Solana is currently one of the fastest rising hubs for DeFi, and of the top 10 biggest DeFi apps on Solana today, Save, which just rebranded from Solend, stands out as a leading protocol on the network.

So what’s new? Amid its rebrand, Save just announced it’s branching out from lending with three fresh offerings: SUSD, saveSOL, and dumpy.fun. Here are the basics:

- 🪙 SUSD — A stablecoin on the Solana network, SUSD allows users to borrow against SOL with no interest. It aims to fill the demand for a liquid and decentralized stablecoin in the Solana DeFi ecosystem.

- 💎 saveSOL — A SOL liquid staking token (LST) designed to offer holders flexibility and liquidity while earning yield. Notably, it will be usable as collateral for borrowing SUSD.

- 🎊 dumpy.fun — A new platform for shorting Solana memecoins that is built to offer a safer alternative to perpetuals trading and to allow users to more easily profit from market corrections.

Now, we’ve seen stablecoins and LSTs on Solana before, but a platform for easily shorting Solana memecoins is unique in the cryptoeconomy currently.

We’re excited to unveil the rebranding of Solend to Save, Solana’s permissionless savings account.

— Save (formerly Solend) (@solendprotocol) July 24, 2024

Along with this rebrand, we’re announcing three groundbreaking new products: SUSD, saveSOL, and @dumpydotfun.

1/n pic.twitter.com/93TVOXO3AM

As some of you recall, I recently wrote about Wasabi, a leverage trading protocol that lets you short memecoins on Blast. dumpy.fun is similar to Wasabi, but Solana is the undisputed capital of memecoins today, so this new platform has big potential.

How does dumpy.fun work?

dumpy.fun lets you short memecoins to potentially profit from their price declines. In other words, users select a memecoin they believe will drop in value and can apply leverage to increase potential returns, though this also increases risk. Underneath the hood, the platform borrows assets via Save and swaps them using Jupiter, the popular Solana DEX aggregator.

Once a short position is established, users can profit if the memecoin's price falls. When the user decides to close the position, they repay the borrowed assets, pocketing the difference if the coin’s value has decreased.An interesting twist is how the platform eventually plans to feature a "squeeze explorer" that displays short liquidation thresholds, encouraging communities to rally and trigger short squeezes. This adds a PvP dimension, where users can force liquidations and profit from the resulting market movements. On the flip side of the equation, liquidity for these shorts is provided by bulls who deposit their memecoins to earn high borrow rates, and the entire process is onchain for transparency.

How to short on dumpy.fun?

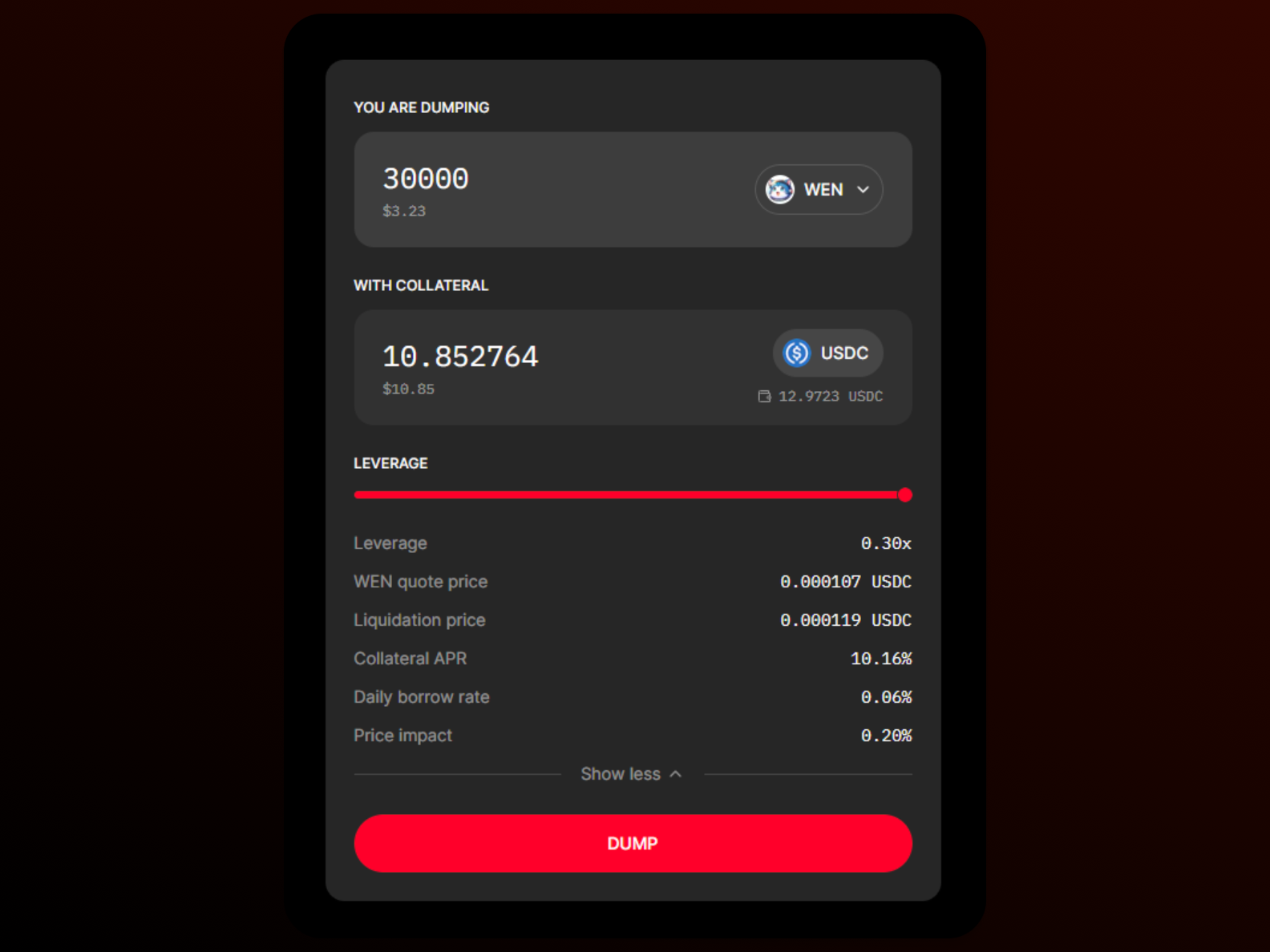

You will need a Solana wallet like Phantom, some SOL to pay for transactions, and some USDC for borrowing collateral to get started on the platform. Once you’re primed and ready to dive in, you would follow these steps:

- 🤫 Get the password — The dumpy.fun beta is gated by a password that you can find pinned in the project’s Telegram channel.

- 🪙 Connect your wallet — Visit dumpy.fun, input the password, and connect your Solana wallet.

- 💎 Select a coin to short — In the trading interface, choose the asset you believe will drop in value. WIF, WEN, BONK, W, and SOL are currently supported.

- 🎊 Set your parameters— Input the amount you want to short, then choose how much leverage you want to apply using the interface’s slider button.

- 🔄 Start your short — Press “DUMP” and complete the transaction with your wallet, after which your selected coin will be borrowed via Save and then automatically swapped on Jupiter for USDC.

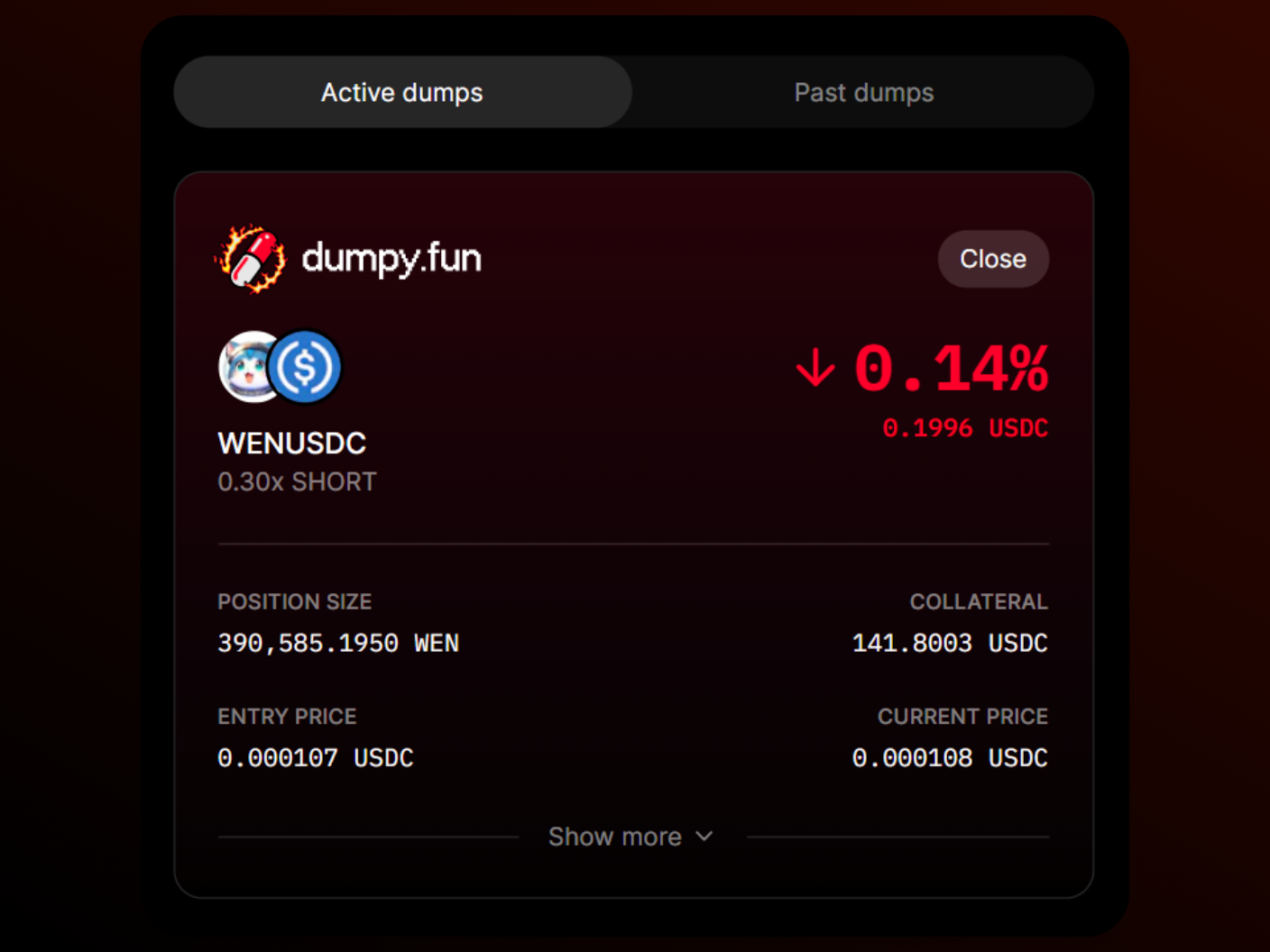

- 📉 Monitor and close your position — Keep an eye on your shorted coin’s price and close your position through the “Active dumps” tab when you're ready to take profit or cut your losses.