Dear Bankless Nation,

Over 1% of all BTC in existence is now tokenized on Ethereum.

That’s no small number—there’s significant amount of interest for these tokenized versions of BTC. Why?

Because yield! People can earn money by putting BTC to work in DeFi.

This trend really kicked into gear with the yield farming mania last year, where endless opportunities arose everyday to earn insane yields on your otherwise-idle BTC.

But it’s been a full year now….and guess what?

The trend for BTC on Ethereum is still up and there’s even more opportunities to earn.

Yields have come down since last summer but you can still earn material returns in DeFi today—ones that beat anything offered in your bank account and other centralized lending providers.

If you’re sitting on native BTC doing nothing with it, this is your guide to putting your capital to work.

Here’s how.

- RSA

TOKEN THURSDAY

Guest Writer: Maximilian Roszko, Head of Ecosystem Growth at Ren

How to earn high yields on BTC

With the advent of Bitcoin (BTC) in DeFi, a new era of yield generating opportunities has arisen for BTC holders within the Ethereum ecosystem. There’s now plenty of different flavors of tokenized BTC now on the market with sufficient liquidity, offering different degrees of trust. As a result, people now have the option to lend and deposit their BTC to DeFi protocols in exchange for some underlying yield—either in the form of interest or the protocol’s native governance token.

The formal introduction of yield farming roughly a year ago has led to a Cambrian explosion of opportunities for anyone who holds BTC and ultimately underpinned DeFi's recent ascent to the masses.

With that preface in mind, we'll be exploring its history and a few ways in which the everyday user can earn yield with their BTC.

Brief History of BTC in DeFi

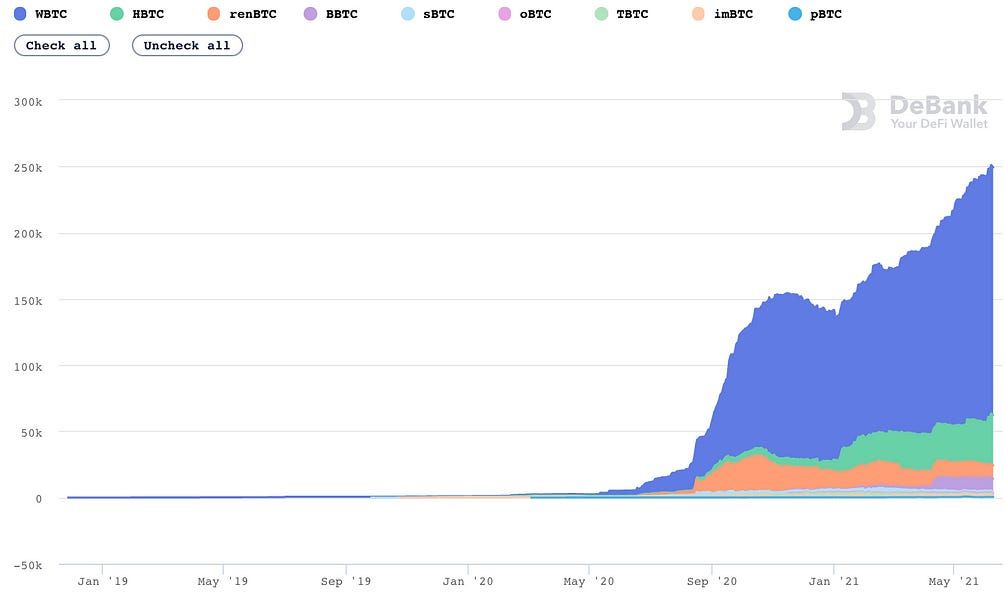

BTC on Ethereum has been around for years, with it first being introduced in early 2019. However, growth in the asset class really picked up in 2020 when Ethereum’s yield farming mania kicked into gear.

For those who are unfamiliar with tokenized BTC on Ethereum, it works like this: BTC is converted from its native format to an ERC-20 standard form through some sort of lock and mint function through a custodian of some sort—either centralized or decentralized. This is a two way bridge where people can take tokenized BTC and redeem it for native BTC and vice versa. Each design has their own tradeoffs but ultimately, this mechanism allows BTC to be used seamlessly within the ETH ecosystem, which is where a majority of DeFi has taken root.

Today, the predominant forms of tokenized BTC include WBTC and renBTC where WBTC relies on a centralized custodian to hold native BTC (Bitgo) while Ren relies on smart contracts (RenVM).

And since the summer of 2020, BTC growth in DeFi has been nothing short of astounding. As of April 1, 2021, there is just shy of 10 Billion USD of BTC locked within DeFi.

More recently, WBTC has tokenized 1% of all BTC in existence. 🤯

Given the obvious market fit, a variety of solutions have cropped up over this time, all with various attributes and risks. We will leave it up to the reader to decide which variant is best for them but there are plenty of great resources out there and here's a good place to start.

So without further ado, let's dive in to how to put your BTC to work.

How to get your BTC on Ethereum

Prerequisites | What you need to get started

- A computer with an internet connection.

- BTC in a cryptocurrency wallet. Minimum $100 USD.

- MetaMask or a web-browser-based cryptocurrency wallet that allows you to interact with DeFi.

- ETH in your MetaMask wallet. Minimum $100 USD.

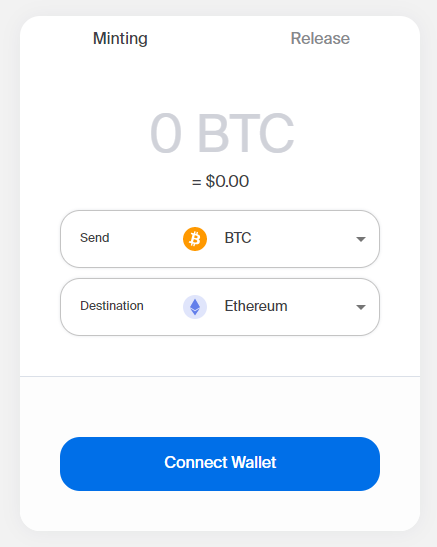

👉 Example method: RenBridge

RenBridge offers a clean and simple user interface for minting BTC on ETH and redeeming renBTC back to native BTC. If you’re looking for a different version of tokenized BTC, you can always swap it for your desired version on Curve!

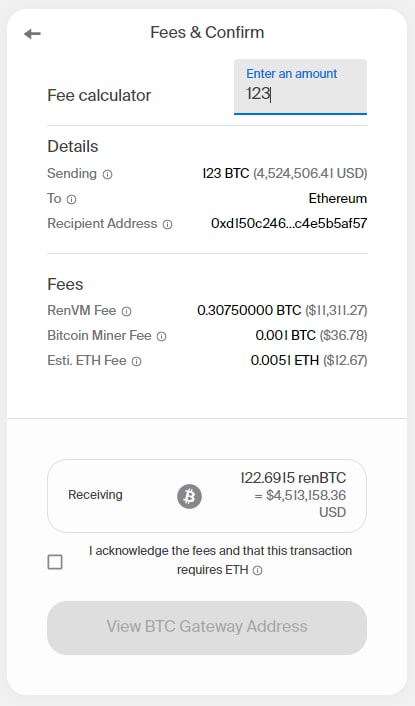

When you enter the amount of BTC you want to wrap you get a full breakdown of the fees and what to expect:

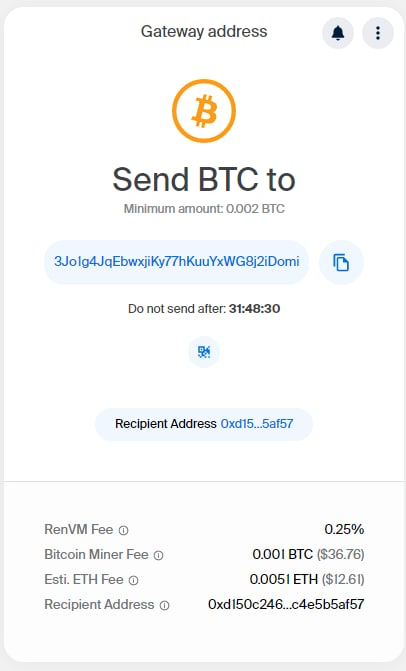

But you can send any amount of BTC to your personal generated gateway address, as long as it is above the minimum amount (0.001 BTC), and RenVM will automatically use the correct fee:

- Input roughly the amount of BTC you think you will be sending over in the UI. And don't worry, you don't have to send exactly that amount for the mint to work, RenVM will automatically calculate the fees correctly.

- Send the BTC to your personal gateway address that pops up

- Once you send the BTC to the designated address, users will have to wait for approximately 60 minutes while the Bitcoin network sends the BTC to ETH. Leave your web browser up and wait patiently.

- At this stage (after waiting 60 minutes) users will be prompted by MetaMask to sign an ETH transaction which completes the process for converting your BTC to renBTC (the ERC-20). Be sure to select "Fast" GAS to ensure there are no issues!

- Once the Ethereum TX is complete (this can take a few minutes), check your MetaMask Wallet and your renBTC will be waiting for you there. You may need to renBTC as a custom token to your wallet, a tutorial can be found here.

- Once you have the renBTC, go down to Earn yield with your BTC 👇

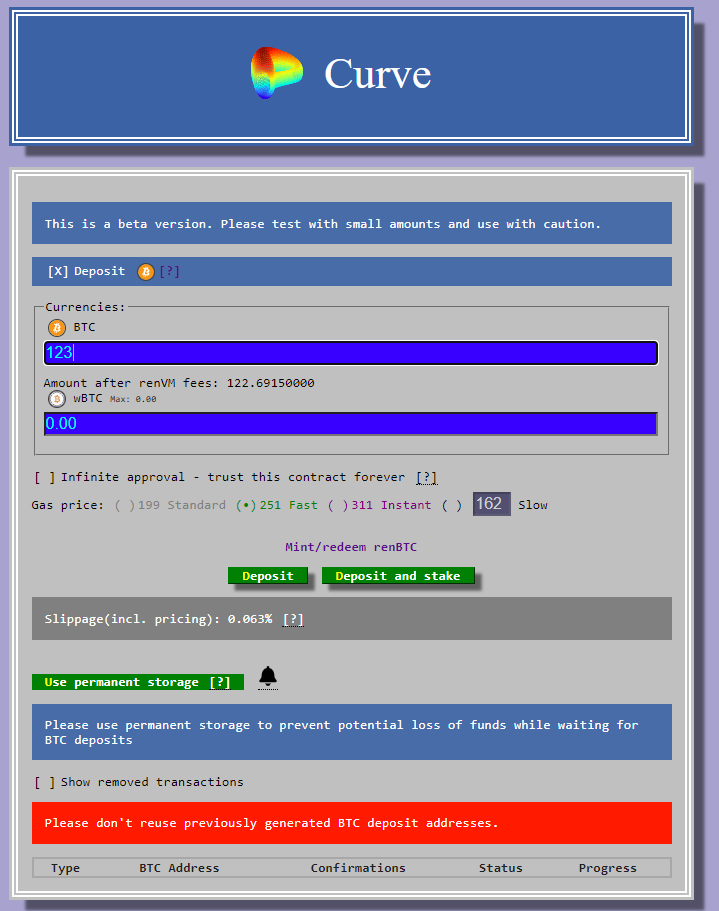

Alternative Method | Deposit BTC directly into Curve Finance

This method is a little more technical but offers the most direct pathway toward earning yield with your BTC. Prior research to determine which 'pool' offers the best use for your resources is encouraged, you can begin by reviewing the pool statistics here.

There are only two pools that allow for direct BTC deposits and withdrawals:

The instructions for depositing your BTC are similar to that of RenBridge but follow the prompts on Curve and you will be all set. For more information on how Curve fits in with the yield generating options available, please refer to Step #2 | Earn yield with your BTC 👇

⚒️ Developer Fact: The native BTC integration for Curve uses RenVM (creators of renBTC) in the background, more specifically the RenJS SDK.

Anyone can use the RenJS SDK to build their own native BTC integration to a user interface they control. Additionally, RenBridge can be forked and used as the base for a user interface you would like to build yourself.

How to earn yield with your BTC 💰

The most common way to earn yield in DeFi is by depositing your assets in a liquidity pool. While there are many variants, each with trade-offs, there are four core types of "liquidity pools" that you can use to generate yield:

Automated Market Makers (AMMs)

Example: Uniswap, Sushiswap, Balancer, etc.

Alpha: Earn 24% APY in BAL plus trading fees on the WBTC/WETH Balancer V2 Pool! 🚨

AMMs are the backbone of the decentralized exchange (DEX) ecosystem. They allow digital assets to be traded in a permissionless and automated way by using liquidity pools rather than a traditional market of buyers and sellers. AMM users supply liquidity pools with crypto assets, and by virtue of doing so, users can earn fees whenever their liquidity is used for swaps.

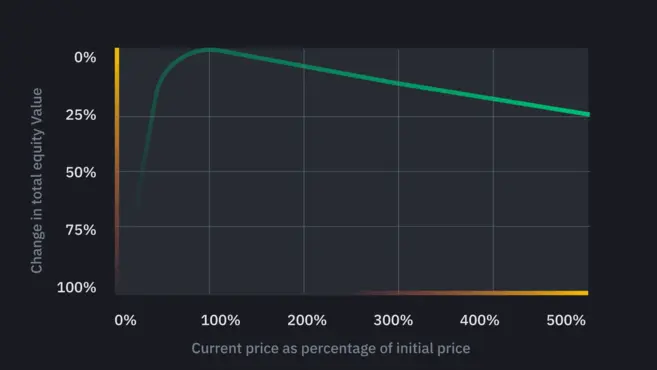

For example, if you add WBTC to an AMM pool, you are lending out your capital in return for exchange fees. The only downside with this strategy is that there’s potential for impermanent loss!

Stabletoken AMMs

Examples: Curve Finance, Shell Protocol, Saddle Finance, etc.

Alpha: Earn up to 5% APY in CRV + trading fees on the Curve sBTC pool. 🚨

Stabletoken AMMs are similar to traditional AMMs but with a focus on like-kind pairs (i.e WBTC to renBTC or USDC to DAI). This is a great option for users as one can supply BTC and earn fees for doing so while also mitigating the impermanent loss risk mentioned above as the tokens are always the same relative value.

These AMMs are also ideal for the trader as large trades can be executed with relatively low-slippage.

Lending Pools

Examples: Compound, Aave, C.R.E.A.M, Unit Protocol, etc.

Alpha: Earn 1.5% APY in AAVE + gain borrowing power on Aave by depositing WBTC. 🚨

Liquidity pools used for borrowing and lending are typically less risky for the supplier of the capital as lenders are the ones that take the risk by having to over-collateralize their loans and face automatic liquidation if their collateral drops below certain thresholds.

Vaults

Examples: BadgerDAO, YEARN, Pickle Finance, etc.

Alpha: Earn 5%+ on the crvRenBTC Badger Vault with auto-compounding rewards. 🚨

A common way to put assets in a liquidity pool is by going through a third-party application that runs Vaults, which can handle the process of compounding your yield so you do not have to manually withdraw your rewards and re-stake.

You can think of them as automated savings accounts, each with a different strategy to earn you more of what you put in. In vaults you deposit capital to a contract, which takes control of the capital, and uses it to put in a liquidity pool or some other yield farm.

You can do everything a vault does manually but depending on how much capital you provide, you will be better off with a vault because it shares the gas and transaction fees with everyone who deposited into the vault, so in turn, you lose much less from the gas fees you would have to pay if you did everything manually.

Vaults do compound smart contract risks, as well as admin control risks, which vary depending on the third-party protocol (more on risks below). There are many projects creating vaults, an example being Badger, which focuses on BTC vaults specifically.

If you’re looking for more alpha and other opportunities, here’s a great sample list protocols where you can earn yield with your BTC!

Understanding the Risks

When putting assets to work within the DeFi ecosystem you are faced with a plethora of trade-offs and risks, so it's important to understand these prior to moving forward.

Blockchain risk: Though not frequently mentioned, each blockchain has its own risks associated with it. Putting BTC on ETH means you are exposed to risk relating to the consensus mechanism of BTC, as well as ETH, along with whatever version of wrapped BTC you are using in DeFi. What this ultimately means is that you are compounding the risks of three separate protocols.

Custodial risk: When putting BTC on ETH, you are usually providing it to a custodian of sorts. Whether it's a company, protocol, or set of smart contracts, some entity is holding your BTC and giving you a 1:1 representation on ETH (which is typically redeemable for native BTC). There’s always risk here, so make sure you understand who’s the custodian when choosing your flavor of tokenized BTC!

DeFi smart contract risks: Whenever you put your wrapped BTC tokens in a DeFi protocol, you’re exposed to the risks of that contract (learn how to assess here). These can come in the form of exploits, hacks, assets being frozen, etc. For each additional smart contract you put your tokens through, you compound that risk. The insurance option below typically covers these variants of risk for users but encourages in-depth research prior to proceeding.

Impermanent loss risk: If you choose to put your wrapped BTC in an AMM (as noted above) there are typically some risks for the supplier of the capital, as your share of tokens in a pool that you have provided changes relative to the rate at which the tokens trade against. Meaning if you simply held the tokens outside a pool, the USD value of your capital could be higher than if you held them in a pool where the price shifted significantly:

Impermanent loss is offset by the trading fees that are being accrued to the liquidity providers. The risk is that the impermanent loss can be bigger than the trading fees you have been rewarded, at the time when you want to withdraw your funds. Nonetheless, as with all other types of risk, we encourage users to research and decide what options are best for them.

Insure your BTC in DeFi

If the above risks has you worried, don’t sweat it! There are projects that offer insurance in the DeFi space to mitigate these risks. One of the biggest in DeFi today is Nexus Mutual. As it stands, Nexus Mutual offers protocol coverage on most major DeFi applications today, so if you’re depositing a material amount of your BTC into DeFi, it may be worth exploring the options.

These services can complement your portfolio and are potentially interesting to the risk-averse. If you’re looking for all the available insurance options, check out some popular ones here.

What's to come for BTC in DeFi

The rate of growth for tokenized BTC on Ethereum has been outstanding. With over 1% now tokenized on the network, and DeFi offering a plethora of opportunities to earn on your otherwise-idle BTC, there’s no signs of this trend slowing down anytime soon.

This is especially true as more and more DeFi protocols come online, and new yield opportunities emerge. On the other hand, the industry is starting to see the early signs of DeFi on Bitcoin emerging, mainly with the launch of Sovryn, a decentralized lending and borrowing platform built on Bitcoin and Rootstock.

The take away?

If you have BTC and want to put it to work, the time is now.

Action steps

- Put your BTC to work!

- Consider migrating your native BTC to Ethereum with RenBridge

Author Bio

Maximilian Roszko is the Head of Ecosystem Growth at Ren Protocol, a decentralized cross-chain liquidity protocol. He’s also a Cognitive Sci PhD student at Lund University in Sweden.