How much will EIP 1559 burn? 🔥

Dear Bankless Nation,

EIP 1559 is here. 🔥

This is massive for Ethereum. Not only does this upgrade provide a more noob-friendly way to pay for Ethereum transactions…it also implements ETH burns.

Starting today every time the Ethereum network is used—ETH gets burned.

Every. Single. Block.

EIP 1559 turns ETH into a commodity money that gets more scarce as its economy is used. (Part of the journey for becoming Ultra Sound Money)

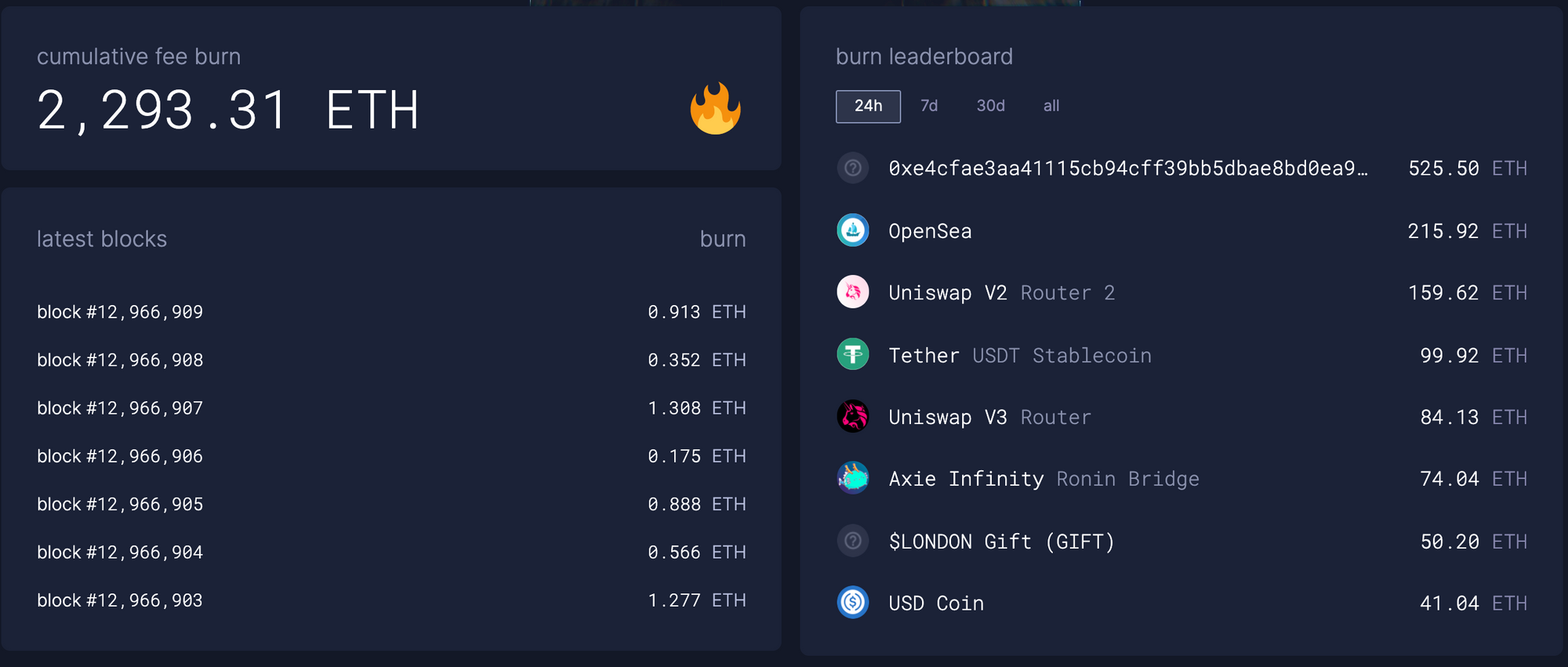

Check this out…EIP 1559 was just implemented this morning and we’re already quickly approaching 3k ETH burned. 🤯

All of this made us want to revisit an article that Lucas wrote last year for Ethereum’s 5th birthday “What if ETH had a fee burn 5 years ago?”. It ran through hypothetical scenarios on what the projected ETH burns would be if EIP 1559 was already live.

At the time, it was estimated that 684,000 ETH would’ve been burned at the projected 75% burn rate if EIP 1559 was implemented at genesis.

But we have another year under our belt and EIP 1559 is now here.

So how much ETH will EIP 1559 burn?

And…is it possible ETH issuance is already less than Bitcoin? 👀

We ran the numbers for you. I think you’ll be surprised.

And as you’re reading this ask yourself: what happens to a highly demanded asset when it hits a massive supply shock?

🔥 = 🚀

- RSA

P.S. Watch Vitalik and Bankless <> ETHHub react the moment EIP1559 goes live

How much ETH would EIP 1559 have burned?

In the words of the great Bruce Buffer:

After nearly two and half years since it was originally proposed, EIP-1559 has finally arrived! Slated to be activated as a part of the London hard fork, 1559 marks one of the most significant protocol changes in Ethereum’s history, completely overhauling the fee market and improving the user experience of paying for the network’s precious blockspace.

Importantly, EIP-1559 also introduces a burning mechanism where a portion of transaction fees paid to miners or validators, will be removed from circulation forever.

Anytime the Ethereum network is used, ETH is burned—meaning that every time a trade is made on Uniswap, or users rush to ape into the latest NFT drop, ETH holders essentially get paid through this mechanism. The fee burning, combined with the massive reduction in block reward issuance from the merge to Proof-Of-Stake, could lead to Ether having a deflationary supply, and fulfilling the meme of ultra sound money.

Although we will have to wait a bit longer to experience its final form, there is still plenty of ETH to burn in the meantime.

But this begs the question: Just how much? What effect would this have on issuance? Is ETH on track to be ultra-sound money?

This is what we’re going to find out.

EIP-1559 Under The Hood

Before we see how much ETH has been burned, let’s take a second to look under the hood of EIP-1559.

EIP-1559 redesigns Ethereum’s fee market. Today, the gas fee a user pays on the network is determined through what’s known as a “first-price auction”. In this system, users bid for blockspace, with transactions with the highest fee being included in a block.

This system can make for a frustrating user experience. As we have all likely witnessed first-hand, gas prices can spike in the period between when a transaction is sent to the mempool, and when it is confirmed. This leads to a situation where you’ve underpaid for gas, and you’re stuck in limbo waiting for the transaction to be confirmed. Dealing with this is incredibly frustrating, as it often requires manually inputting a higher gas price.

1559 mitigates this issue on several fronts. One is through introducing a mechanism that temporarily expands the size of a block during periods of high network usage, in order to accommodate the higher demand for blockspace. The other, and the focus of this article, is that it replaces the free-for all, first-price auction model and changes the composition of fees.

Instead of paying a monolithic fee, gas fees are now made up of two parts. The first is what’s known as the “base fee”, which is determined algorithmically and varies on a per-block basis depending on its utilization. The second is the “priority fee,” which is a user-determined tip for miners to provide an incentive for them to include the transaction.

🧠 Users can also set a max fee which specifies the highest gas price they are willing to pay to have their transaction included in a block. Should the combined base and priority fee exceed the max fee, the difference will be refunded.

The base fee is the portion of the transaction that is burned. From this, we can easily infer that more ETH will be removed from circulation in periods of high network activity (i.e when gas prices increase and blockspace is scarcer, and less when the opposite is true).

In addition, we can also see that the value accruing to ETH holders is tied directly to demand to use Ethereum.

The Fee Burn Rate

Now that we understand the mechanics of EIP-1559, let’s see the effects that fee burning would have on the ETH supply and issuance.

When making these estimates, it’s important to remember that the base fee fluctuates on a block-by-block basis. According to Tim Beiko, an Ethereum core developers who took on a leading role in the implementation of 1559, the base fee is expected to account for anywhere from 25-75% of the total transaction fee.

Due to the difficulty of manually determining what the historical base fee per block would have been, we’ll use the range of his projections, 25%, 50%, and 75% as the worst, base, and best-case rates for how much of the total transaction fees were burned.

Because of this, it’s possible these estimates are not entirely accurate.

Cumulative ETH Burned

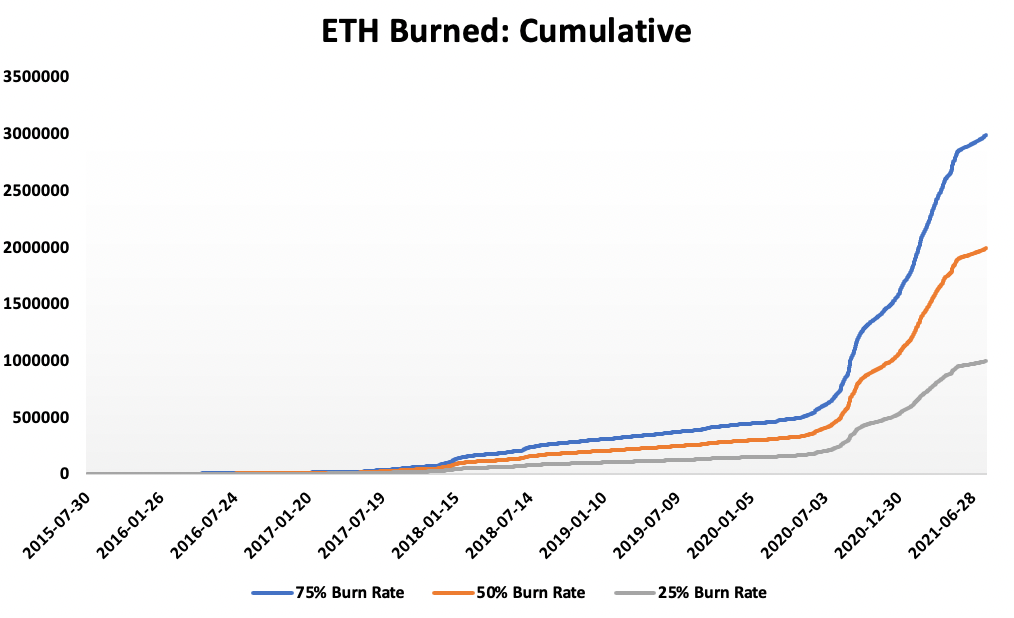

Let’s start off by looking at the ETH that would have burned if 1559 was active since Ethereum’s inception.

Currently, the total ETH supply sits at roughly 116.9 million.

Were 1559 implemented on Ethereum’s August 2015 mainnet launch, 2.9 million, 1.9 million and 994,000 ETH would have been cumulatively burned at base-fee rates of 75%, 50%, and 25% respectively.

This means that the ETH supply would theoretically sit between a range of 114-115.9 million.

While it may not seem that large, it’s still a meaningful reduction in total issuance, as the ETH supply would have shrank by either 0.85%, 1.70%, and 2.55% depending on the rate.

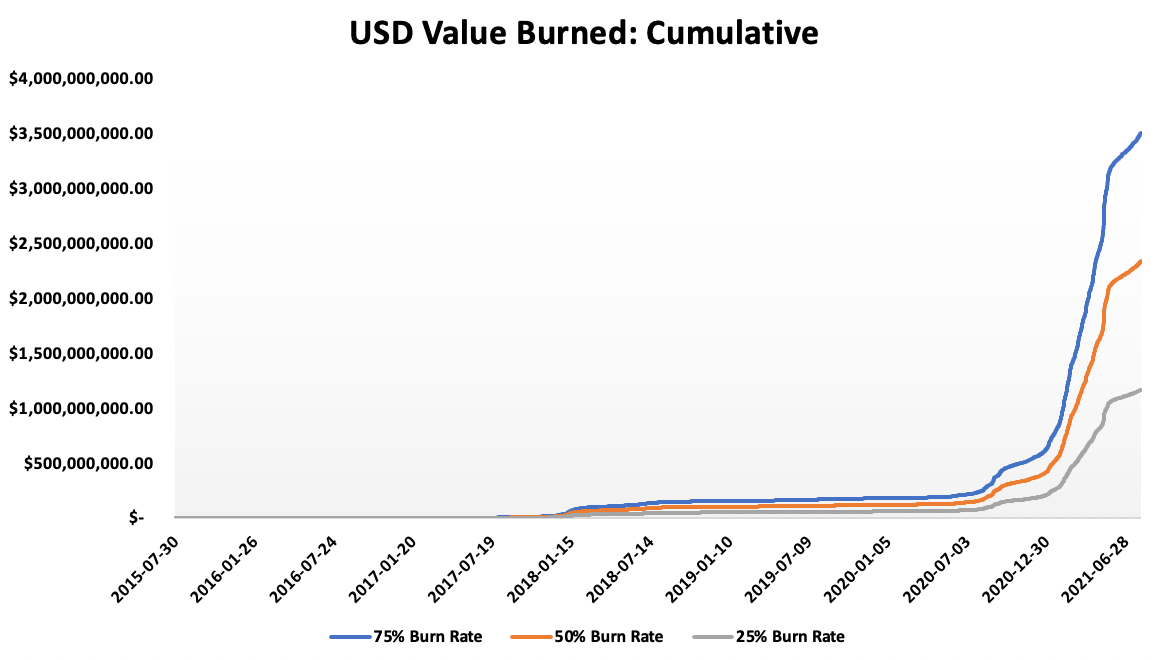

When put into USD terms, this cumulative burn total seems far more impressive. Assuming the same rates, between $1.16-3.50 billion worth of ETH would have been burned over Ethereum’s lifetime. To give some perspective, the low end of that range is equivalent to burning the entire market cap of SushiSwap, while the high exceeds the combined value of Yearn and Compound. 🤯

Looking at the charts above, we can also see that the amount of ETH burned skyrocketed beginning in the second half of 2020.

This makes sense. This was when DeFi summer began, which exploded the demand for Ethereum, and ushered in the high gas fee (and now burning) era that we are currently living in.

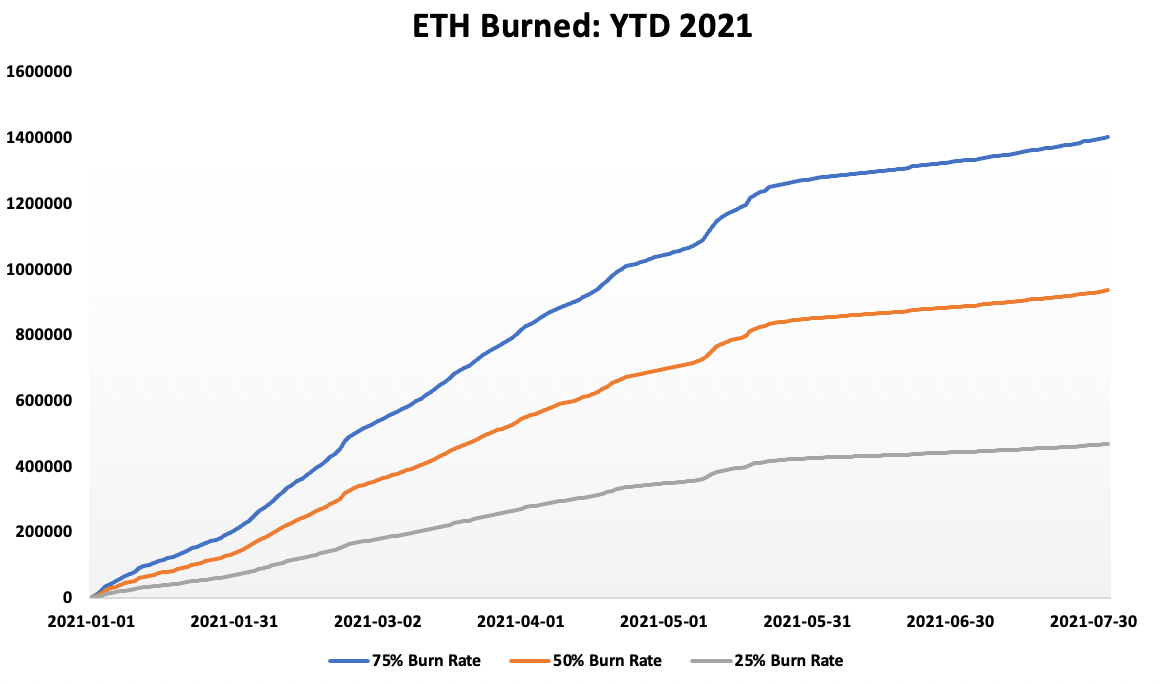

ETH Burned YTD 2021

Let’s hone in on the fees generated year-to-date in 2021. This is an important year because it likely paints the most accurate picture for the level of network utilization, and therefore fees burned, in the future.

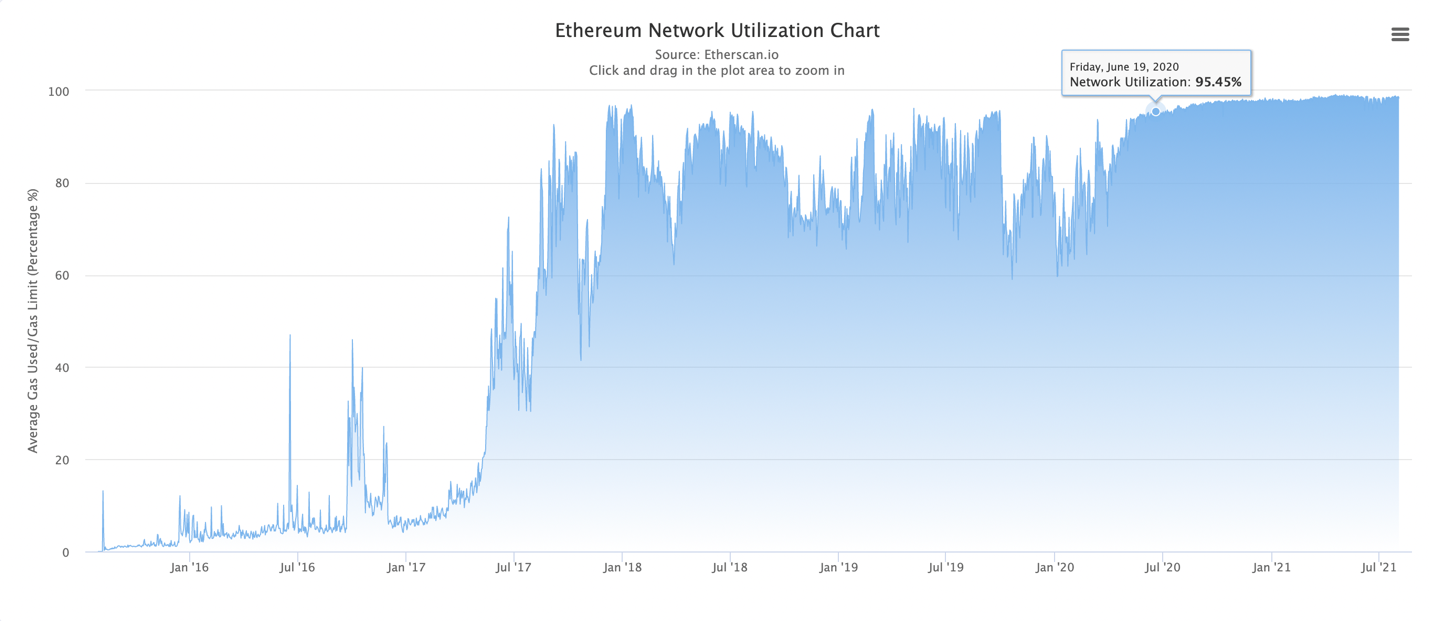

As we can see, between DeFi summer 2020, a raging bull market in the fall, winter and spring of 2021, and the NFT mania this summer, Ethereum has been operating at peak capacity over the past year.

Although painful for users because it means higher gas prices, this sustained utilization does indicate that there is strong, persistent demand for Ethereum blockspace. If you’re a Bankless reader, you likely expect this to continue for the foreseeable future, meaning the fees generated this year can help give a reasonable expectation of what the level of burning may look like moving forward.

Using the same 75%, 50%, and 25% burn rates, were 1559 in effect, over 1.4 million, 935,000, and 467,000 ETH would have been burned year-to-date in 2021. Annualizing these figures, this means that between 800,000-2.4 million ETH is projected to be burned in 2021.

From this data, we can see the power that high network utilization has on fee burning, as the first seven months of the year have accounted for more than 48% of the would-be ETH burns.

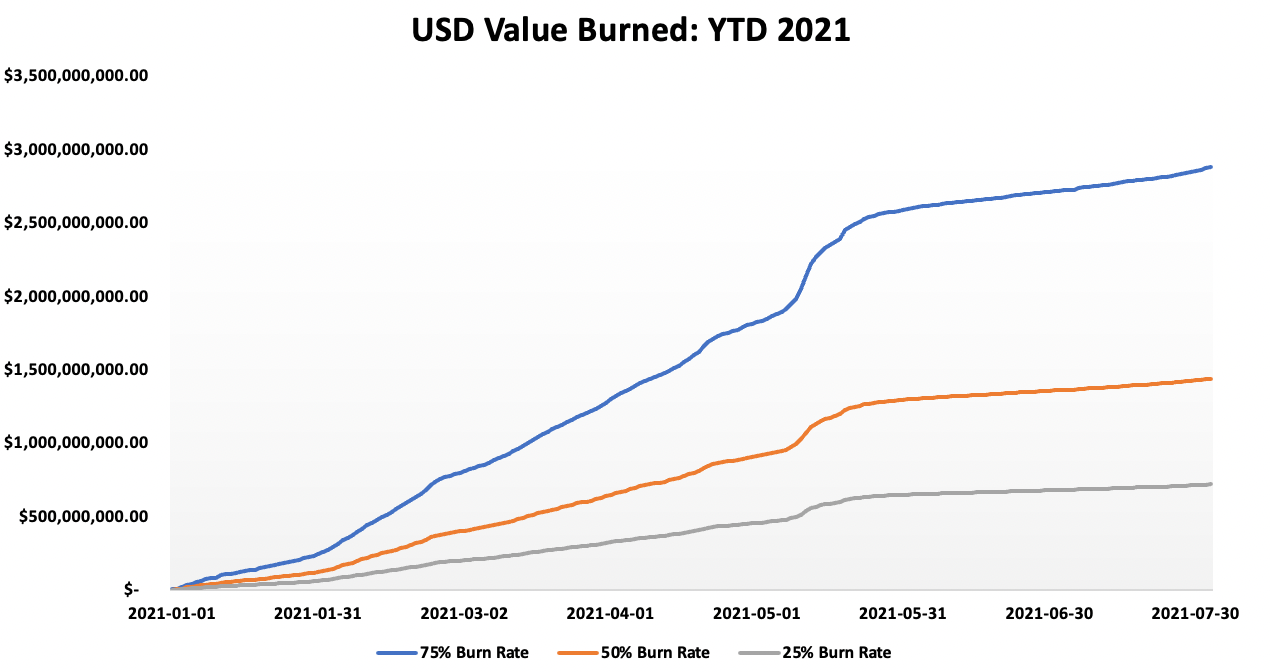

On a USD basis, assuming the same base-fee rates, this translates to between $959 million and $2.8 billion, worth of ETH being burned. When annualized, the value of ETH burned ranges from $1.6-4.8 billion. These are staggering figures. For perspective, at the high-end, we’ve already burned more value in ETH this year than the market cap of MakerDAO’s MKR. Taking this a step further, in the best case scenario of the annualized estimates, the value of ETH being burned would put it in the top 25 crypto assets by market cap.

However, it’s important to keep in mind that dollar denominated value ETH burns can sometimes be misleading, as its dependent on the price of Ether. This can help explain the discrepancy in the total percentage of ETH-denominated value burned in 2021, versus dollar denominated.

As we discussed above, the former is 48%, while the latter comes out at more than 80%.

Influence of EIP-1559 on ETH Issuance

Now that we see how much ETH has been burned this year, it poses the question: Has Ether already become deflationary?

To determine this, we’ll have to look at the total Ether issuance over the course of 2021, and subtract the hypothetical fee burn from it.

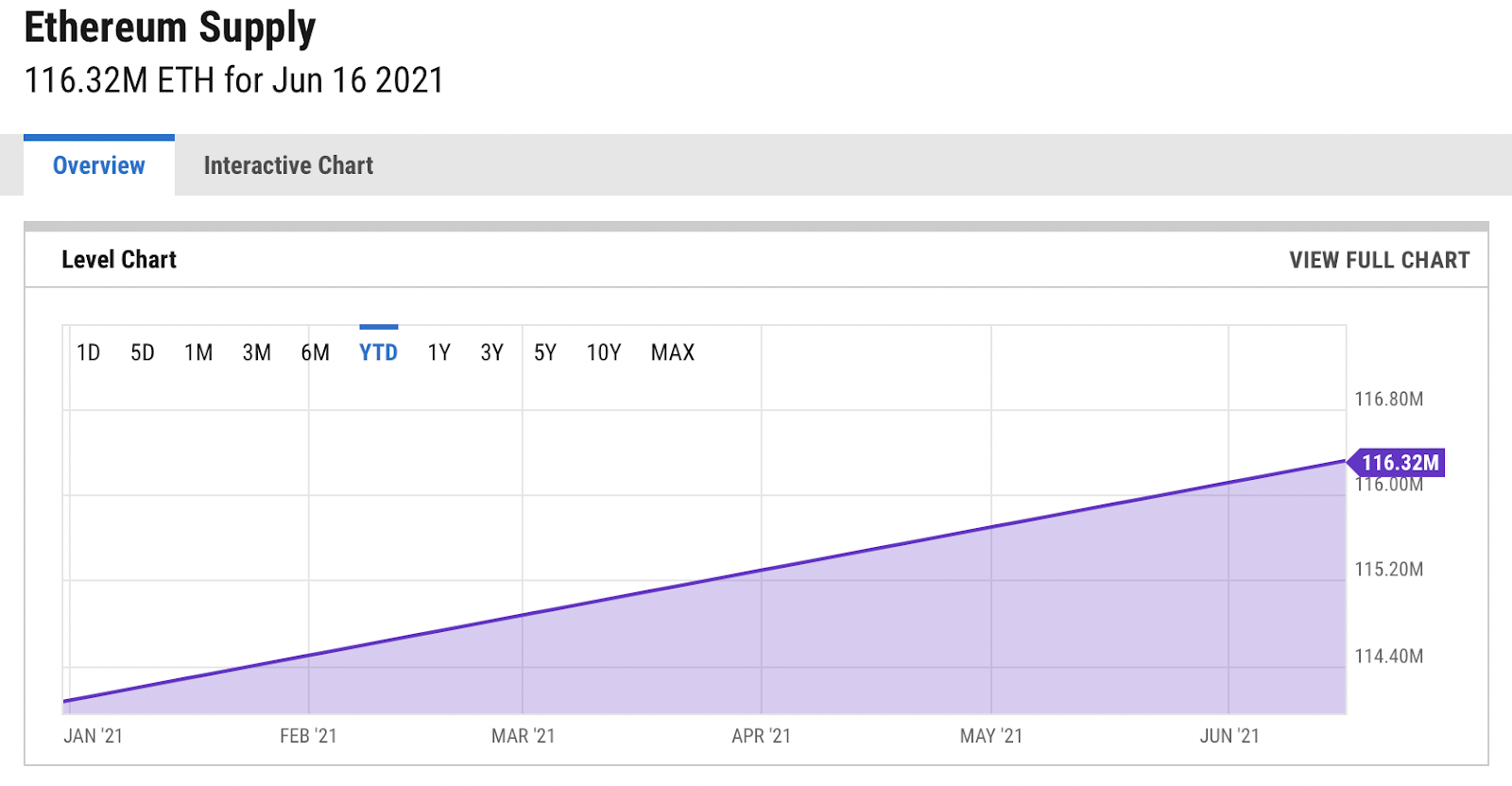

As we can see, 2.24 million ETH have been issued over the first seven months of 2021, or 10,418 per day. On an annualized basis, this would equate to the ETH supply inflating by 3.80 million, or 3.33%, over the course of the year, increasing from 114.09 million to 117.89 million.

Using the same data from the section above, were 1559 in effect, 1.4 million, 935,000, and 467,000 ETH would have been burned at 75%, 50% and 25% base-fee rates respectively. This translates to 6511, 4348, and 2172 in daily burns.

From this, we can see that with 1559, the net daily issuance of ETH would be 3907-8246 per day, a reduction of 20-62%. When annualized, new net issuance would fall between 1.44-3.04 million, meaning ETH would have a net inflation rate of 1.26%-2.66%.

Although it’s not yet deflationary, that’s still a tremendous decrease in supply coming onto the market. The lower bound of that estimate drops ETH’s inflation rate below that of Bitcoin’s current 1.77%, before the merge takes place. This also means that like Bitcoin, Ether would experience a halving-like reduction in sell pressure. As we know, miners in a Proof-Of-Work system are forced sellers, as they must cover considerable electricity and hardware costs. 1559 instead redirects that sell pressure into buy pressure, transferring value from miners into the hands of ETH holders.

The Path To ETH As Ultra Sound Money

The supply shock from 1559 alone points ETH on a clear path towards fulfilling its destiny as ultra sound money post-merge.

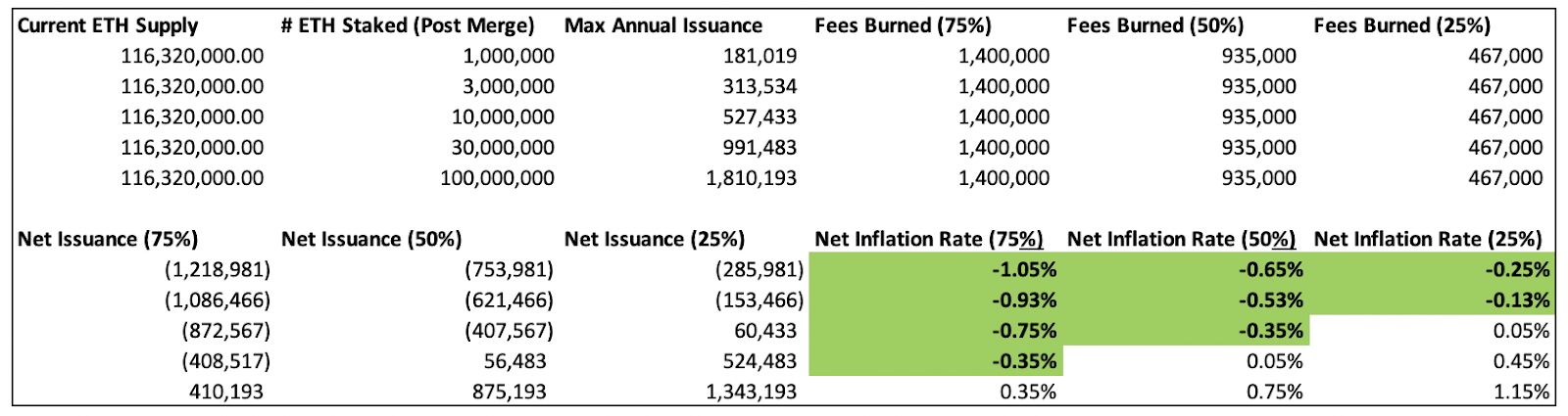

PoS dramatically reduces the issuance required to secure the network. According to the estimates provided by ETH Hub, even if 100 million ETH were staked (which really isn’t even economically viable), the maximum issuance of 1.81 million is still 52% less than the projected 2021 increase under Proof-Of-Work.

As we can see, based on the current supply and annualized 2021 burn figures (both of which are of course subject to change, and are just being used as rough parameters), there is a strong likelihood that ETH becomes deflationary after the transition to Proof-Of-Stake. Depending on the burn rate, the inflation rate of Ether may fall as low as -1.05% (However, it should of course be noted that it’s extraordinarily unlikely only 1 million ETH is staked).

No, this is not a drill.

ETH may really become an ultra-sound money 🦇🔊

Action steps

- Project how much ETH would have been burned under EIP 1559

- Watch ETH get burned every block

- 📺 Watch Vitalik and others witness EIP 1559 going live

- 📺 Watch our EIP 1559 bull panel w/ DCInvestor, SquishChaos, James Wang