How Is Polygon Doing It?

Dear Bankless Nation,

Crypto is not here to make you rich, it’s here to make everyone free. That means building for the mainstream is not only inevitable, but kind of the whole point.

Polygon Labs has been on a tear lately with a business development team focused largely on the non-crypto world. Today, we dig into Polygon’s partner success.

- Bankless team

Polygon has been punching above its weight as of late.

Over the course of 2022, they’ve onboarded some of the world’s largest brands – Starbucks, Reddit, and Meta – into the land of crypto and brought to life a new (albeit somewhat controversial) NFT format designed for non-crypto natives in the process, known as collectibles.

Decrypt calls that Polygon’s “secret sauce.”

How are the Web3 giga chads in the Polygon business development (BD) team bringing all of this real world crypto adoption?

What’s Polygon’s Deal?

Growing a decentralized network is no easy task. Beyond the most nascent of all crypto projects, few (if any) have obtained scale without financially supporting evangelists for the chain.

Ethereum has the Ethereum Foundation.

Solana has Solana Ventures (and formerly had an army of VCs bankrolling projects building on and migrating to the chain).

In the same vein, Polygon has Polygon Labs; the BD team is one of the groups within this organization.

Much like the BD teams of traditional Web2 firms, Polygon BD finds new use cases and partnership opportunities for the chain and works with promising projects to onboard them into the community, providing technical assistance along the way.

Polygon’s impending upgrade to a zkEVM is a highly complex and drastic core protocol change which invites technical questions and concerns from developers. Polygon Labs is there to showcase protocol development and future roadmap items to assuage transition-related unease.

Polygon’s Progress

While crypto users went into retreat during 2022’s brutal bear market, USD-denominated DeFi TVL across all chains plummeted 75% off December 2021 highs.

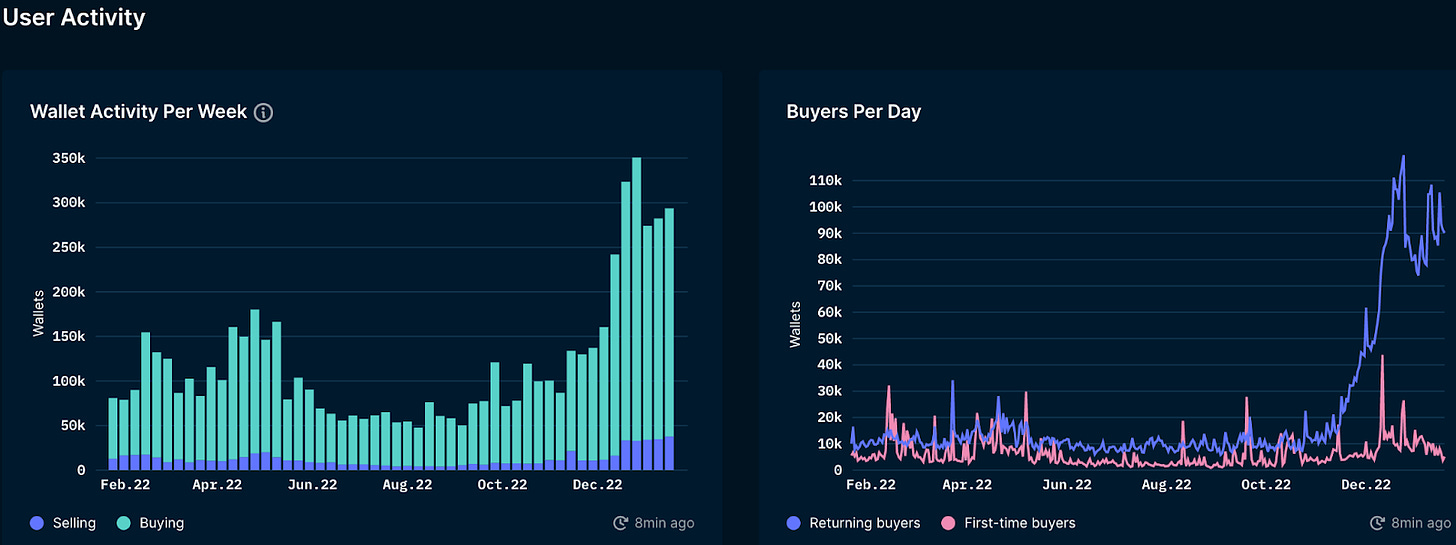

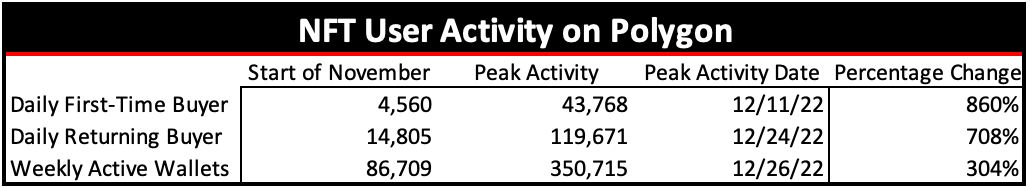

Yet, NFT user activity on Polygon proved to be a highlight for the chain in late 2022 as the BD team’s carefully crafted relations bore fruit and their partners’ projects gained adoption.

FTX drama in November proved to be no hurdle for Polygon NFT user adoption, which saw exponential increases throughout the month and into December.

First-time purchasing activity declined dramatically off of its highs while returning buyer activity held strong into the New Year, indicating that the number of new deployments has declined while existing projects have been successful at retaining users.

How do Polygon’s BD relations fit into the story?

Arguably, the most compelling adoption story for Polygon comes from its NFT collectibles partnership with Reddit.

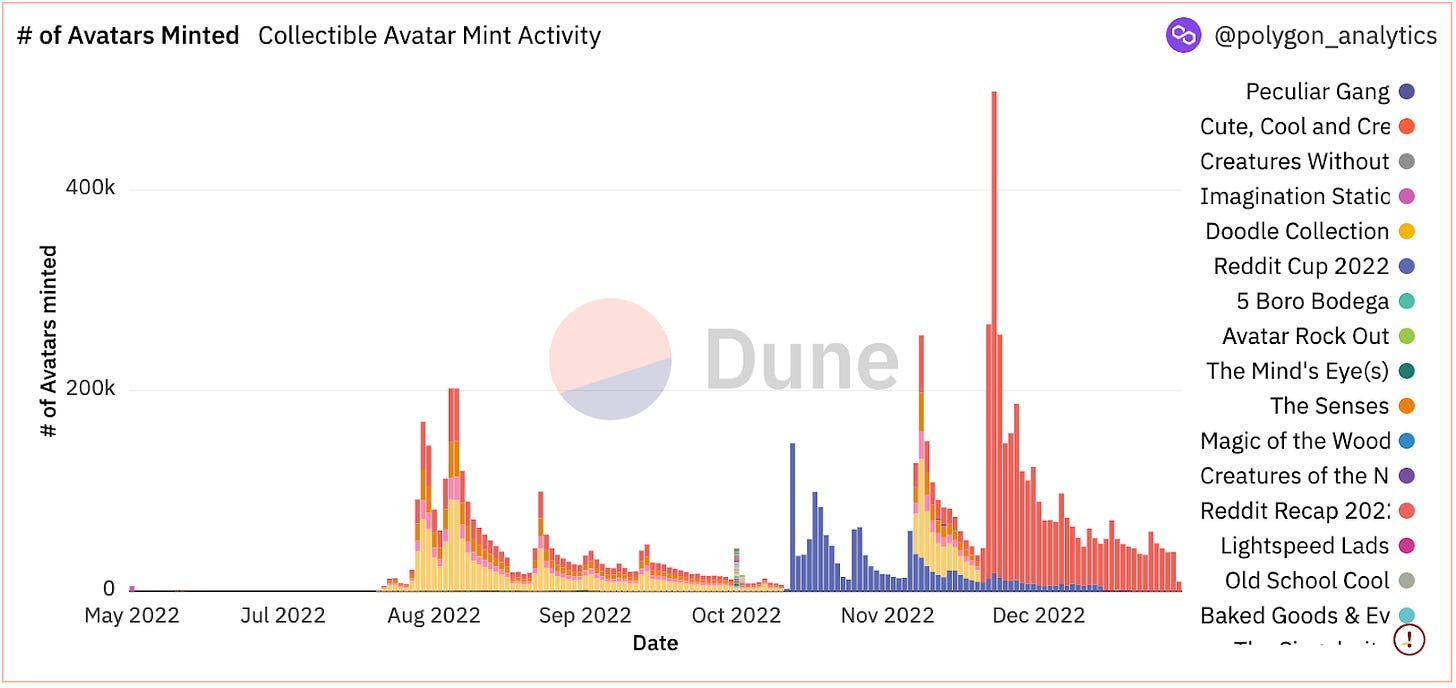

According to Dune Analytics, more than 6M unique user addresses hold Reddit collectibles, with over 8.4M avatars minted since the project’s launch and nearly every subsequent release achieving higher mint volumes than preceding drops, displaying clear user adoption.

Reddit users minted nearly 500k avatar collectibles on December 16th alone!

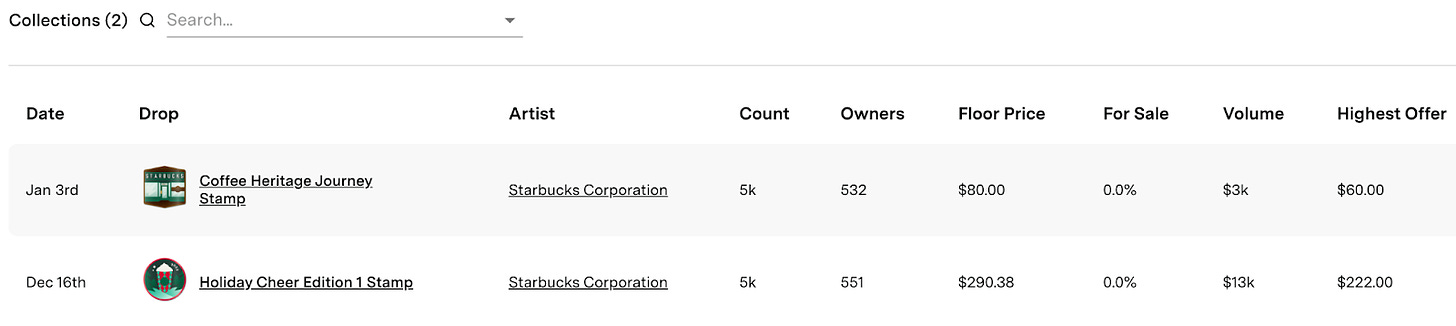

While Starbucks’ collectibles remain in the beta testing phase, a spokesperson for the company stated that they have seen “unprecedented interest in [the] Starbucks Odyssey” in combination with “overwhelming” customer responses and a massive beta tester waitlist.

Despite its limited release, Starbucks’ Odyssey has done nearly $16k in trading volume, with a $290 floor price for the Project’s first “stamp.”

As Terra’s implosion sent investors fleeing from crypto in May, Meta doubled down, announcing its pilot NFT program that would enable select creators to share their Ethereum and Polygon digital artwork with Instagram’s 1.28B users.

On November 2, Meta stated it would provide creators with an end-to-end toolkit (launching natively with Polygon), empowering the creation, showcasing, and sale of their artwork.

Despite hefty 15% to 30% platform fees, Instagram has proven successful in bridging the gap between Web2 platforms and Web3 technology, allowing users to purchase digital assets with fiat currencies.

.@AkuDreams NFTs sold out in 11 seconds on @instagram

— Sandeep | Polygon 💜 Top 3 by impact (@sandeepnailwal) January 9, 2023

Powered by @0xPolygon !! https://t.co/rnWsc2M3wo

The triumphs don’t end with collectibles either.

Native Polygon support for Coinbase and Robinhood’s non-custodial wallet products is a direct result of Polygon Labs’ BD relations, and the team remains closely engaged with the exchanges to help unlock the powers of Polygon DeFi features to further enhance their product offerings.

In CBDC land (commence audible Bankless reader groan), Polygon’s BD team has also made significant inroads.

Project Guardian is the brainchild of Singapore’s central bank, the Monetary Authority of Singapore, and involved participation of JP Morgan Chase, Singapore-based DBS Bank, and Tokyo-based SBI Digital Asset Holdings, leveraging the support of Polygon Labs.

The pilot program explored potential DeFi applications in wholesale funding markets, utilizing permissioned Aave pools to conduct Forex and government bond transactions against liquidity pools consisting of tokenized Singapore Government Securities Bonds, Japanese Government Bonds, Japanese Yen, and Singapore Dollars.

JP Morgan issued Tokenized Singapore Dollars in the process, a general liability for the firm and the first instance of tokenized deposit issuance by a bank.

3rd, we issued Tokenized Singapore Dollar Deposits! 💸This is a deposit token which is a general liability of JPM. It’s a native token giving stable on-chain value without the scalability issues of stablecoins. This is the 1st issuance of Tokenized Deposits by a Bank!

— Ty Lobban (@TyLobban) November 2, 2022

According to Polygon's business development team, Project Guardian represented a significant milestone for Polygon Labs and is just one aspect of their burgeoning CBDC strategy, with several other projects looking to launch on Polygon.

An Unnecessary Expenditure?

Polygon Labs is funded via subsidies from the Polygon community treasury and does not create products or generate revenue on its own.

Despite successful project implementations, CT has some outstanding questions regarding the group's methods to attract collaborators.

“Bro the Polygon biz dev team are such chads”

— Solo (@c0rellian) November 28, 2022

The Polygon biz dev team: https://t.co/FdmiVcjnTp pic.twitter.com/FTEerpDUmF

Like HR in a traditional corporation, Polygon Labs is a cost center.

Simply because a group does not generate profits, however, does not mean that it is worthless. Running an Amazon-sized company without an HR department would be impossible!

Cost centers provide value beyond profitability by facilitating operations for the broader organization.

The question is does Polygon Labs provide enough value back to MATIC hodlers to justify the expense?

Phrased alternatively: béchamel or steak sauce?

Sauce It Up

Béchamel sauce: a silky cream sauce that can be used either on its own or as the base for countless other sauces. One of five French “mother sauces” and key to some absolutely b*tchin’ Mac n’ Cheese.

Steak sauce: Tang, but for meat. A great way to insult your host and/or ruin a good steak.

So is the Polygon biz dev more béchamel or steak sauce?

Do they improve the community by seeking out novel partnerships and use-cases? Or is their only function to drain the Polygon treasury, harming the chain’s competitiveness against alt L1s and substitute L2s?

I am certainly not here to attest that every single dollar Polygon Labs has shelled out has been put to its best and highest use. For example, providing a $3M grant to get y00ts to migrate from Solana may not have been an optimal use of capital…

Then again, I never was really into Soylana NFTs.

What really excites me about Polygon’s BD is their ability to attract non-crypto native corporations and build real world partnerships.

No one is even close to relationship building in Web 3.0 to @Fwiz and the team at Polygon

— Josh.Bobrowsky.eth (@JoshBobrowsky) September 12, 2022

Hands down the best biz dev in the industry

Not bullish on partnering with real world companies and onboarding normies into crypto, anon? First, please remember that every “crypto native” was once a “normie” too.

Disagree. Betting on a single L2 for ETH is risky af. What if narrative and attention shifts to Arbitrum? Polygon got some biz dev deals with mainstream companies, but you know how fickle that is. Companies quick to associate and then distance themselves with web 3

— oxy.sol (@oxydotsol) January 11, 2023

Sure, companies are quick to associate and disassociate their brand image with Web3 when all Joe Schmo sees is an industry filled with con artists and crypto grifters searching for their next quick buck. But these companies never truly associate themselves with Web3 in the first place!

Instead, they distance themselves with snazzy marketing terms like “collectibles”, simply applying crypto’s tech and obfuscating the backend, packaging it in a user friendly format intended for the masses.

It is the DeFi mullet thesis playing out in front of your eyes, just in a different form.

Blockchain tech provides novel property rights structures, faster settlement speeds, composability of protocols, and so much more that companies and central banks can co-opt into their business models — using them to design new products and build much deeper connections with their customers.

What results is a highly symbiotic relationship between the Polygon chain and the trad firms building on it, with Polygon Labs providing the technical support needed for mega corporations to feel comfortable building on the chain.

Yes, it is just a silly little collectible NFT for a coffee rewards program.

But then it opens the door to so much more.

To whom does Starbucks or Nike turn when they decide to implement in-store crypto payments? Where does DraftKings decide to build an on-chain sports book? On what chain do I receive my tickets to an NFL game or Disney cruise?

All of these companies are Polygon partners and would more likely first approach the team they have crafted a long-standing relationship with and trust to provide the technical guidance required to secure billions of dollars in transactions and endless streams of user data.

Relationships and trust are everything when it comes to doing business in traditional markets and take a very long time to build, especially when you come from an industry viewed by the mainstream as seedy and you are asking multi-billion dollar companies to commit resources, time, and money to building on your chain.

If you wait to seek out partners in the bull market or when the use cases finally emerge, you will be too late!

Idle USDC sitting in a treasury wallet doesn’t do anyone any favors and while not every BD expenditure can be guaranteed to be 100% necessary or prudent, that is simply the nature of crypto: you do not know what will prove profitable, forcing a spray-and-pray approach.

Tech startups are frequently unprofitable. For Polygon, the decision to spend money today to build network effects tomorrow could translate to outsized success years down the road.

In this writer’s opinion, Polygon Labs appears to be béchamel sauce quality ✅