Dear Bankless Nation,

In the world of centralized finance, loans were envisioned as tools of financial empowerment, giving people the upfront capital needed to pursue meaningful ventures—education, homeownership, business.

But as with most centralized entities, over time that ideal soured and loans turned into tools of profit maximization.

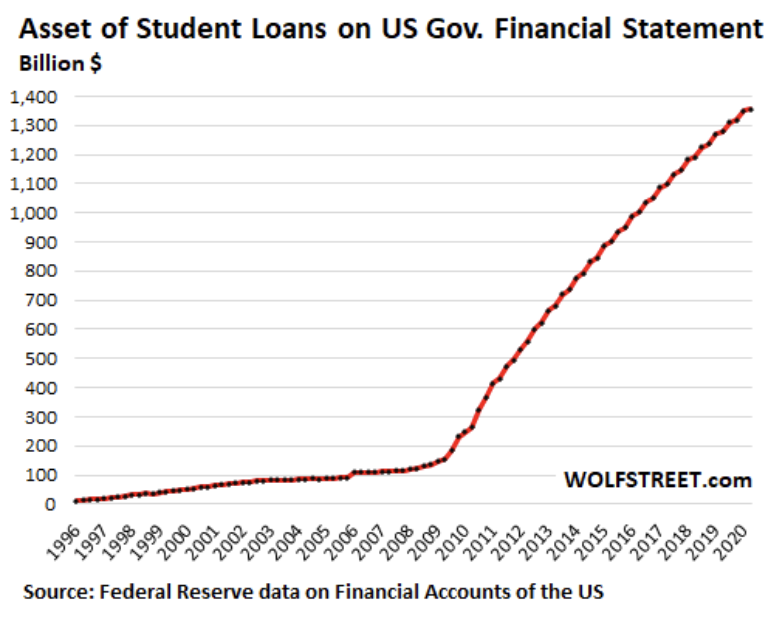

Student loans are one example. The next generation of the U.S. workforce is straddled with crushing student debt, ballooning to over $1.5T in 2020.

Banks are approving teenagers for massive six-figure loans with nearly double-digit interest rates at a time when a college degree is often just the bare minimum.

Stuck in the cycle of pinching pennies, refinancing, and chipping away at a lifetime of loans, is it any surprise that student debt is intimately linked with mental health?

DeFi brings power back to the people.

Using decentralized financial protocols, we can take our financial sovereignty back from centralized institutions.

We can leverage permissionless money legos and form our own financial strategies.

We can go Bankless.

Here’s how.

- RSA

PS, I’m going to be attending Bankless DAO’s Season 2 launch event. Are you?

Guest Writer: Robin Kim is a Founding Engineer at Gallery, a platform for NFT collectors to showcase their art. He is also a Senior Software Engineer at Coinbase.

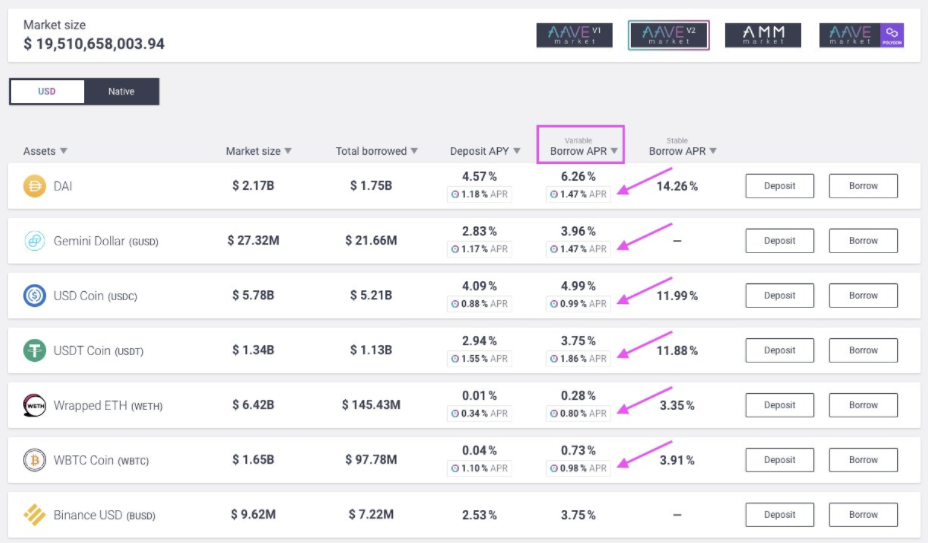

Aave is a decentralized lending protocol, allowing users to borrow, lend, and earn interest on a number of crypto assets. Aave’s rewards programs also distribute AAVE as well as L2 tokens for borrowing and lending as an added incentive.

This tactic demonstrates how you can leverage incentive rewards and interest rates to pay off CeFi loans.

- Goal: Learn how to use Aave to pay off CeFi loans

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: Lower rates and 0 interest

A CeFi Tragedy

I graduated from New York University in 2015 with roughly $150,000 in student debt at an interest rate of 8.8%. I know, it was foolish of me to sign those papers in the first place! But when you’re young, naive, and a little dumb, you assume that things will one day work themselves out. More importantly, there’s no way a well-respected institution would knowingly provide a borderline exploitative loan subsidized by the federal government and crony capitalism to a low-income, financially illiterate teenager... right?

As I waved from the auditorium stage on graduation day, it dawned on me that I would likely carry this debt for the rest of my life, unless I worked a million jobs and ate rice and potatoes for every meal.

No joke, I actually only ate rice and potatoes for the first few months out of school.

Thankfully I lucked into working at some great companies and taught coding as a side hustle. I was able to chip away at the debt and reduce the interest rate by growing my income and refinancing over time. I paid refinancing fees to the CeFi lenders at each step, which I deemed to be worth the cost.

Last year, when the Fed cranked up the money printer into overdrive and compressed interest rates, I refinanced once again to a heavenly 3.5% rate.

Coming from 8.8%, I felt much less pressure to pay off my loan quickly. Society went as far as to categorize it as “good debt” – whatever that meant. I patted myself on the back for this remarkable accomplishment and assumed it couldn’t get much better than this… right?

Wrong.

While my CeFi loan sat at 3.5% APR, I still felt the pain of ~$1,700/month payments. Does this need to be going towards my debt right now? And does it need to be on the same day, every month?

Because I refinanced through a private lender, I wasn’t able to enjoy the student loan interest freeze, wouldn’t be able to qualify for loan forgiveness in the future, and missing a payment would damage my credit. (Admittedly, I signed up for this in order to bring down my rate in the first place.)

One way to lower payments would be to pay down a significant chunk of principal by selling some of my crypto holdings. However:

- Crypto had appreciated over the years and I didn’t want to incur capital gains taxes

- Rotating out of crypto would incur an opportunity cost in upside exposure

In other words, if I believed that ETH would appreciate more than 3.5% per year over the next 5 years, I’d be better off holding onto it versus using it to pay off my loan.

So how did I solve this through DeFi?

Disclaimer: Whether or not ETH actually performs at that rate is a different story. Not financial advice. DYOR.

The Play on Aave

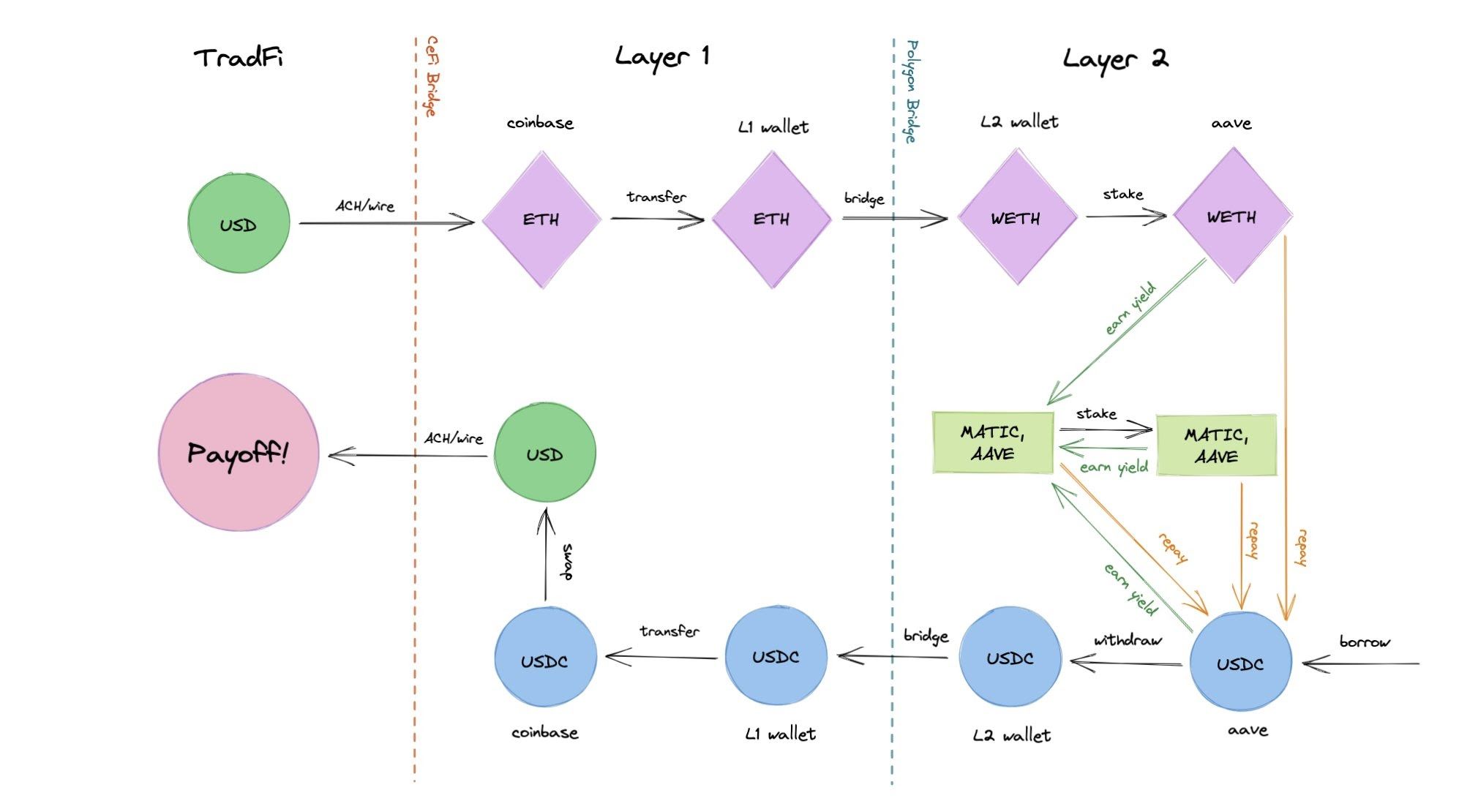

TL;DR – I borrowed the CeFi loan amount in USDC using the DeFi lending platform Aave, converted the USDC to USD on Coinbase, and paid off my CeFi loan.

“Hold on ser: you just moved your loan from CeFi to DeFi? Did that actually accomplish anything?!”

Yes, I do still owe that amount to the DeFi protocol. It didn’t just disappear. But there are some key benefits so let’s explore the tradeoffs!

Benefits of DeFi Loans

No Fixed Period

The lack of a “repayment period” was a pretty big culture shock. I can hold the loan indefinitely. There’s also no minimum payment and no monthly cycle.

This means I can pay down my debt, whenever I want, however I want.

If I’m going through a period of high expenses, I can skip payments without having to worry about calling anyone or impacting my credit score. My payments also go through instantly, as opposed to waiting 3-5 business days for it to crawl through the ancient pipes of CeFi.

Subsidized Borrowing

In DeFi, you’re “paid” to borrow. Think of this as a promotion for using the platform, similar to the $200 referral bonus I got from my CeFi lender for refinancing with them.

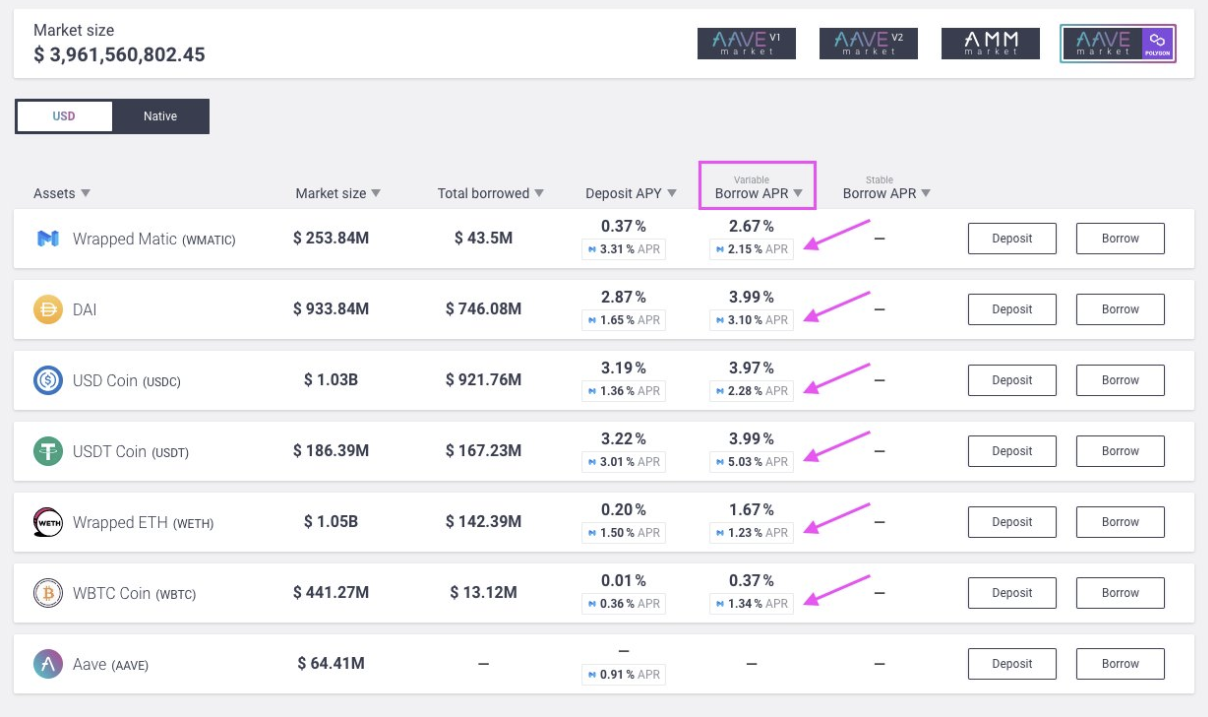

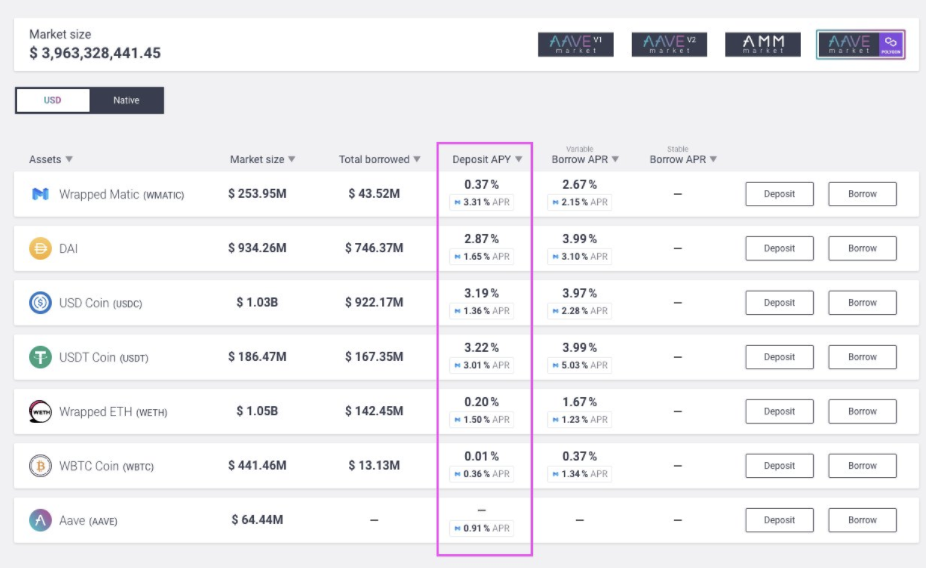

On Aave, your borrow rate is subsidized by a steady stream of AAVE, the protocol’s governance token.

Bonus: Polygon Incentives

Aave also has a Polygon market, where you’re subsidized via MATIC (as of October 2021 they also support Avalanche). Generally, the net interest rate on the loans is smaller via Layer 2 incentives. This gets even better if you’re generally bullish on MATIC and see the Polygon ecosystem burgeoning over time.

Incentivized Deposits

In order to borrow, you need to deposit collateral. Collateral is how the protocol secures your loan. Aave isn’t just giving you free money; you need to give them the assurance that you can pay them back.

DeFi allows this to occur swiftly, efficiently, and transparently, without counterparty risk.

Your collateral can then be loaned out to other users on the platform (perhaps even yourself) to reap the fruits of their interest payments. This is the fundamental business model for banks, and in this scenario, you get to be your own bank! Once again this does not involve any centralized authority or counterparty risk.

But wait, there’s more. You also get incentivized rewards for the act of depositing! You’re paid in MATIC on Polygon and AAVE on L1 Ethereum.

No Fixed Period

I know this was my first point but I need to highlight it again. To understand it, though, we need to understand LTV:

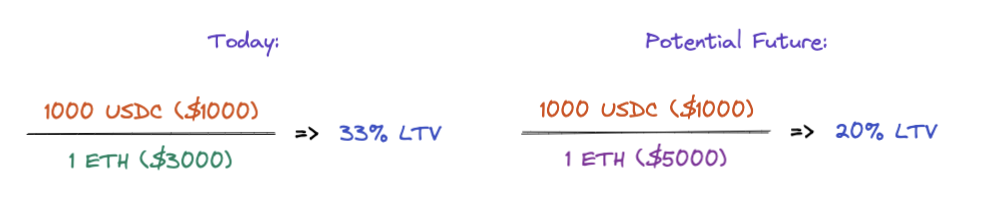

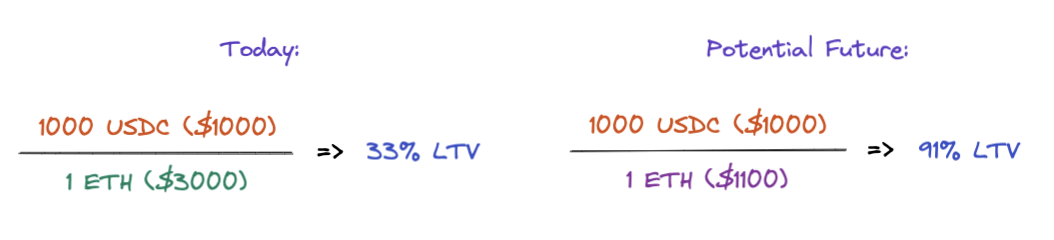

Aave uses a metric called Loan-to-Value to determine the health of your loan. LTV is simply the ratio of your loan relative to your collateral. If you’re borrowing $500 against $1000, your LTV is 50%. If you borrow $800 against the same amount, the LTV is 80%, and so on.

The lower your LTV, the healthier it is, which you can control by increasing your collateral or decreasing your borrowed principal.

Now let’s introduce crypto-denominated lending and borrowing.

Say you deposit 1 ETH (~$3000) and borrow 1000 USDC against it. This gives you an LTV of 33%. Then let’s say ETH continues to have a good year and reaches $5000.

Since your loan is still worth 1000 USDC, LTV decreases to 20%!

What does this mean? In theory, if crypto continues on an up-and-to-the-right trajectory, you would never need to repay the loan, as it would represent a decreasing fraction of your overall deposit.

You may think this is some crazy, unprecedented hack, but this is precisely why rich people die with a lot of debt: they lever the hell out of their assets (aka as collateral).

Continued Upside Exposure

Remember how I wanted to avoid selling my ETH in case I missed out on potential future gains? Since my collateral is literally ETH, I’ll be able to enjoy the upside if it moons.

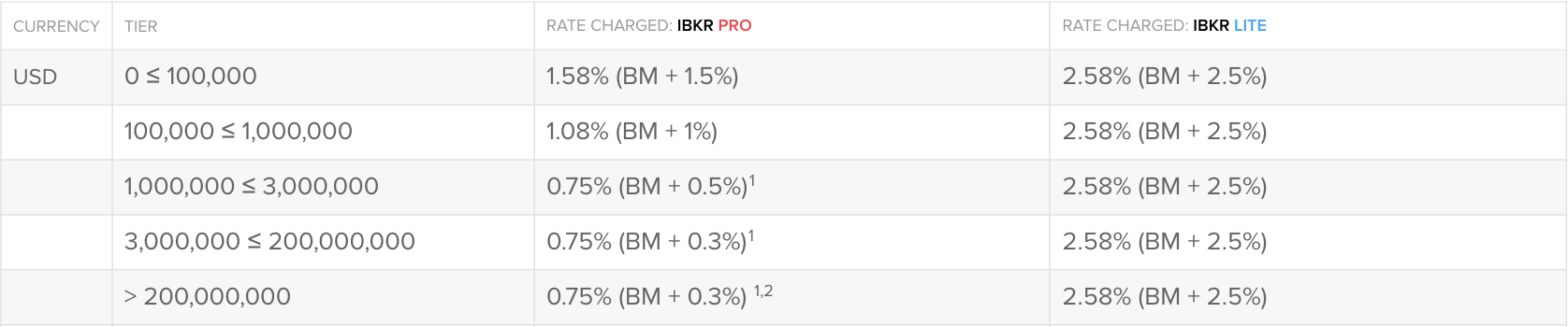

This strategy is nothing new. In CeFi, folks who have held onto a lot of stocks for a long time and don’t want to reduce their exposure can borrow cheaply against them.

Layer 2 Scaling

I chose to use Polygon for lower fees and faster confirmations. Why?

Almost every action you take on Aave is a smart contract interaction (depositing, borrowing, claiming rewards). This means you could pay a hefty fee—sometimes up to hundreds of dollars at each step—if you’re on L1 Ethereum.

L2s allow me to have more flexibility in managing my loan. I could claim my earned MATIC as often as I’d like, rather than waiting until I “break-even” in fees. I could even stake the earned MATIC to juice further returns before I decide to pay down my principal.

Using L2s greatly increases the efficiency of capital allocation due to significantly lower gas costs.

Self-Repaying Loans

Under certain conditions, the loan pays for itself! Let’s put our concepts together:

That said, note that the rates are variable and may not stay this way in the future. We’ll go over this in the risks section later on.

Risks of DeFi Loans

Now you might say: “Thank you ser! All of these DeFi thingies sound amazing and nothing could possibly go wrong, taking out a self-paying loan ASAP to buy a new house!”

I appreciate the kind words, but that’s completely wrong: There are some very serious systemic risks!

Liquidation Risk

Remember the LTV exercise we did? It laid out the optimistic case where ETH rises in value. The opposite can happen where a black swan event causes a massive drawdown, increasing your LTV:

The fact is no one knows how ETH will perform in the future. It’s probably too painful for you to remember, but Ethereum dipped below $100 in March 2020 during the height of the COVID black swan. I vaguely recall my soul leaving my body during that month.

On the way down, Aave will realize you’re at risk of not being able to repay your loan and begin selling your ETH to make itself whole. This process is called liquidation, aka. getting rekt.

To avoid liquidation, you can either a) pay down a portion of your debt and/or b) add more collateral, both of which make your LTV healthier. This flexibility in DeFi is heavily underrated.

The Liquidation Threshold is the point at which Aave will begin selling your collateral. The threshold varies per asset based on liquidity, volatility, smart contract risk, etc., and you can read more about the risk parameters here. These levers are in turn governed through a decentralized process.

Smart Contract Risk

Smart contracts run the Aave protocol. This means that lending, staking, borrowing, liquidating, interest rates, etc. are all controlled by automated processes. As exciting as this is, those contracts were ultimately written by humans, and it is impossible for any one person to understand how all of this code will interact with each other in practice, now or in the future.

There are many cases of DeFi platforms getting rekt by unforeseen vulnerabilities. The nightmare case would be your collateral getting called away through an exploit, making you lose more than the value of your initial loan.

In addition, I mentioned I was borrowing via L2 Polygon. This is a newer, less battle-tested protocol that’s built as a layer on top of L1, so the risks are compounded: I’m exposed to the potential bugs on both L1 and L2.

There are dozens of amazing DeFi platforms out there. In general, the newer protocol => the higher the promo rates, but that comes with increased risk given its shorter existence running in production. I chose Aave because they’ve been around since 2017 and have ~$25B locked in the protocol.

Variable Rates and Returns

Aave’s Polygon market doesn’t let you borrow at a stable rate. Since rates are variable, your borrow APR could spike depending on the supply and demand. An event like this could make my DeFi loan more expensive than the 3.5% I had in CeFi.

Also, remember that parts of my loans are subsidized. As the ecosystem matures, there will be less MATIC to hand out to participants, ultimately making the loan more expensive.

Market Risk

The last thing I want is for this post to go viral and have everyone take out a loan and max their LTVs and buy mansions. Pushing leverage to the limit is precisely how we ended up with the 2008 housing crisis. Make sure to be vigilant in keeping your loan health in check!

Conclusion

With these tradeoffs in mind, I made the personal decision that the risks are worth the benefits.

Let’s summarize:

Pros

- Flexible repayment options & terms

- Flexible loan health management

- Freeing up $1700/mo

- Getting token rebates to deposit and borrow

- Maintaining exposure to crypto upside

- Instantly claiming rewards, moving funds in L2

- Learning about DeFi (the best part of all this)

Cons

- Liquidation risk

- Smart contract risk

- Market risk

- Variable rates & returns

Time will tell whether I make it out of this alive without getting liquidated. But, having dipped my toe in, I can say with confidence that DeFi will eventually eat CeFi, and now is the best time to learn about these emerging technologies.

P.S. None of this would’ve been possible without the guidance of Dennis Qian’s galaxy brain, who shepherded me through this process.

Action Steps

- 🎓 Learn more about Aave from Bankless

- 💰 Borrow and lend on Aave

- 🎧 Listen to our interview with Aave’s founder, Stani Kulechov