How to Use DeFi-Native Leverage

Dear Bankless nation,

Leveraged trading isn’t for the faint-hearted. But thanks to the composability of DeFi smart contracts, these high-risk high-reward trades are accessible to people outside TradFi institutions.

Today’s newsletter looks at how Gearbox simplifies complicated leveraged trading strategies into a few clicks.

- Bankless team

Gearbox is a composable leverage protocol in DeFi. Whether you’re inclined to be a low-risk lender or a leverage degen, this Bankless tactic will show you how to approach Gearbox as it stands!

- Goal: How to use Gearbox Protocol

- Skill: Advanced

- Effort: One hour

- ROI: Yields from Passive Pools or one-click strategies!

A beginner’s guide to Gearbox Protocol

What is Gearbox? 🧰

Gearbox Protocol is a DeFi lending marketplace that specializes in composable leverage.

This emphasis on composability lets users take on leverage — i.e. using borrowed funds for further investment — and readily use that leverage for maximum effect through multiple protocols at once (e.g. Gearbox + Curve + Convex simultaneously).

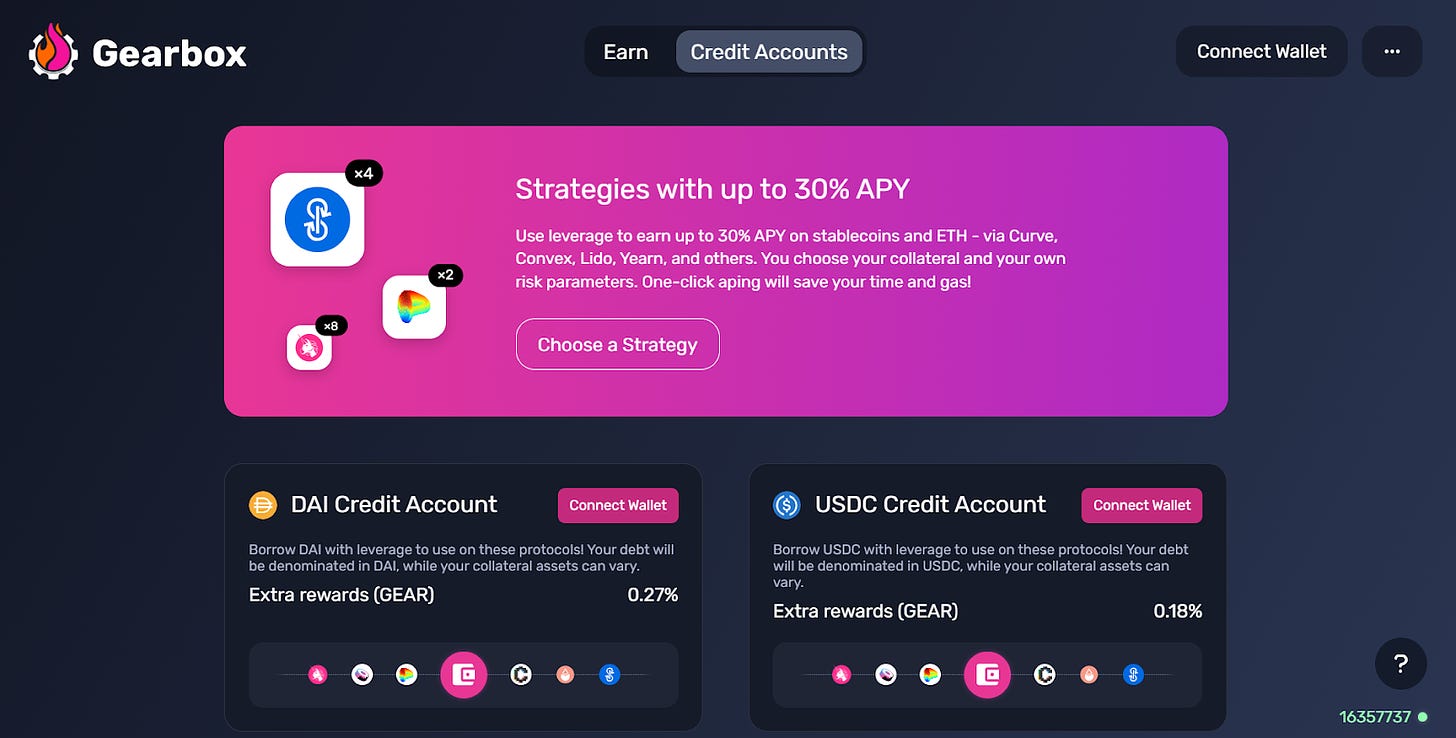

Specifically, then, Gearbox addresses two main user bases. The first are lenders, who seek to earn low-risk yields by providing crypto liquidity to borrowers, and the second are leverage degens, who borrow for leverage to try and amplify returns from more advanced, actively-managed, and higher-risk DeFi strategies.

The basics of Gearbox lending ⚙️

If you head into the Earn section of the Gearbox app, you’ll see a Passive Pools dashboard like the one below.

It’s here you can review the available lending pools, plus each pool’s current supply size, supply APY (the APY you’d earn from borrowers + GEAR liquidity mining) and borrow APY (the rate borrowers must pay).

Zooming in, prospective Gearbox lenders should keep in mind:

- dTokens are key — Diesel Tokens are Gearbox’s liquidity provider (LP) tokens, and lenders automatically accrue more of them over time via borrowers’ payments; GEAR rewards are handled separately with a dedicated page!

- No active management — You don’t have to worry about liquidations. The pools are all isolated, so you can kick back and earn by supplying your asset of choice on your own schedule!

- The GEAR yields can be volatile — expect Supply APYs to fluctuate!

- Gearbox lending is low-risk, but not no-risk — the protocol has been audited six times, but you should still research what its main threats are, and never deposit anything you can’t afford to lose just to be safe!

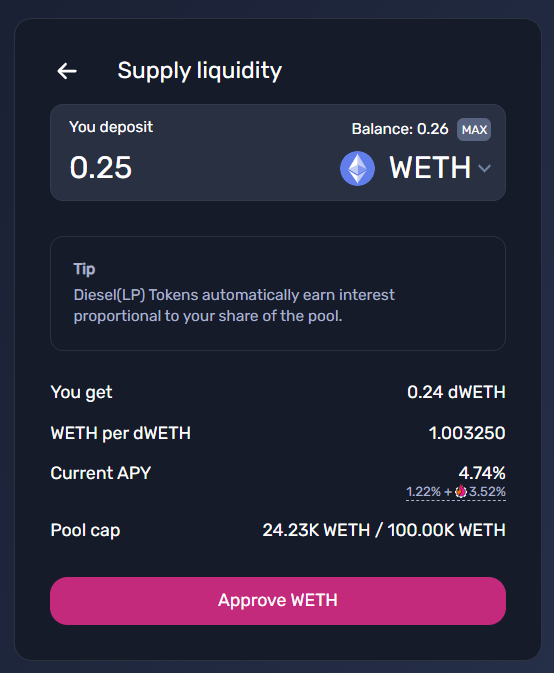

All that said, if any of these yield opportunities strike your fancy, you’d simply click on the pink Supply button for your desired pool. You’ll be asked to accept Gearbox’s terms and conditions, after which you could sign into the app via wallet signature.

Next, you’d encounter a Supply liquidity interface where you could input your chosen deposit amount. Review the info, fire off a token approval transaction, and then complete the final deposit transaction. When you’re ready to close your position, use the Withdraw button on the Passive Pools dashboard to proceed.

How to use leverage on Gearbox 💸

First, make no mistake that leverage can be very risky due to the threat of liquidations and thus Gearbox’s leverage services are for more experienced DeFi users and traders who are comfortable actively managing their positions.

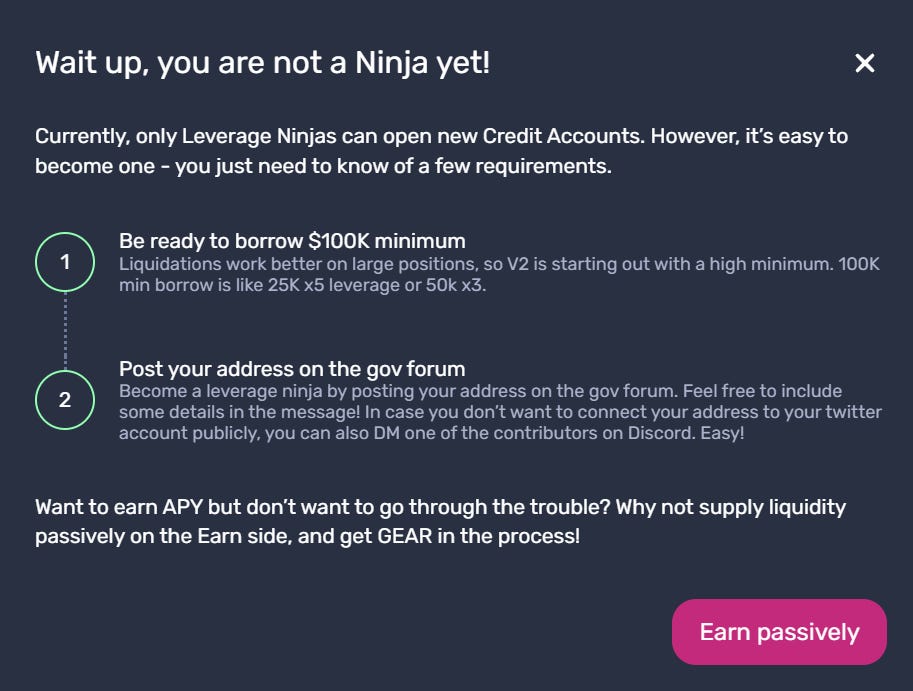

Besides, the Gearbox V2 lending products are new and thus still in a locked beta, which is currently only open to people who post their address in the Gearbox governance forum and are ready to borrow a minimum of $100,000 USD worth of crypto.

Of course, Gearbox’s DeFi-native leverage infra won’t be in beta forever, so let’s walk you through the basics of this system so you’ll be up to speed on how it works when it does launch to everyone in DeFi.

The Gearbox Credit Account

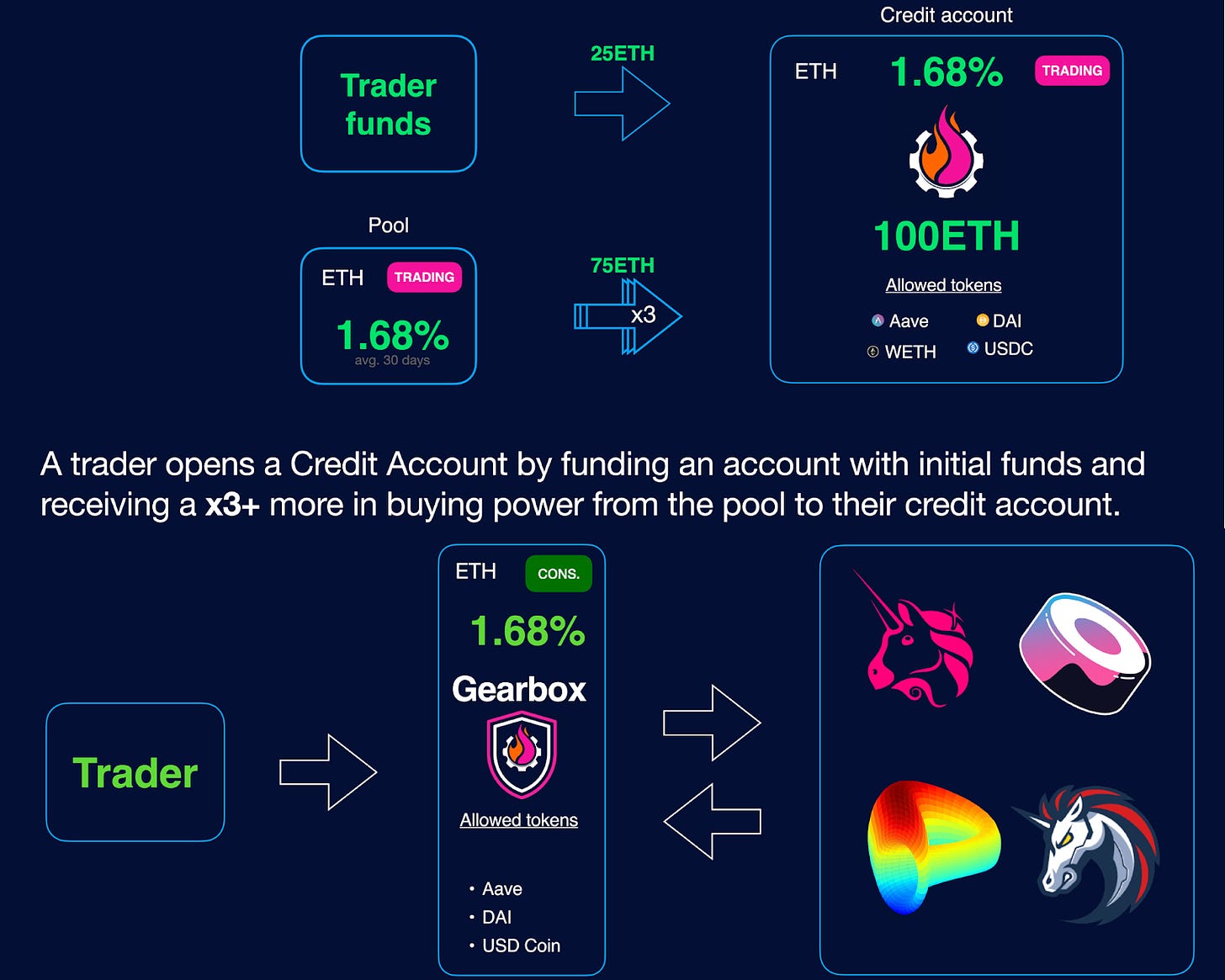

Central to the Gearbox leverage system are Credit Accounts.

If you’re a leverage degen — a “Leverage Ninja” in Gearbox’s terminology — these accounts are isolated smart contracts that are responsible for holding your collateral and your borrowed funds. You can think of one like an automated DeFi wallet that’s tailored for facilitating leverage.

“Funds on Credit Accounts are used as collateral for debt, and users can operate these funds by sending financial orders to their Credit Accounts,” Gearbox has explained. “That could be: margin trading on Uniswap or Sushiswap; leverage farming on Yearn; arbitraging pegged assets on Curve, and more!”

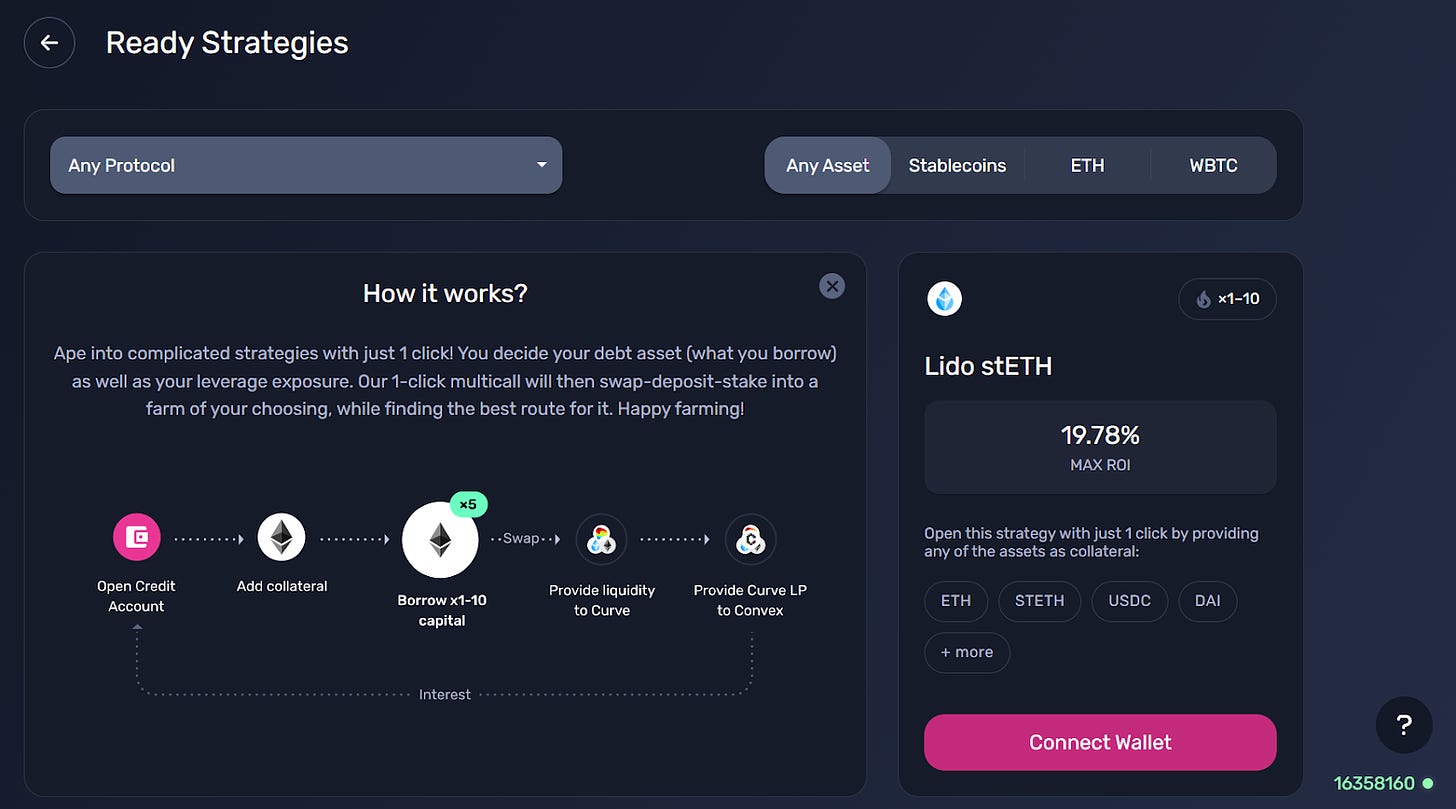

One-click strategies

To streamline the leverage process, Gearbox V2 also offers one-click strategies that let users open up a Credit Account, deposit collateral, and then lever up through external protocols with a single transaction.

For example, a couple of strategies that are possible right now include:

- Leveraged liquid staking — e.g. borrow ETH on Gearbox, buy Lido’s stETH, add to Curve stETH pool, and stake LP tokens in Convex to farm CRV, CVX, LDO, plus staking and trading fee rewards!

- Leveraged stablecoin farming — e.g. borrow DAI/USDC/USDT on Gearbox, add to Curve 3Pool, and stake LP tokens in Convex to farm CRV, CVX, and trading fee rewards!

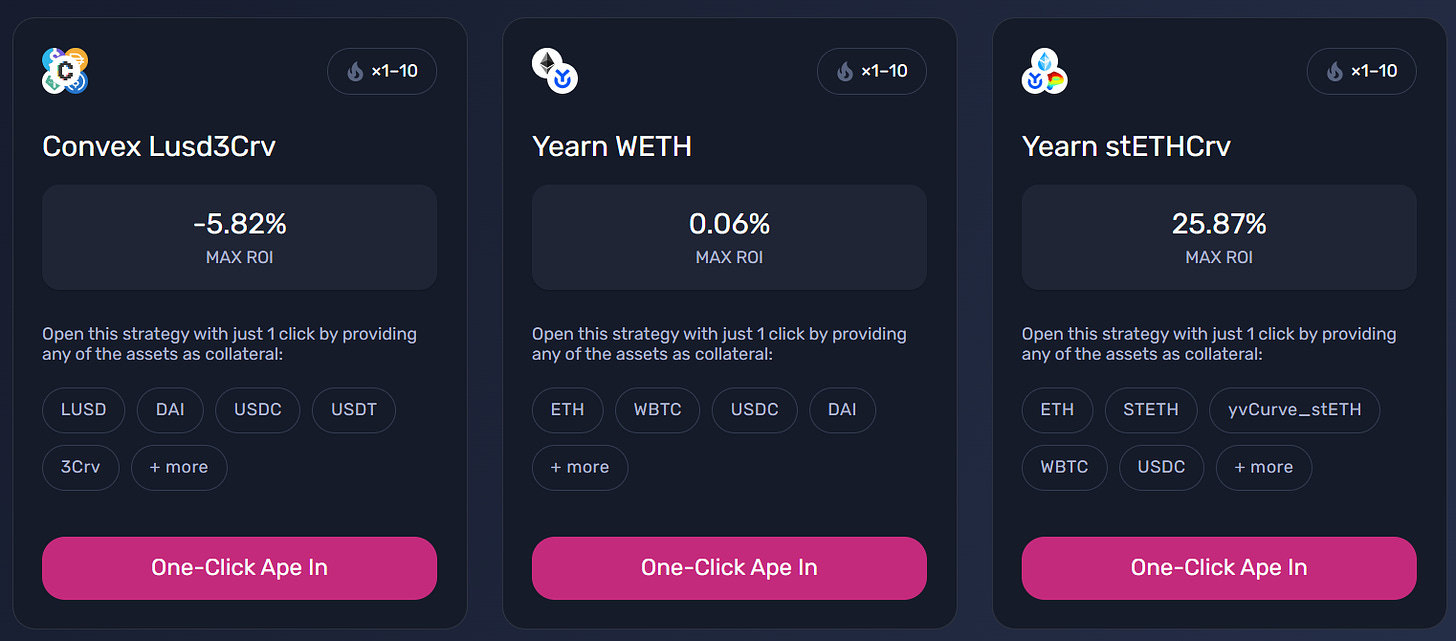

You can build your own custom strategies if you’d like, but Gearbox also offers a selection of ready-made strategies to pick from. Warning though: the opportunities range from totally unprofitable to very profitable, as you can see from the image below, so choose wisely and remember the rates can fluctuate considerably.

If any of the strategies stick out to you (and if you’re allowlisted/V2 is opened up), you would click the One-Click Ape In button for your option of choice. Then you’d:

- Choose your borrow asset (e.g. WETH)

- Choose your collateral (adding multiple assets is supported)

- Choose your desired leverage amount (from 1x to 10x)

- Review the position stats to double check everything

- And then complete your final deposit transaction to finish up!

Managing Credit Account positions

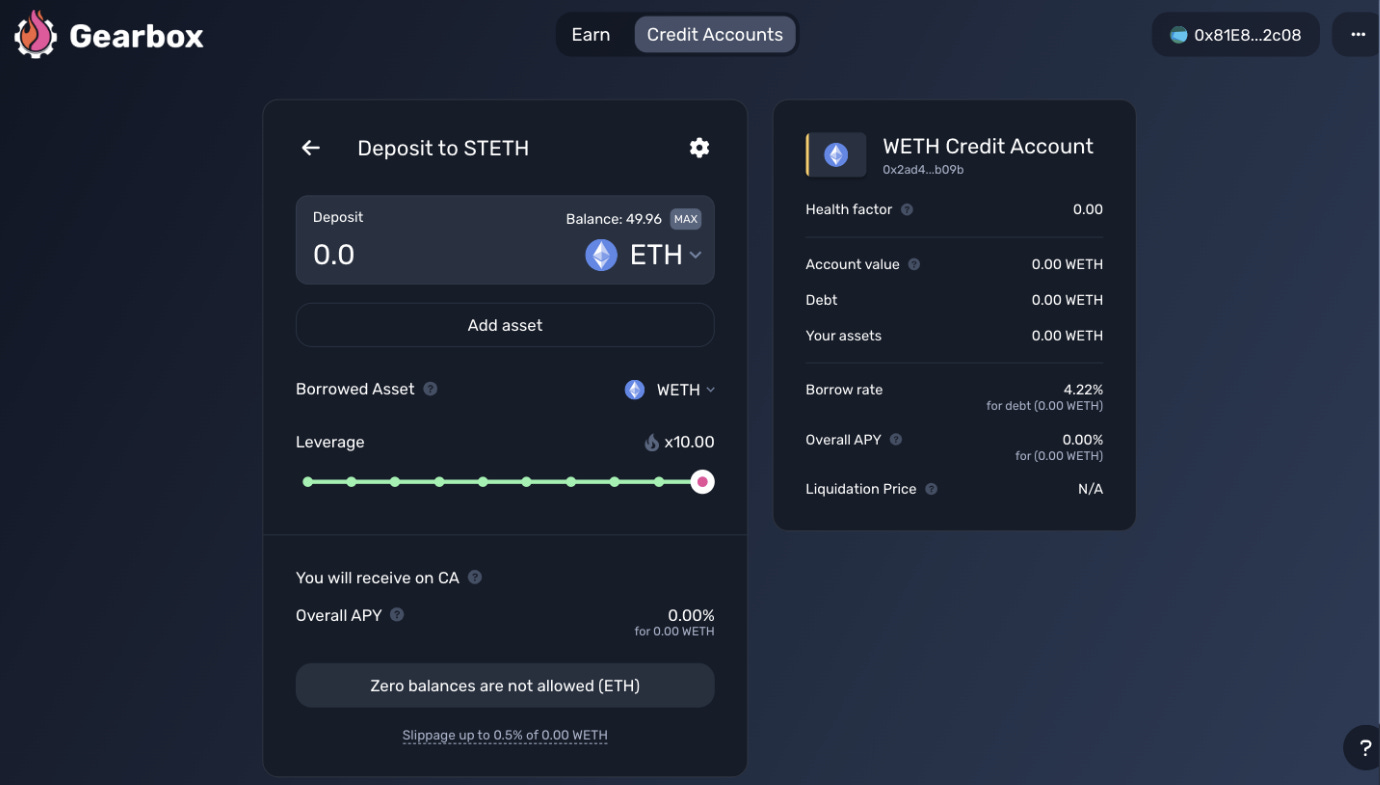

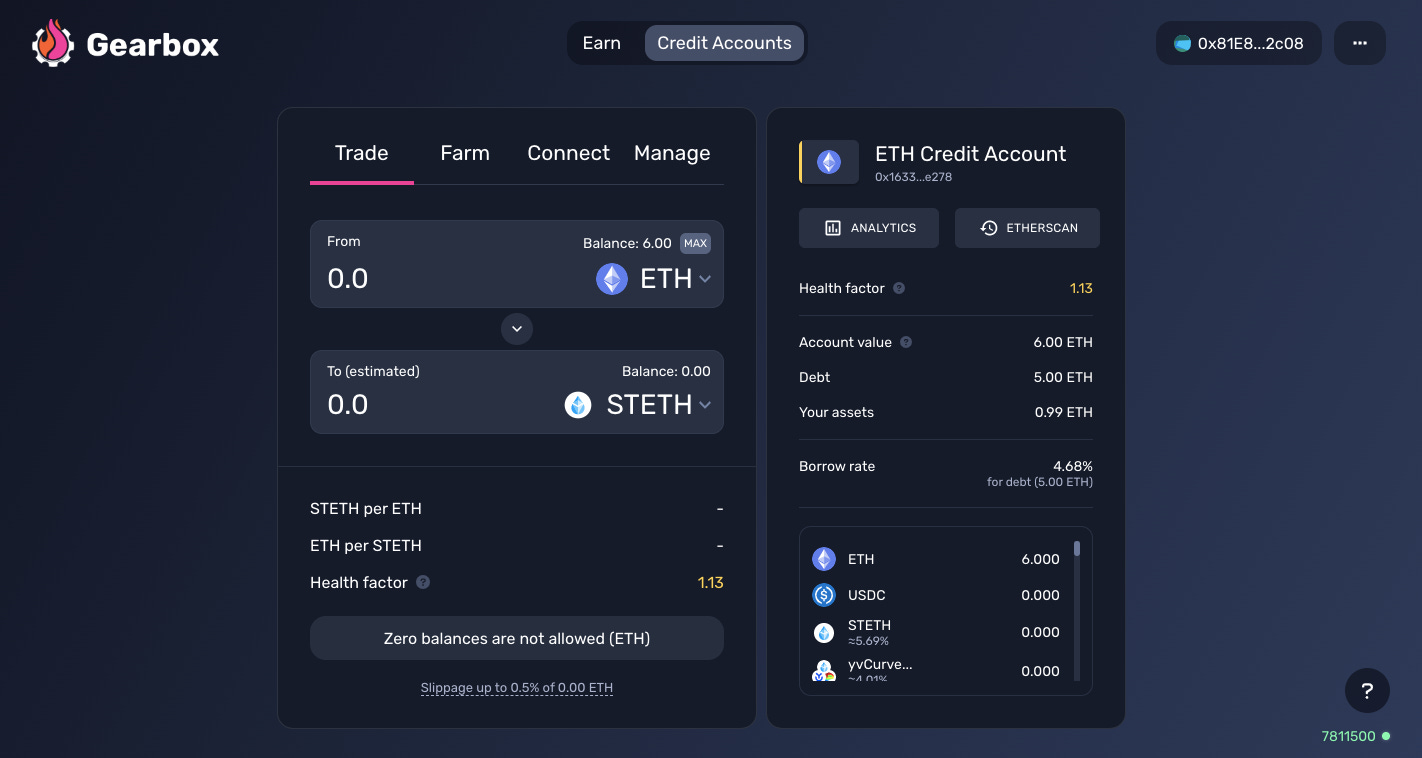

So let’s say you’ve hypothetically opened a leverage position using Gearbox, now what? Once your Credit Account and position are live, you’ll encounter a new management UI that looks like so:

Naturally, in this interface the Trade tab lets you swap your levered funds for other allowlisted assets, while the Farm tab is where you’ll find an ongoing list of the biggest DeFi yield farming opps to choose from. Select, deploy, voila!

Next, the Connect tab allows you to use WalletConnect to interact with DeFi protocol’s using their native interfaces, while the Manage tab is where you’d go to readily add more collateral, borrow more funds, decrease your debt, or close your Credit Account altogether.

As for specifically managing leverage, the main thing to keep in mind on Gearbox is that your position can be liquidated if its Health Factor metric falls below 1! Add more collateral or pay down your debt to mitigate the liquidation threat as needed.

Just the beginning for Gearbox

DeFi leverage certainly isn’t for everyone.

Yet for those who want leverage in crypto-native fashion, Gearbox is a compelling and rising option whose V2 solution has only just arrived.

The protocol has plenty more room to grow from here, then, and it’s sure to attract more than a few newcomers once its leverage tools open to everyone.

Be on the lookout for when that happens, but in the meantime Gearbox’s Passive Pools are decent yield opps for DeFi novices and experts alike!

Action steps

- ⚙️ Check out the Gearbox app + its Passive Pool opps

- 💥 Read our previous tactic How to protect against stablecoin blowups if you missed it!