U.S. House Passes “FIT21” Crypto Bill

The U.S. House of Representatives just passed the Financial Innovation and Technology for the 21st Century Act (FIT21), marking a significant milestone in crypto regulation.

What's the scoop?

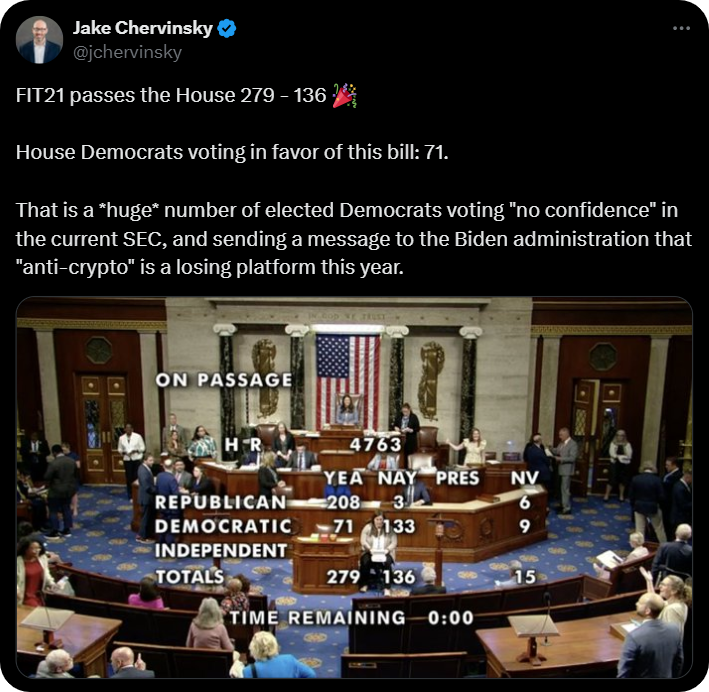

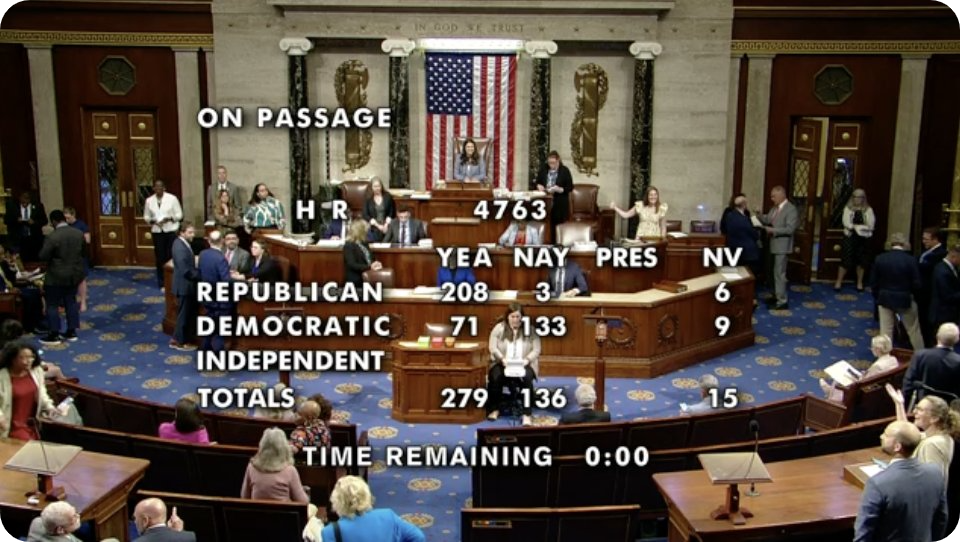

- The House voted 279-136 to approve the bill, with 71 Democrats joining 208 Republicans in favor.

- FIT21 aims to regulate the digital assets market and would empower the Commodity Futures Trading Commission (CFTC) as a key regulator alongside the Securities and Exchange Commission (SEC). The bill also includes consumer protections and provisions for stablecoins and anti-money laundering processes.

- High-profile Democrats, including former House Speaker Nancy Pelosi, supported the bill, highlighting the rising bipartisan tide around crypto regulation.

- Several amendments were considered, with only those by Reps. Brittany Pettersen (D-Colo.) and Ralph Norman (R-S.C.) passing. Pettersen's amendment expands the Bank Secrecy Act to digital assets, while Norman's requires a study on foreign-owned digital asset businesses.

Bankless take:

The FIT21 legislation now moves to the U.S. Senate, where its future is uncertain due to a lack of a companion bill and unclear support. Even if FIT21 were to pass the upper house of Congress, it would still be subject to a potential veto by President Biden, who has been critical of the bill but hasn’t confirmed any veto plans yet.

Whatever happens, it’s the first major non-resolution crypto bill approved by the U.S. House, marking a big political win for the crypto industry. The passing of the bill’s first hurdle coincides with a seemingly thawing regulatory environment in the U.S., as Ethereum ETFs seem on the verge of approval and the Senate recently repealed a SEC-backed crypto rule.

If FIT21 does go on to succeed in the Senate, a new era of more sensible American crypto regulation would be decidedly within reach.