Dear Bankless nation,

There’s a common theme underlying the year’s biggest crypto blowups.

From 3AC and Celsius to FTX (and perhaps soon Genesis?) — plenty of centralized crypto entities have been blowing up and leaving users holding the bag.

For consumers that want to reject centralized finance and embrace DeFi — the transition can often seem daunting. DeFi tools can often feel harder to navigate and discover than their CeFi counterparts, but the payoffs to this exploration are immense.

This week, we get back to basics with this tutorial by William which shows the best places to get started in DeFi.

- Bankless team

Amid the recent FTX-driven turmoil in crypto’s centralized finance sector, the top DeFi projects on Ethereum have been trodding along just fine.

These battle-tested decentralized protocols show us the power of being able to personally manage your own money onchain without having to worry about corrupt intermediaries like FTX’s leadership.

Accordingly, this Bankless tactic will walk you through the best ways to take control of your crypto by doubling down on DeFi using the most proven dapps available today.

- Goal: Double down on DeFi

- Skill: Beginner

- Effort: 1 hour to set up positions

- ROI: Self-secured onchain money management

How to make DeFi your crypto base command

Why DeFi matters more than ever

In the wake of the FTX collapse, traders who kept money on custodial exchanges have learned the hard way that those actually weren’t their keys, and it’s no longer their crypto.

FTX’s leaders abused their power and seem to have stolen and squandered funds from a lot of people, many of whom were regular, everyday folks just trying to manage and get ahead on their finances.

The "middle of the bell curve" take is that FTX will trigger harsh regulations for everything in crypto, DeFi included.

— Jake Chervinsky (@jchervinsky) November 19, 2022

I don't think so.

Policymakers will have to investigate every last detail about FTX. They'll finally be forced to see how different DeFi is from CeFi.

This is why DeFi is so important.

True DeFi disintermediates power. DeFi gives regular people and institutions alike the ability to manage their money while self-custodying it. Only you can deposit or trade or withdraw your funds when using a decentralized exchange (DEX) like Uniswap, for example.

Managing your money onchain puts the power in your hands. But let’s say you’re newer to DeFi, or it’s been a while since you’ve dove in — what, then, are the most solid apps to focus on in this post-FTX landscape?

No worries, I’ve got you covered! Let’s walk through the three most solid ways to double down on DeFi today ⬇️⬇️⬇️⬇️⬇️

🏦 1) Maker + Oasis for borrowing $

Automate your vaults to avoid liquidation!

— Maker (@MakerDAO) November 10, 2022

→ Stop-Loss Protection by @DeFiSaver: https://t.co/LCklZkb7Rl

→ Stop-Loss Protection by @oasisdotapp: https://t.co/bsgaqzP1ug

Maker and Oasis are two of the oldest and most proven apps in DeFi.

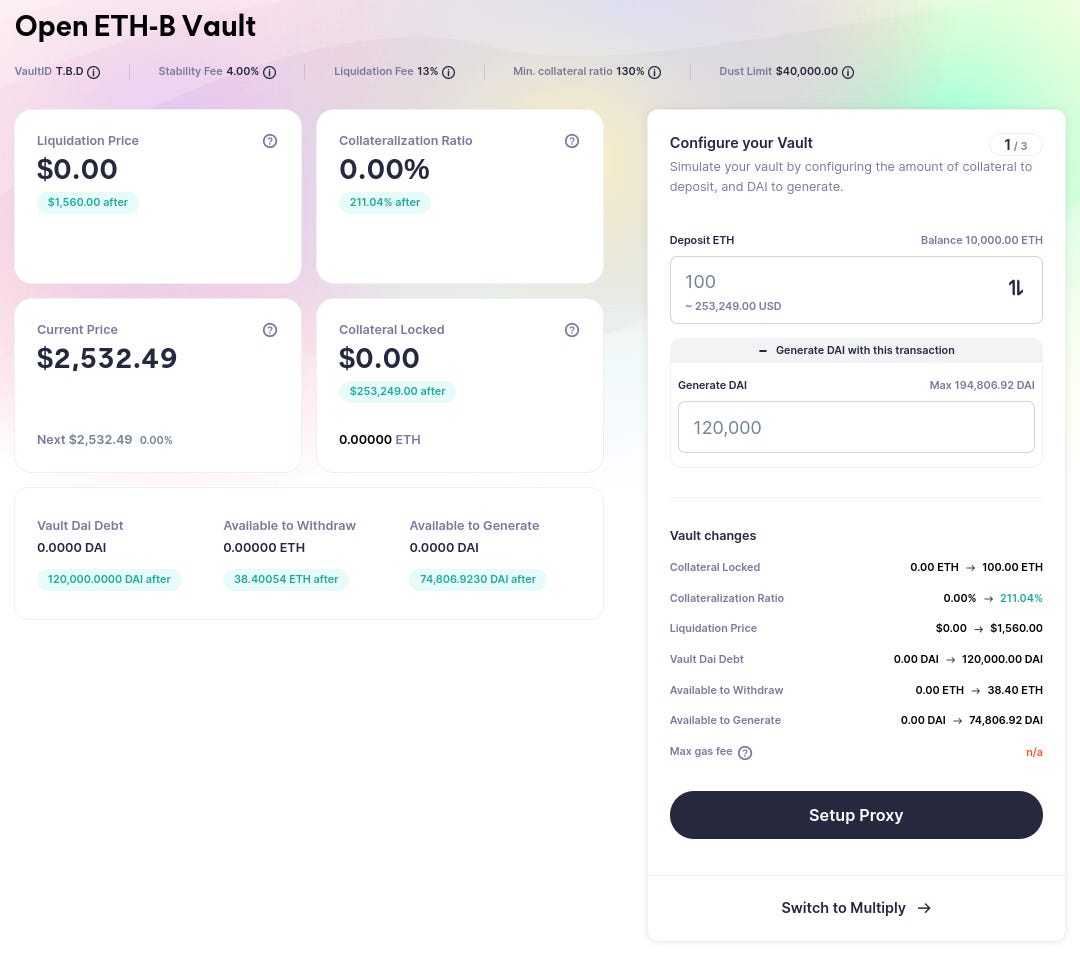

Maker is a decentralized borrowing protocol where you can collateralize crypto like ETH and then borrow DAI dollar stablecoins against your collateral. Oasis is the leading front-end for setting up a Maker Vault, a.k.a. a borrow position, in just a handful of clicks.

So let’s say you’re long ETH for the long-term and you don’t want to sell any if possible, but you also periodically have life expenses where a little extra liquidity could go a long way.

Here, cue in the Maker + Oasis combo, where you can draw DAI liquidity against your collateral and then sell the DAI as needed and pay back the loan over time on whatever schedule works for you. Check out this complete tutorial for a step-by-step guide to the onboarding process.

The main responsibility you’ll have? Avoiding liquidation by ensuring your Vault remains adequately collateralized along the way. Fortunately, this management has never been easier since Oasis now offers automated buys/sells and stop-loss protection for managing your positions.

👻 2) Aave for lending ETH

1/ Lending ETH on @AaveAave

— Zerion (@zerion) November 17, 2022

💰 Yield: 0.5%-1.5%, from borrowers

🎲 Risks: smart contracts, which are battle-tested & hold billions

You don’t have credit risk as undercollateralized borrowers are liquidated

It’s as close as it gets to the “risk-free rate” of DeFi

For years now, the Bankless theory is that ETH is becoming the settlement layer and risk-free rate of the internet itself.

In a similar vein, and as Zerion aptly pointed out in the tweet above, Aave’s ETH lending market is sort of like the native “risk-free” rate of DeFi and typically offers ~1% APY yields.

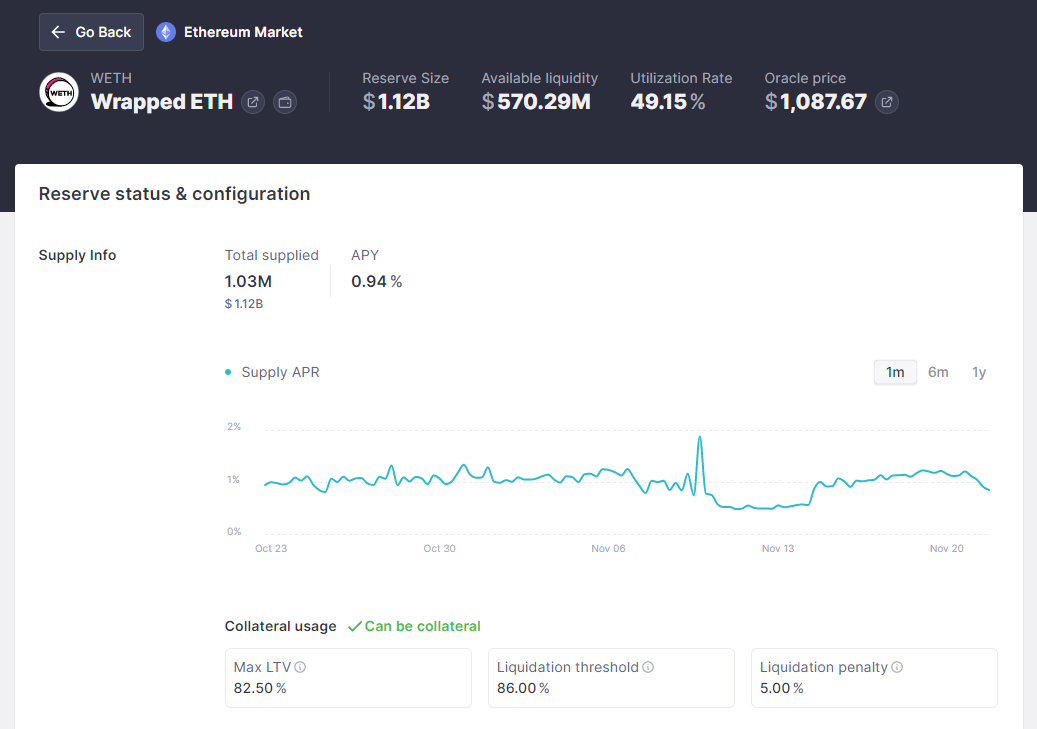

For the uninitiated, Aave is a decentralized and non-custodial liquidity protocol. This means Aave is a borrowing and lending system where users can borrow against collateral or lend crypto to earn yields from interest.

That said, if you have some ETH you’re hodling for the long-term but wouldn’t mind earning some passive income on top of that, lending on Aave is a very solid avenue to consider. The DeFiSafety team currently scores Aave at 94%, for instance.

To proceed you’d simply head over to app.aave.com, connect your wallet, press “Supply” at the ETH lending market, and then fill out your desired parameters and complete your deposit transaction. Over time, you’ll earn interest from borrower payments accordingly!

🦄 3) Uniswap for trading crypto

Core financial infrastructure, such as the ability to exchange value, is too important to be controlled by corruptible centralized entities.

— hayden.eth 🦄 (@haydenzadams) November 9, 2022

This is one of the many reasons I work on defi and decentralized exchange.

Uniswap is the most successful and battle-tested DEX to date.

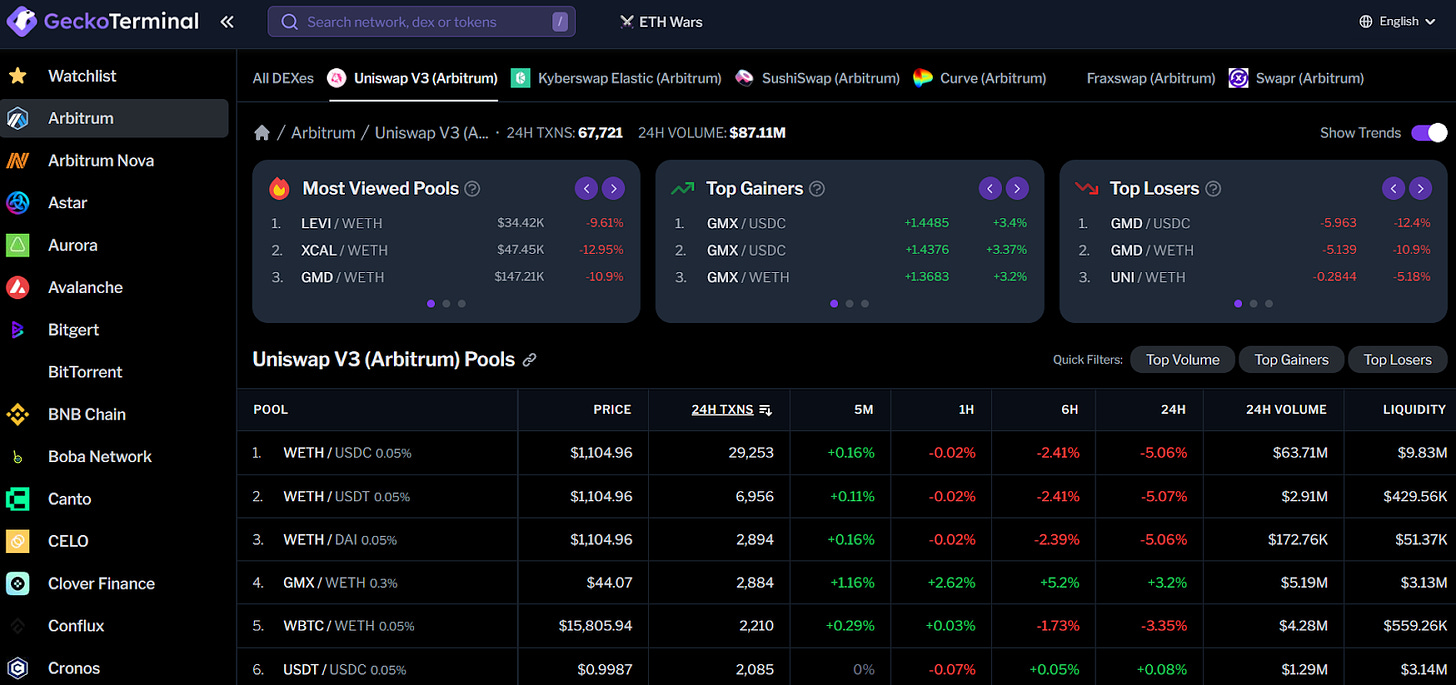

The majority of cryptocurrencies are ERC20 tokens on Ethereum Virtual Machine (EVM) blockchains, so you can use Uniswap — which is currently deployed on Ethereum, Polygon, Arbitrum, and Optimism — to trade into and out of just about any crypto that’s out there.

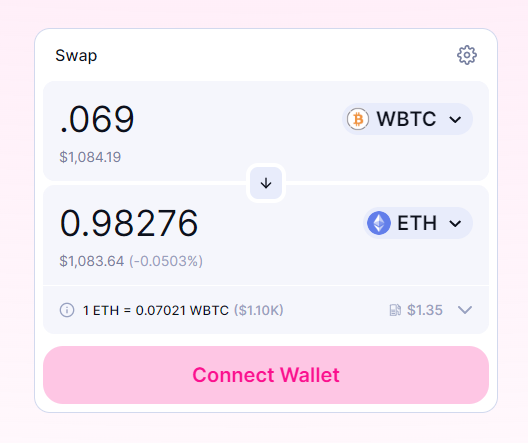

As such, you definitely don’t need to have funds parked on a CEX if you want or need to trade stuff. Using Uniswap with a wallet you personally control will work just fine for most, if not all basically all, of your swapping needs.

As for actually trading on Uniswap, it’s quite easy. Go to app.uniswap.org, connect your wallet, select the token you want to trade into and the token you want to trade out of, and then complete the swap transaction with your wallet.

If you run into trouble finding a token that you’re looking for, try searching on a service like GeckoTerminal, which makes it easy to search token pairs by chain and DEX, e.g. Uniswap on Arbitrum.

🏧 Bonus tip: level up with DeFi Saver

As expected, our new dedicated dashboard for Compound v3 includes all the advanced features our users are used to:

— DeFi Saver (@DeFiSaver) October 3, 2022

- Creating and closing leveraged positions in 1-tx

- Boost and Repay features for 1-tx leverage management

- Supplying+borrowing / paying back+withdrawing in 1-tx pic.twitter.com/yjvngIkzFW

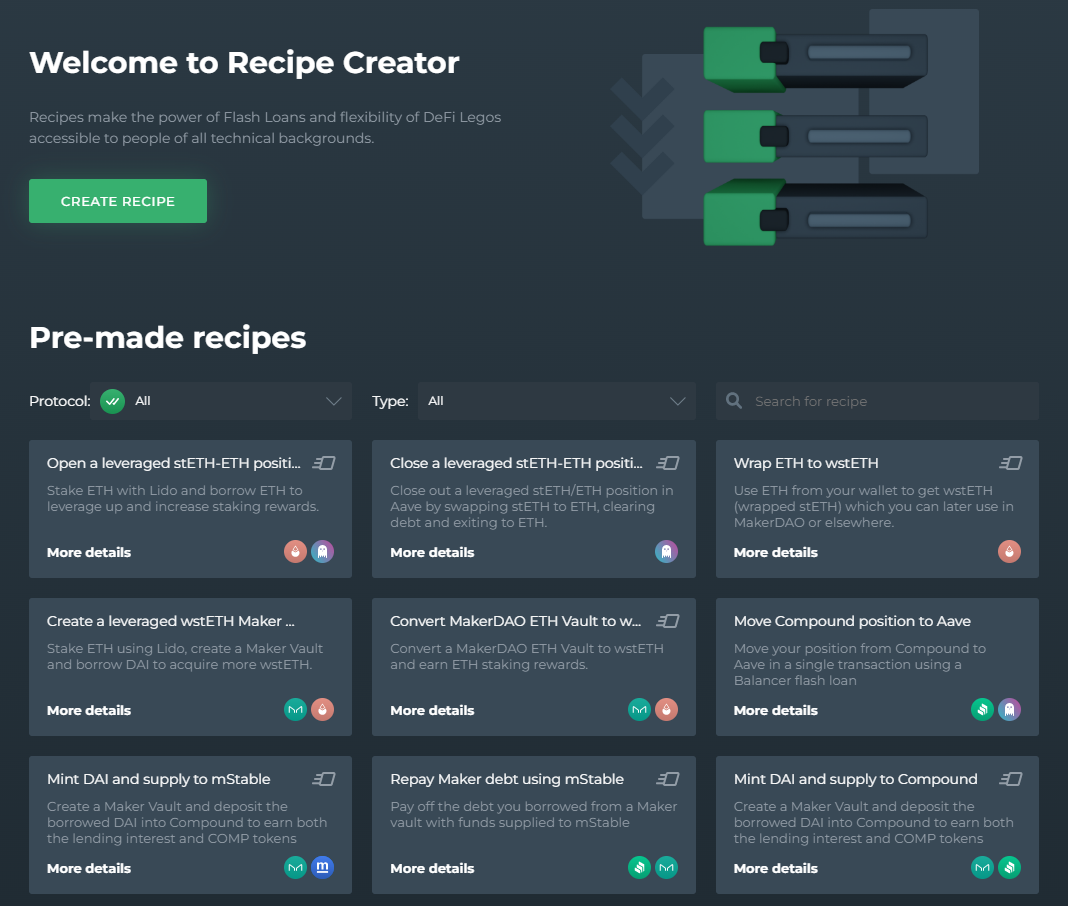

DeFi Saver is an advanced DeFi management platform.

Remember how Oasis was a simple front-end for Maker? In comparison, DeFi Saver is like a pro front-end for multiple top DeFi projects on multiple chains, namely Ethereum, Arbitrum, and Optimism right now.

Indeed, once you’ve learned the ropes of using Maker, Aave, and Uniswap — a great way to step up your DeFi base command game is to import your positions to DeFi Saver so you can have a one-stop hub for automating your increasingly advanced DeFi needs.

Right now the platform supports Maker, Compound, Aave, Reflexer, and Liquity positions. It also offers a LiFi-powered token bridge, an 0x-powered DEX UI, and other compelling features like:

- Smart Savings — a dashboard of curated DeFi yield opps

- Loan Shifter — a tool for migrating your DeFi loans between protocols

- Recipe Creator — a builder UI for creating and executing sequences of DeFi actions within a single transaction

- Simulation Mode — a sandboxed environment where you can test out DeFi Saver’s features without using real crypto

True DeFi is here to stay

The DeFi ecosystem isn’t even five years old yet. Of course it still has rough patches and places where we need more advancements, but more progress will come.

And make no mistake: that progress will come through, around, and upon the first DeFi heavyweights like Maker, Aave, and Uniswap that have been battle-tested and gotten the space this far. Using and setting up shop on these decentralized heavyweights today can help you securely steer your onchain journey for years to come.

Action steps

- 💪 Double down on DeFi with proven protocols like Maker, Aave, and Uniswap

- 🏰 Take your DeFi “base command” capabilities to the next level with DeFi Saver

- 🔐 Also check out our previous tactic How to take custody of your crypto keys