5 Tools for Crypto Whale Watching

Dear Bankless Nation,

In the bear market, it’s your responsibility to level-up your tactics for finding alpha. That’s why you’re here.

Today, we dig into the best tools and tricks for watching specific wallets so that you know what whales are buying as soon as possible.

- Bankless team

How to Swim with Whales

Bankless Writer: William Peaster

“Alpha” comes from being in the know. And if you’re not in the know, then following those who tend to be is certainly one way to try to make a killing in crypto.

In this week's write-up, we'll go over 5 free resources for monitoring the activities of the most prolific crypto wallets, i.e. “whales,” in case you want to try emulating their strategies.

- Goal: Learn how to whale watch for free

- Skill: Beginner

- Effort: 30 mins. to start

- ROI: Varies depending on the whales you watch!

🐳 5 Tools for Crypto Whale Watching

By closely tracking crypto and NFT wallets of note, you can potentially earn substantial profits.

However, the challenge lies in identifying the right alpha wallets at the right times in order to successfully capitalize on lucrative opportunities.

Here's a list of five free resources you can use to find, monitor, and act upon whale wallets as you see fit!

1) Arkham

LQTY was announced to be listed on Binance this morning.

— Arkham (@ArkhamIntel) February 28, 2023

This means a surge of interest in the on-chain pairs.

Here's an interesting case of MEV that we found, when a Uniswap V3 Liquidity Provider got drained for 70+ ETH in a single block. pic.twitter.com/4Ge0cY2Hhu

Arkham is a free, upstart crypto analytics platform that makes it easy to track crypto wallets, like those belonging to DAOs, influencers, major traders, and more.

For example, Arkham is a great platform for finding whales that got in on certain tokens early and then sold for much higher later. You can use the site to find a token that recently exploded in price, e.g. Liquity’s LQTY, and then readily identify whales that accumulated LQTY before it took off.

To do this, simply use the token search option to navigate to the token you’re interested in, like LQTY, then click on the “Time” button and select the time period right before the token took off (e.g. December 31st, 2022). Next, click on the "Value" button to sort transactions by value.

Once you've sorted transactions by value, you’ll then have an exhaustive list of all the whales that bought $LQTY right before the token recently started trending up. Here you can click on any address you like, at which point Arkham will show you the latest activity of that wallet as well as its holdings on Ethereum. You could then sort transactions by $LQTY token to find whales who sold from their token stacks for profit.

If you find a whale consistently making profitable trades, you can add that wallet to your Arkham watchlist dashboard going forward! At the time of writing, there was a waitlist to join the platform’s private beta, which you can sign up for here.

2) Etherscan + Dexscreener

3/ Head over to Etherscan and look up the token address to find its profile. Once you reach the profile, you want to press on Dex Trades. This button will show you all the buys, sells, and swaps that occur on all major Dexes. pic.twitter.com/A2tycDVq9I

— Minty (@DeFiMinty) January 6, 2023

Don’t feel like waiting to join the Arkham beta? No worries, you can use the analytics combo of Dexscreener and Etherscan to replicate the same sort of insights immediately.

For instance, with these tools you’d start on Dexscreener by searching for tokens that have undergone major price surges, and once you find such surges you want to note the specific dates they occurred on.

At this point, you’d head to Etherscan and copy over your target token address in the search bar to access its main dashboard page. Once you’re on that page, click on the “Dex Trades” button to see all of the buys and sells that have occurred for that asset on decentralized exchanges (DEXes).

Next, you’d click on the “Action” button and then “View All” to see the full list of historical DEX transactions, then you’d hone in on the time period (right before your target price surge happened) for analyzing.

Here, you’ll want to keep an eye out for larger buy transactions, and — if you find any — you can investigate them further by clicking on the transaction’s hash. Doing so will bring up all of the main details, e.g. the wallets that participated in the swap, the fees paid, and beyond.

Once you’ve identified some alpha wallets like this, you can dig through their wallet histories to see if they’re raking in profits from their recent buys and sells!

3) Impersonator

Pretty slick little tool. Lets you connect to any WalletConnect dapp as an arbitrary address if you want to easily see someone's positions or other info without querying the chain and building it up from scratch: https://t.co/Yl8UpslRGI

— Tom Schmidt >|< (@tomhschmidt) July 25, 2022

Impersonator is a tool developed by Apoorv Lathey, the lead protocol developer at NFTX, in 2022. It enables users to log in to web3 applications by impersonating any Ethereum address through WalletConnect.

However, for all you degens out there keep in mind that Impersonator is only a visual solution for monitoring activities, as logging in to view an address doesn’t permit any transactions since this system doesn’t touch private keys.

Nonetheless, users can enter a specific wallet, such as rsa.eth or vitalik.eth, into Impersonator to obtain a firsthand view of their recent crypto activities!

Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7.

4) DeBank

1/2

— DeBank (@DeBankDeFi) February 17, 2023

Dear OGs, do you still remember that you left a deposit on EtherDelta many years ago?

I guess you might have completely forgot about it as EtherDelta's UI has been taken down.

The good news is that now DeBank has supported EtherDelta's portfolio! https://t.co/MpFSk50WCr

Interested in a tool like Impersonator where you can explore activity for any Ethereum address, but want it to be a generalized dashboard for that address’s stats instead of a login visualizer for one app at a time? Then you ought to check out DeBank!

DeBank is a wallet analytics tool that has a really friendly UI that you can plug any address into. For example, this is the DeBank Profile page for the Ethereum Foundation; you can access a similar page to track whatever wallet you want by appending your target wallet’s address onto the end of the https://debank.com/profile/ url.

6.

— DefiDog (💙,🧡) (@ArbiAlpha) February 21, 2023

3 Main Reasons to look up whale TXN

👉 Do they have more to dump? ↓

👉 Do they have stables to buy more? ↑

👉 What other projects do they like?

You can also observe

👉 Stables?

👉 Other transactions?

👉 NFTS

Looking up their wallet on @DeBankDeFi offers a lot of value. pic.twitter.com/8bNaaq37Da

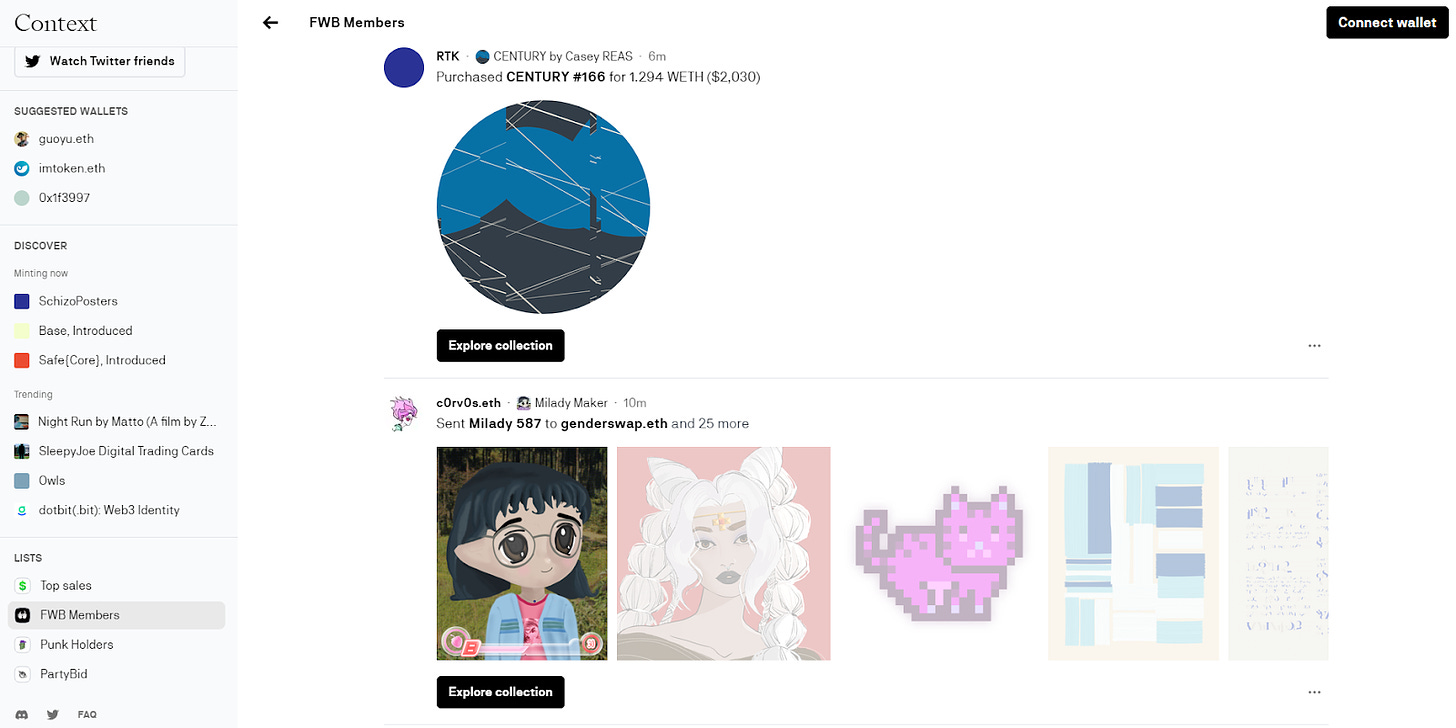

5) Context

Context is a platform that enables you to monitor the NFT activities of your target crypto wallets, ensuring that you always stay up-to-date with the newest NFT happenings from people you care about — through the platform's feed stream or navigation bar.

Connect your wallet, hook up your Twitter network, click “Watch all,” and get to watching! That’s all it takes with Context, which is part of the mint.fun and Lanyard product family.

Zooming out

Make no mistake, whale watching has its pros and cons. It’s one way to try to score big wins, but it’s also a potential avenue for racking up big losses. What’s right financially for a huge crypto player may not be right for your portfolio.

That said, it’s extremely important to conduct your own research and analyses to make decisions based on what you determine is best for your personal goals and risk tolerance levels. With diligence and a sound strategy, though, it’s absolutely possible to earn substantial gains through tracking major crypto wallets using free resources like the ones mentioned above!

Action steps

- Learn to whale watch: add Arkham, Dexscreener, Etherscan, Impersonator, DeBank, and Context to your crypto tracking toolbox 🐳

- Dive into NFTfi: follow last week’s tactic to learn about 5 under-the-radar NFTfi opps 🔥