It’s a Goose Market 🦢

Dear Bankless Nation,

Bear market? Bull market? More like Goose market.

That’s what it felt like this week as Sotheby’s 3AC bankruptcy auctions saw the defunct trading firm’s NFTs, including Dmitri Cherniak’s legendary Ringers #879 — a.k.a. “The Goose” — auctioned off to bidders.

The Goose, the centerpiece of the event, ended up going for a whopping $5.4 million USD, a validating, estimate-beating sum that sent many in the NFT space into an excited frenzy.

It’s a step forward in Cherniak’s artistic journey (which Metaversal readers first got a glimpse into in Feb. 2021), but also a leap forward for long-form generative art + NFTs as a viable medium for such art. Cheers to these milestones!

For now thanks as always for reading, let’s get to the weekly roundup. Beyond that have a great weekend everyone ✌️

-WMP

P.S. Crypto and NFT scams investigator ZachXBT, a “massively outsized positive influence on this industry,” is being sued for his research. Support free speech and critical discussion? Learn more and consider donating ETH or stables to his legal effort here. I’m in for 500 USDC, Bankless is in for $25k, anything helps — let’s band together to protect Zach!

📊 The big picture

Over the past week, the floor-based market cap of the NFT space grew from 7.65 million ETH to 7.81 million ETH, a climb of 2.1%. Interestingly, this modest growth came as the ETH price, which is currently trading at ~$1,720 USD, sunk down over 6% in the same span. Broadly speaking the recent ETH sell pressure hasn’t seemed to affect the NFT market too much, in other words.

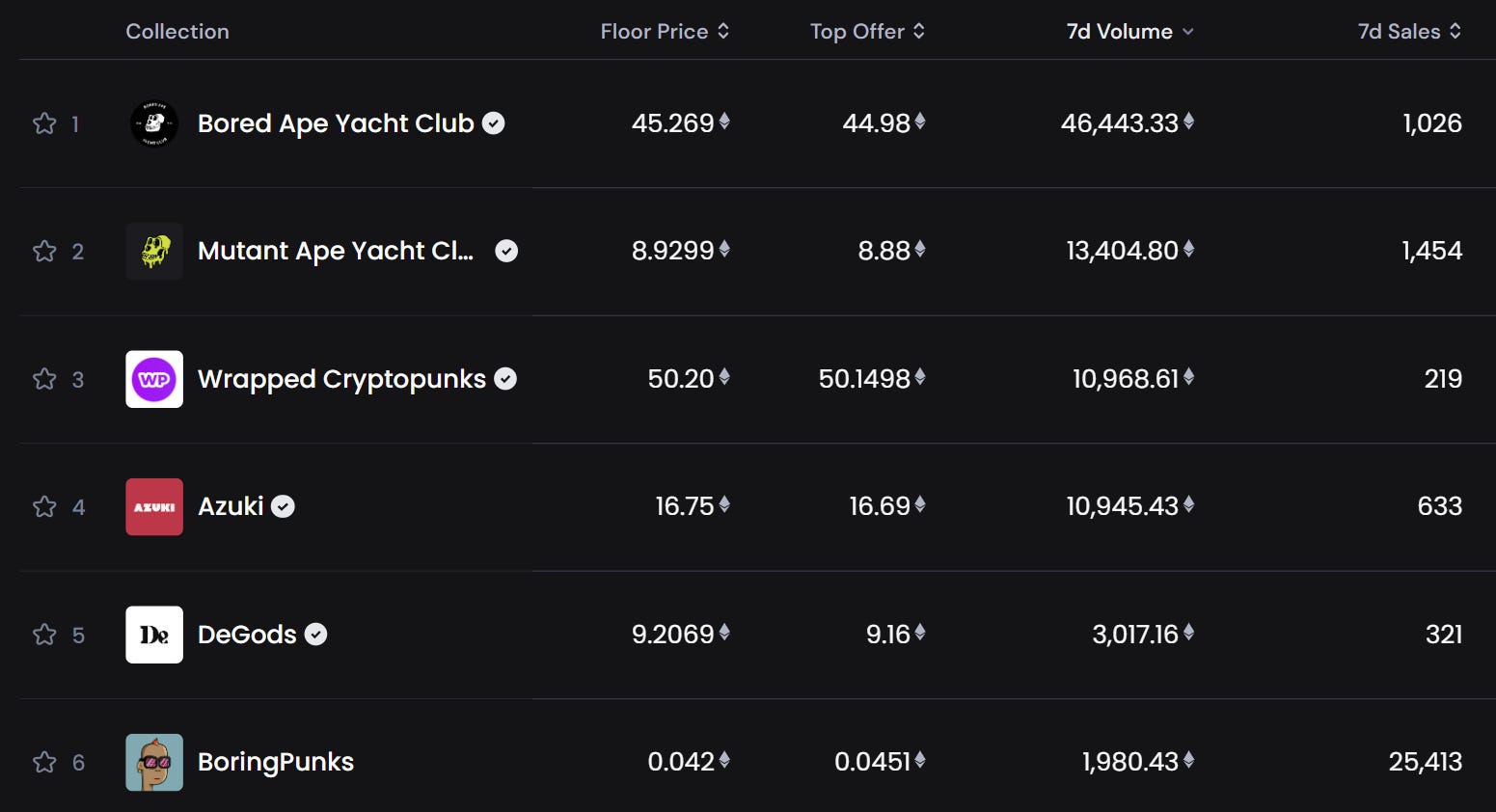

🔝 7D top collections by volume

📰 General news

- DeFiLlama added an NFT Earnings dashboard.

- Limit Break introduced Payment Processor, the first NFT marketplace protocol compatible with its ERC-721C royalties system.

- Manifold now supports minting L2 NFTs on Optimism.

- Nouns Governance Pools, an incentivized delegation system for Nouns DAO, launched.

🏆 Digital collectibles

- Bankless Collectibles published its latest Collectibles: Phase II update.

- Snoop Dogg launched a new Passport Series collectible.

🎨 Cryptoart & music

- Bueno Grants is accepting applications for a one-month, fully-funded arts residency program.

- Fini (formerly finiliar) is being featured in the Immersive Realities: Art in the Gaming Age exhibition at the Centre Pompidou.

- Keiken, an artist collective, launched its Wisdom Vessels mint.

- Museum of Crypto Art (M○C△) is hosting a fundraiser event to maintain its operations.

- Sound added support for minting L2 NFTs via Optimism.

- Steve Pikelny, an acclaimed conceptual artist, is releasing Dopamine Machines via Art Blocks next Wednesday.

🎮 Decentralized gaming

- Axie Infinity published its June Development Update and introduced Axie Land Delegation.

- Pirate Nation rolled out Islands.

- XAI, a new gaming-centric “L3” built on the Arbitrum tech stack, was announced.

🌐 Virtual worlds

- Decentraland is hosting the Polygon Music Festival tomorrow, June 17th.

🪙 NFTfi

- Arcade has started accepting real world assets (RWAs) as NFT collateral, like ROLEX watches, via 4k Protocol.

- Abacus, an NFT borrowing protocol, is closing up shop.

- Backed, the team behind the Papr borrowing protocol, is also winding down.

- Uniswap introduced Uniswap V4.

🎆 Mint spotlight: HOLD THE LINE

Crypto’s dark side is getting out of hand… Remember the first Bankless Crypto Wars open edition we dropped back on 4/20? Now the second in the series, HODL THE LINE, is live for the next day. If you want to nab this follow-up mint be sure to do so before it closes at 1:30PM EST tomorrow! Mint price is 0.0069 ETH a pop.

🙇 New insightful threads to level up your web3 knowledge!

1. 6529 on The Goose 🦢

2. Mando on Degenz Pro updates 📊

3. Adam McBride on Cursed Ordinals 🎃

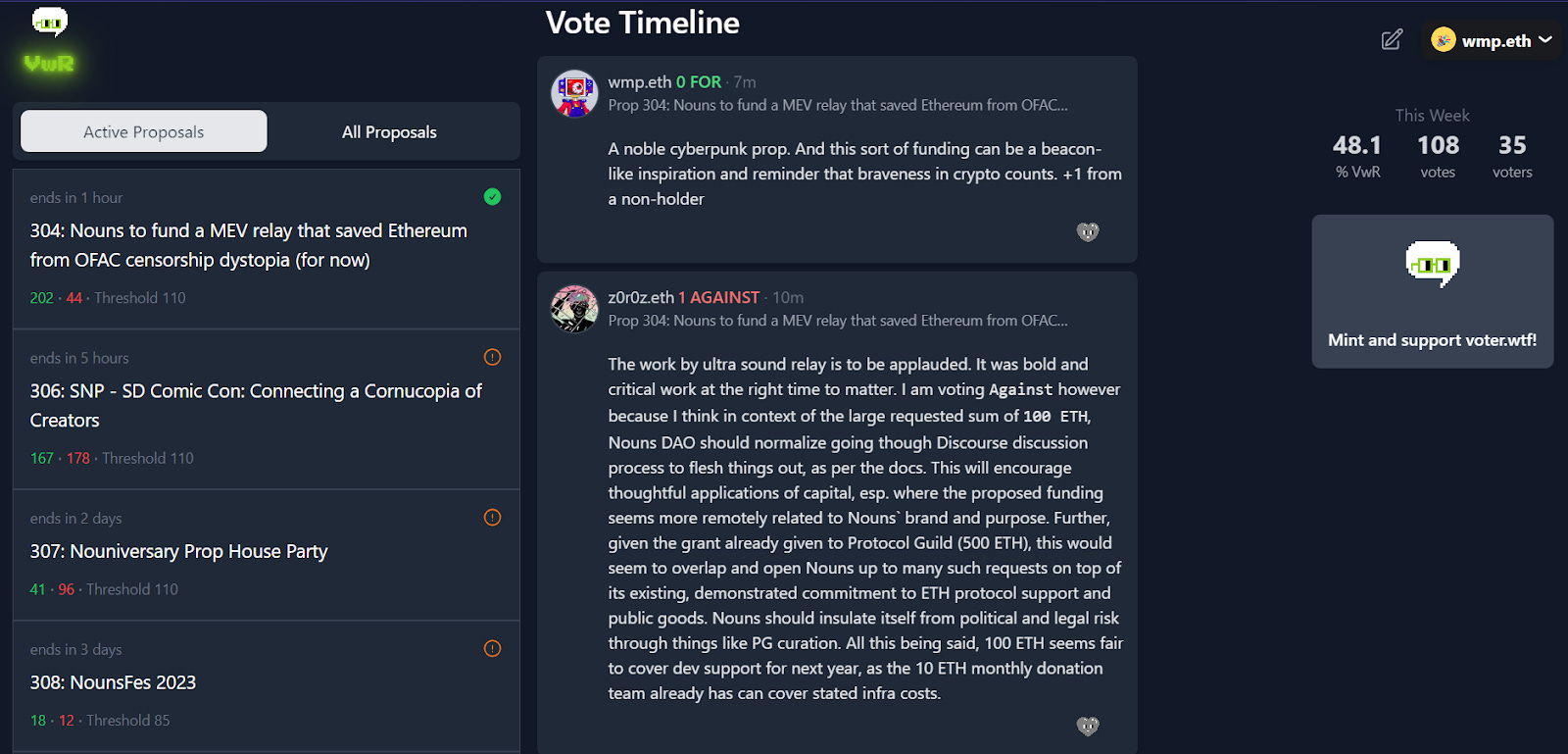

✨ My NFT tool of the week: voter.wtf

Did you know? You can use the voteWithReason function to have your say in Nouns DAO without having to actually own a Noun NFT. Your votes won’t be tallied this way, but your comments will be recorded onchain. It’s a great way to get involved with the Nouns community in an accessible way, and Wilson Cusack has built voter.wtf as a resource for letting Nouners and non-Noun holders alike vote and comment on proposals currently before Nouns DAO. Watch how easy it is to use here.

🤯 For this week’s meme segment, we close out with a bite-sized interview with the creator of the conceptual art memecoin — CAP — by artist, coder, and onchain frontiersman Sterling Crispin…

WMP:

How did you first get involved with cryptoart and NFTs?

Crispin:

I made a sculpture in 2015 called “Self-Contained Investment Module and Contingency Package” that was a Bitcoin mining ASIC computer surrounded by dehydrated food and water filters and survival equipment. The idea was that you’re kind of hedging your bets, either the artwork gains value, or the bitcoin does, or society collapses and the sculpture can help you live. I sold the work but lost the bitcoin I mined, so I stepped away from crypto until late 2020 when I saw artists like Mario Klingemann minting work on Super Rare and the curator Kenny Schachter involved. That was an inflection point for me, before the wild Beeple drop, that something was happening and I had to get more involved.

WMP:

With regard to your experience as an artist working with NFTs, what do you think the rise of NFTs bodes for the future of art?

Crispin:

Digital art and content in general is valuable, but we haven’t had good systems to represent that value until recently. Younger generations growing up online put a lot of value on digital experiences and objects. As they get older I think NFTs could be a very normal and obvious part of life, and less controversial.

WMP:

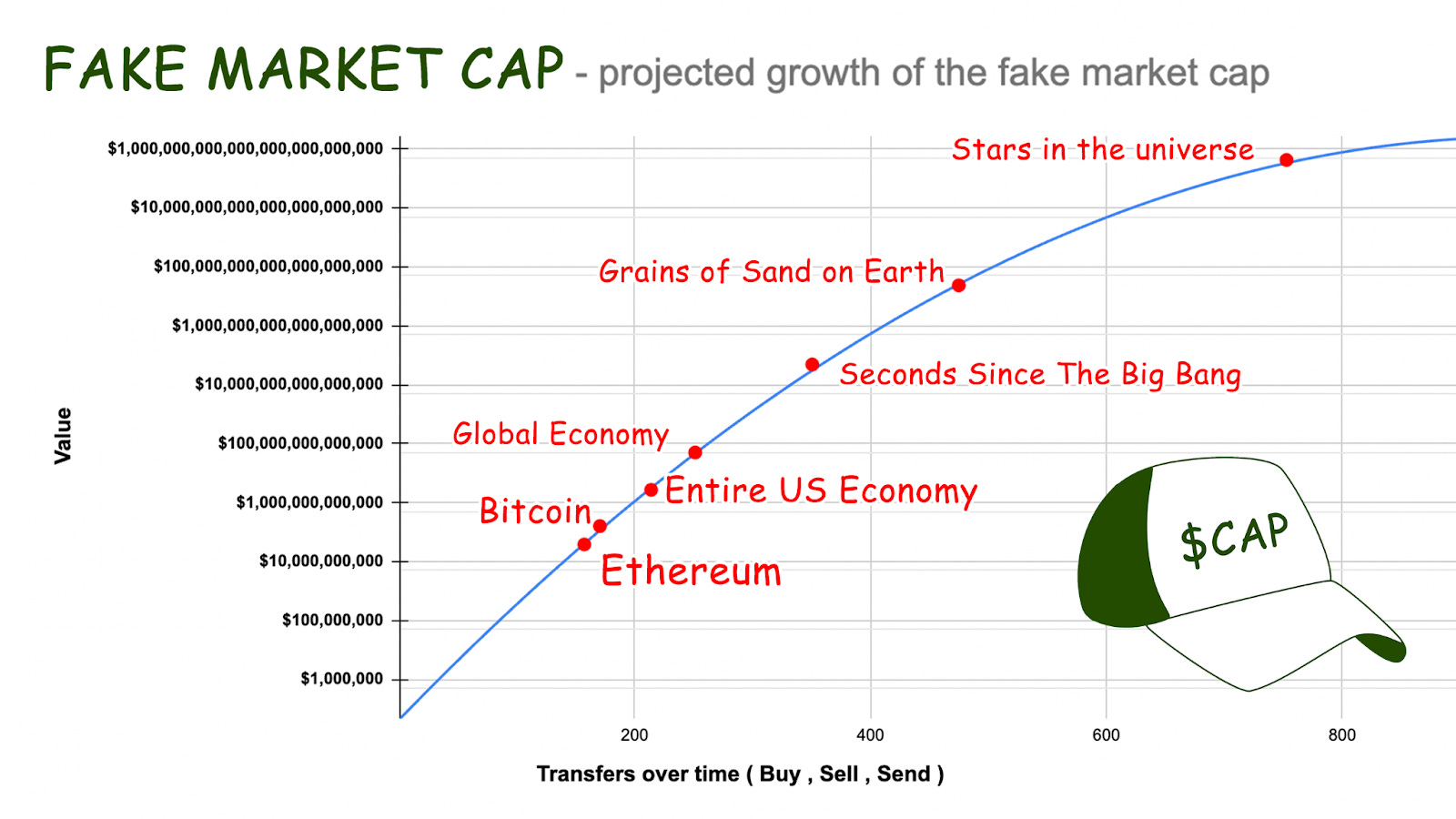

Tell us about this newer conceptual project of yours that you’ved coded up, Fake Market Cap, ticker symbol $CAP. What inspired you to create a memecoin as an artistic statement?

Crispin:

CAP is a memecoin with a fixed supply, but each time it’s traded the reported supply increases. That makes the market cap grow beyond ETH, BTC, the US economy, the global economy, and the number of stars in the universe. It’s a part of my Not Audited series, experimental smart contracts that subvert expectations either through technical innovation or absurdity. Actually I was inspired to make CAP after I got scammed for the first time recently on a coin you could buy but never sell. I looked closely at their code and then tried to turn my frustration and FOMO into something positive. It’s similar to my experimental NFT collection Wiiides, in that CAP breaks the meaning of a cryptocurrency system using the medium of economic transactions.

WMP:

What do you hope people will take away from the $CAP project?

Crispin:

I hope people will be inspired to make more experimental coins and use smart contracts as an artistic medium. There’s a long history of conceptual art questioning how we assign value and there’s space for more introspection in crypto.

WMP:

What's next for you? Are there any upcoming projects you can share with us?

Crispin:

I have an upcoming project releasing on Art Blocks in the summer called Flourish. It’s the sketchbook of an algorithmic architect. I was inspired by architectural ornamentation drawings from the late 1800’s and early 1900’s. Flourish is kind of an alternate timeline for architecture, taking that aesthetic and automating it with a logic system that structures shapes like a language.