How NFTs Could Upend Copyright Law

Dear Bankless Nation,

Today’s copyright law is looking like a relic of the past. We can do better.

In this issue, securities lawyer Brian Frye (who recently joined Ryan & David for a podcast conversation) makes the case for how NFTs are ushering in an artistic renaissance and changing the way we think of intellectual property.

- Bankless team

NFTs & the New Creative Economy

Author: Brian L. Frye, Law Professor at University of Kentucky1

In order for things to stay the same, everything will have to change.2

Copyright is obsolete, we just can’t admit it yet. It lasted almost 500 years and did a lot of good, but we don’t need it anymore.

Why? Because NFTs have introduced a new way of compensating authors that is far more efficient. Copyright was always a kludge, making works of authorship artificially scarce in order to indirectly subsidize their creation, publication, and distribution. It was a reasonable compromise when publishing and distributing works was costly. But now it’s free, and copyright is just a transaction cost on consumption. Sure, copyright still encourages authors to create works, but not very efficiently or effectively. We can do better, and the NFT market is proof.

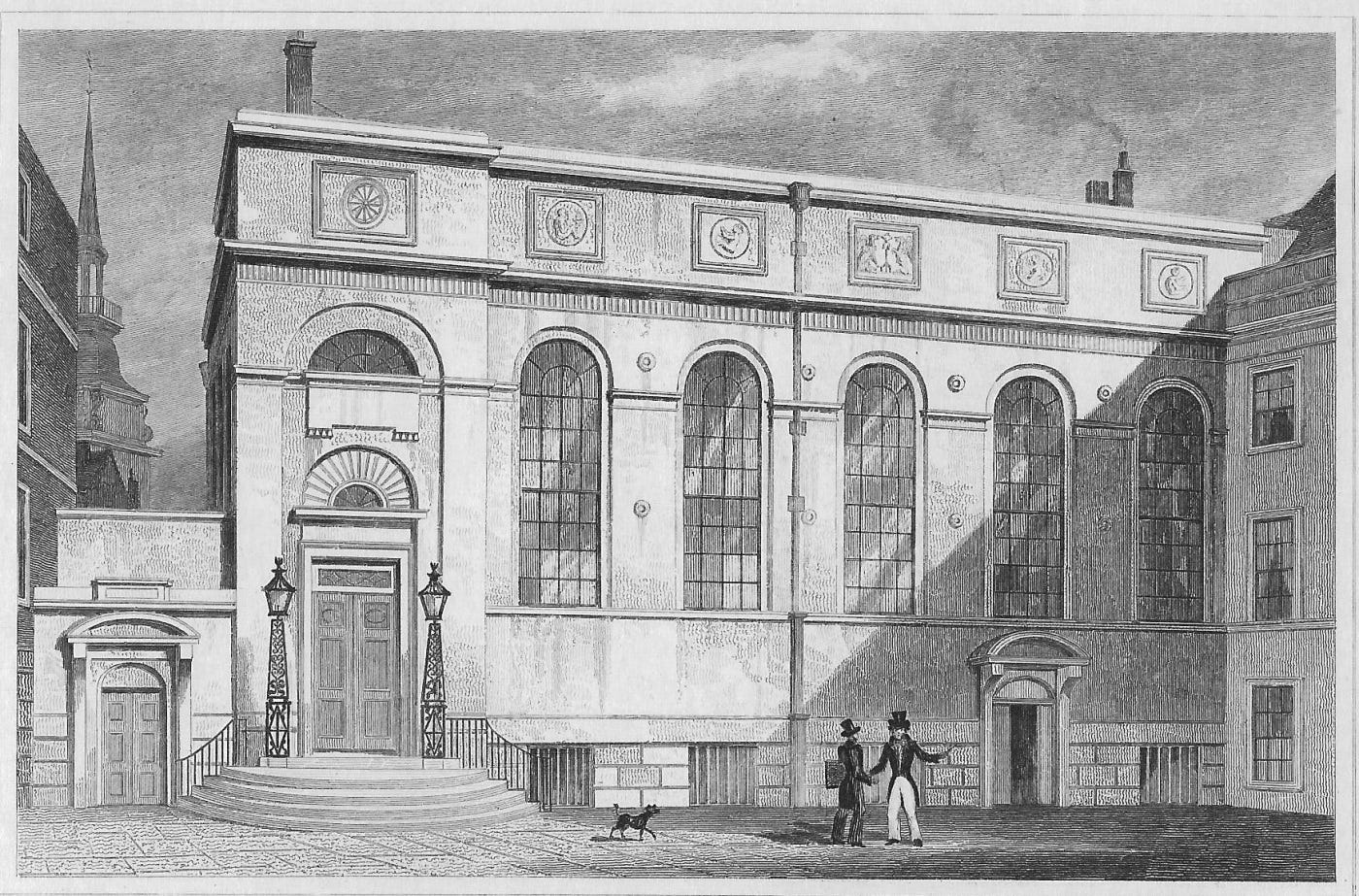

The Stationers’ Company invented copyright in the early 16th century, soon after the printing press came to London. In 1710, it convinced the Crown to create the first copyright act, the Statute of Anne, which granted copyright ownership to authors. Of course, authors still got the short end of the stick, because publishers just bought the copyright in the works they wanted to publish.

When the United States ratified the Constitution, it gave Congress the authority to create copyright, which Congress immediately exercised, plagiarizing the Statute of Anne. While the scope and duration of copyright have gradually expanded since then, the basic idea remained the same. Copyright gives authors certain exclusive rights to make and distribute copies of their works, in order to encourage the creation and distribution of those works.

At least in theory, copyright is supposed to benefit the public — all of those consumers hungry for content — by encouraging authors to create new works and encouraging publishers to distribute them. Without copyright, works of authorship would be “public goods,” available for anyone to use however they like. That’s why copies of old works in the public domain are cheap or free.

Yes, copyright makes content more expensive. But that’s ok, because it also encourages authors and publishers to create and distribute more of the works we love to consume. It’s a bargain, if the value of those works exceeds the cost of copyright. But the bargain starts to look like a swindle, when copyright expands, even as the cost of producing and distributing works decreases.

It’s especially odd that copyright automatically protects just about everything you create, whether or not you even want it. After all, the whole point of copyright is to give people a financial incentive to create and distribute content. If they don’t want or need an incentive, it’s just a deadweight loss. At the very least, we should question the efficiency of copyright, when 99.99% of the works it protects have no economic value at all. After all, I gladly wrote this essay for free, but copyright protects it anyway. Except it doesn’t, because I put everything I create in the public domain and adopt a “plagiarism license.”

There’s gotta be a better way. And there is. We’ve known about it for years. It’s called the art market.

When I talk about the art market, I mean the market for art as an investment, not a consumption good. Lots of people buy art as decoration, and that’s great, but it isn’t the art market. You’re participating in the art market when you purchase art because you reasonably believe it could be more valuable in the future. Obviously, there’s no guarantee an artwork will increase in value. In fact, art is usually a terrible investment. Only a tiny fraction of artworks sold on the primary market have any value whatsoever on the secondary market. But some do, and few become immensely valuable.

Everyone assumes the art market is a market for objects. They’re wrong, but for an interesting reason. In fact, the art market is a market for ledger entries. When you buy an artwork, you’re really buying an entry on an artist’s catalogue raisonné, the list of works attributed to that artist. Of course, you typically get a physical token that symbolizes your ownership of the ledger entry, usually a dirty piece of cloth or a lumpy rock. But the physical token is worthless, without the ledger entry. The art market values paintings and sculptures only because everyone agrees they were created by a popular artist, not because they are intrinsically valuable.

The NFT market works exactly the same way, it just gets rid of the physical token and enables investors to buy and sell ledger entries directly. It’s a deceptively radical move. The art market seems familiar, because we understand markets in objects. But the NFT market makes art uncanny, by eliminating the object, and forcing us to recognize that the art market was never a market in objects, it was always a market in clout. When you buy an artwork or an NFT, what you’re really buying is an investment in the future commercial goodwill associated with an artist.

In other words, the art market has always been a securities market, and the NFT market is just a new version of that same securities market. That’s what makes it so cool and promising. When art collectors buy an artwork, they are effectively investing in an artist’s career. They’re making a bet that the artist will be more popular in the future. NFT collectors do exactly the same thing. But the NFT market is way more transparent, liquid, and accessible.

What’s more, the NFT market proves that authors don’t need copyright to make money. The art market was only ever accessible to a tiny percentage of authors, who were chosen by the art world elite. The NFT market is decentralized and accessible to everyone. Sure, it’s hard to succeed selling NFTs. But selling art has never been easy.

For better or worse, we live in a clout economy. Value depends on fame and influence. Once upon a time, it was expensive to distribute ideas. Now it’s free. When technological changes make information free, markets need to change as well. Copyright was a great policy tool in a world beset by scarcity. But it sucks, in a world of abundance.

For the first time, NFTs promise authors and other creators access to capital markets. Rather than selling copies of their works, they can sell shares in their creative enterprise. I think it will transform the creative economy. As Marshall McLuhan observed, meaning is the message. Now, we can monetize it.

Action steps

- 📖 Read Brian’s previous classic article on Pwning NFTs in a Clout Economy

- 📺 Watch Brian’s podcast appearance on Are NFTs Securities?

Author Bio

Brian Frye is a Professor of Law at the University of Kentucky and a conceptual artist who works with NFTs.