How to Use Ajna Finance

Dear Bankless Nation,

Amid the recent uncertainty in DeFi, a new protocol has emerged...

Ajna Finance is a new breed of DeFi lending project, and it's aimed at offering users flexibility while minimizing points vulnerable to external manipulation. Let's get you up to speed on the basics of borrowing and lending with this rising project.

-Bankless team

Getting started with Ajna Finance

Bankless Writer: William Peaster | disclosures

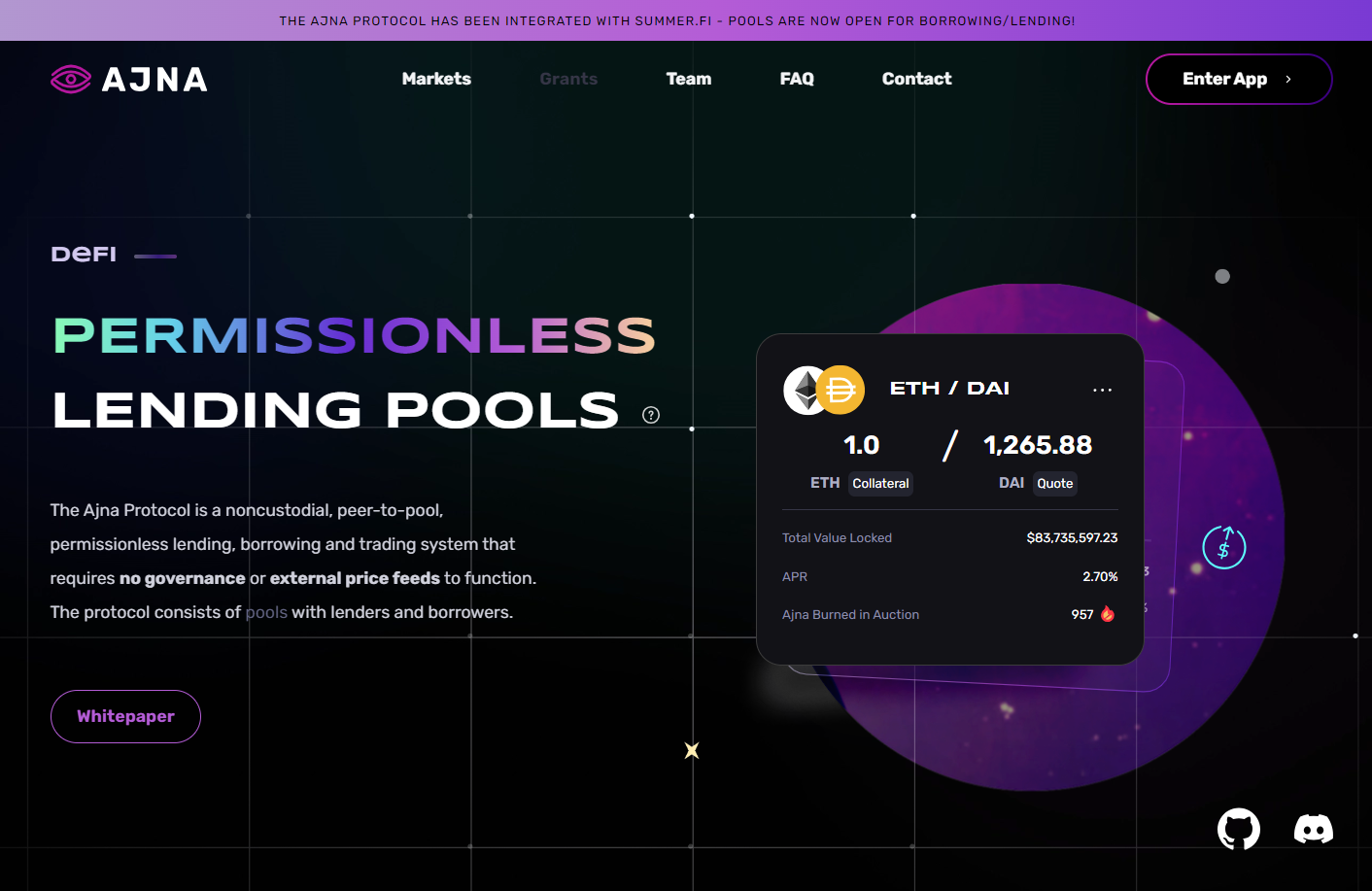

Ajna Finance stands out from the DeFi borrowing and lending crowd due to its unique oracle-less and governance-less design, which operates according to a peer-to-pool model.

As such, Ajna doesn't depend on external price feeds to determine asset prices or rely on governance voting to set parameters like rates or loan-to-value ratios.

These factors are entirely market-driven and managed by an internal order book within the protocol itself.

This innovative, low-touch approach minimizes risk by eliminating potential points of failure or points vulnerable to external manipulation. Additionally, Ajna is permissionless, allowing anyone to create a pool for any ERC-20 or ERC-721 compliant assets (though for NFT collateral pools, quote tokens still need to be an ERC-20).

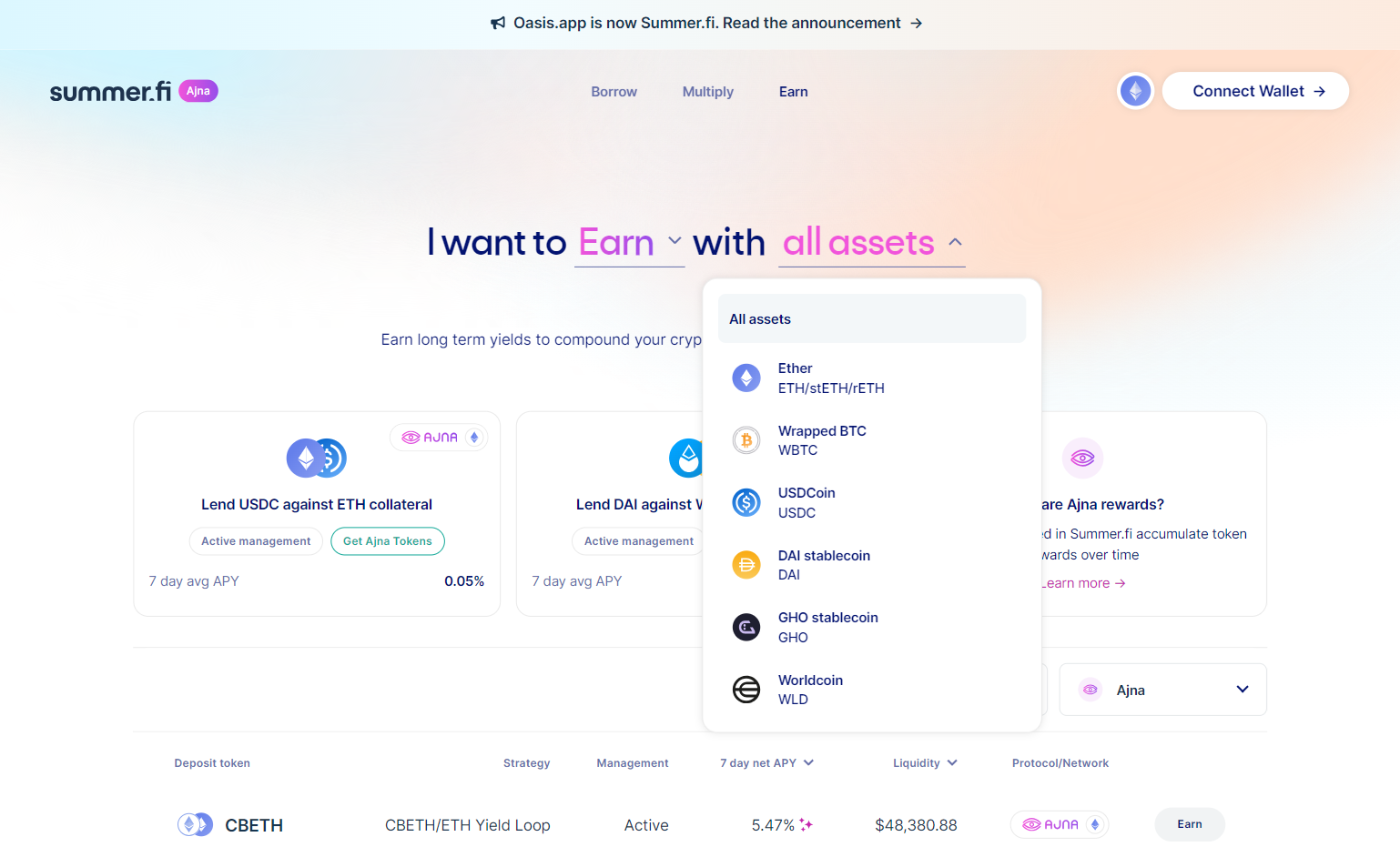

Zooming out, the Ajna team just launched their protocol, and one of the first things they’ve done since then is to partner with Summer.fi, a platform we just covered at Bankless that’s aiming to become the most trusted place for deploying crypto into DeFi.

Summer.fi is currently the hot platform for borrowing and lending through Ajna, so below we’ll walk through the basics of navigating the summer.fi/ajna integration specifically. Furthermore, users of Ajna via Summer.fi are currently receiving additional AJNA token rewards, so keep that perk in mind too!

A beginner's walkthrough to Ajna x Summer.fi

If you’re looking to borrow against or lend out some of your crypto in return for a yield, Ajna works differently to most lending protocols and thus requires some nuanced understanding of how the protocol works.

To dive deeper here, I recommend checking out the general Ajna FAQ and its Borrowing and Lending overviews. As far as the basics go, here’s a general primer on how to get started with Ajna via Summer.fi! 👇

Borrowing 101

- Go to summer.fi/ajna

- Connect your wallet

- Use the provided interface to choose the “Borrow” option and select your desired collateral, i.e. ETH, WBTC, or USDC

- Click on your desired pool, e.g. ETH/USDC

- Input your desired deposit amount, e.g. 1 ETH

- Input your desired borrow amount, e.g. 500 USDC

- To proceed, press the “Create DeFi Smart Account” button

- Make a final review of your position info and then press “Confirm” to continue

- Complete the transaction with your wallet, and then wait for the transaction to confirm

- That’s it! You can now press the “Go to position” button to go to your position management dashboard, where you can pay down your debt over time, borrow more, etc.

Lending 101

- Go to summer.fi/ajna/earn

- Connect your wallet

- Use the provided interface to elect your desired deposit capital, i.e. ETH, WBTC, USDC, or DAI

- Click on your desired pool, e.g. USDC/ETH (“Lend ETH against USDC collateral”)

- Input your desired deposit amount, e.g. 1 ETH

- Accept the default liquidity range or use the interface slider to alter your liquidity parameters

- To proceed, press the “Create DeFi Smart Account” button

- Approve the required token allowances for the tokens you’ve selected

- Make a final review of your position info and then press “Confirm” to continue

- Complete the transaction with your wallet, wait for the transaction to confirm, then press “Go to position” to manage your lending position going forward!

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further then Kraken Pro, a highly customizable, all in one trading experience and our most powerful tool yet.

The big picture

As with any DeFi project, it’s important to understand the risks involved for users, and Ajna is no exception here, particularly on the lending side of things.

Yet at the same time, Ajna is definitely an interesting new step in the direction of risk-minimized DeFi lending markets thanks to its oracle-free and governance-free approach. The project is also welcoming support for new tokens, like GHO and WLD, all the while.

That said, if you’re a frontiering DeFi pioneer, don’t sleep on this project — it’s brand new and offering flexible loan options + decent yields.

Action steps

- 🪬 Check out Ajna Finance: Borrow or lend on Ajna via Summer.fi

- 🔄 Catch up on the previous tactic: Getting Started with LayerZero