Dear Bankless Nation,

“The NFT market is collapsing.”

That’s per NFT Sales Are Flatlining, an article published earlier today by Wall Street Journal reporter Paul Vigna.

In the article, Vigna points to things like declining NFT search trends and sales numbers to suggest the first big NFT bubble is bursting.

In the very least, though, this bursting notion is complicated in the near term by how the NFT ecosystem just witnessed a handful of unprecedented activity milestones. Let’s walk through these milestones to get a better bird’s-eye view of the space as it currently stands.

-WMP

NFT market collapse or consolidation?

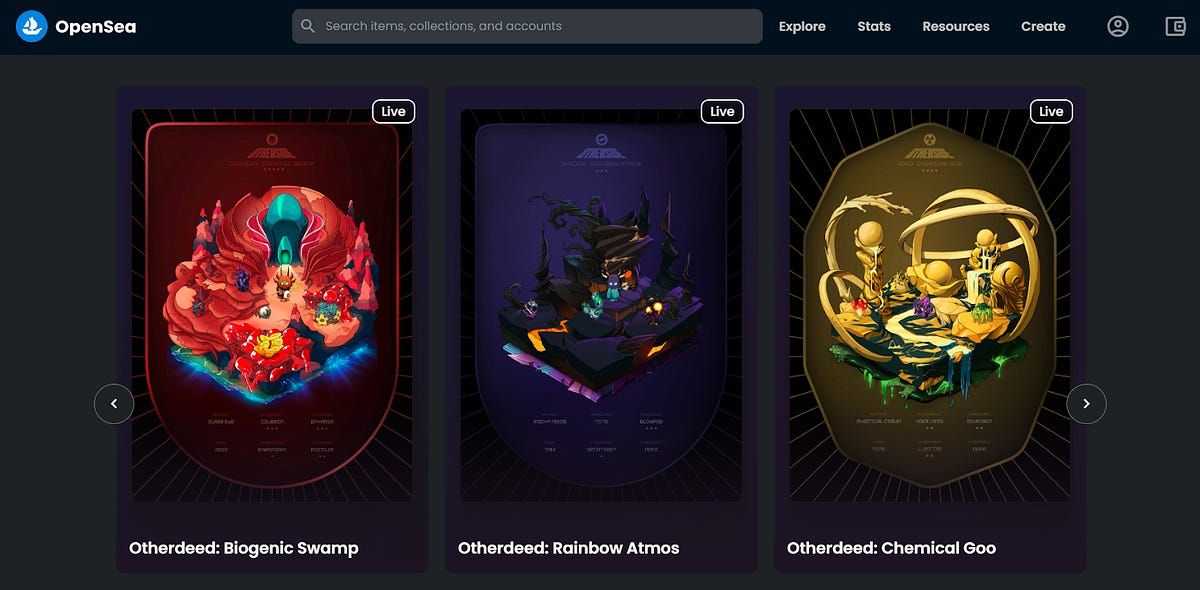

On Saturday, April 30th, Yuga Labs — the creators of the Bored Ape Yacht Club universe — launched minting and claims for Otherdeeds.

These NFT deeds offer holders a right to digital land in Yuga’s in-progress Otherside metaverse project, so demand for the drop (and the rare Kodas spread among some of the deeds) was unlike anything the NFT ecosystem has seen before.

That said, The inefficient design of the minting contract and the straightforward style of the sale event led to a gas war that easily eclipsed all gas wars Ethereum’s seen previously. On Sunday, May 1st, an unprecedented NFT trading surge kicked off too.

For example, according to a thread of charts curated by 1confirmation’s NiftyTable, major new records that were set on Sunday include:

- NFT marketplace juggernaut OpenSea notched its biggest trading day yet in facilitating nearly $500M in 24-hour volume.

- Transaction surges led to Ethereum’s biggest daily ETH burn since the enactment of EIP-1559.

- NFT marketplace aggregators (Gem and Genie) had their best volume day yet in powering +$43M worth of trades altogether.

However, it’s not all the “Yuga Effect” in play here. Indeed, consider how Ethereum Name Service NFT domains had their best activity day ever on May 2nd after seeing tons of growth throughout April 2022.

So while activity and interest may be shrinking in some parts of the cryptoeconomy, it’s surging in others.

It seems the simplest answer here is that instead of total collapse, we’ve recently seen many people attempting to consolidate from smaller NFT projects into bigger, more proven “blue-chip” collections.

There are many NFT projects whose floor prices and volume levels are down over, say, the past 30 days. Yet there are more than a few projects whose floors prices and volume levels are up over the same span, too. Scroll down the “30D Chg” and “30D Volume” columns on NFT analytics site WGMI.io to see what I mean.

I do think we’re seeing consolidation, a sort of King of the Hill effect where the biggest collections are generally doing the best right now. Is an all-out collapse of the NFT market occurring? I don’t see that at this point, though we’re in crypto so it’s always shrewd to prepare for rainy days … or rainy years, as DC Investor put it:

Action steps

- 🤔 Is the NFT market growing or contracting? Share your thoughts in the comments below, I’m keen to hear what you’re thinking.

- 🕵 Read my latest Bankless tactic 5 tips to spot the next big NFT