How to automate Uniswap V3 liquidity

Dear Bankless Nation,

Uniswap V3 created a new way to provide liquidity in DeFi.

Rather than requiring liquidity providers (LPs) to provide liquidity to a full price range (like in V2), Uniswap V3 enables this thing called concentrated liquidity. In short, it gives LPs preferences on a price band where their liquidity is used.

When your price band is highly concentrated, your position is more capital efficient and generates more fees when the price is in range.

There are tradeoffs! The wider the price band, the fewer fees you’ll accrue. But if you have a tighter price band, you’re at a higher risk of impermanent loss.

Kinda tricky?

If you’re not completely following along, I get it. To be a successful liquidity provider in V3, you have to understand market-making and be more active in your day-to-day management.

But not everyone is a professional market maker! Some of us want to set it and forget it.

Fortunately, crypto is in the process of building retail-friendly tools to automate liquidity positions in Uniswap V3—just as Hayden Adams predicted in our last conversation.

There are some interesting designs for automated liquidity already. Some give you a fungible ERC20 token that represents your position (rather than the NFT). Others use vault designs similar to Yearn.

All of these designs drastically improve the LP experience.

And the yields can be…👀

Today William gives us an overview.

Here’s how to automate your Uniswap V3 liquidity positions.

- RSA

P.S. 🚨 Opportunity alert! TracerDAO is building hot new DeFi Infrastructure for derivatives. Their perpetuals are launching in September, and they’re recruiting DAO members now. Join their Discord and get involved!

How to automate Uniswap V3 liquidity providing

Ethereum’s decentralized exchange (DEX) ecosystem took a huge step forward earlier this year with the release of Uniswap V3. 🦄

The issue is that providing liquidity on Uniswap V3 is more complicated than in V2. Accordingly, this Bankless tactic will show you how to automate your Uniswap V3 liquidity provider (LP) positions through some of the most popular and easiest to use Uniswap V3 LP automation dApps available today.

- Goal: Explore the automated Uniswap V3 LP ecosystem

- Skill: Easy

- Effort: 1 hour to familiarize yourself with relevant projects

- ROI: Attractive annualized returns if you join the right liquidity pools

The New Uniswap V3 Paradigm

Uniswap V2 was and is a marvel because of its simplicity. For any V2 trading pair you want to provide liquidity to, all you had to do was acquire an equal proportion of the two tokens in question, then you can become a market maker at any time and from anywhere in the world.

But that’s the thing: Uniswap V2 mandates uniform liquidity (i.e. price-wise you provide liquidity from zero to infinity for any token pair you LP for) and you do so in 50/50 fashion, meaning you deposit 50% ETH and 50% DAI for the Uniswap V2 ETH/DAI pair and your position will cover trades from $0.00 to ∞.

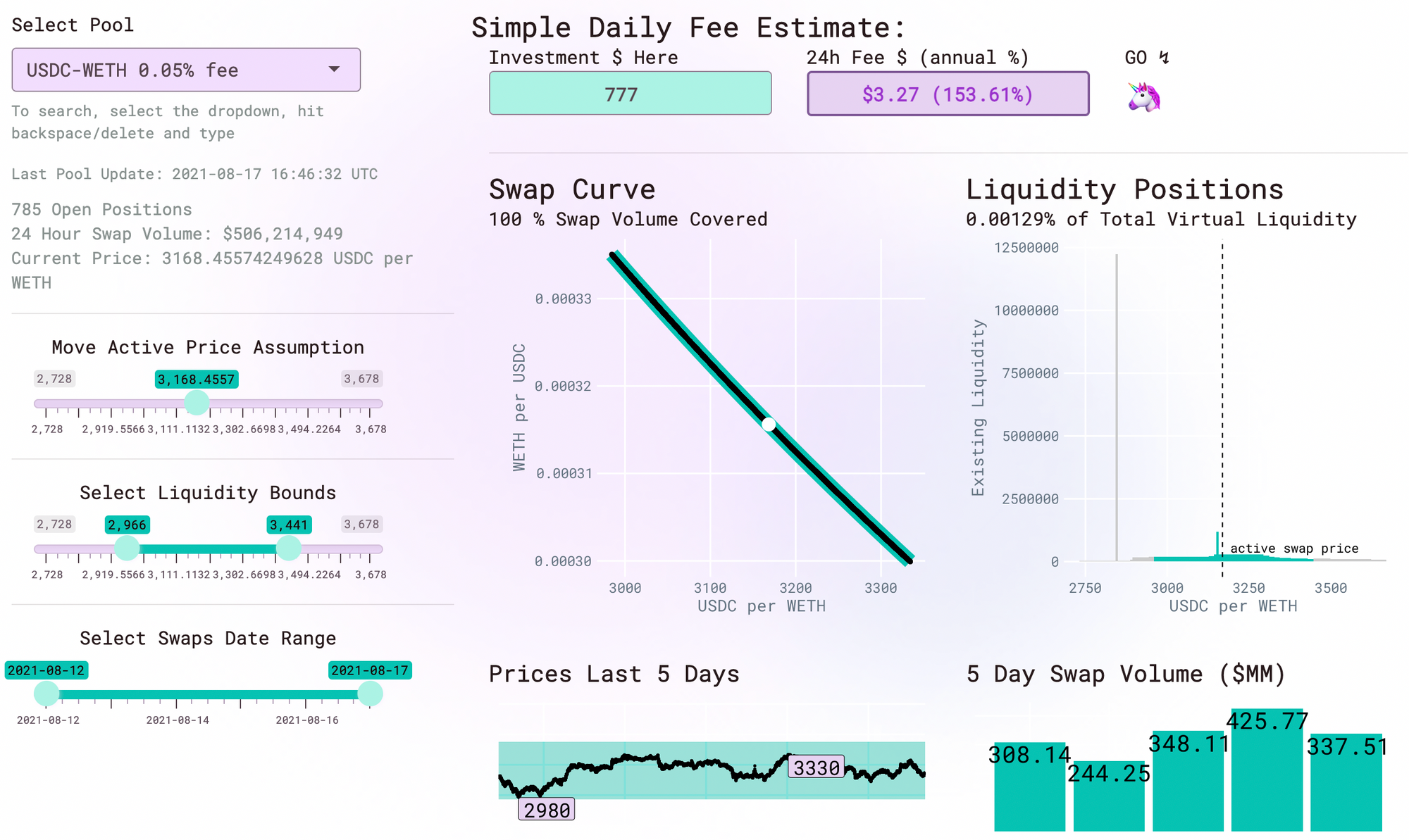

One of the main innovations of Uniswap V3 is concentrated liquidity—instead of LPing price-wise from zero to infinity, V3 LPs can now customize precise price ranges they want to provide liquidity within.

The advantage of concentrated liquidity for Uniswap V3 LPs is that they can earn more than their V2 peers, especially when times are good (tons of volume!). Your capital is a lot more efficient.

On the flip side, these same LPs lose more from impermanent loss when trading acutely turns ugly. If you can imagine, sensibly fine-tuning the parameters of your Uniswap V3 LP position is really important, but it can also be really complicated for beginners.

That’s why one of the most interesting verticals in DeFi right now is the automated Uniswap V3 LP sector. Forget manually deciphering Uniswap V3 price ranges and fee tiers on your own, you don’t have to any more courtesy of a rising wave of automated Uniswap V3 LP protocols that make it easy to earn V3 yields via preset strategies.

Just deposit money in and these services manage everything under the hood!

Sound interesting? Perfect.

Here are some of the top automated Uniswap V3 LP solutions available today so you can get up to speed and even try them out yourself! And you can get a super rare LP NFT too!

Bankless Resources on Uniswap:

- 🦄 How to make money with Uniswap V3

- 🎙️ Uniswap on Bankless Podcast | Hayden Adams

- ❤️ A Guide to Uniswap on Optimism

Best ways to automate Uniswap V3 positions

The automated Uniswap V3 LP space is currently blossoming, but it’s still relatively small. There are five rising dapps in this sector to consider at the moment, so let’s briefly cover them one by one!

🔁 xToken’s xU3LP tokens

The xToken project specializes in offering “buy-and-forget” ERC20 tokens that represent specific DeFi staking and LP opportunities.

In other words, you buy one of these xU3LP tokens to bypass having to manually input and actively manage all the key LP parameters involved. Some of the most popular strategies offered here include:

- xU3LP A: Maximize yield via the DAI-USDC Uniswap V3 pool.

- xU3LP B: Maximize yield via the USDC-USDT Uniswap V3 pool.

- xU3LP C: Maximize yield via the sUSD-USDT Uniswap V3 pool.

🔁 Gelato Network’s G-UNI

Gelato Network, “Ethereum’s automation protocol,” pivoted into automated Uniswap V3 LPing earlier this summer. That’s when Gelato introduced G-UNI, an automated liquidity provision ERC-20 for Uniswap V3, with the central aim of the venture being to make “Uniswap V3’s non-fungible liquidity positions fungible.”

As the Gelato team has explained:

“G-UNI combines the capital efficiency of Uniswap V3 with the simple user experience of Uniswap v2 by enabling users to simply deposit their funds in a G-UNI ERC-20 that manages their liquidity on Uniswap v3 automatically on their behalf.”

If you’re interested in exploring these tokenized V3 LP positions further, consider checking out the G-UNI pools currently available on Sorbet Finance and Zerion.

🔁 Visor Finance

The Visor Finance team has developed what it calls an “NFT Smart Vault” system. Remember, Uniswap V3 LP positions are represented by NFTs after all!

Users come to Visor to deposit funds into one of the protocol’s Uniswap V3 liquidity vaults, or Visor Vaults. These vaults are then managed on-chain by smart contract systems dubbed Hypervisors and Supervisors, which automatically earn depositors trading fees via pre-specified strategies.

Head over to Visor’s Vault dashboard and connect your wallet to review which vaults are presently listed!

🔁 Charm.fi Alpha Vaults

Another set of offerings worth considering here are Charm.fi’s Alpha Vaults, i.e. Uniswap V3 liquidity vaults.

Charm currently has three active vaults (pictured above), all of which are near maximum capacity so don’t expect to hop in instantly just yet. However, expect these capacity restraints to be eased over time, so if/when you can get in the passive rebalancing strategies available are efficient and lucrative.

🔁 Mellow Protocol

One of the newest projects to keep an eye on in the Uniswap V3 LP automation space is Mellow Protocol.

Mellow doesn’t have any liquidity vaults live yet, but the project has announced that it’s launching some in the not-so-distant future. In an article published last week titled “Uniswap V3: Liquidity providing 101,” the Mellow team noted:

“The goal of Mellow is to build a robust ecosystem of tools for eliminating market inefficiencies and generating outcome for users [...] We don’t see this just as a product, but as an evolution of what complex math can bring to the DeFi space. Similar to how Uniswap and Curve innovated user trading experience, we believe LP optimization is also pushing forward the boundaries of what was possible in TradFi.”

Zooming out, can you earn high yields with Uni V3?

Providing liquidity in Uniswap V3 is among the most impactful ways you can put your crypto to use in DeFi these days.

However, setting up your Uniswap V3 LP position can be tedious if you manually do it yourself, particularly if you’re a newcomer to crypto in general.

All of these protocols and applications are new. They are risky. So if you’re looking to get in on this opportunity, the most important thing is having some funds set aside to play with. Once you’re ready, automated V3 positions are arguably among the easiest ways to earn a substantial yield by simply just holding!

Action steps

Automate your Uniswap V3 liquidity

👀 Level up with these Bankless resources on LP’ing and Uniswap V3!