How to Double Up on Airdrops 🪂

Dear Bankless Nation,

You can build wealth the hard way or the easy way.

Bear markets are abundant with opportunities to do it the hard way.

But if you look closely enough, there’s juicy, low-hanging fruit ready to be plucked.

Bankless and Metaversal writer WM Peaster’s got a juicy treat: a low-risk, high-reward strategy that's simple and bear-proof

Learn how to double up on airdrops in the emerging Layer 2 ecosystem with today’s tactic.

— Bankless Team

There are a number of layer two (L2) scaling solutions that will launch native tokens.

There are also apps on these L2s that will launch their own tokens as well.

It may be possible to receive two airdrops later for the price of performing one on-chain activity now.

Accordingly, this Bankless tactic will show you how you may “double up” on future airdrops while early adopting Layer 2 tech.

- Goal: Learn about doubling up airdrops

- Skill: Intermediate

- Effort: 30 minutes

- ROI: Earning future airdrops

Where to look for double up opportunities

Hunting for airdrops is one part pastime, one part on-chain gig work for the modern degen. Right now, the frontiers of web3 are where the best potential opportunities to efficiently “double up” on airdrops can be found.

By that, I mean performing one activity to get in line for two distinct future token distributions.

To find these opportunities, here’s where you start:

- Find a promising Ethereum L2 that hasn’t released a token yet — or in the case of Optimism, a project that plans further phases of token airdrops in the future.

- Find and use apps on these L2s that also haven’t released native tokens yet.

Keep in mind that there are no guarantees with this strategy. It could lead you to trying out L2s or apps that never actually release their own tokens!

This early on in the lifespan of the blooming L2 ecosystem, there will be more than a few “double dip” airdrops that come to pass. Positioning yourself now will make all the difference later.

Accordingly, if you’re interested, consider trying some token-less apps on candidate L2s so that if any of those projects + rollups do eventually conduct retro token launches to early users, you’ll be among those users.

As for which L2s to specifically target: Optimism, zkSync, and Arbitrum appear to be low-hanging fruit.

For instance, we already know Optimism is holding multiple additional rounds of OP airdrops going forward, and the zkSync project has confirmed its own token plans. Arbitrum’s team has been mum on token talk, but it seems all but poised to release a token for community coordination.

That leaves us with having to pick out specific apps that are presently token-less that can be used on these L2s. I’ll help you cut to the chase here by showing you some projects that fit that bill…

First, head for the bridges 🌉

There are many L2-centric bridge projects out there that haven’t launched tokens yet.

Hop unveiled its HOP earlier this year. it’s probable that in the months ahead, multiple bridges perform retro-distributions in bids to keep up liquidity-wise.

Some such bridges that may eventually release their own tokens that you might try include:

- Bungee — supports Arbitrum, Optimism, and other L1 EVMs

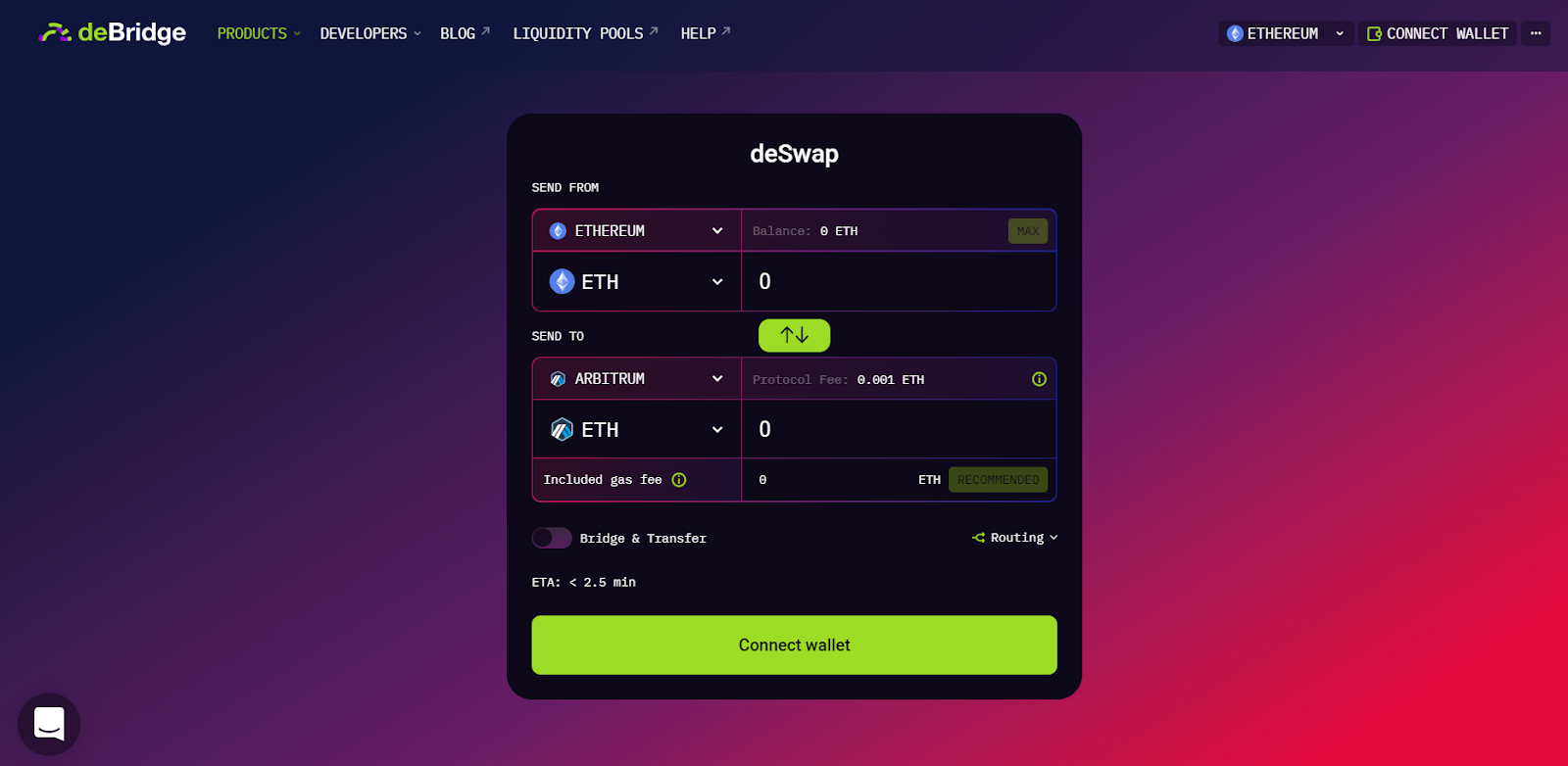

- deBridge — supports Arbitrum and other L1 EVMs

- Mosaic by Composable Finance — supports Arbitrum and other L1 EVMs

- Orbiter Finance — supports zkSync, Arbitrum, Optimism, and other L1 EVMs

- transferto.xzy by LI.FI — supports Arbitrum, Optimism, and other L1 EVMs

Some of these projects, like Orbiter Finance, may not be fully audited yet, so use with caution — and not with your full crypto stack, of course.

However, these bridges present some of the most obvious potential “double up” airdrop candidates right now.

Other L2 projects without tokens🕵

Beyond bridges, there are also a number of token-less DeFi, NFT, and wallet projects on L2s that you can try:

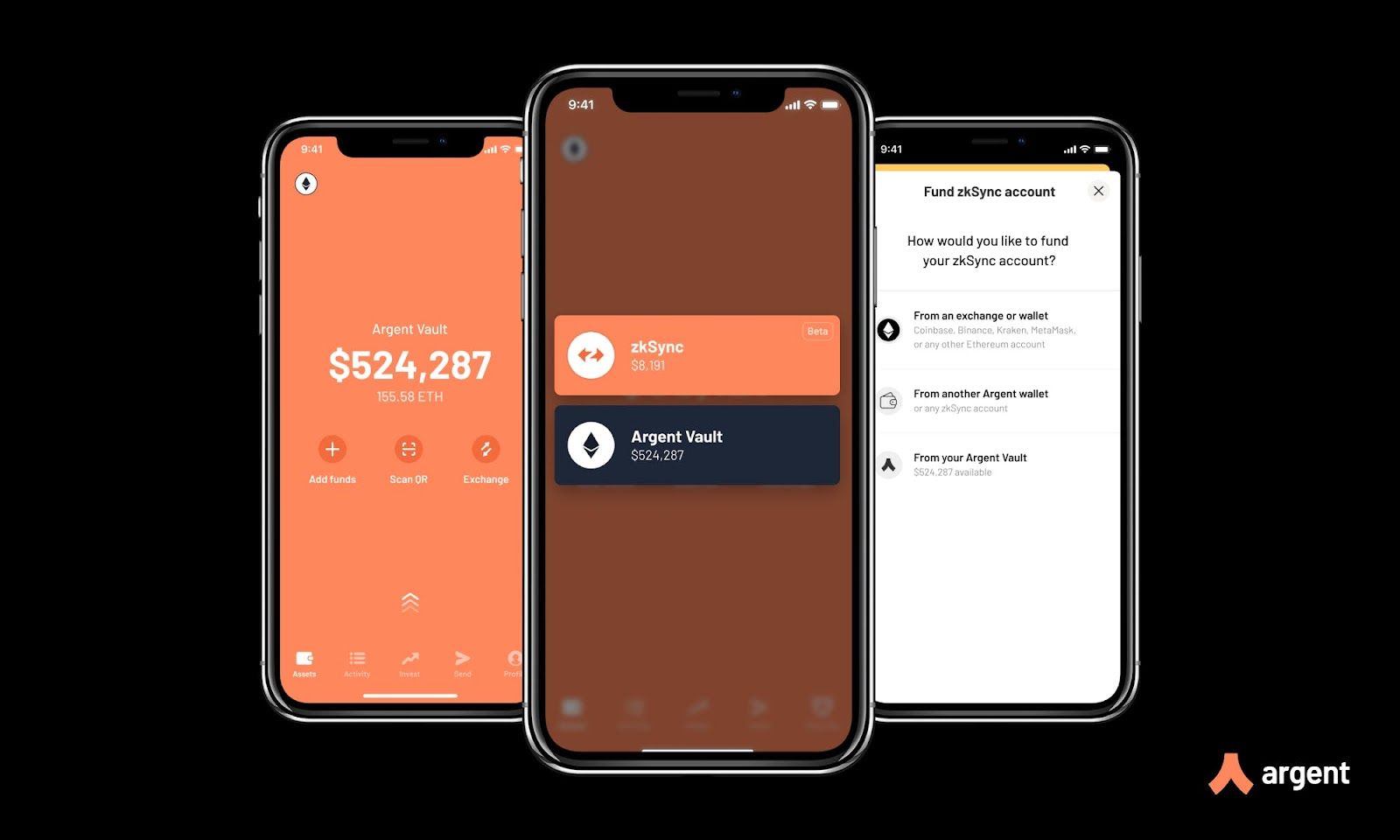

Argent

Argent is a mobile social recovery wallet that supports Ethereum and the zkSync L2. On the zkSync side of things, Argent offers curated L2 DeFi investment opportunities across Aave, Lido, and Yearn.

If Argent ever launches a retro token distribution, having used these integrations will have prepared you for that and presumably the eventual zkSync token.

♟️ Potential strategies:

Use zkSync on Argent to lend DAI or USDC on Aave

Use zkSync on Argent to stake ETH on Lido

Use zkSync on Argent to invest ETH, DAI, USDC, or WBTC into Yearn

Cozy

Cozy Finance is an open-source, insurance-like protocol that allows people to create automated DeFi protection markets.

Earlier this year the project added support for Arbitrum, and remains token-less. It remains in the realm of possibility that supplying, borrowing, or investing on Cozy might affect your chances for COZY + ARBI tokens down the road.

♟️ Potential strategies:

- Use the Protected Investing feature on Cozy

- Deposit funds to provide protection on Cozy

- Borrow funds on Cozy

(Note: Cozy is not available to U.S. users 🇺🇸)

DeFi Saver

DeFi Saver is an advanced DeFi management platform that’s like a personal on-chain command center.

The token-less project even lets you simulate popular DeFi actions, so you know how transactions will work beforehand. Earlier this year the project rolled out support for Arbitrum and Optimism, and while its team has made no indication that it has plans to airdrop a token to its L2 users, that possibility remains in play.

♟️ Potential strategies:

- Make a swap through DeFi Saver while on Arbitrum or Optimism

- Use the Aave integration on DeFi Saver while on Arbitrum or Optimism

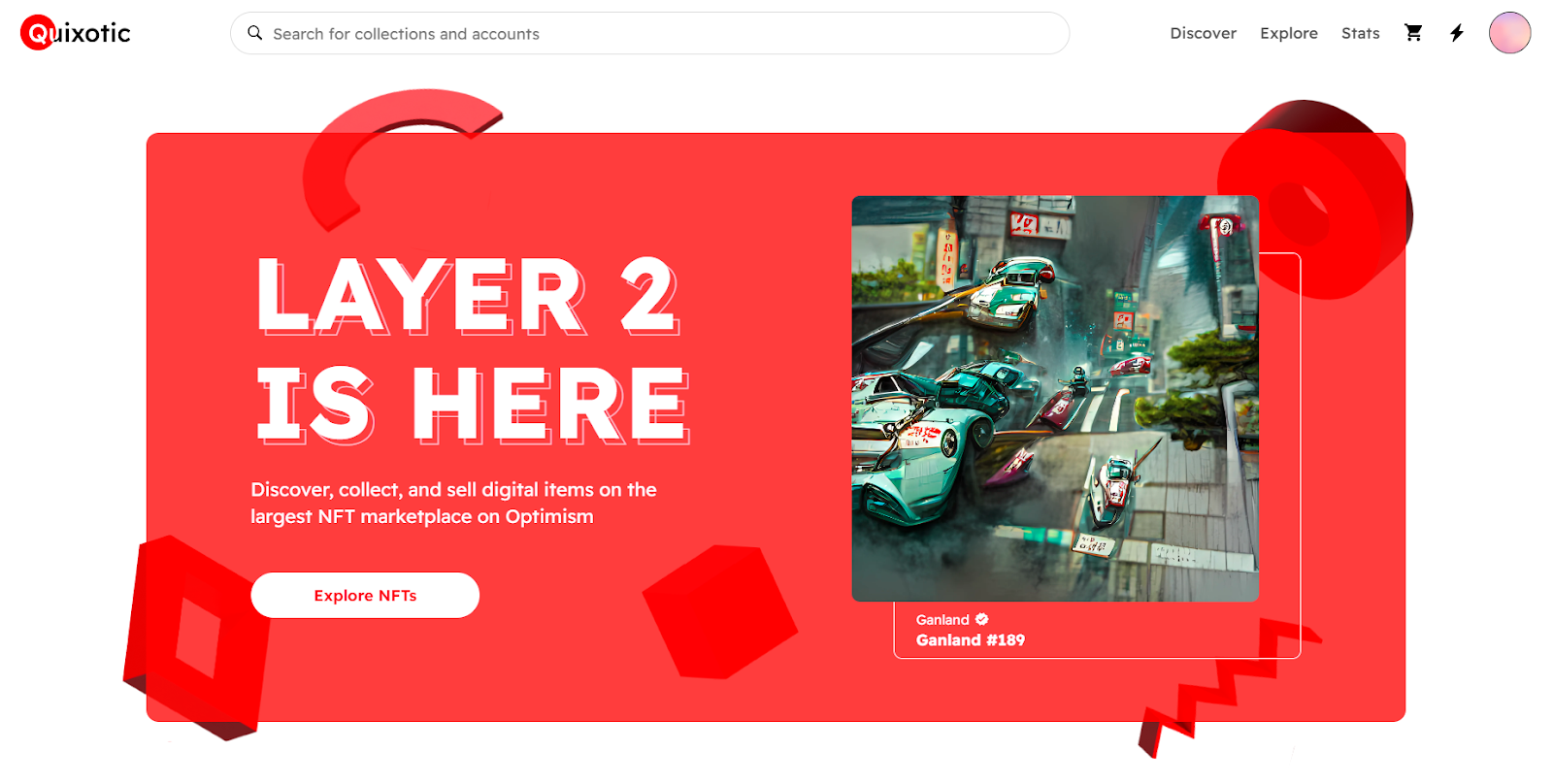

Quixotic

Quixotic is currently the largest NFT marketplace on Optimism.

It may one day opt to launch a token like other NFT marketplaces, e.g. SuperRare and RARE. Accordingly, buying and selling NFTs on the platform might later help you “double up” on a Quixotic token (if it actually happens) and further OP airdrop phases.

♟️ Potential strategies:

- Buy NFTs on Quixotic

- Sell NFTs on Quixotic

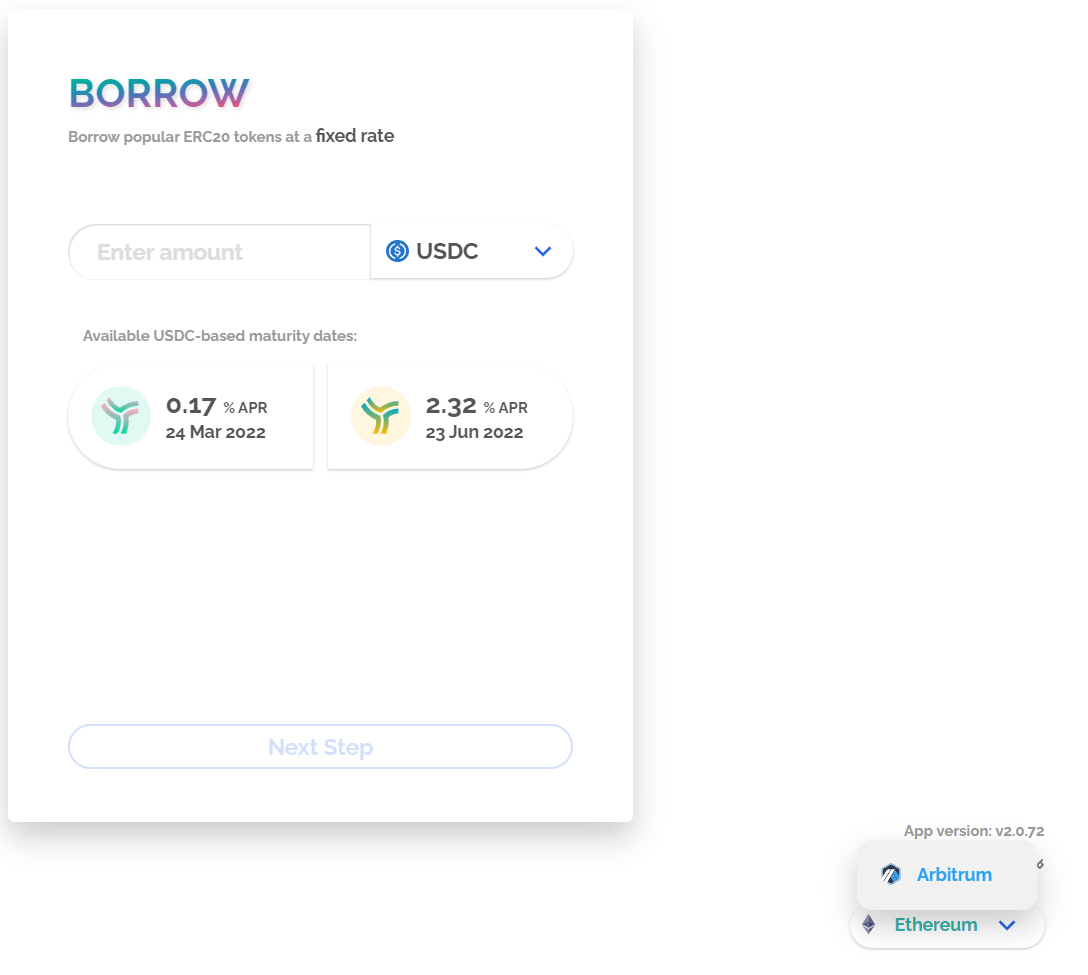

Yield Protocol

Yield Protocol is a fixed-rate borrowing and lending protocol that activated support for Arbitrum in March 2022.

The project’s FAQ explains that “long-term we expect Yield Protocol to be community-owned,” so it seems a token is indeed coming somewhere down the road. Whether that token would come to fruition on Arbitrum over Ethereum remains to be seen, but nevertheless Yield Protocol’s a project to watch in the meantime.

♟️ Potential strategies:

- Lend on Yield Protocol’s Arbitrum deployment

- Borrow on Yield Protocol’s Arbitrum deployment

- Provide liquidity on Yield Protocol’s Arbitrum deployment

Conclusion

It’s quite simple: Find promising L2s that are likely to perform retro distributions, use cool token-less apps on these L2s — and then sit back and wait.

Of course, things might not always be so simple -- you may have to participate in wider programs like The Arbitrum Odyssey (which is currently paused) to lock down a token allocation, for example.

It’s a low-risk, bear-ready speculative strategy that you can move on right now. But there are so many things we don’t know: how potential L2 token distributions will work, or which projects will unveil tokenomics, etc.

What we do know, though, is that most L2s will likely launch tokens. and some apps on these L2s will likely launch their own tokens, too.

Accordingly, a straightforward thing to do to position for these potential “double up” airdrop opportunities is to try as many candidate projects as you want and then see if you get any bites in the future.

Action steps

- 🌉 Try token-less bridge projects on L2s

- ⛹ Try token-less DeFi and NFT projects on L2s

- 🙇 Also check out our previous tactic How to value NFT fundamentals tactic if you missed it!