How Polymarket Decisions Get Resolved

After an electric election season for Polymarket, the prediction market's biggest contest is over as multiple news organizations have called the presidential election for Donald Trump. So, what happens now?

I just got word that the Trump campaign HQ literally found out they were winning from Polymarket.

— Shayne Coplan (@shayne_coplan) November 6, 2024

History was made today.

Surreal

Billions in bets have flowed through Polymarket in recent months, but how does the platform's prediction resolution work and when will you get paid out?

Let's dig in 👇

How Does Polymarket Work?

Polymarket is the world’s largest prediction market, enabling users to profit by staying informed and using their knowledge to bet on future events, from presidential elections to Super Bowl outcomes.

In October alone, Polymarket saw ~$2.5 billion in trading volume, much of it driven by the election.

Polymarket offers shares of event outcomes priced between $0 and $1, so every pair of opposing outcomes is collectively worth $1. Shares are created when two parties agree on odds, ensuring the total payment equals $1.

Once an event’s outcome is known, those holding shares of the correct result receive $1 per share. Alternatively, users can sell shares before the outcome is decided, allowing them to lock in profits or cut losses.

Who Decides Who Won?

At least for now, politicians are not elected onchain, so how does Polymarket ensure the decisions made on its platform are correct?

Polymarket uses optimistic oracles to pull the off-chain data required to settle these prediction markets. Unlike traditional oracles that provide constant price feeds to projects like Aave or Lido, optimistic oracles are better suited for prediction markets, which don’t require continuous updates. For example, the market on “Who will be the next U.S. president?” only needs resolution once the election ends.

How does this all go down?

- First, a user creates a prediction market with two possible outcomes, a description of the event, a reward for correctly asserting the outcome, a bond requirement for asserting the outcome, and a challenge window, which is the period during which the assertion can be contested.

- When the event concludes, a user can put up the required bond and assert the event’s outcome. If no one challenges this assertion within the challenge window, the outcome is optimistically accepted, the market closes, and the data asserter receives their reward.

But what if the asserter is wrong or malicious?

Take the resolution of the U.S. presidential election prediction as an example. Despite Trump's win being established by multiple organizations, let’s say an asserter put up a $100,000 bond claiming Kamala won. In this case, a disputer would also stake $100,000 to challenge this assertion. The dispute then goes to UMA’s Data Verification Mechanism (DVM), where UMA stakers vote on the true outcome.

If UMA stakers confirm Trump’s win, the original asserter loses their $100,000 bond. The disputer receives their principal back and $50,000 of the asserter's bond, while UMA stakers who voted correctly share the remaining $50,000 proportionate to their staked UMA and receive a portion of the final fee from the market creator.

Critically, UMA stakers who voted against the majority have their stake slashed. Those who have staked their UMA tokens but don’t participate in voting also have their stake slashed.

In a case where the asserter correctly reports the outcome but is disputed, the asserter would gain half of the disputer’s bond, and correct UMA stakers would also receive a reward.

Potential Doomsday?

With large amounts of money being bet on the U.S. election, there’s a potential risk that someone could attempt to manipulate UMA’s market resolution system by providing false results. While considered an extreme scenario, this is more plausible than some might think.

The risk sits in the fact that, like in many other platforms, a user's votes are commensurate to their staked assets, so users with a large amount of staked assets could have an incentive to overwhelm the vote for an outcome in their favor.

The average voting participation has been about ~15M UMA, but there are whales out there with the potential to swing major votes. Case in point, this wallet, which has staked ~7.43M UMA but has not voted since January of this year. Although more stakers would likely show up if something major like election results were disputed, large wallets like these with outsized voting power can complicate conflict resolution.

When Will the Decision Finalize?

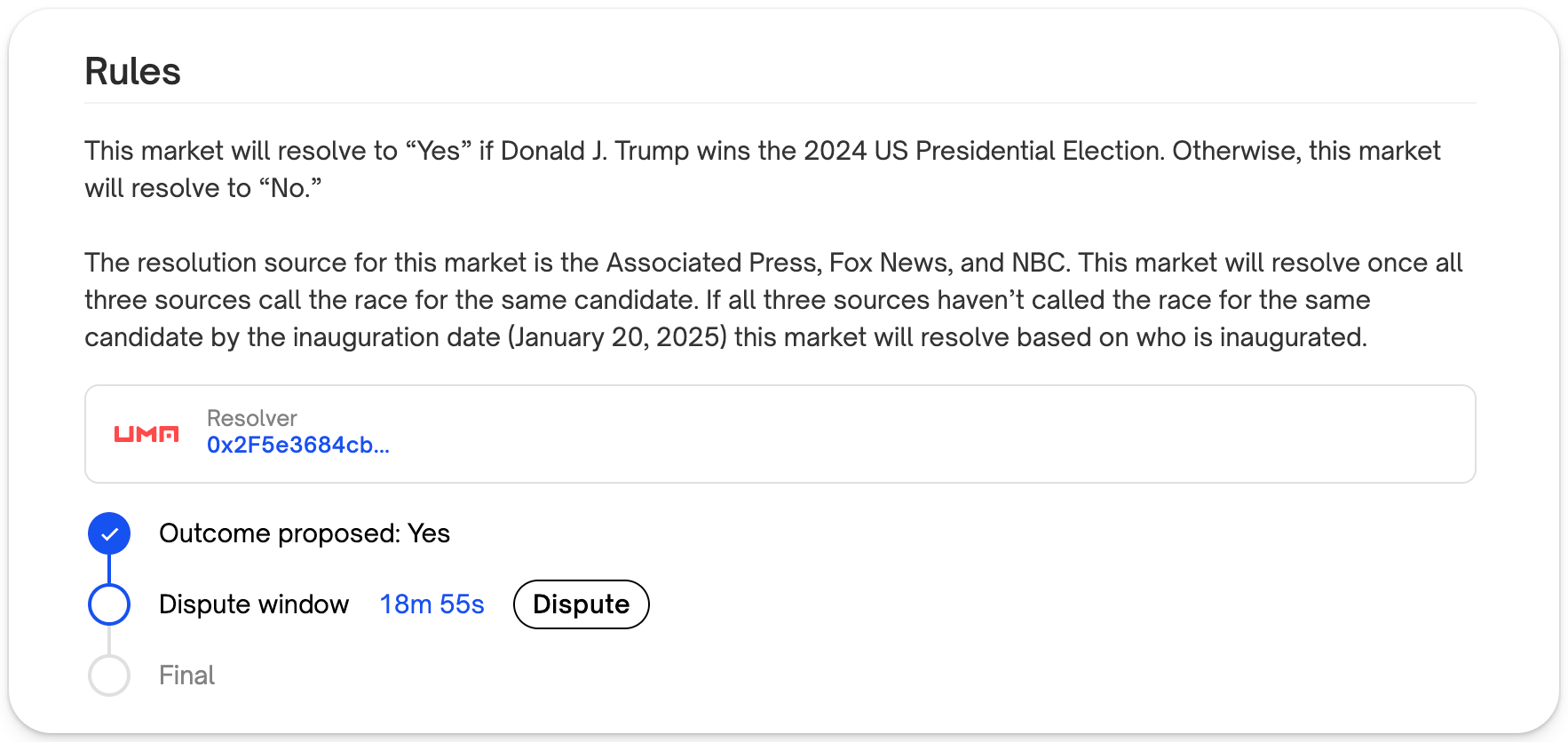

According to Polymarket's description of the U.S. Election betting market, the election will be resolved when the Associated Press, Fox, and NBC have all called the election for the same candidate. That's already happened.

*AP, FOX AND NBC CALL ELECTION FOR TRUMP, MEETING POLYMARKET RESOLUTION CRITERIA

— db (@tier10k) November 6, 2024

gg french whale

The outcome has already been proposed for the race, and with less than 20 minutes remaining in the dispute window at the time of publishing, a final decision is likely imminent!