How to borrow Magic Internet Money

Dear Bankless Nation,

Over the past couple of weeks we’ve talked a lot about DeFi 2.0.

Perhaps you listened to our episode with Zeus of Olympus DAO or Scoopy Truples from Alchemix or Jai from Rari. Or maybe you saw BanklessDAO propose a new index with a number of DeFi 2.0 protocols.

Is DeFi 2.0 a thing?

I think there’s enough going on here to warrant a label yes.

One trend in DeFi 2.0 is the way DeFi 2.0 puts yield-generating assets to work.

Let’s take Abracadabra, which competes on the same turf as Compound. While Compound lets users lend and borrow against staples like ETH and WBTC, Abracadabra does the same, but for yield-generating assets like those locked in Yearn vaults or staked Sushi.

Why does Abracadabra bring utility to yield-generating assets when Compound cannot? Because Yearn and Sushi did not exist when Compound was launched.

What we’re seeing here is the continual evolution of DeFi building new primitives on top of existing primitives. We’re unlocking new branches in a tech tree.

Maybe a year from now we’ll all be talking about DeFi 3.0.

Until then let’s dig into Abracadabra with William Peaster.

Quick PSA: In addition to new ideas DeFi 2.0 also presents new risks. Treat this protocol and those like it with an extra measure of caution. There’s no rush. ⚠️

- RSA

Abracadabra.money is a “magical protocol to make your crypto work for you.” Simply put, the lending platform lets you borrow magic internet money (MIM), the project’s native stablecoin, against interest-bearing DeFi tokens.

The vision? To help make peoples’ interest-bearing tokens that much more useful (e.g. via leveraged yield farming) and to do so across multiple chains. This tactic will show you how to use Abracadabra to borrow and farm with MIM!

- Goal: Learn how to borrow and use MIM

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: The possibility of higher yields with leverage

An introduction to Abracadabra.money

“Currently, a lot of assets, such as yVaults have locked in capital, capital that you own, but can’t use. Abracadabra is here to give you an opportunity to use it.” — Abracadabra.money

Abracadabra is a decentralized bank of sorts, like Maker.

Yet Abracadabra is deployed on a handful of chains and accepts interest-bearing tokens for collateral, whereas Maker is still devising its multi-chain strategy and has focused on non-yielding assets like ETH, WBTC, and so forth.

Remember: the idea with interest-bearing tokens is that they steadily grow in value over time as your underlying position (which yield-bearing tokens represent) continues to be productively used in DeFi.

As such, Abracadabra unlocks further utility for yield-bearing tokens because the protocol makes it easy to use them for leveraged yield farming.

For example, let’s say you deposit wrapped ETH into Yearn’s WETH Vault and receive yield-bearing yvWETH tokens to represent your position. You deposit your yvWETH into Abracadabra, borrow MIM, trade the MIM for WETH, and then repeat from the beginning. Boom, that’s leveraged yield farming.

Abracadabra under the hood

Abracadabra.money is based on the same code underpinning Sushi’s Kashi lending platform.

Accordingly, Abracadabra is fundamentally a borrowing and lending platform that relies on isolated lending markets. While a project like Aave shares risk collectively across its markets, Abracadabra is able to isolate risk to individual token pairs.

This isolated lending model is key, as it allows Abracadabra to support more exotic tokens like yield-bearing tokens and at a more rapid pace than what traditional lending protocols can offer.

Lastly, it’s worth noting that Abracadabra users face liquidation risks, but the potential upside is that their interest-bearing tokens will grow in value and thus lessen the risk of liquidation over time.

Why Abracadabra matters

Abracadabra.money launched this summer, and since then the project’s experienced a rapid influx of users and capital.

Indeed, over its 5 current chain deployments (Ethereum, Arbitrum, Avalanche, BSC, and Fantom) and in as many months, Abracadabra has achieved a +$4B TVL, making it one of the biggest and fastest growth stories in DeFi this year.

This surge has also placed the upstart protocol firmly in the position of being Maker’s biggest DeFi competition yet.

How to borrow MIM

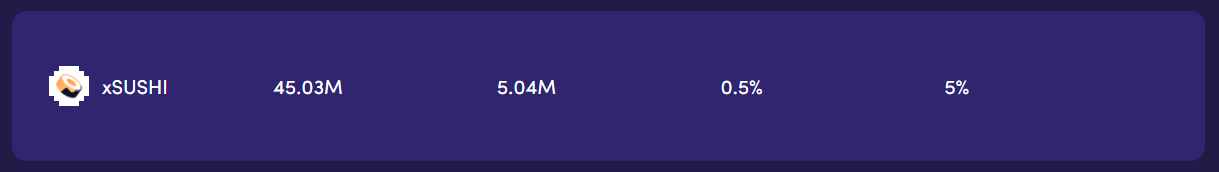

The borrowing process is generally the same across all of Abracadabra’s chain deployments. For the sake of simplicity, below we’ll focus on Ethereum and Sushi’s yield-bearing xSUSHI staking token.

- Step one is to make sure you have your collateral prepped. For xSUSHI, you could stake SUSHI on Sushi or simply purchase some on a decentralized exchange.

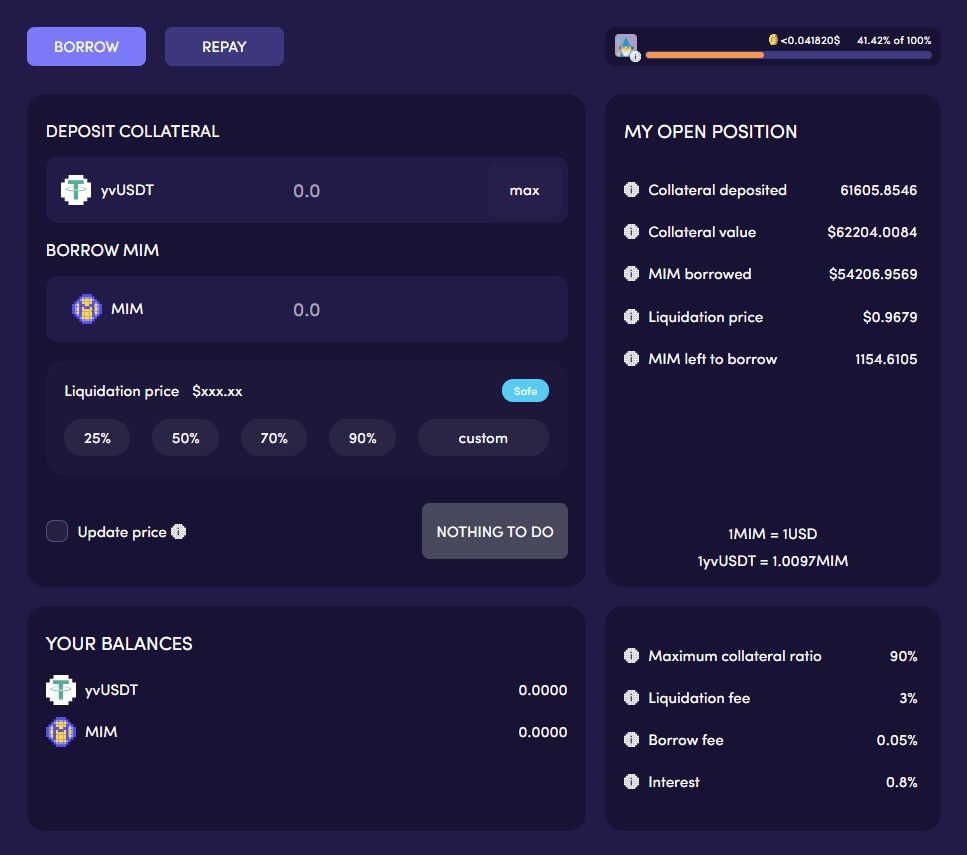

- Then visit the Abracadabra.money Borrow dashboard; connect your wallet and make sure you’re connected to the network you want, in my case Ethereum. Then click on your market of choice.

- Now input how much collateral you want to supply and select your desired liquidation price. These factors help you customize your position’s risk profile.

At this point and going forward, pay close attention to your:

Max collateral ratio - The maximum amount of debt a user can borrow Borrow fee - The one-off fee added to your debt when you borrow MIM Interest - Annualized percent that your debt will increase each year Liquidation fee - Paid to liquidators upon position liquidations)

- If everything looks good, use your wallet to complete the deposit transaction. Once that confirms, you’ll receive your selected amount of MIM! Now you can use MIM as you would any stablecoin!

- You can manage your open position through the same dashboard that you made your deposit through. Here you’ll be able to do things like add more collateral, borrow more MIM, repay your loan, and so forth. You can also use your Mana Bar to track your risk of liquidation at any given time.

How to use Abracadabra for leveraged yield farming

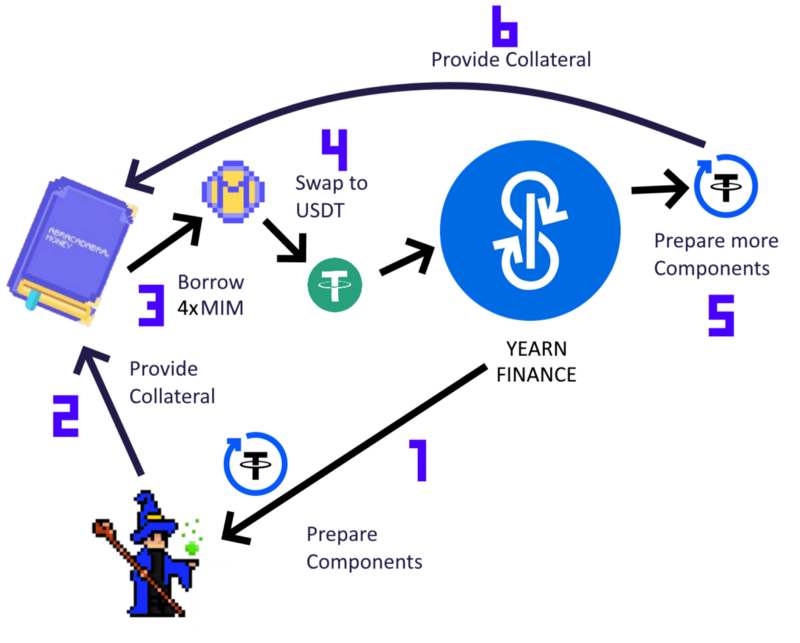

You can manually do leveraged yield farming via Abracadabra, but there’s no need for going through that process if you don’t want to. That’s because Abracadabra lets you leverage a position through a single multi-part transaction.

Before proceeding, just keep in mind that with leverage comes heightened liquidation risks. “Different from what happens in unleveraged positions, if the leveraged position gets liquidated, users will not have any assets in their possession,” the project’s doc explains.

All that said, be cautious and deposit responsibly if you do decide to try.

- To open up a leveraged position on Abracadabra, head to the Borrow dashboard and select your market of choice.

- Then in the deposit interface, click the “Change Leverage” button.

- Pick the number of leverage loops you desire and your swap tolerance. You’ll receive a series of position projections based on your inputs.

- Next, first-time users will have to go through a few approval transactions and then a final deposit transaction. Once that’s done, Abracadabra will have automatically leveraged your position for you!

- You can manage your position and de-leverage it through the same interface. For a comprehensive overview of the deleveraging process, check out Abracadabra’s docs.

💫 Other Abracadabra resources 💫

- SPELL/sSPELL: Abracadabra.money’s governance/staking token

- Abracadabra Bridge: A token bridge to help people access the project’s multi-chain deployments.

- MIM3POOL: A Curve pool for MIM, DAI, USDC, and USDT swaps.

- Staking dashboard: For staking SPELL in order to earn a cut of the protocol’s earnings via sSPELL (similar to how xSUSHI works)

- Farms: Abracadabra’s incentivized liquidity pools.

The big picture

With Abracadabra.money, you can earn yields on your crypto and borrow against it at the same time. This opens up powerful new possibilities for DeFi users who want to live off their yields and minimize their tax liabilities.

Zooming out, Abracadabra’s rate of growth has been incredible this year, and its multi-chain strategy has the project well-positioned to keep gaining ground in rapid fashion. Keep this one on your radar… or rather, in your spellbooks.

Action steps

- 🧙 Have some interest-bearing tokens sitting around? Consider using some to trial borrowing MIM on Abracadabra.money.

- 👀 Check out our previous tactic, How to borrow and lend any token (via Rari Capital’s Fuse).