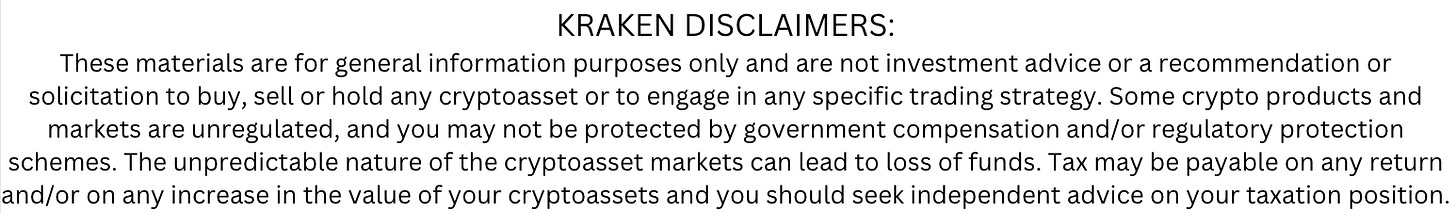

➰ Hop Protocol

- Networks: Ethereum, Arbitrum, Optimism, Gnosis Chain, Polygon

- Assets: ETH, USDC, USDT, DAI, MATIC, SNX

- Yields: 8 - 12% APY

The first major bridge is Hop.

Built on a rollup token bridge, Hop Exchange allows users to transfer assets cross-chain between major Ethereum Layer 2s and sidechains.

The protocol leverages market makers known as Bonders, who earn fees for fueling the liquidity behind these swaps. The bridge currently holders around $66M in value locked and has facilitated billions of dollars in transfers.

After launching the HOP token, the protocol implemented a liquidity mining program, issuing 2.2M HOP every month on ETH, USDC, DAI, and USDT liquidity pools. The allocation of the tokens is determined by the volume of each bridge, changeable by governance.

Interestingly, Hop currently offers a few pools with multi-asset rewards. The first is the SNX bridge which is incentivized with both HOP and OP, offering a 28% annualized yield for LPs.

The other two notable pools are the DAI and USDT Gnosis pools, where LPs of these stablecoin pools earn both HOP and GNO as part of their rewards program.

🤑 Start earning on Hop Protocol

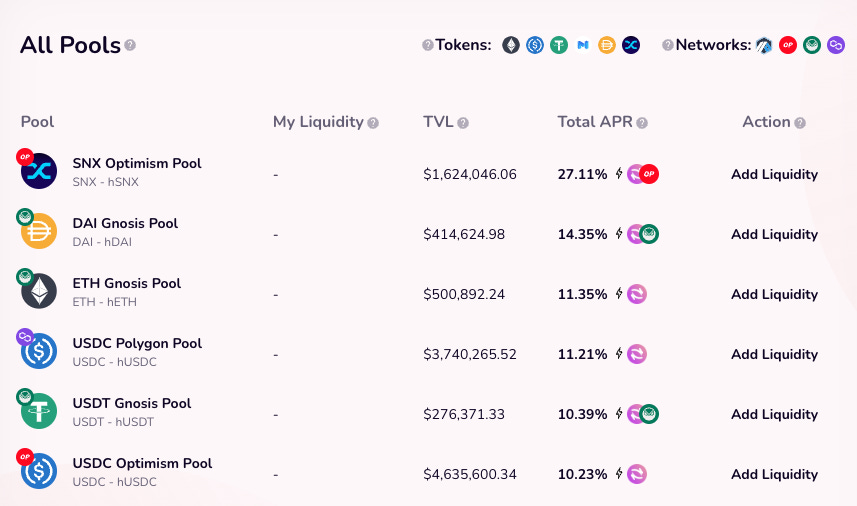

🧠 Synapse

- Networks: Ethereum, Arbitrum, Optimism, Polygon, BNB Chain, Canto, Avalanche

- Assets: ETH, USDC, USDT, DAI, BUSD, NOTE

- Yields: 5 - 22% APY

Synapse (SYN) is described as a cross-chain messaging protocol.

The Synapse Bridge enables users to swap between a range of L1 and L2 assets using an AMM. Unlike Hop Protocol, Synapse expands beyond Ethereum and its encompassing chains and enables swaps between alternative Layer 1s like Canto, Avalanche, and Harmony, in addition to the prominent Ethereum L2s like Arbitrum and Optimism.

That said, similar to Hop, Synapse also features the SYN token which is distributed via a substantial yield farming program across the majority of pools.

As you can see below, there’s a handful of lucrative opportunities to capitalize on, with yields going as high as 22% for the hottest new L1 on the scene: Canto.

🤑 Start earning on Synapse Protocol

🙏 Together with ⚡️KRAKEN⚡️

Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7.

👉 Visit Kraken.com to learn more and start your experience today.

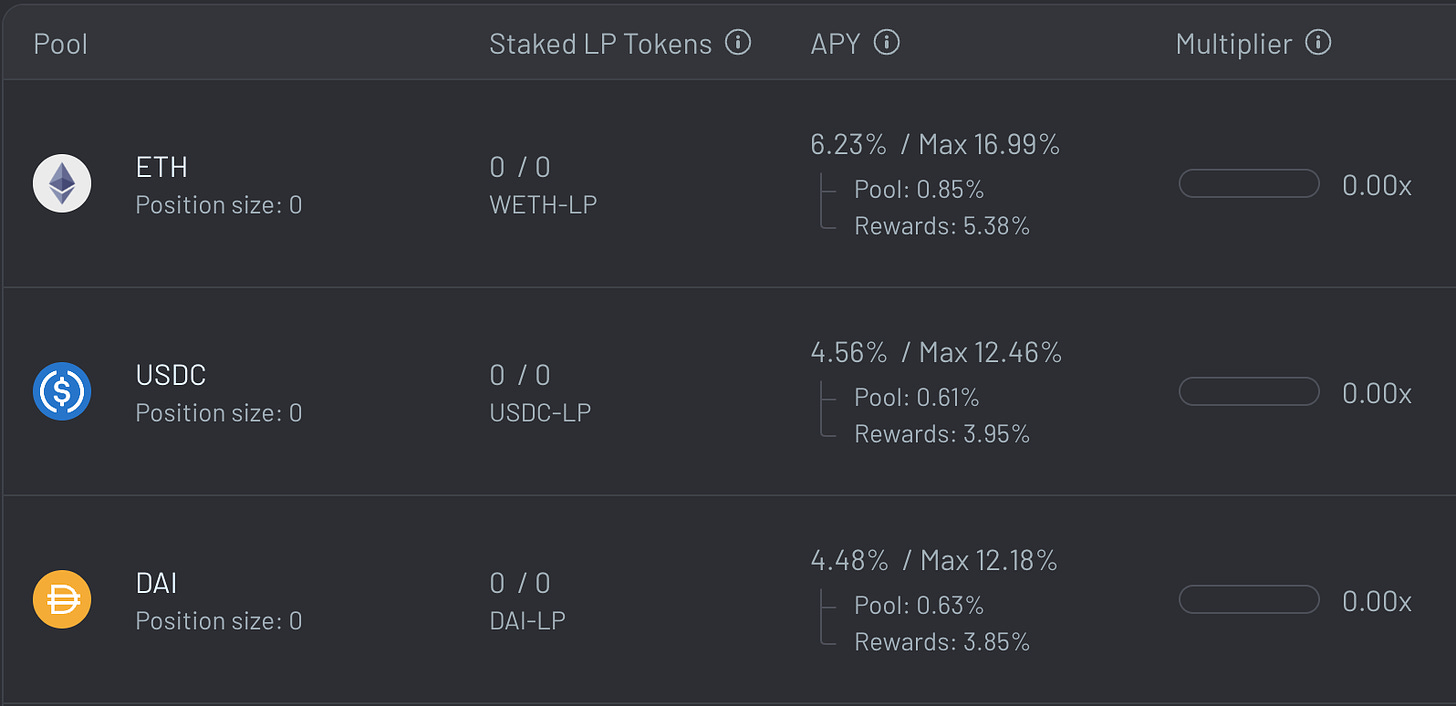

🌉 Across

- Networks: Ethereum, Arbitrum, Optimism, Gnosis Chain, Polygon

- Assets: ETH, USDC, USDT, DAI, WBTC

- Yields: 4.5 - 17% APY

Across Protocol has become a fair competitor on the cross-chain landscape, recently crossing over $1.3B in total value transferred.

Built by the team at UMA Protocol, the bridge works by offering incentives for LPs to provide short-term loans to users on the other chain, which are repaid after two hours from a liquidity pool on L1.

After launching the token in November, the protocol now offers a couple yield farming opportunities for the ACX token. Across’s yield farming program stands out as it gives LPs a rewards multiplier based on the amount of time the user has provided the liquidity.

Users can reach the max APY listed below by providing liquidity on the protocol for more than 100 days.

🤑 Start earning on Across Protocol

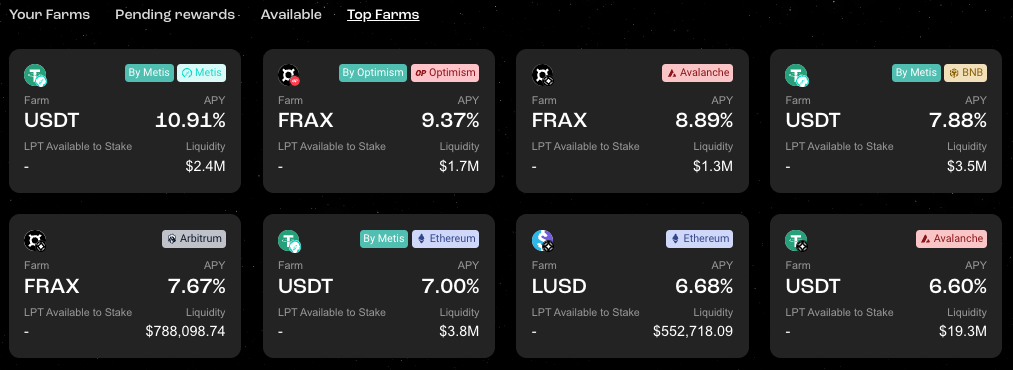

🌟 StarGate

- Networks: Ethereum, Avalanche, BNB Chain, Polygon, Arbitrum, Optimism, Metis

- Assets: ETH, USDC, USDT, DAI, FRAX, LUSD

- Yields: 3-10% APY

The final bridge we’ll discuss is Stargate, built on Layer 0’s omnichain technology.

The protocol currently has $381M in TVL with its token, STG, trading at an $83M market cap and $600M FDV. Similar to the above bridges, the protocol taps into its native token in order to boost the yields for prospective LPs.

Most of the pools on the platform include these STG rewards – going to upwards of 10% APY on the Metis USDT pool and 9.9% APY on the FRAX Optimism Pool.

🤑 Start earning on Stargate Finance

Conclusion

There’s plenty of opportunity in the cryptoverse to earn high yielding APYs by providing liquidity for cross-chain swaps.

The recent surge in activity on Cosmos chains like Canto and Ethereum Layer 2s allows LPs to capitalize on these value flows.

People are bridging between chains, all the time.

This guide serves as the basis to start earning.

You can win the multi-chain future by providing the picks and shovels (read: liquidity) for these value flows. Take a look at the landscape and see if one of these is the right opp for you!

Action steps

- 📚 Read What I Talk About When I Talk About Bridges by 0xjim

- 📺 Watch a Bankless podcast panel on cross-chain L2s

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.