How To Get In The NFT Market

An unofficial NFT Guide - What is an NFT?

Dear Bankless Nation,

NFTs, NFTs, NFTs. Nonfungible tokens. What is an NFT?

The headlines are everywhere these days. Literally…this is from today. 👇

Mark Cuban is on the train. Chamath is building a sizable portfolio. NFTs platforms having $50m dollar months. Anyone with a community will capitalize on the wave.

There’s no doubt that NFTs are going through their own hype cycle.

So how can someone capitalize on the opportunity? What are the best ways to get exposure to this asset class?

That’s what we’re going to answer today.

William Peaster (he writes our NFT newsletter—set email notifications “on” to get it) runs us through the options we have today. And surprisingly, there’s more to it than just “buying NFTs”.

Let’s explore how to get exposure to NFTs.

- RSA

Tactic Tuesday

Guest Writer: William M. Peaster, lead writer of Bankless’s NFT publication Metaversal.

How to get exposure to NFTs

Everyone in crypto is talking about NFTs lately. But why?

They represent the future of digital content. They’re on-chain, programmable, tradable, permissionless, and DIY media legos built for the digital age.

These blank digital canvases are game changers for creators of all stripes. But it’s one thing to talk and gawk about them, and it’s another thing to start trying to get direct NFT exposure in your portfolio. So where do you even start?

That’s where many people find themselves lately, both crypto novices and veterans alike. There’s no shame to your game no matter what walk of life you come from: everyone’s in the same boat right now trying to grasp NFTs and their potential, from small artists to big institutions.

So how does someone start taking up promising positions around the blossoming NFT economy?

Well it’s as pertinent a question as ever, seeing as how billionaire investors like Mark Cuban and Chamath Palihapitiya are currently diving head first into NFTs. Do you want to be late to this once-in-a-lifetime cultural party?

This tactic will show you how you can build your NFT portfolio through a variety of means, including directly buying NFTs, buying NFT platform tokens, or buying NFT index fund tokens.

Of course, make sure to do your own research! This guide is only some ideas on how to get started.

- Goal: Get NFT exposure in your crypto portfolio

- Skill: Easy/Intermediate.

- Effort: 15-30 mins to get started.

- ROI: Potentially significant if you sit on your NFTs for years as the NFT market continues to go mainstream.

How to approach NFTs

There are a range of ways to get exposure to NFTs, including NFT games, so fortunately you’ve got options. Ultimately, it’s up to you to decide which, if any, of these approaches is right for your portfolio.

A simple place to start is to just buy NFTs in your price range from projects and creators that you find compelling. You’ll custody these NFTs in the same way you manage your ERC-20 tokens, like through a hardware wallet or a browser wallet like MetaMask.

But there are other interesting ways to capitalize on the upside of the NFT ecosystem, too.

I’ll break down all your main options here so you can start devising your personal NFT strategy.

1. Owning NFTs directly

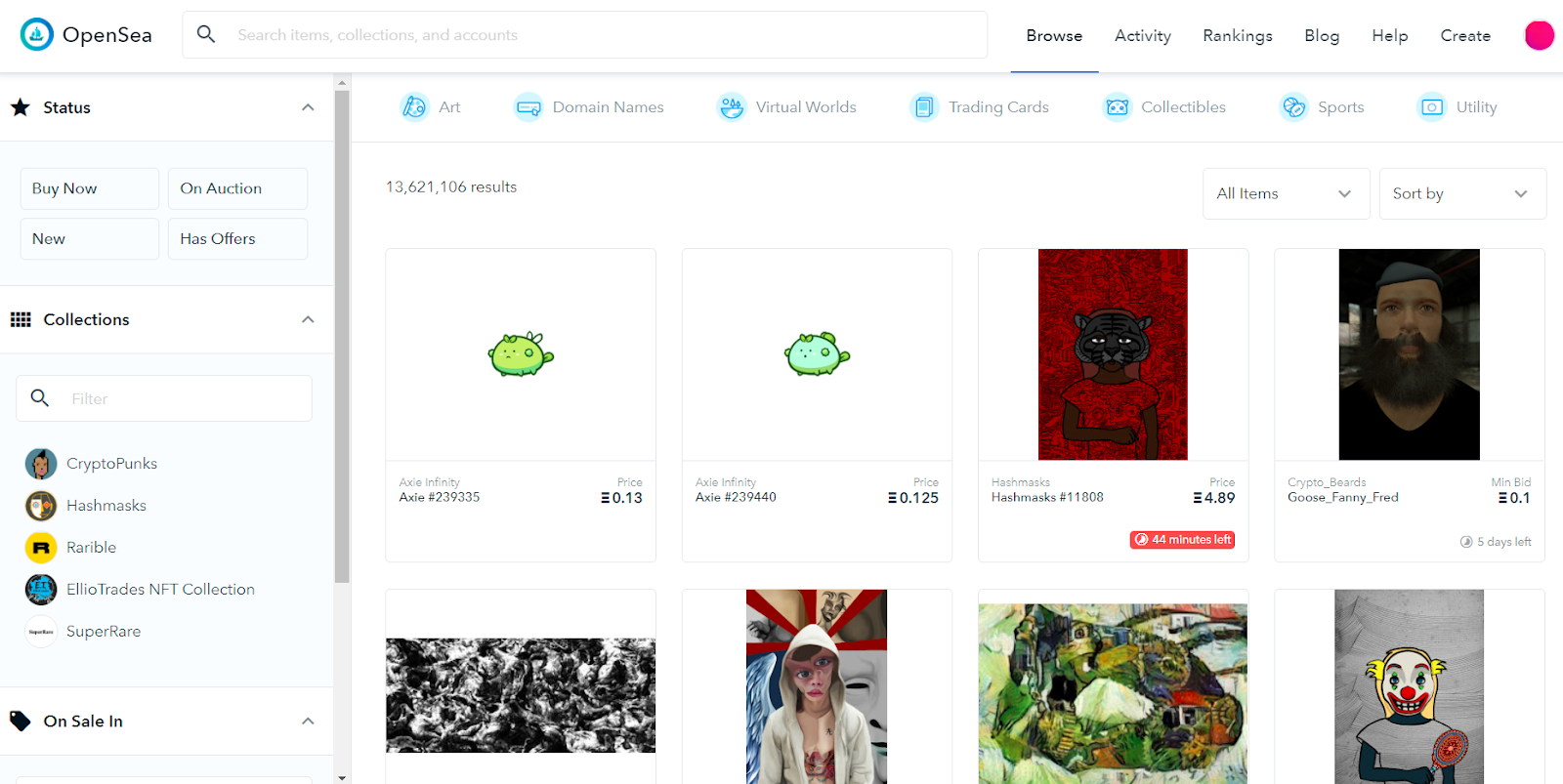

Ethereum already has more than a few general NFT marketplaces like OpenSea and Rarible that aggregate NFTs from around the ecosystem, thereby letting users shop for a wide array of NFTs via singular, user-friendly dashboards.

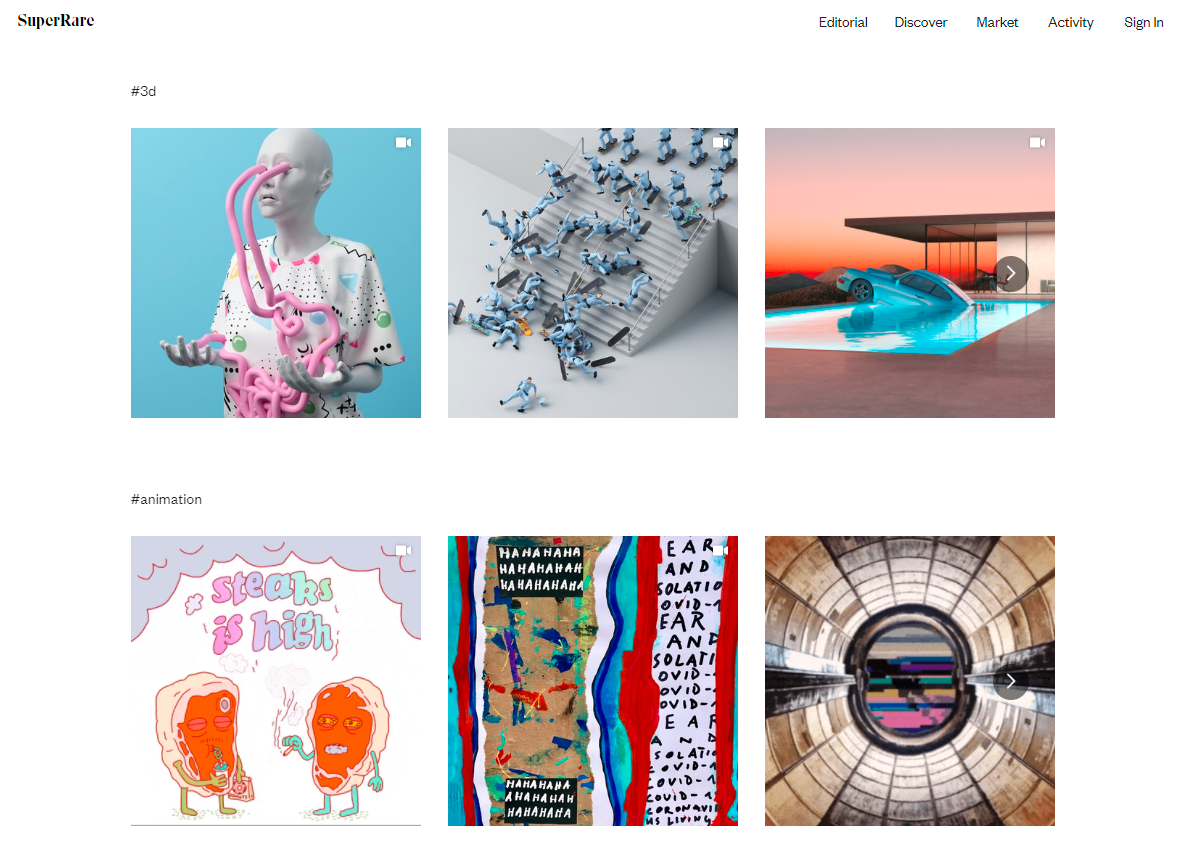

Additionally, there are also specialized NFT marketplaces like SuperRare and Nifty Gateway (watch our show with them), which are specifically centered around cryptoart NFTs.

You can use both of these kinds of platforms, of course, but before you can do anything you’ll need to have some ETH set aside for buying and/or bidding on NFTs.

Marketplaces like OpenSea allow purchases and sales in many tokens, but ETH is usually the main currency of choice. You’ll also want to have a browser wallet like MetaMask so you can directly interact with NFT marketplace’s smart contracts.

Source: superare.co/discover

Once you have your crypto money and a wallet ready, it’s time to go shopping. Go to your marketplace of choice and connect your wallet, and you’ll be ready to get to collecting.

Have a budget that you work within, and then look for NFTs that fall inside your price range. You might not be able to afford every cool NFT that catches your eye, but there are certainly NFTs available at all prices and from creators of all backgrounds.

Of course, there’s not necessarily a right or wrong way to build an NFT collection. Just realize that NFTs are illiquid assets, and you’re not guaranteed to make back the ETH you spend. Remember: value is subjective—it’s all in the eyes of the beholder!

There are no shortage of opportunities or market inefficiencies to capitalize on around NFTs right now.

However, your safest approach is to just buy NFTs that you personally find really cool or unique and that you wouldn’t mind having for years. The potential upside is that someone else may eventually find your NFT really cool, too, and make a profitable offer on it at some point in the future.

⚠️ Pro-tip: You can use NFT marketplace data websites like NonFungible to analyze prices and recent market activity.

Bankless Resources on NFTs:

2. NFT-based ERC20 Tokens

Ethereum ERC20 tokens can be used to tokenize or represent anything, so naturally we’ve seen these tokens deployed across a range of instrumental use cases in the NFT ecosystem.

For example, governance tokens like Rarible’s RARI or Axie Infinity’s AXS. These are projects which are NFT-focused and therefore, likely benefit from the boom in NFTs.

These tokens allow holders to govern these projects from the bottom up and own them together as communities rather than being company-owned, top-down, and extractive in style.

If these NFT projects grow considerably from here, demand for their governance tokens should grow in kind. Buying these tokens on DEXes like Uniswap is one way to gain exposure to the NFT ecosystem, though these particular assets can also be acquired through ecosystem participation (e.g. making buys or sells on Rarible or regularly playing Axie infinity).

Next, there are utility tokens like Meme Protocol’s MEME and The Sandbox gaming platform’s SAND token. By utility tokens, I simply mean that these assets afford their holders some advantage or utility that’s impossible to access without holding them.

For example, Meme Protocol is an NFT farming project that requires users to stake MEME in order to participate in its signature NFT drops, while the SAND token is the native currency used to pay for in-game experiences in The Sandbox universe.

These assets can capture the growing demand for these NFT projects, so they’re another avenue to consider.

The last category of NFT-centric ERC-20s to consider are fractional ownership tokens, like NIFTEX’s sharded NFTs or Metapurse’s B20 token.

To dive in here, NIFTEX is a platform that lets users fractionalize their NFTs into easily tradable and liquid ERC-20 tokens. Accordingly, NIFTEX is a promising avenue when it comes to collective ownership of NFTs, and it already has some 20 NFT shard markets to choose from.

Metapurse’s B20 token also employs a similar idea, as the group has fractionalized ownership of The Beeple 20 Collection artworks. With Beeple’s upcoming Christie’s auction, this could be a unique way to get exposure to his work and the potential upside that may come from the auction.

If you think the underlying NFTs are going to go up in value, these fractional ownership tokens are an easy way to get associated exposure.

3. Lend crypto to NFT users

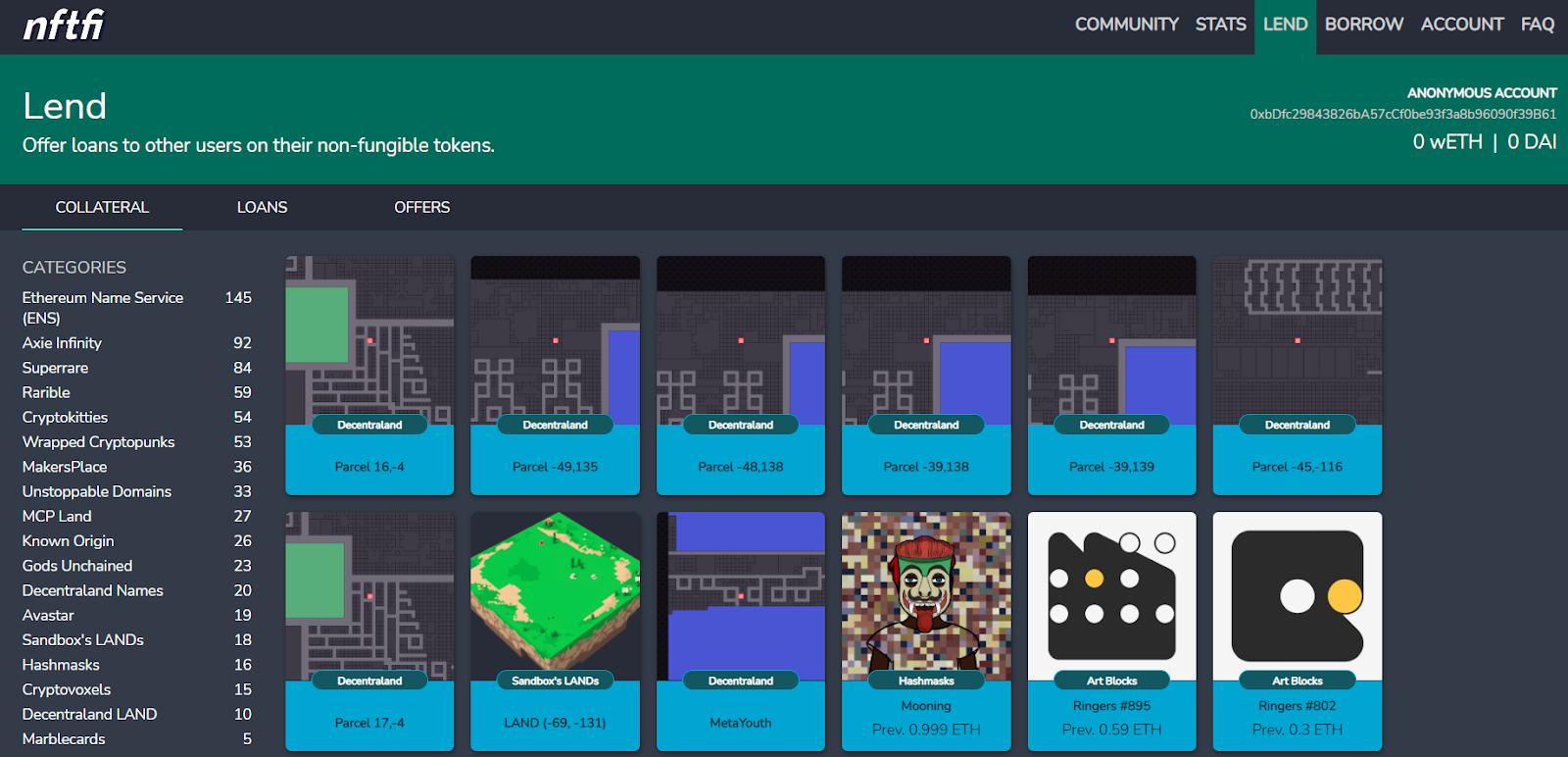

There’s a growing number of NFT holders who are interested in borrowing crypto against their NFTs on platforms such as NFTfi, a platform for NFT-collateralized loans.

The takeaway? You can lend crypto peer-to-peer to someone who’s put up an NFT as collateral and earn interest for doing so. If the borrower defaults, you get rewarded with the underlying NFT collateral.

Source: nftfi.com/app/lend/assets

If this sounds like the kind of NFT x DeFi intersection you’re interested in, navigate to NFTfi’s Lending dashboard, connect your browser wallet, and then make loan offers on any of the listed NFT collateral propositions that suit your fancy.

4. Buy NFT index funds

Lastly, we’ve started to see the rise of NFT index funds that track baskets of similar NFTs.

One of the pioneers here is NFTX, which is focused on building index funds that track the floor prices of specific NFT classes, like Zombie CryptoPunks or Origin Axies.

In other words, you can buy fractions of the PUNK-ZOMBIE token if you want some easy, liquid exposure to Zombie CryptoPunks in your portfolio, and the same is true of the ORIGIN-AXIE when it comes to Origin Axies.

These NFTX index funds have the most liquidity on Sushiswap currently, and the initial funds available for trading include:

- PUNK-BASIC (tracks the floor price of CryptoPunks)

- PUNK-FEMALE (tracks the floor price of Female CryptoPunks)

- PUNK-ZOMBIE (tracks the floor of Zombie CryptoPunks)

- PUNK-ATTR-4 (tracks the floor price of CryptoPunks with 4 attributes)

- PUNK-ATTR-5 (tracks the floor price of CryptoPunks with 5 attributes)

- PUNK (an index fund composed of NFTX’s various CryptoPunks indices)

Non-Fungible Tokens - Wrapping Up

The NFT economy is heating up like never before. People are waking up to the potential of these assets. As a result, any savvy crypto investor should consider how they can capitalize on the current boom.

There’s plenty of ways to get exposure. You can invest directly in NFTs, acquire NFT-centric ERC-20s or NFT index funds, or even lend crypto out to borrowers who want to use NFTs as collateral. But not without risk!

Always exercise caution when investing in new assets and approach your personal NFT strategy with lots of due diligence and consideration of risks.

The more thought you put into your collecting efforts, the better your chances at building up a strong NFT portfolio!

Action steps

- Try buying an NFT on OpenSea, Rarible, SuperRare, or NiftyGateway

- Trade NFT-based tokens on Uniswap or Sushiswap

- Investigate NFT lending platforms like NFTfi