How Canton Network Works

Canton Network is quickly becoming the crypto industry’s latest obsession. Is the next breakout L1 trade brewing?

This RWA-centric blockchain has been dominating news headlines in recent weeks thanks to splashy integrations with TradFi heavyweights (including the DTCC and J.P. Morgan) and eye-popping claims that it supports over $6T in onchain real-world assets and processes $280B in daily transactions.

Today, we’re exploring the technical and tokenomic architecture of Canton Network in hopes of better understanding this breakout network’s design. 👇

Canton founder Yuval Rooz just joined David & Ryan for a wide-ranging conversation on his network. The interview is live in Early Access for Bankless Premium subscribers now!

Canton's Technical Architecture

Canton is an interoperability layer that connects independent networks (confusingly also called cantons), similar to Cosmos’s approach of letting separate chains talk directly to each other.

In terms of consensus, the Canton Network itself is validated by “Super Validators,” an invite-only list of just 13 distinct validating nodes, many of which are operated by the network’s investors. One of these nodes is operated by the Canton Foundation, a collective of early Canton corporate supporters, brand partners, and investors.

CIP-0097 is now approved and we’re happy to welcome @Nasdaq as a Super Validator on @CantonNetwork!

— Canton Foundation (@CantonFdn) January 5, 2026

With up to 10 SV weight earned through a milestone based, escrowed program overseen by the Tokenomics & Accountability Committees of @cantonFdn.

Another step in aligning Canton's… pic.twitter.com/tTYng4kijh

Much of the activity on the Canton Network occurs at the individual "canton" level, similar to how the Osmosis exchange within the interoperable Cosmos ecosystem came to anchor the majority of ecosystem liquidity and user activity over Cosmos itself.

The non-super validators that operate these independent cantons are responsible for processing all data on their independent “shard,” and enjoy ultimate flexibility with respect to the rules of this independent execution environment, ranging from custom gas to data sharing preferences.

While the integrity and source of Canton’s advertised metrics are difficult to verify due to the opaque nature of its canton design, one notable example of an independent canton is Temple Digital Group, a recently launched exchange experience backed by YZiLabs.

Introducing Temple Trading

— Temple (@temple_ny) January 8, 2026

Temple is live and officially open for trading on Cantonhttps://t.co/l7jTSuZlPK pic.twitter.com/Zvmo3FQeY2

Canton's Tokenomics

Canton Network is centered around Canton Coin, a native utility token with the ticker symbol CC that was “designed to reward real network usage over speculation.”

Similar to Ethereum, Canton burns tokens when users pay gas fees, producing deflationary pressure on CC. When Canton Network is used to trade, settle transactions, synchronize data, or transfer assets, all fees paid in CC are burned, permanently removing them from circulation.

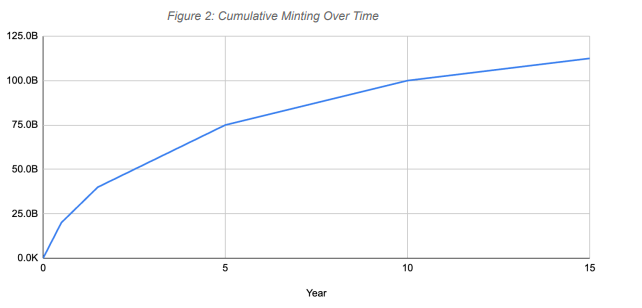

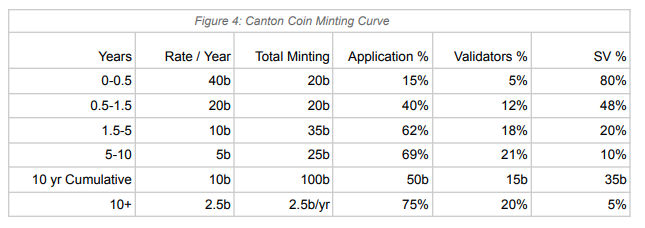

Like Bitcoin, Canton employs a programmatic token emission curve with regularly scheduled issuance halvings. New CC coins can be continuously minted by multiple categories of network participants for adding “measurable utility” to the network.

Currently, permissioned Canton Super Validators (primarily early network investors) receive 48% of all CC emissions for ensuring global consensus. Validators receive 12% of the CC token supply, which is distributed primarily based on the value of Canton Coin transfers initiated by their users, with a potential bonus applied for node uptime if minting caps permit.

Echoing Berachain, Canton also emits tokens directly to applications, in the form of gas fee rebates. “Featured” applications – a designation that can be applied to applications by Super Validators – can mint up to 100x more CC than burned by fees, whereas unfeatured applications are only able to mint 80% of burned fees as CC.

For example, if an unfeatured application burns $1 worth of Canton Coin, the application provider is only eligible to mint up to $0.8. Meanwhile, the featured application provider can mint as much as $100 worth of Canton Coin for the transaction.

It is worth noting that CC tokens were minted in accordance with years 0.5 to 1.5 on the schedule below at the time of writing. Yet, with the second Canton halving set to occur in just three days, the CC mint rate will soon be slashed in half and its distribution altered in accordance with years 1.5 to 5 of the schedule below.

For traders seeking an edge to monetize here, the imminent supply reduction created by CC’s halving event could boost token price in the immediate term by way of supply-demand dynamics, regardless of the network’s underlying fundamental investment case.

Conclusion

Canton certainly presents a compelling investment story, but one that comes with an equal amount of questions as it does potential upside.

Its highly configurable, privacy-focused design holds clear appeal for TradFi incumbents, yet the network’s convoluted tokenomics and concentrated control structure introduce pronounced insider advantages, increasing the risk of misaligned token distribution.

Permissioned Super Validators retain outsized influence over Canton’s emissions by virtue of their ability to designate “featured” applications, meaning the flow of CC tokens will remain heavily controlled by insiders, even though the group’s own emissions are scheduled to decline by roughly 80% in a matter of days.

Canton’s abrupt rise to prominence just ahead of its second ever halving adds another layer of intrigue. Supply shocks are most pronounced from early-stage halvings, and while CC’s impending emissions reduction creates a clear catalyst for a short-term trade, long-term investors would be wise to avoid conflating supply constraints impacts with durable fundamentals.