GONDI’s Surge to NFT Lending Dominance

Activity around many NFT projects receded over the past couple of years. Yet one platform that bucked this trend decisively was GONDI, the NFT lending hub.

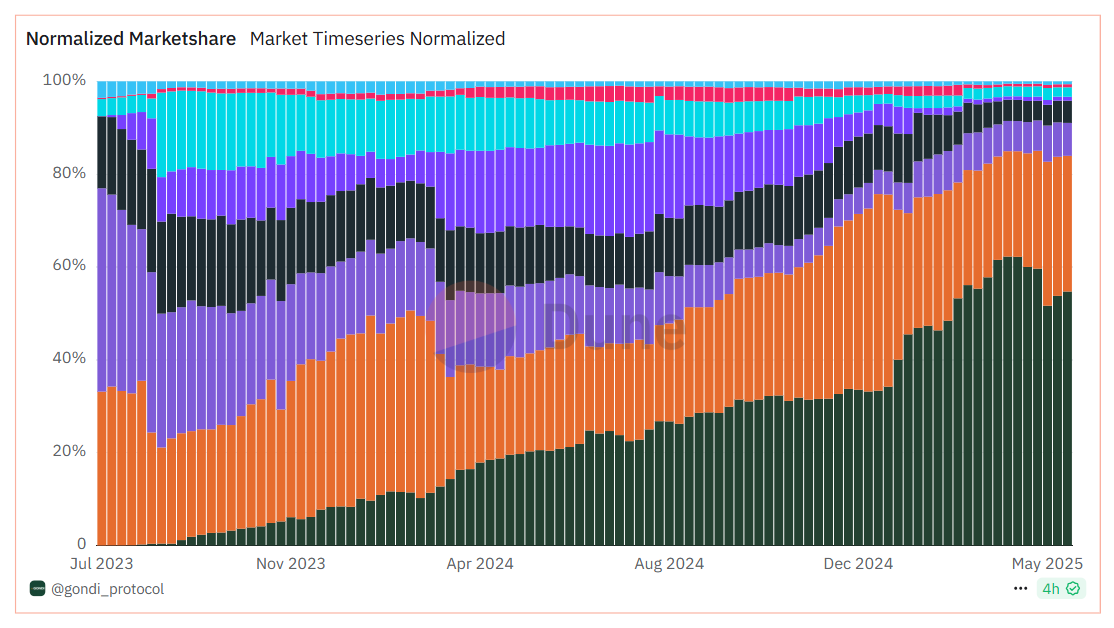

In Sept. 2023, the NFT lending market was dominated by NFTfi and Blur's Blend, which commanded 27% and 23% market share respectively. At the time, GONDI was facilitating only 1% of the activity here.

But fast forward to today, and the picture is quite different. Now GONDI accounts for a 55% market share majority in the NFT lending space, followed by Blend at 29% and NFTfi at 7%.

Notable Loan on GONDI:

— GONDI (@gondixyz) May 25, 2025

Spirit Azuki #6737 originated a 30 ETH loan.

Terms: 30 ETH principal at 24% effective APR for a 60-day duration pic.twitter.com/8CutROJmqT

In other words, of the $76 million in outstanding debt across this entire category currently, over $42 million is being facilitated by GONDI. It has become the go-to platform for borrowing or lending USDC or WETH against popular NFTs.

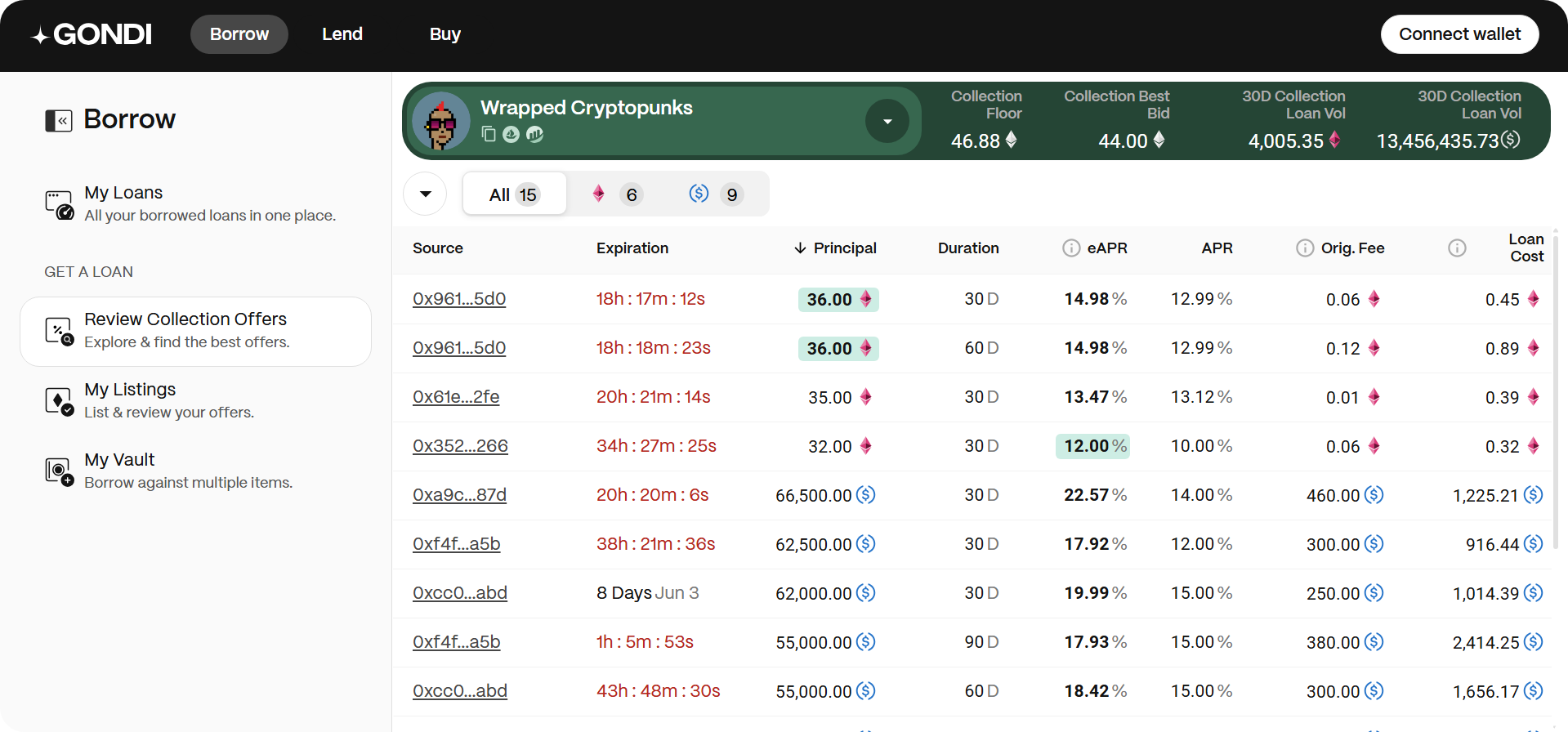

Its model is peer-to-peer, not pool-based. Collectors who want liquidity but don't want to sell their best NFTs can accept loan offers from lenders, while lenders can make offers on listed NFTs, place collection-wide offers, extend existing loans, create junior tranches, or take over any loan via refinancing.

Over time, borrowers pay back their loans plus interest to reclaim their NFTs. Lenders earn yield through this interest, and in the case of loan defaults they get to claim the underlying NFT collateral as compensation.

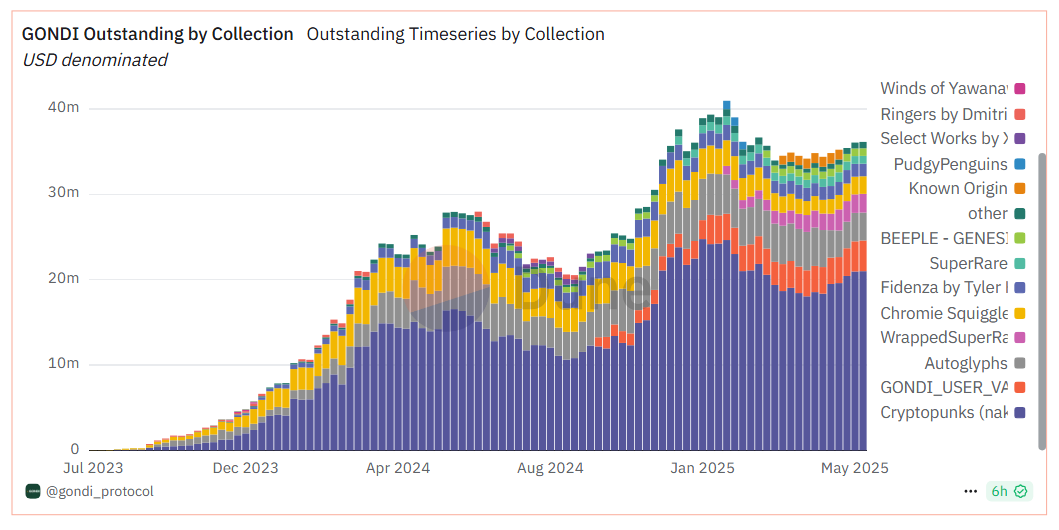

As for what's supported as collateral, the GONDI team has curated an allowlist of +120 approved collections, which so far have all been heavyweights from Ethereum's PFP and cryptoart scenes.

CryptoPunks—the most iconic NFT collection and the largest per its $1.2 billion market cap—accounts for around half of all loan activity on the platform. This isn't surprising, as GONDI supports both the OG and Yuga Labs wrappers and "naked" unwrapped 'Punks, so it covers all the bases.

Some of the next largest markets here come via Autoglyphs, Bored Apes, Chromie Squiggles, Fidenzas, and Pudgy Penguins.

So the grand question, then: what's been driving GONDI's dominance in NFT lending?

If I had to venture a guess, I think it boils down to the fact that GONDI offers a flexible platform with good UX that NFT power users enjoy. It also helps that they routinely iterate by adding new useful features.

For instance, in recent months the team added:

- Sell and Repay — Borrowers can sell their NFT collateral to close a loan and pocket any excess funds in one transaction.

- Instant Refinances — Lenders can take over any loan permissionlessly if they reduce the APR for the borrower by at least 5%.

- Buy Offers — Users can now place buy offers on any NFT, whether it's in a loan or not, paving the way to direct sales on the platform.

These sorts of features are making GONDI a hub for big ticket transactions. For example, an XCOPY recently sold directly on the platform for 1.15 million USDC, while CryptoPunk 5684 was purchased for 250k USDC via Sell and Repay and Seedphrase just renegotiated a $2.75 million loan here.

🚨 Historic Sale on GONDI 🚨

— GONDI (@gondixyz) May 7, 2025

"Last Selfie" by @XCOPYART sold on GONDI for 1,150,000 USDC - the highest sale yet for a LS.

Congrats to @8888Benji on the purchase, and @0xbigint on the sale. Brokered by the one and only @eli_schein.

GONDI is where grails are being bought,… pic.twitter.com/zL9u6AAygS

The bottom line is GONDI has been gaining ground in spite of the tougher NFT market that we've seen in recent years, and that's impressive. We'll have to see if they can maintain this momentum, but they have a good pace and network effects going for them now.

If you want to explore the platform as a borrower or lender, check out the docs and the team's primers on making loan offers, renegotiating, and refinancing. My hunch is GONDI will continue being an NFT hotspot through the rest of 2025, so don't be surprised if the project keeps making waves.