Dear Bankless Nation,

This year the NFTfi ecosystem has been growing rapidly.

Amid this boom, one of the newest NFTfi projects to arrive on mainnet is Hook, which both launched and open-sourced its NFT-native call options protocol this week.

NFT call options, while risky, let traders get exposure to an NFT’s potential financial upside while investing much less than the NFT’s full price.

That said, over time Hook’s NFT options can work to siphon “speculative volatility away from floor prices and into a side market,” so let’s take a closer look at this new project for today’s Metaversal.

-WMP

Hook NFT call options explained

What is Hook

Hook is a decentralized derivatives protocol specifically focused on facilitating NFT call options.

NFT call options work differently than call options do in mainstream finance, but the idea is generally the same. In other words, NFT call options let you “long” an NFT, i.e. make a speculative bet that its price will increase, during a specific window of time.

As such, Hook is an on-chain protocol for two main stakeholders: traders and NFT holders. The project lets traders efficiently get exposure to an NFT collection’s potential financial upside, while it lets NFT holders earn premiums on their NFTs and/or sell them at favorable prices.

How Hook works

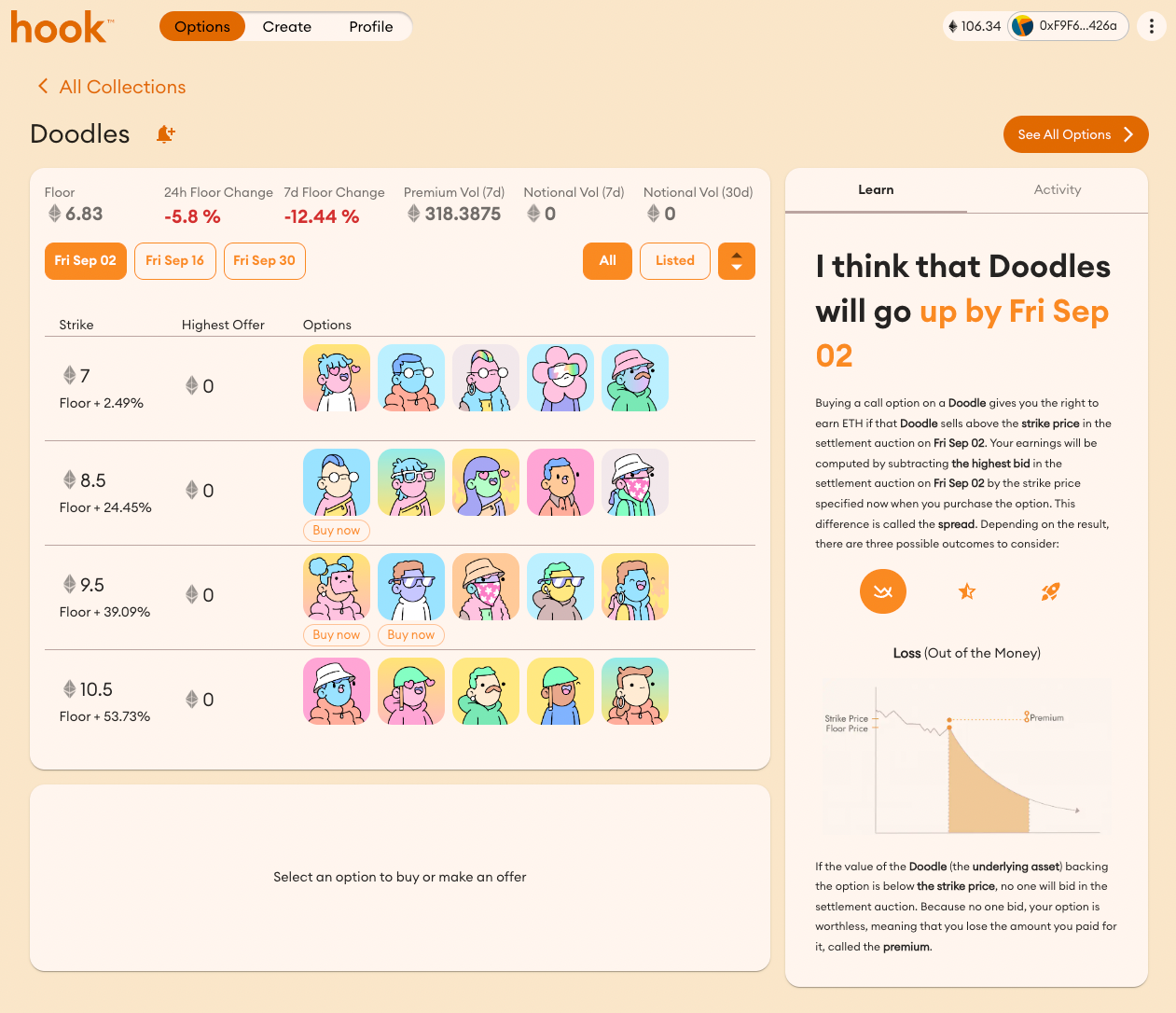

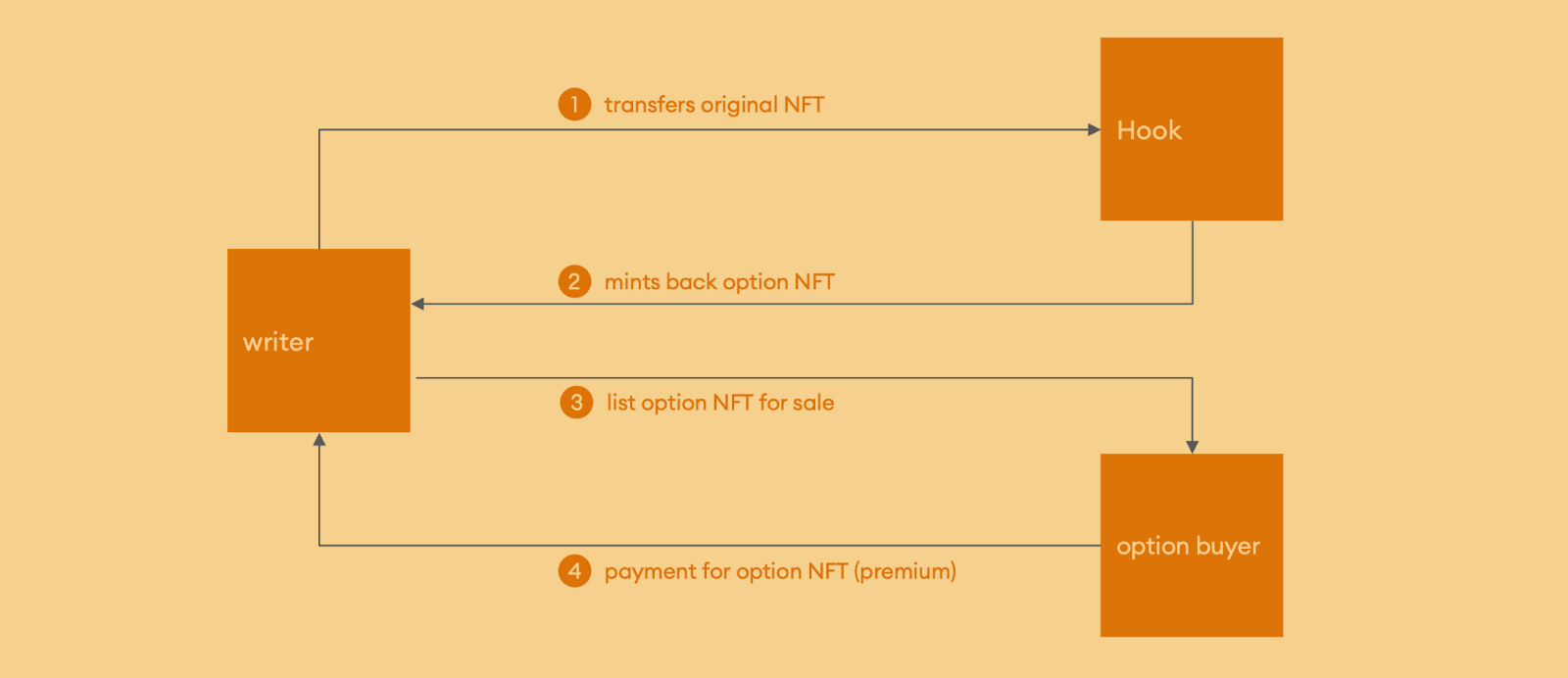

Let’s say you have a Doodle PFP that’s currently worth 10 ETH. You could deposit this NFT to Hook and specify a strike price (the value at which the NFT can be purchased) and an expiration (the date at which the strike price can be paid) to “write,” or create, an NFT call option.

At this point, Hook will hold your Doodle and mint you a separate ERC721 NFT to create and represent your option position, e.g. a 12 ETH strike price with an expiration date one month from today.

You, as the option writer, could next sell this option NFT for a premium, e.g. 1 ETH. Whoever buys that NFT would then become the owner of the option position and earn from its upside if the underlying bet pans out.

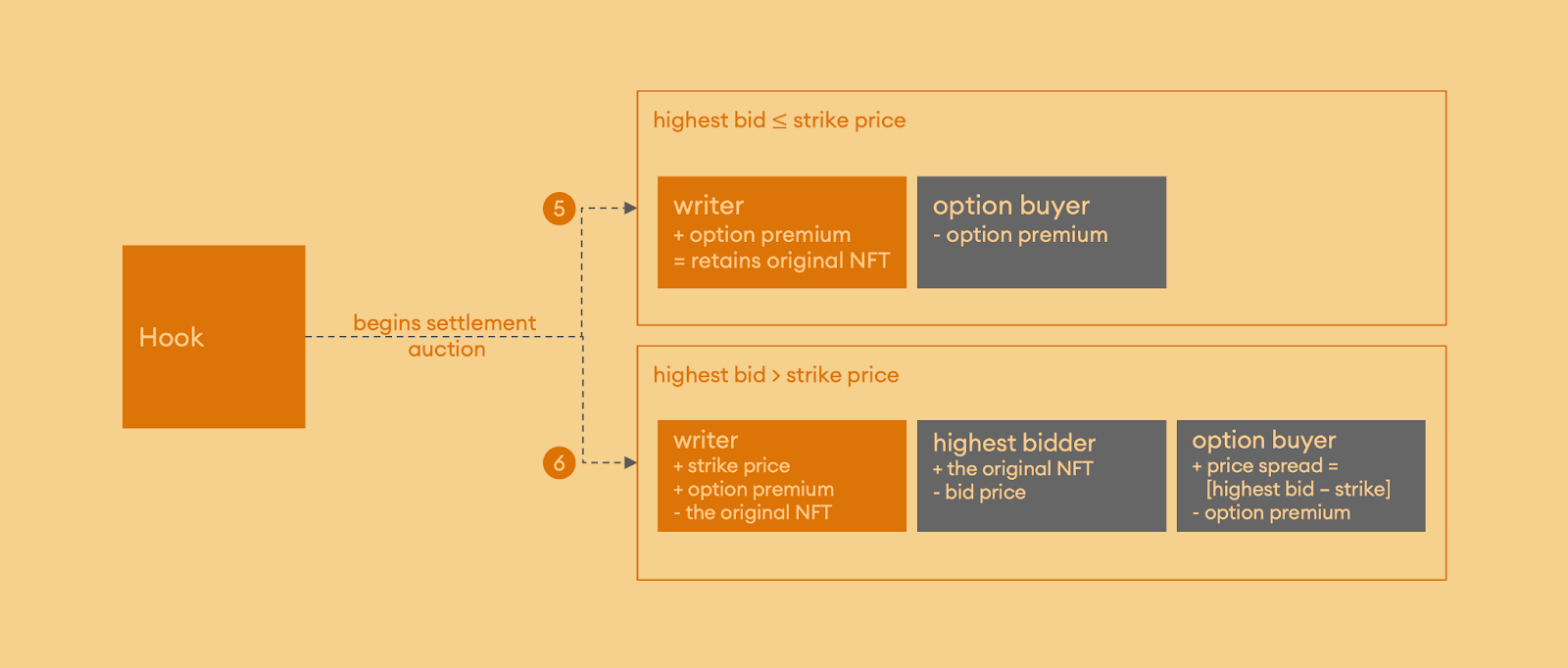

Let’s say that bet does pan out, and your Doodle NFT’s worth appreciates to 14 ETH, or 2 ETH above the 12 ETH example strike price as seen in the image above. You, the option writer, would earn 12 ETH from the strike price auction sale + the 1 ETH premium for selling the option. Conversely, the option buyer will have paid 1 ETH for the option, but in this example they end up earning 2 ETH from the spread between the 12 ETH strike price and the final 14 ETH sale.

In this hypothetical scenario, the option buyer makes a 100% ROI on their ETH investment (i.e. turned 1 ETH into 2 ETH) betting on the Doodle’s upside without having to pay 100% of the NFT’s market value. Yet options are risky precisely because the buyer would have just been out 1 ETH (and the writer up 1 ETH) if the Doodle’s value depreciated, or didn’t appreciate enough to hit the strike price, by the time of the option’s expiration.

Why Hook

In a July 2022 post titled “Why call options make sense for NFTs,” Hook founder Jake Nyquist made a case for how a protocol like Hook could benefit the NFT space. His three main points were as follows:

- NFT call options can help to stabilize NFT prices, with the argument being that “optioned assets are locked in Hook protocol’s vault, reducing available NFTs in the market and the amount of floor undercutting in a bear run.”

- Writing NFT call options offers a way for large collectors, e.g. project treasuries, to earn on their otherwise idle NFTs, since “selling covered call options [can] generate recurring premiums for the owner.”

- NFT call options offer a capital-efficient way for traders to go long NFT collections.

Of course, Hook’s only just arrived on mainnet, so it remains to be seen how the protocol will fare in accomplishing these benefits. Nevertheless, these three fundamental aims lie at the very heart of the project.

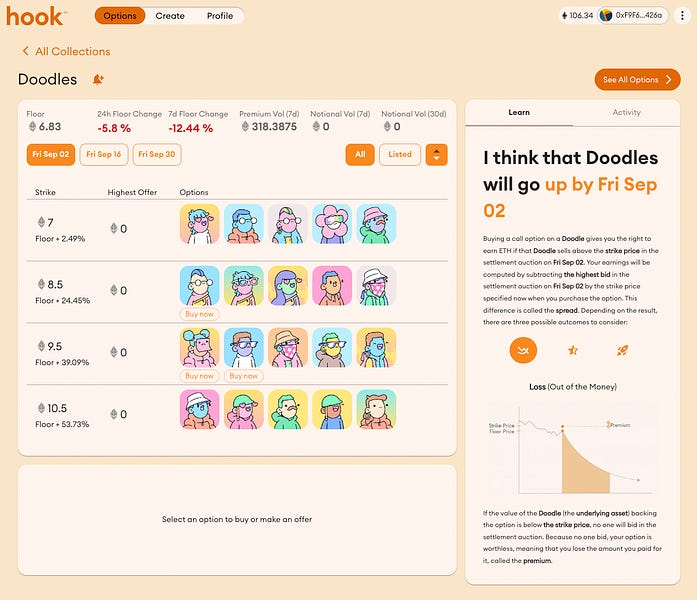

Using Hook

Hook launched with support for a limited number of collections, so at the time of this post’s writing the new protocol’s main attraction is the single Wrapped CryptoPunk that it’s brought in so far. As such, there’s not much to actually use at the moment, but Hook will be expanding to more collections later so expect more liquidity to flow in over the months ahead.

In the meantime, if you’d like to learn more about the ins and outs of using Hook’s option markets, check out the project’s guides on writing options and buying call options.

Zooming out

Hook’s entry to prime time represents the latest outgrowth in NFTfi’s derivatives sector. To be sure, this sector is still very experimental and should be approached cautiously by users, but it’s also worth noting that Hook itself has approached the space cautiously in being insured up to $10M by its smart contract auditor, Sherlock. With the protocol now live and that insurance in place, let’s see where Hook can go from here.

Action steps

- 📈 Check out the Hook app and Hook docs

- 💥 Read my previous post The BendDAO bank run if you missed it!