Dear Bankless Nation,

We’ve believed for a while now that you can value DeFi protocols the same way you value traditional companies.

They’re like growth-stage startups. They build products that generate value flows.

You can use growth projections to build a valuation framework for the protocol’s native token.

Don’t believe us?

Here’s a traditional VC doing exactly that for Maker’s MKR token.

- RSA

P.S. TracerDAO needs help building new DeFi derivatives infra! Join Discord to get involved!

MakerDAO Teardown: Burning all the way to the bank

A valuation framework based on the principles of growth-stage investing

Taking crypto to the next level requires broader investor buy-in—markets shouldn’t move on just memes and tweets, but on fundamental analysis.

In venture capital and on Wall Street, we evaluate an investment’s expected returns by forecasting the asset’s financial performance and assuming it trades at some multiple of revenue or EBITDA on exit.

The surprising aspect is that we can apply this exact framework to many revenue-generating protocols to create an investment case for the traditional investor. In this post, I’ll give a teardown on MakerDAO.

What is Maker?

I’ll stick to the basics here, but if you’re interested in going deeper, check out these resources.

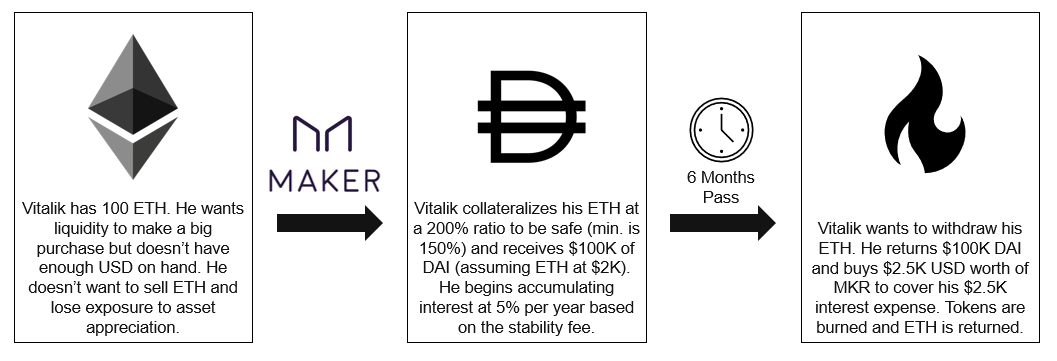

- Maker is a platform for taking out collateralized loans on your crypto. Users collateralize assets into a vault, creating a collateralized debt position or “CDP”, at a rate of 150% or greater, and receive a USD pegged stablecoin, DAI. Interest accrues on your loan at a rate denominated by the owners of the MKR token (through a token vote), and that interest (the stability fee) is paid by the user at the time of closing out their loan.

- Why does it matter? Users can maintain exposure to price appreciation in their assets (i.e. not sell ETH) while gaining liquidity that can be used for daily expenses (i.e. working capital) or leverage.

- What can you do with DAI? There are billions of dollars in DAI liquidity. It can be used across the crypto ecosystem, exchanged for fiat USD on an exchange, and hopefully spent for real world purchases with spend cards in the not too distant future.

- Where does Maker store the deposits? As a bank would historically store your capital within the metal doors of a vault, Maker stores your capital in cryptographically protected code (smart contracts built on Ethereum).

How do Maker and its owners make money? Interest, but not with the traditional mechanism. When a user closes their position to reclaim the crypto stored in Maker, they pay the accumulated interest by ‘burning’ the dollar equivalent of the amount owed in MKR tokens (we’ll walk through an example on this below).

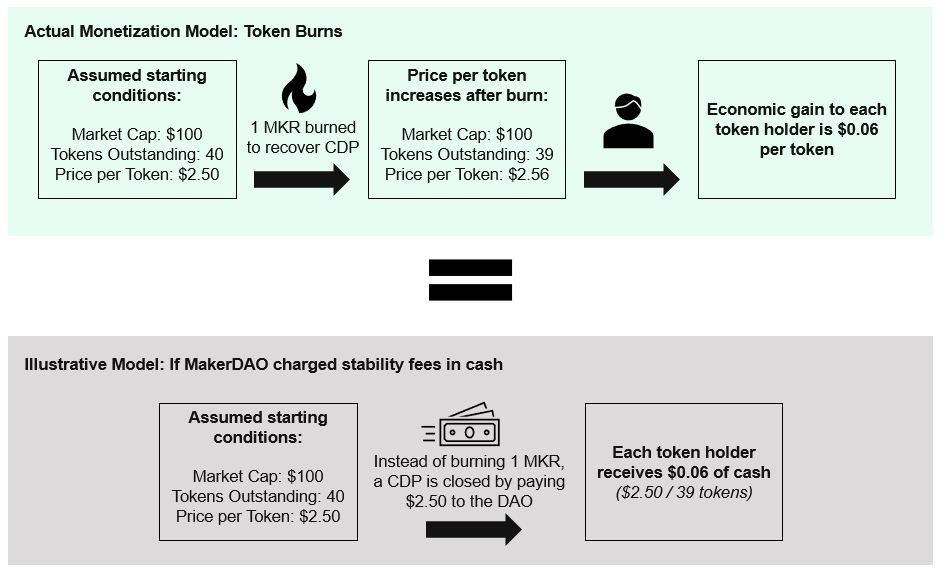

When a token is burned, it is eliminated from the supply of shares available. Assuming the market cap of MKR is unchanged (as the future expected cash flows are not materially impacted by an individual sale), the price per MKR token should increase proportionately to the number of MKR tokens burned.

How should we think about Maker’s future ‘cash flows’?

As CDPs age, they generate stability fees that will be repaid through token burns in a future period. These token burns should generate economic gains to MKR holders in the form of price appreciation that is equivalent to the receipt of cash.

Let’s run through an example to demonstrate this below:

In both examples above, MKR holders receive $0.06 for the payment of stability fees upon closing of a CDP. In the first scenario, token holders receive their earnings in the form of intrinsic token price appreciation. In the second scenario, token holders receive earnings in the form of cash. The token burns should be economically equivalent to a cash payout.

However, businesses don’t recognize their revenue upon receipt of cash but based on the period of service. If you were to purchase a subscription and pay for it at year’s end, the business would still recognize revenue throughout the year. As revenue is recognized, there is an increase in accounts receivable on the balance sheet.

The same is true for Maker. The protocol should recognize stability fees in the period they are generated and accrue a “token burn receivable” in the background. In traditional finance/venture, we value businesses based on the revenue they generate in a given period, not based on the receipt of cash. Therefore, we can value MKR on the stability fees we expect the protocol to generate in a given period.

How to forecast stability fees like a VC?

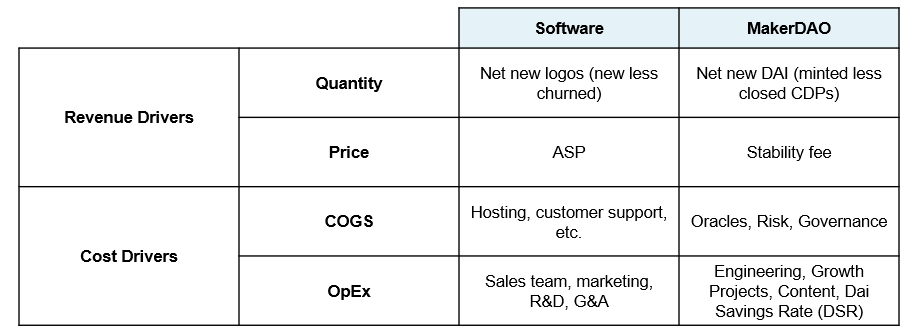

Investors forecast cash flow to software businesses based on a few key revenue drivers (customer wins, ASP/contract size, retention, etc.) and cost drivers (COGS, OpEx).

We can draw equivalents to these for MKR.

Forecasting the drivers

New Supply

New DAI will grow alongside increased crypto penetration, asset price appreciation, and increased demand for DAI across DeFi. A few methods investors can explore:

At what rate is MKR acquiring new users/capital?

What percentage of ETH wallets have created a CDP?

What percentage of a user’s wallet do you believe will be locked in MKR?

Are there any major deals you expect MKR to win with TradFi institutions, and if so how much will this grow CDPs? Note: this approach is likely unnecessarily granular for today’s market and will be more valuable once the space matures.

What percentage of the USD money supply can we expect to be consumed by stablecoins?

What percentage of the total USD stablecoin market can we expect DAI to account for?

What percentage of the total crypto leverage market will Maker deposits account for?

What does this imply in terms of the total value of the CDPs held in MKR? Does this imply a reasonable total crypto market cap?

Stability Fee

This is a question on the cost of capital. Maker could become the risk-free rate on Ether deposits. Historicals suggest rates in the low single digits.

Cost of Goods and Services (COGS)

Many of these costs should reach significant economies of scale as deposits and stability fees expand. Oracle costs will likely scale at a higher rate than risk and governance costs.

Operation Expenses (OpEx)

Engineering, growth, and content costs should achieve economies of scale as R&D and S&M do in traditional software / FinTech businesses. The DSR is the savings rate provided to deposits of DAI in Maker (note, not all DAI outstanding). This can be increased to spike demand for DAI. The DAO voted to drop this rate to 0% in 2020, and it has yet to increase meaningfully…with so much DeFi action generating DAI demand, it’s unclear if it will ever come back!

MKR Valuation Model

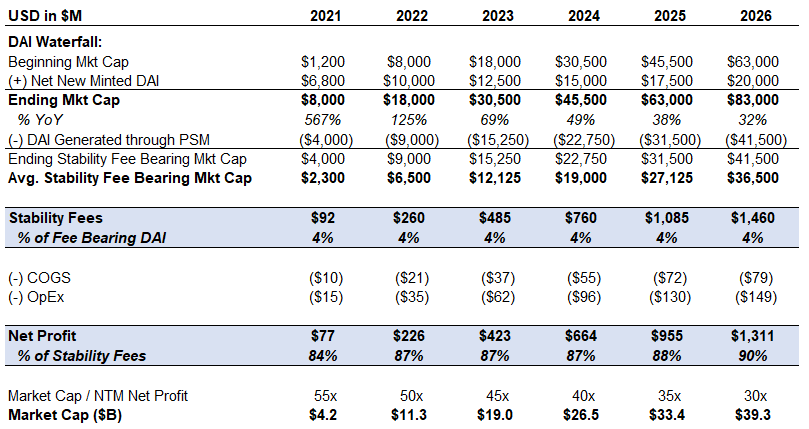

We can construct a model for Maker’s financials and assign an expected exit multiple to forecast the protocol’s market cap after a 5 year hold period.

Let’s run through some of the assumptions driving our math:

DAI Outstanding

Net new DAI minted increases to ~$20B on exit. Total DAI outstanding in 2026 is equivalent to the assets of a regional bank in the US.

If you (conservatively) assume the money supply flattens after the massive spike earlier this year, DAI accounts for 0.3% of the money supply on exit. The total market for stablecoins accounts for something in the low single-digit percentage of the total USD money supply, assuming modest DAI market share increases. A bull case would assume integration of real-world assets, FinTech integrations, and increased asset types. A bear case would assume hawkish regulation on decentralized stablecoins.

Peg Stability Module (PSM)

A portion of DAI's market cap will be backed 1-to-1 with other stablecoins (ie USDC). DAI generated in this manner does not generate stability fees. There is a small fee for the creation of DAI through this method, but this has been excluded for immateriality. This has fluctuated throughout the year—check this Dune dashboard to track. The model assumes this is constant with averages at ~50% over the forecast period.

Stability Fees

Rates have been ~4% for much of the year. This is assumed to be constant over the forecast period as a base case. If you built a bull case, you could argue consumers will pay a security premium for the protocol with time. The bear case would argue that consumers would prefer competing platforms with better capital efficiency (ie undercollateralized loans).

COGS and OpEx

These line items scale as a percentage of overall DAI outstanding and stability fees. Some line items, like Oracle costs, should scale with increased usage. Others, like content and special growth projects, reach early economies of scale. I assume the DSR never makes a meaningful comeback as DAI demand is stimulated by ecosystem development. The protocol operates at profit margins of ~90% on exit… that’s a business model that is drool-worthy!

Exit Multiple

Public market investors often think in terms of NTM (next twelve months) multiples to give credit for future growth expectations. VCs assume a multiple that public markets will assign to a business and forecast valuation based on this. For many software/FinTech businesses, we would value a business off of its revenue.

We can’t do that here because the cost structure is so different from a traditional business. Instead, we’ll value Maker off its net profit and assume it trades in line with EBITDA multiples on high-growth FinTech businesses.

Our model assumes the business trades at ~55x today and compresses over time to ~30x on exit. Depending on the month, this would be in line with the Visa, PayPal, and other scaled players. That said, with the massive multiples some FinTechs are seeing (Square acquiring Afterpay at a triple digit EBITDA multiple 👀 ), there is a bull case to push this meaningfully higher.

Using this framework and these illustrative assumptions (not investment advice), we can build a VC case for ~$40B MKR in 5 years.

Closing Thoughts

Crypto protocols are creating game-changing products.

Builders are leveraging innovative tech and economic design to craft new business models. While not all of these businesses will have traditional cash flows seen in software, many do create quantifiable economic value. It’s time to innovate on financial theory to better understand fair value of the businesses that are on path to build our decentralized economy.

Note: None of the above is investment advice, nor reflects the views of Insight Partners.

Action steps

- Apply this framework to other DeFi tokens

- Adjust the model to your own thinking!

Author Bio

Evan is an investor at Insight Partners, a $40B AUM multi-stage VC based in NYC. He focuses on Series A to pre-IPO investments into high-growth businesses across crypto, FinTech, internet, software, and emerging markets. Interested in exploring the valuation on another protocol, reach out on Twitter @evanbfish.